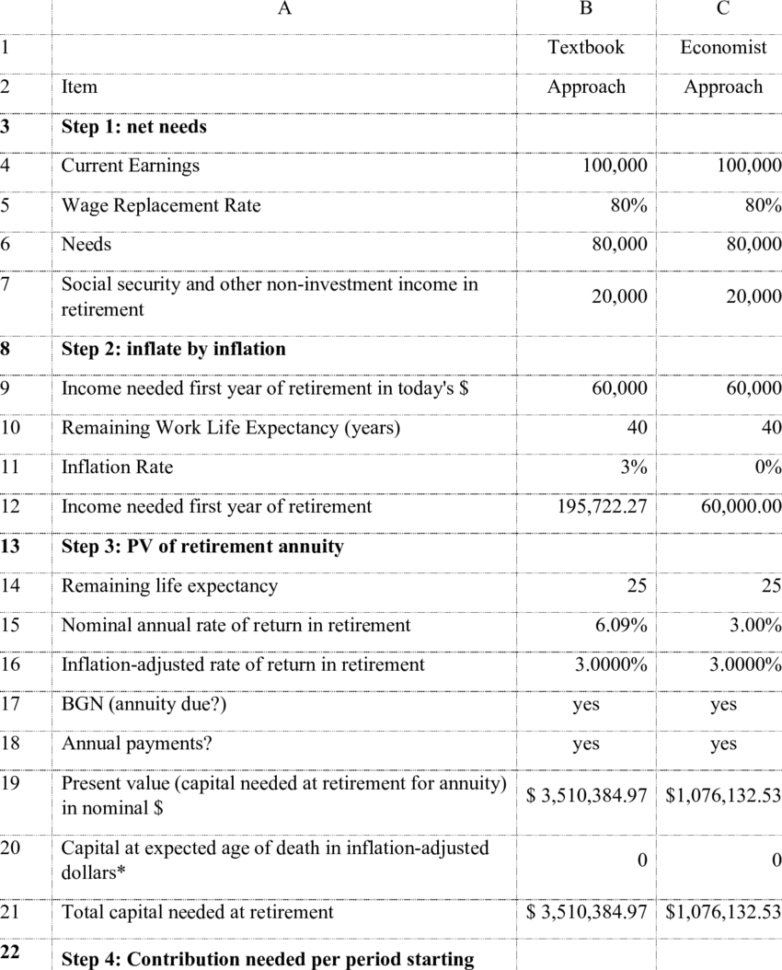

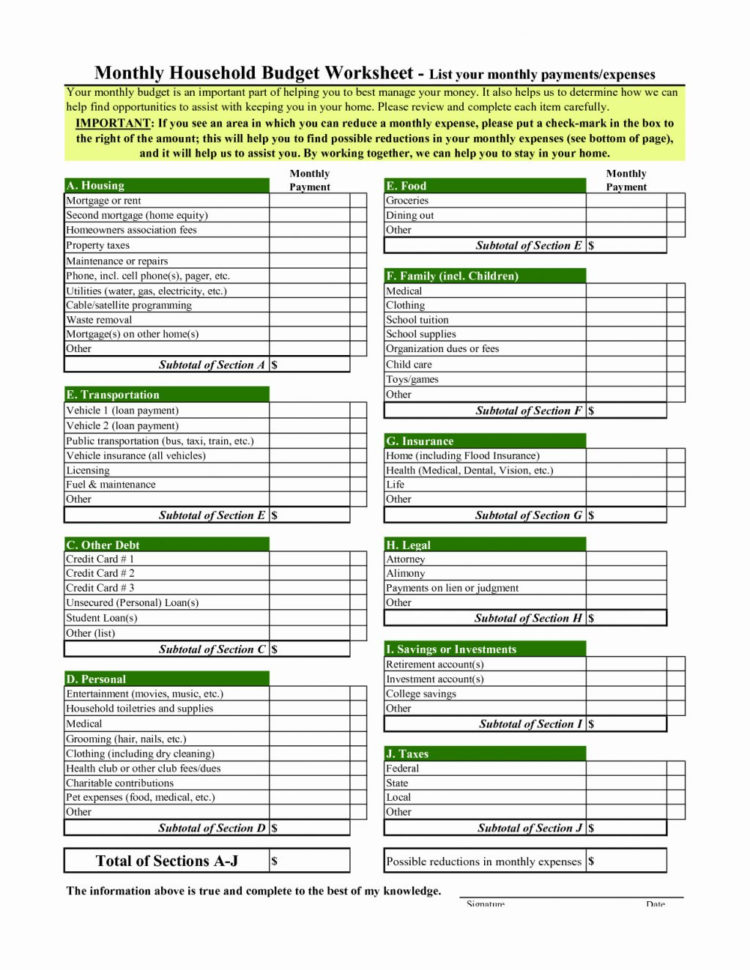

Retirement calculators are excellent for making a retirement plan with paper forms. However, they should not be the only tools used in a retirement planning method.

We all know that saving money is important, and that if you save money it can make life easier later. Most people know that they need to have a nest egg for their retirement years. This nest egg should be invested in a good stock portfolio or a secure investment, which will earn a higher rate of return in retirement than it was when you started investing.

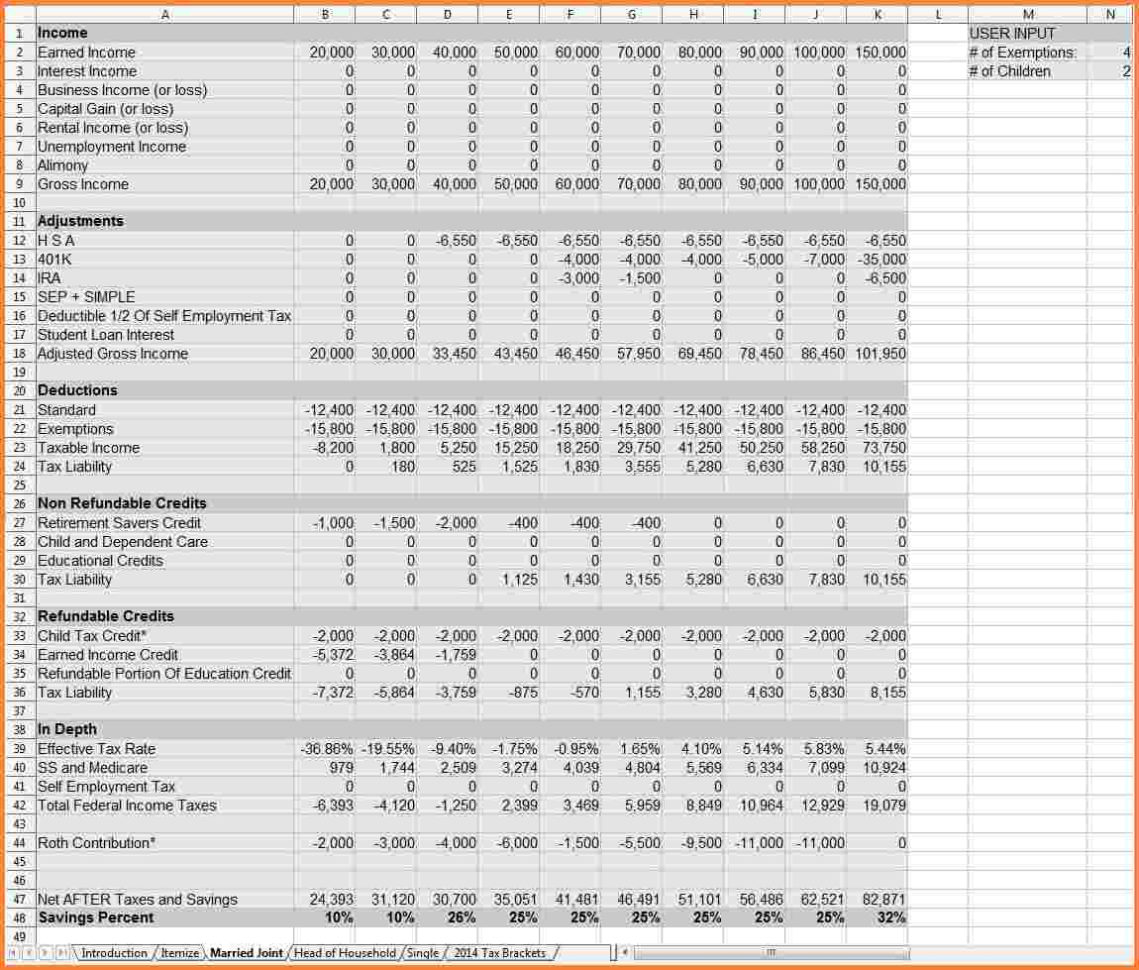

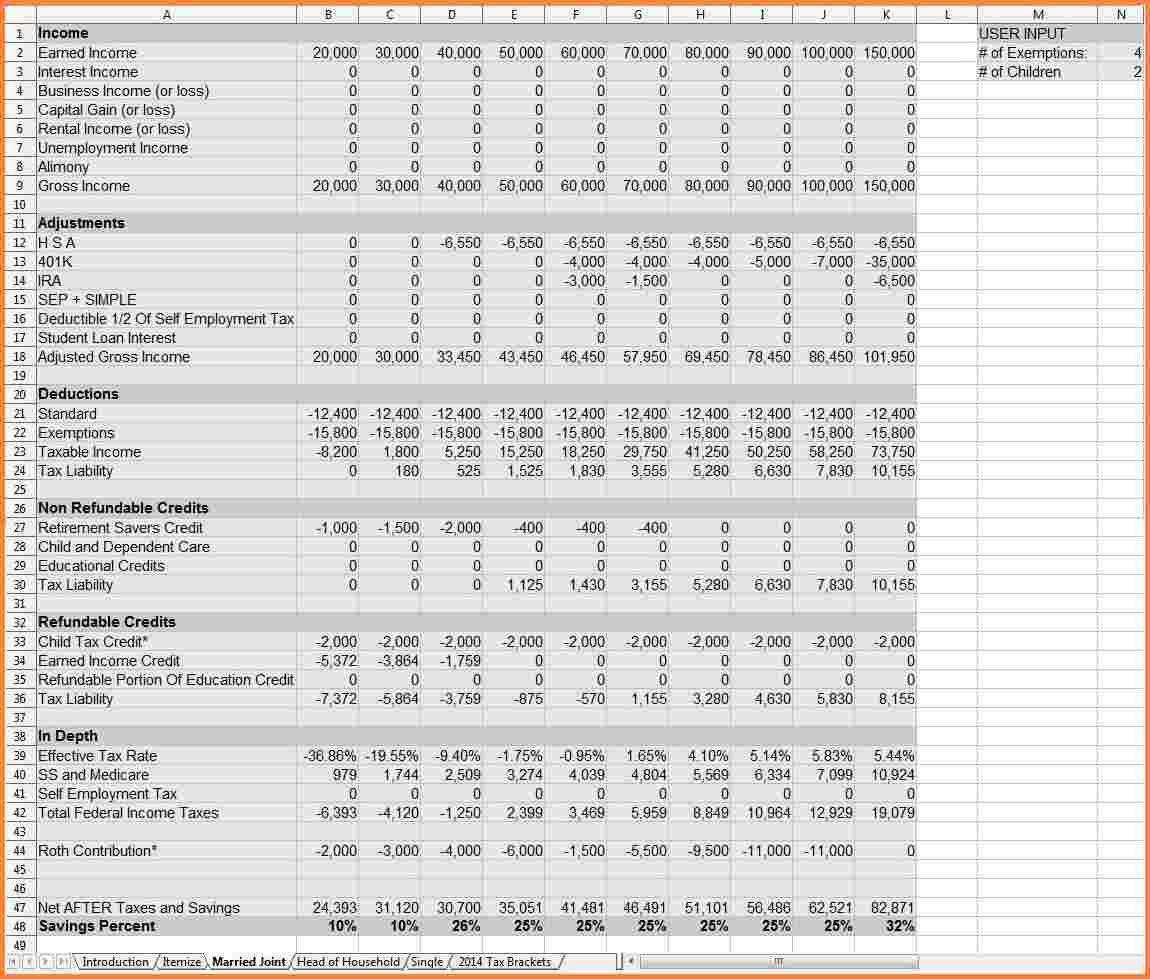

Saving For Retirement With Retirement Calculator Spreadsheets

Investing money in a high return investment account could make it easier to build your nest egg. If you want to build your nest egg, then you should find a good investment strategy that is best suited for your current financial situation. When you invest, you should focus on one stock, mutual fund, or fund.

The best advice is to invest your money in mutual funds. It is best to invest in real estate as well if you want to do this, but most people prefer mutual funds.

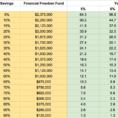

Now, as far as retirement calculator spreadsheets are concerned, you should consider these facts. First, you may want to invest in mutual funds that are managed by a professional.

This is a fact and is not just a recommendation made by a retirement calculator spreadsheet. Second, most people prefer that the mutual funds they invest in should be managed by a professional. This is because professional managers can analyze market trends and can know the buying and selling prices at any time of the day or night.

They also have many tools at their disposal to make investment decisions and they are trained in how to manage your money in order to meet your goals. Third, investment management professionals use many different types of software programs.

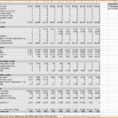

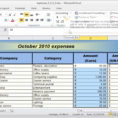

The most common software programs that are used are Microsoft Excel and Power Point. The point is, you should get a program that is easy to use and that also has the necessary features to protect your privacy.

You may need to pay for the software, but the cost of software is usually small compared to the cost of owning your own software program. Fourth, these programs can be found over the Internet.

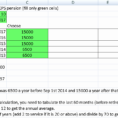

You do not need to go to your accountant’s office in order to find these programs. Fifth, you should get several retirement calculator spreadsheets that are different in length, depending on the information you want to include and how much you want to work with.

You should use more than one retirement calculator spreadsheet to make sure that you are comparing apples to apples. Sixth, to get the most accurate results possible, you should make sure that the investment strategies you are using are the same as your programs.

It is possible that the investment strategies you are using are different from your program’s investment strategy. You should check this out, and if the different investments you are using will not be compatible, you should use the programs which are the same. YOU MUST LOOK : retirement calculator spreadsheet template

Sample for Retirement Calculator Spreadsheets