As rental property properties become a booming industry, more property owners are relying on the Rental Property Excel Spreadsheet. But did you know that you can also save yourself some money on your mortgage and avoid unnecessary fees? When you know how to calculate your property expenses using the Rental Property Excel Spreadsheet, you will learn how to reduce your tax burden by staying within your income limits and the value of your investment.

Just a few years ago, a mortgage payment that was too high could have had a drastic effect on your financial freedom. It may have made it impossible for you to make your monthly mortgage payments, resulting in foreclosure or bankruptcy.

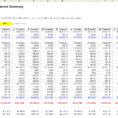

The Benefits of Using Rental Property Excel Spreadsheet Free

But with a home equity loan, you don’t have to worry about those things. All you have to do is take out a standard loan, which usually has lower interest rates than a mortgage because the loan takes into account your mortgage balance as opposed to the value of your home.

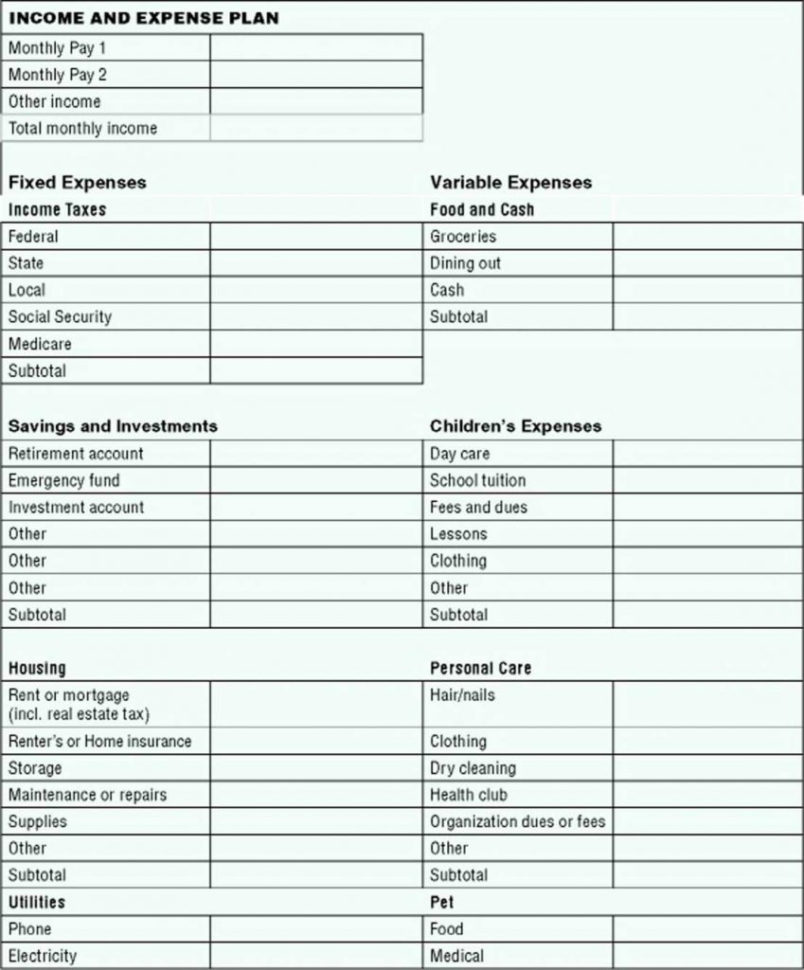

With a mortgage, you will be paying interest on it for many years. And in addition to the interest payment, you also have to pay the property taxes, insurance premiums, homeowner’s association dues, and other miscellaneous costs that go along with being a home owner.

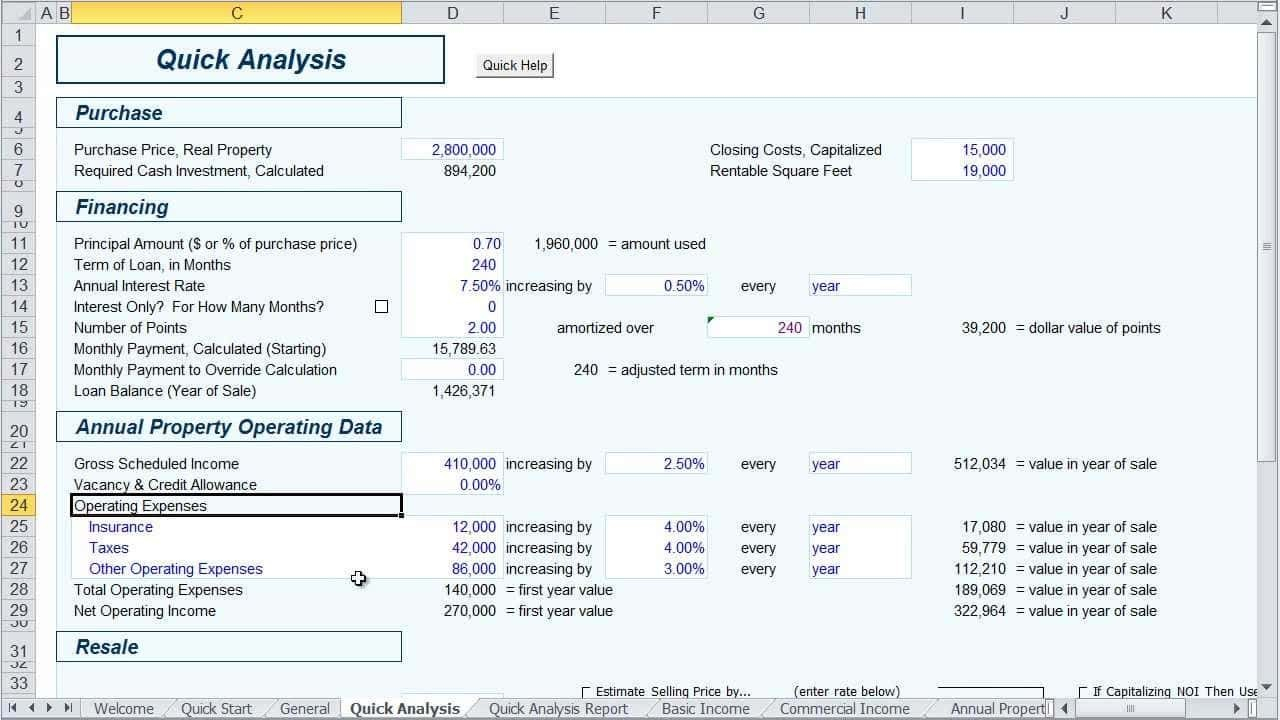

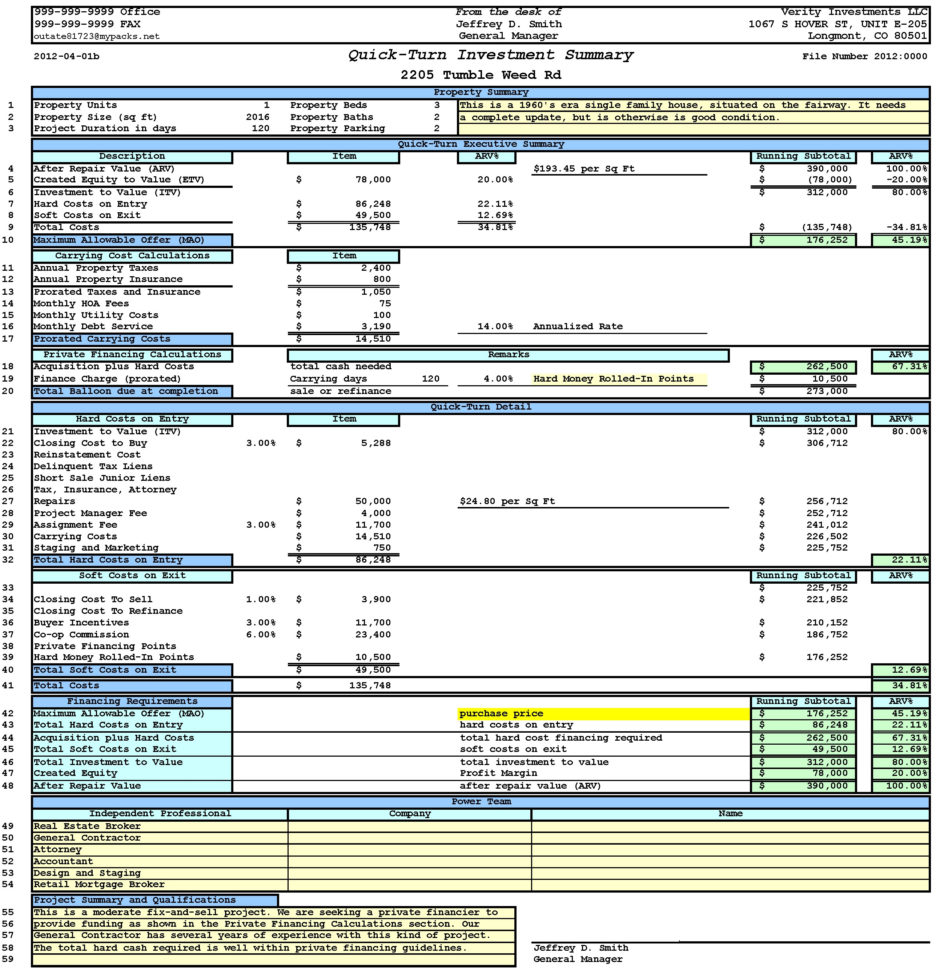

There are more costs associated with a mortgage than just the interest, which is why it is important to know the full life cycle of your property in order to get the most for your money. This is where a Rental Property Excel Spreadsheet comes in handy.

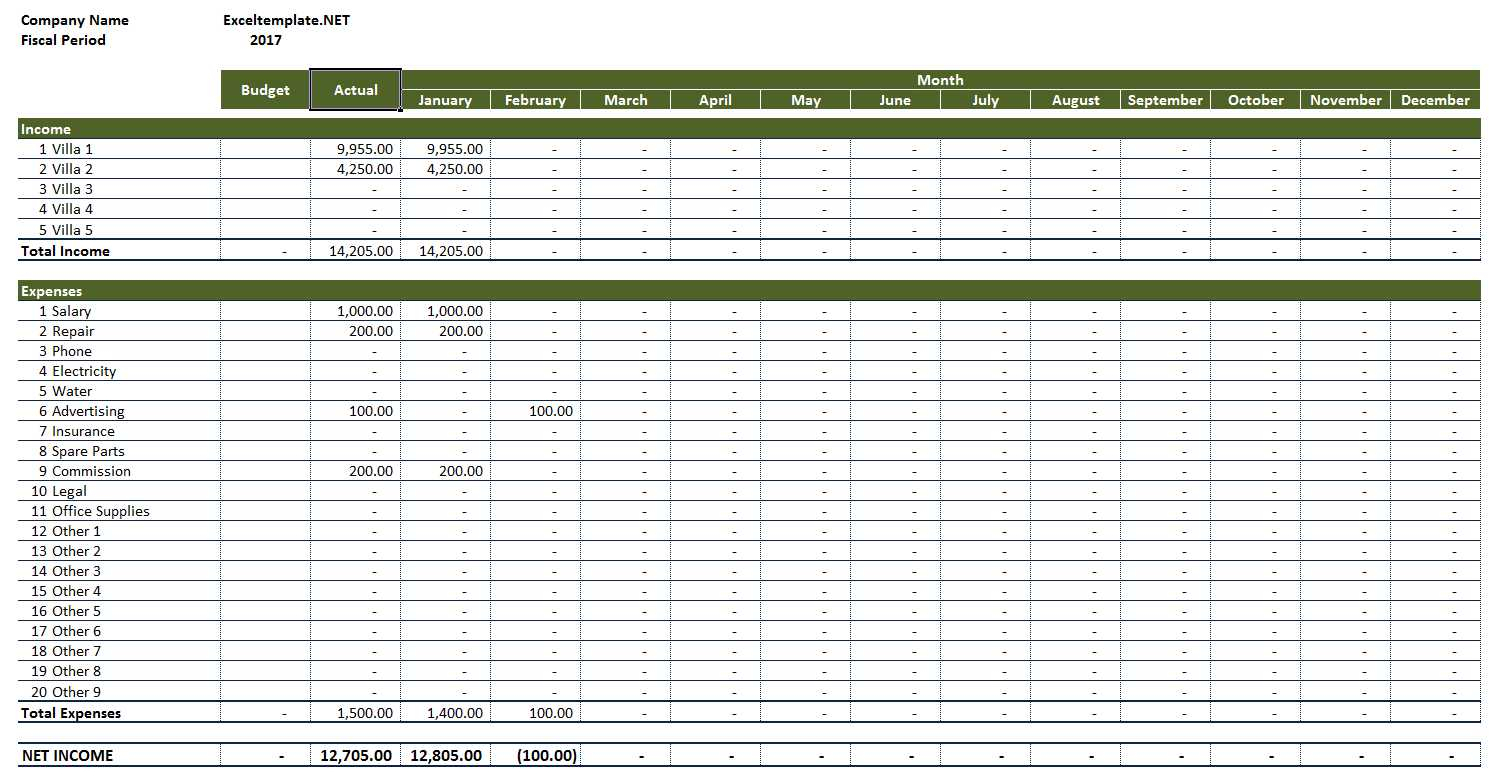

To use the Rental Property Excel Spreadsheet free and without any obligation is a tremendous advantage to property owners. Property owners benefit from this free service, because they are able to gain access to important tools that help them calculate their property’s true value, show if they are within their credit limit, and stay within their income limits.

Property owners can easily apply for a mortgage that matches their needs. This means that they don’t have to pay mortgage insurance fees for their property just because it was already paid off by another person or a private investor. These fees can quickly add up.

Another benefit of using the Rental Property Excel Spreadsheet free is that you will know how much money you can spend on repairs to your property. You will be able to avoid adding needless repair and maintenance costs. This would have you borrowing more money each month, which would make it even harder to keep up with your mortgage payments.

Instead of finding out that you are behind on your mortgage payments, you will know if you are on the right track by checking your income requirements. This is a helpful feature that will allow you to stay within your income limits and avoid foreclosure on your property.

Property owners don’t have to pay taxes, insurance, and maintenance on their property. They can use the Rental Property Excel Spreadsheet free to get free updates and reminders of when these things are due.

Once you learn how to use the free tool, you will be able to stay on top of your property investments while staying within your budget. This is a great way to save money and stay within your debt limits without paying for costly services that are not necessary.

Save time and money today with the Rental Property Excel Spreadsheet free. Use the tools to your advantage and start saving! SEE ALSO : rental property excel spreadsheet

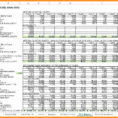

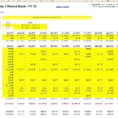

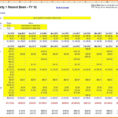

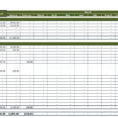

Sample for Rental Property Excel Spreadsheet Free