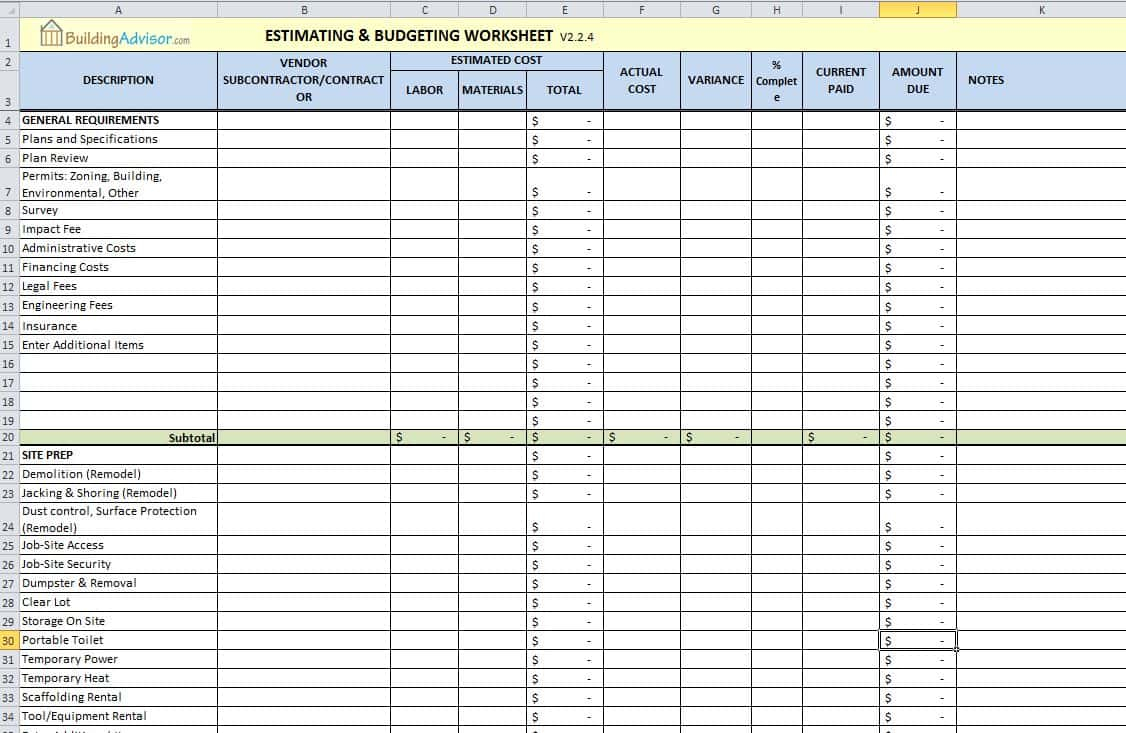

The freeze tool will continue to keep the very first row static when scrolling to aid you match the data to the right field. Rather, stick with simple tools, particularly whenever you’re just starting. One other important tool to rate the odds of new small business success is the Business Plan, a overview of your organization as well as the goals and activities required for it to succeed. There are tons of software’s and programs via online which can be utilize by everyone and everything that you should do is personalize it.

Rental Property Expenses Spreadsheet Template Intended For Rental Propertyreadsheet Template Sheet Worksheet Management Excel Uploaded by Adam A. Kline on Wednesday, January 23rd, 2019 in category 16, Download.

See also Rental Property Expenses Spreadsheet Template Within Templates Rental Property Expenses Spreadsheet Homebiz4U2Profit from 16, Download Topic.

Here we have another image Rental Property Expenses Spreadsheet Template Throughout Tax Template For Expenses Return Taspreadsheet Awesome Rental featured under Rental Property Expenses Spreadsheet Template Intended For Rental Propertyreadsheet Template Sheet Worksheet Management Excel. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading Rental Property Expenses Spreadsheet Template Intended For Rental Propertyreadsheet Template Sheet Worksheet Management Excel.