Warning Signs on Rental Property Roi Spreadsheet You Should Be Aware Of

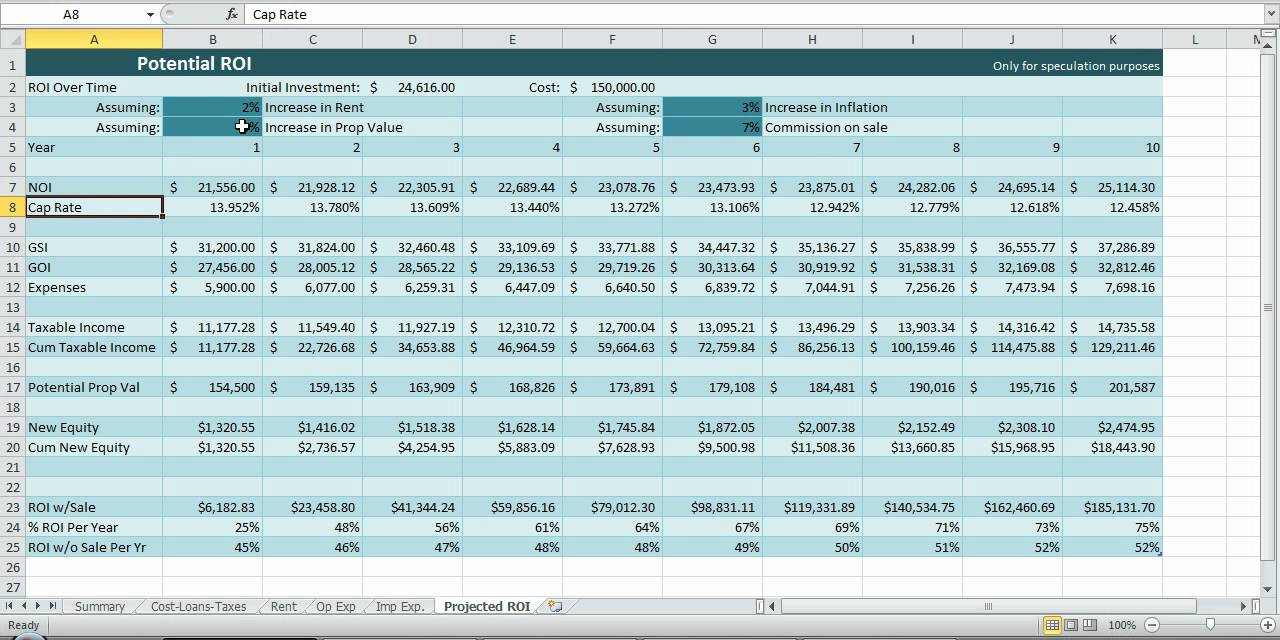

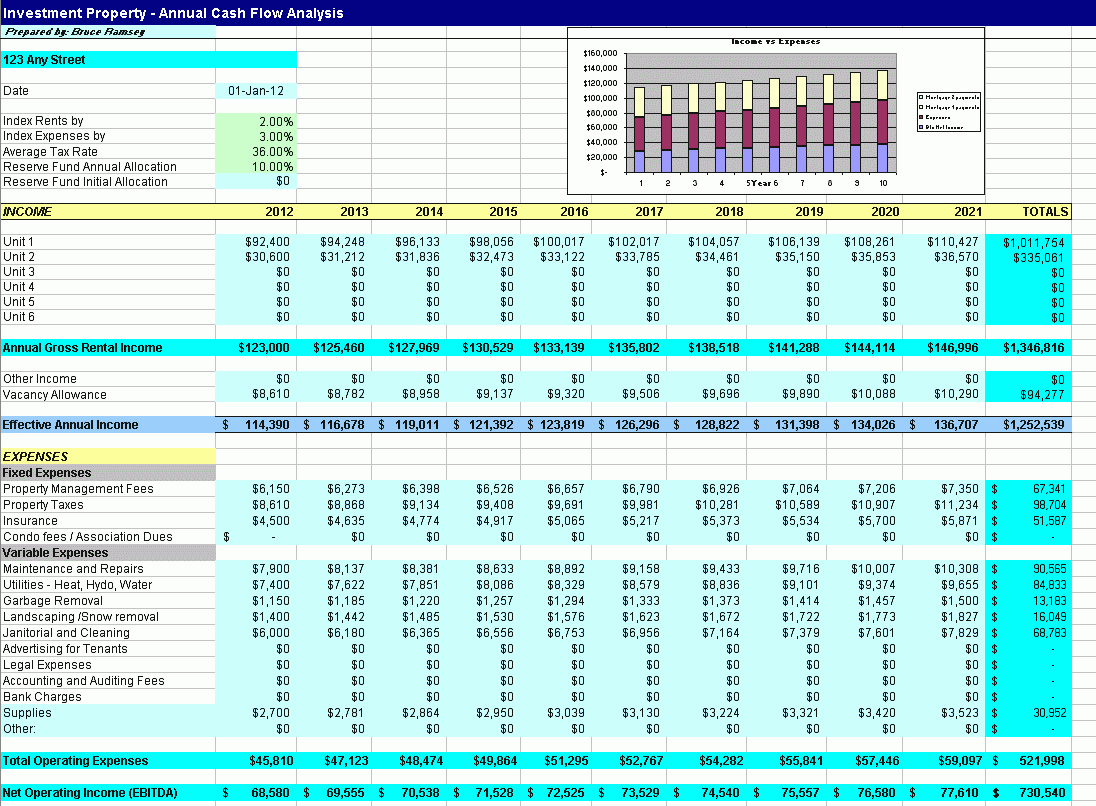

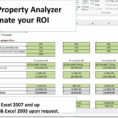

Viewing Long-Term Projections If you intend to hold on to the rental for some time, you will discover the Projections screen extremely helpful. If you would like to own rentals, here are the best 5 suggestions to maximize your profits and minimize your pain. Although the rent is also lower, your ROI is via the roof.

Things You Won’t Like About Rental Property Roi Spreadsheet and Things You Will

Since you may see, the cost process is a better approach to figure the ROI on a rental property. In many instances, the ROI will be higher in the event the price of the investment is lower. You’ll observe that we got a greater ROI while using the out-of-pocket method than what we got following the cost method though it’s the very same property. Before it’s possible to calculate the genuine ROI of a rental property, you’ve got to factor in all the expenses related to holding that property, not only the purchase amount.

The 5-Minute Rule for Rental Property Roi Spreadsheet

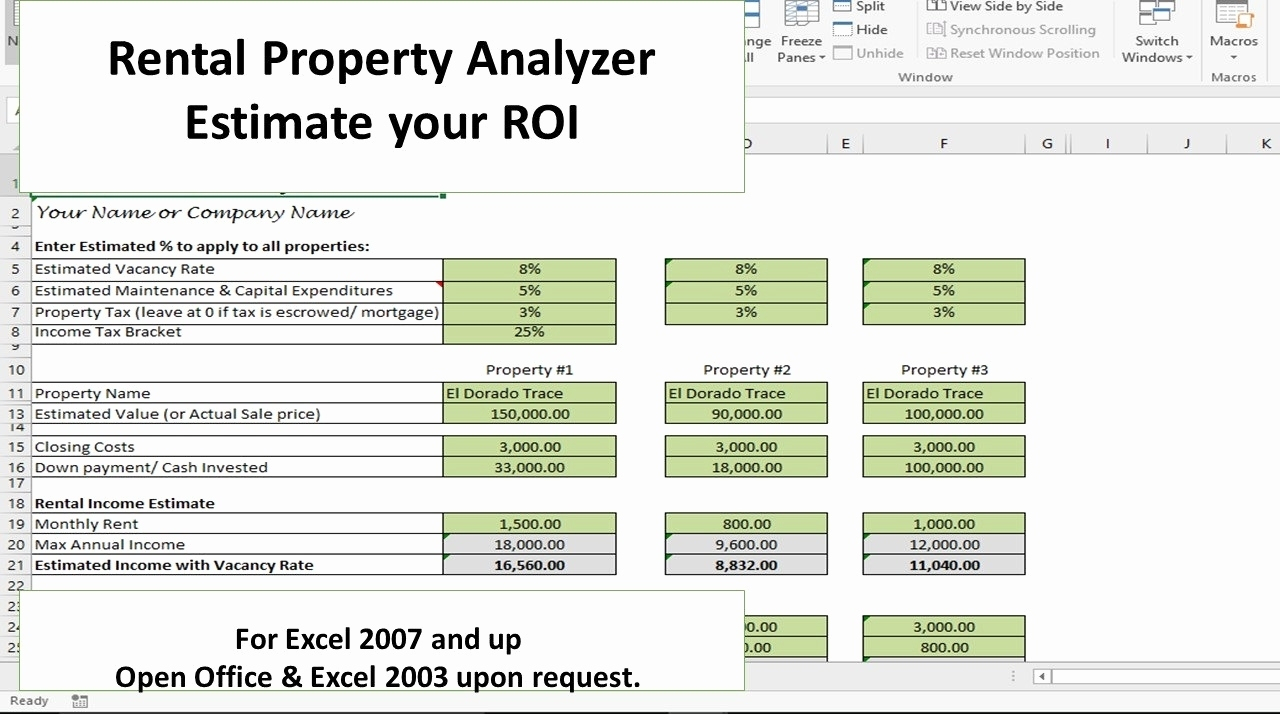

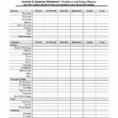

Upon purchase you’ll be in a position to immediately download the spreadsheet to your PC. The spreadsheet is advised for real estate investors who intend to purchase and hold rental property. A new spreadsheet is only a huge table with blank cells where the user can enter information. It’s possible to locate other spreadsheets that supply a more thorough investment analysis (for instance, 10-year cash flow projections). Spreadsheets are somewhat more versatile than word processors when it comes to their capacity to manipulate massive quantities of rows and columns of information. They are used to perform much of the same functions as an investment property calculator. At the same time that you could feasibly create a spreadsheet for anything, there are particular kinds of spreadsheets commonly utilised to supply such versatility.

The Unusual Secret of Rental Property Roi Spreadsheet

Which method you should use is dependent on the manner in which you finance purchasing a rental property. If you are in the market for distressed properties which have been vacant for a long duration of time, things are going to begin breaking as soon as people start turning them on. Just like any investment, rental properties ought to be regarded as a long-term investment, not an immediate cash cow. Having a rental property along with your main residence can be a means for you to construct wealth, especially in the event you could be averse to investing in the stock exchange. When you’re purchasing real estate, make certain not to get mentally affixed. You are able to purchase Section 8 properties.

Spreadsheet calculations are finished by hand. The calculator also informs investors of the very best type of property in a specific area. PropertyREI’s rental property calculator makes it simple to figure out the free cash flow a single-family residence will generate. It helps you calculate the ROI on a condo investment within a matter of minutes.

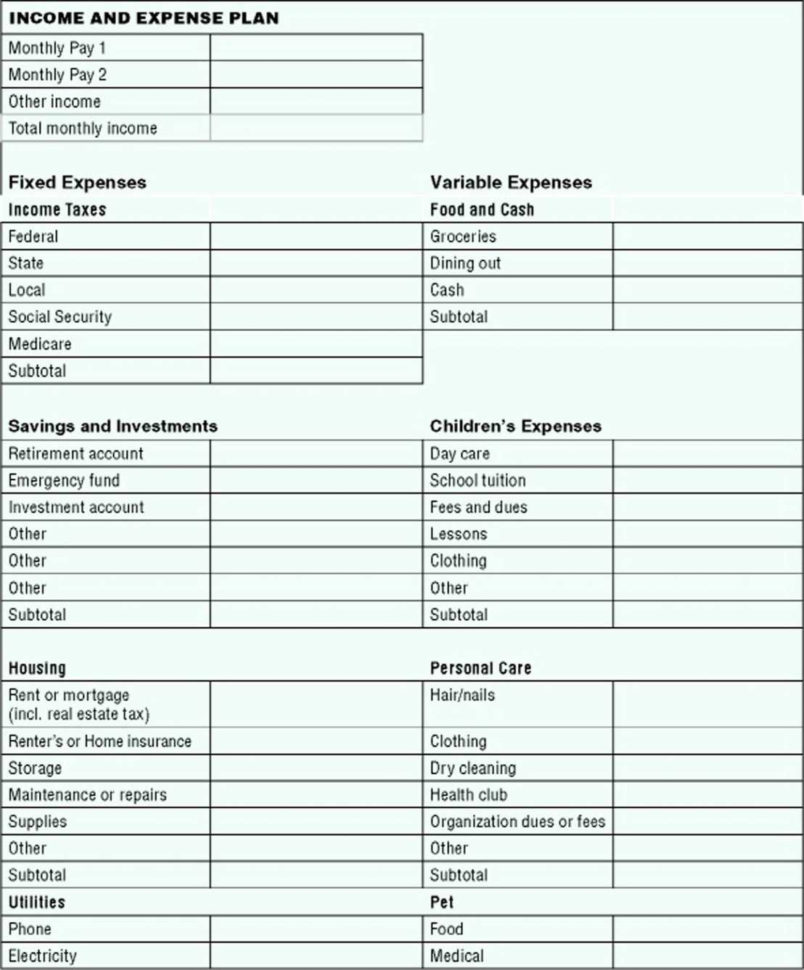

The expenses will be dependent on several things, including the sort of property, age, place, condition and whether you’re using a property management firm or attempting to handle it all yourself. Just like you would like to track every expense, you likewise don’t need to forget the record your earnings. The only expense you’ll have to pay is your mortgage. Rental expenses are equally as crucial as rental income when searching for rental properties. Computing rental expenses is not readily accomplished by hand, however.

What’s Actually Happening with Rental Property Roi Spreadsheet

Considering your real estate equity will probably be a huge portion of your financial portfolio, it’s a fantastic concept to do a normal analysis of your properties to be certain they’re still as profitable as when you first began renting. The greater the IRR, the more desirable it’s to create the investment. Purchasing a real estate property with the target of renting it’s a typical investment that may insure a constant cash flow of revenue. Contrary to what most people think, rental property investment isn’t passive income, especially if there’s no management consultant hired to deal with administrative work, a service which usually costs about 10% of revenue. Therefore the marketplace is now flush with people seeking to rent. There’s almost always a huge market for them, because they are fantastic for young families. Get a specific to inform you on your home market prior to going into.

1 key benefit to a condo as an investment property is that the majority of condo associations deal with maintenance issues like plowing snow, gardening upkeep, cleaning common places, etc for the full condo complex. As an investor, you will need to effectively restrict your investment opportunities to the properties which have the best chances to produce in the future. Any sort of property, while it’s commercial or residential, can be a very good investment prospect.

Sample for Rental Property Roi Spreadsheet