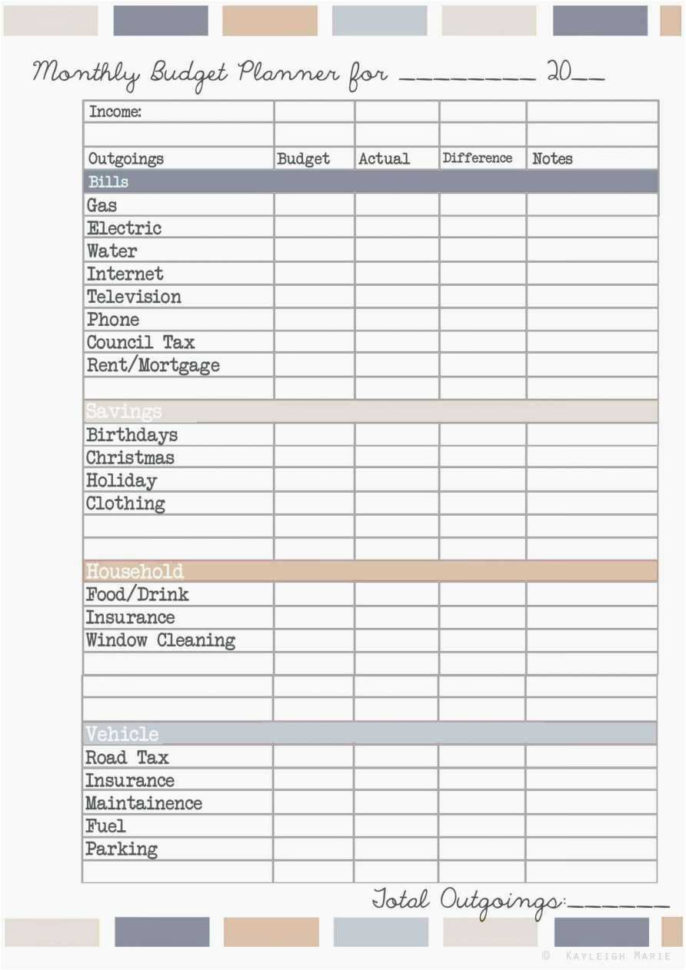

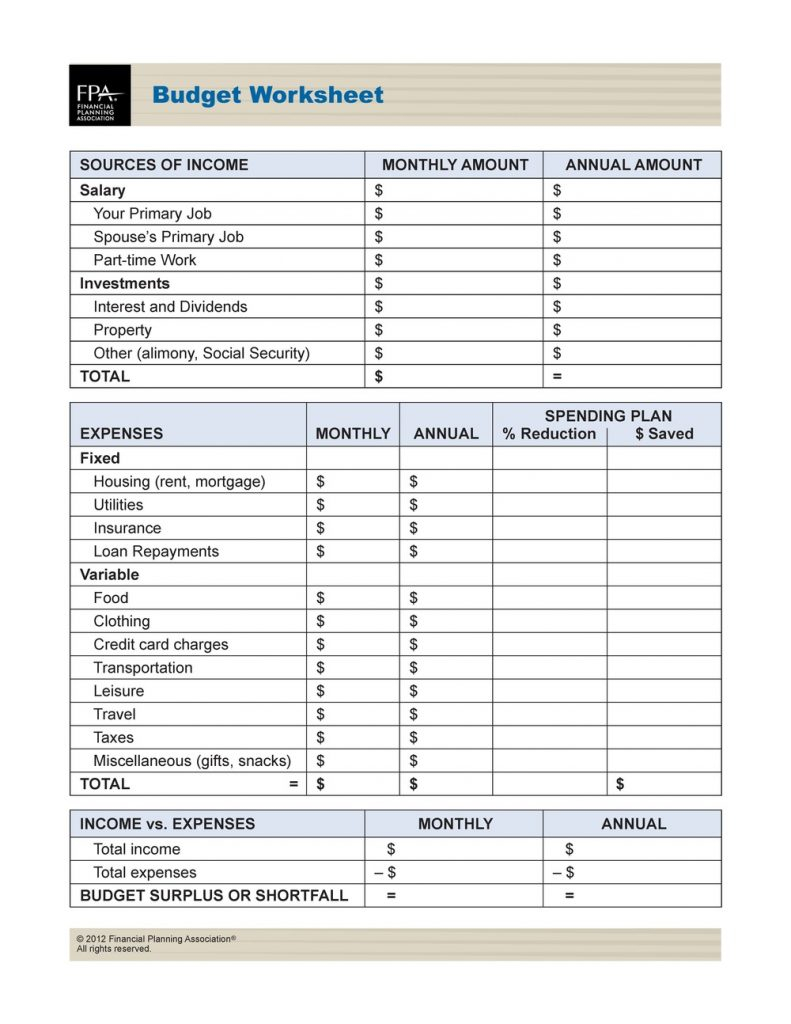

If you are planning to retire, the best way to manage your money is to use a retirement budget planner spreadsheet. A spreadsheet will help you see where your money is going and how much you are spending each month. It is important to track your expenses, but what is even more important is to know where your money is going and how it is being spent.

You need to know how much you are paying each month into your retirement fund. How much of your income is going towards this fund? That is why it is so important to get an online retirement budget planner spreadsheet.

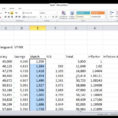

The Best Way to Use a Retirement Budget Planner Spreadsheet

Your retirement fund is something that you cannot do without. It is your savings for your future and you should not spend it recklessly. You also should not leave it in your will unless you have the money to cover it up.

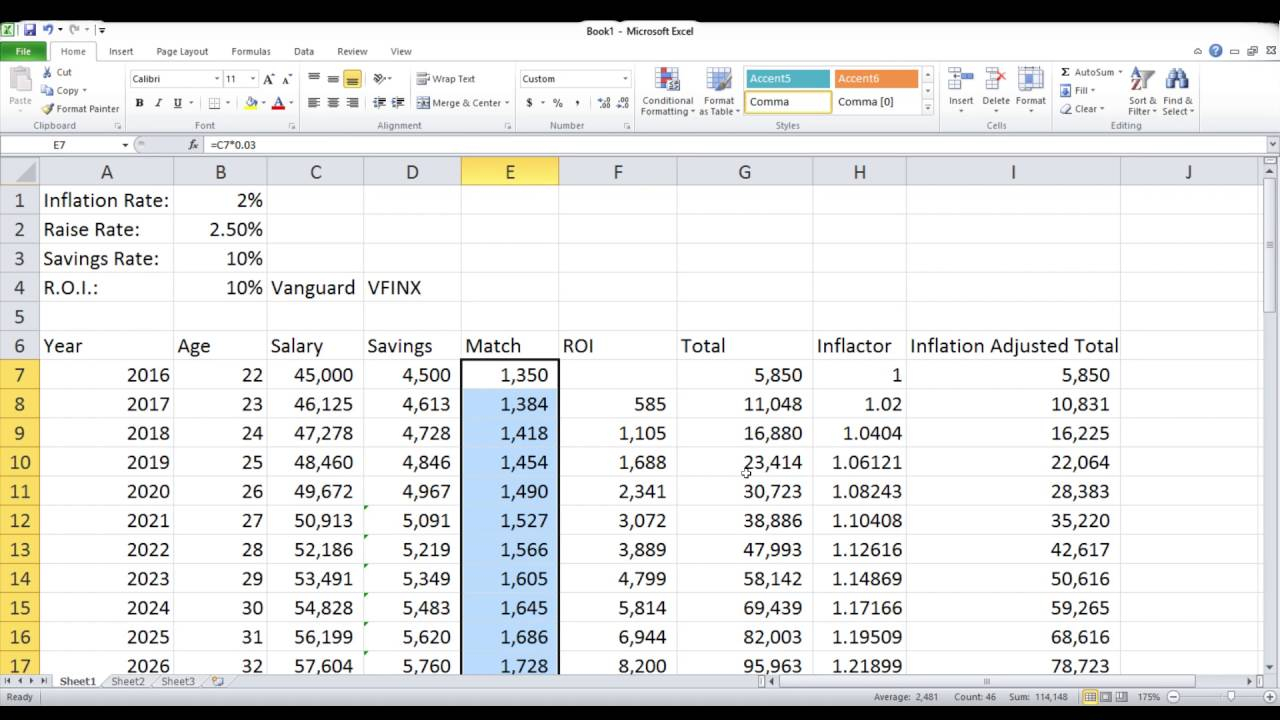

To make things easy for you, there are easy math equations on a spreadsheet that you can use. If you look at it that way, you will find it easier to budget your money. You also want to be aware of your obligations in terms of your retirement plan.

If you are going to hire a financial adviser to help you, you will need to have all your financial information ready. It might take a while to gather all of your numbers but they are worth it. You do not want to give up your rights to know exactly how much you are spending on retirement.

Look at your retirement plan as an investment. You want to make sure that you are investing it in the right places. If you are going to invest in stocks and bonds, you want to make sure that you are getting the best rate of return for your money.

You can get started by using your retirement fund as collateral for a loan. You can borrow your money from your retirement plan to pay for your education or to fund some extra expenses. If you make the payments on time, you can use the money for any purpose you wish.

You do not want to see yourself struggling to get out of financial problems. You should never be embarrassed about using your retirement money wisely. You do not have to live in poverty after you retire.

You do not have to pay taxes on the money that you earn during your retirement plan. There are many things that you can do with your money. You just have to make sure that you have enough to pay your bills each month.

You do not have to sit back and watch as your financial freedom slips away. There are some ways that you can start today to improve your situation. Make sure that you are using the best retirement planner spreadsheet to help you do this.

The best thing that you can do for your retirement plan is to stay organized. A spreadsheet is one of the best tools that you can use to keep track of your money. You can start today and save your money for a rainy day.

You do not have to wait until you are in financial difficulties to do it. Get started today and start saving for your future today. YOU MUST SEE : retail store inventory spreadsheet

Sample for Retirement Budget Planner Spreadsheet