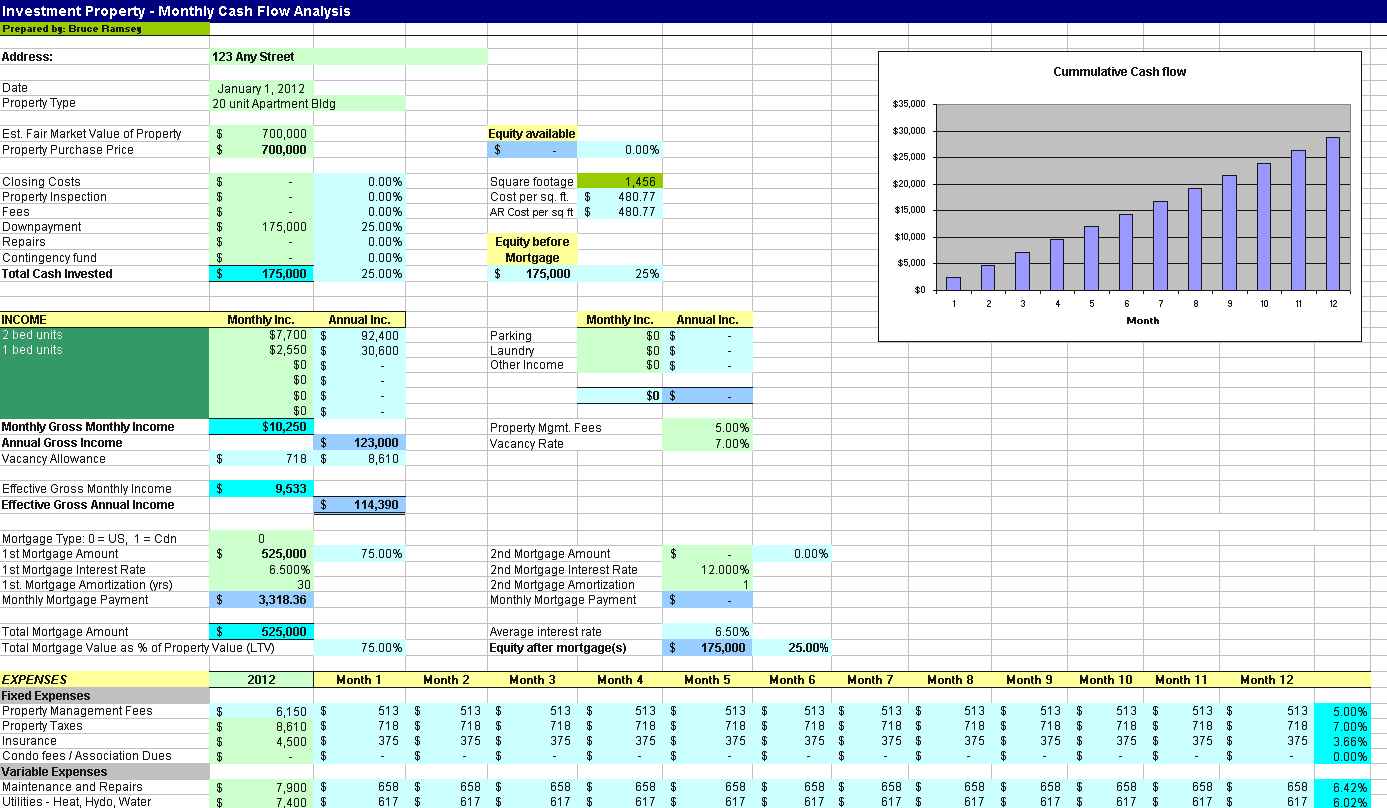

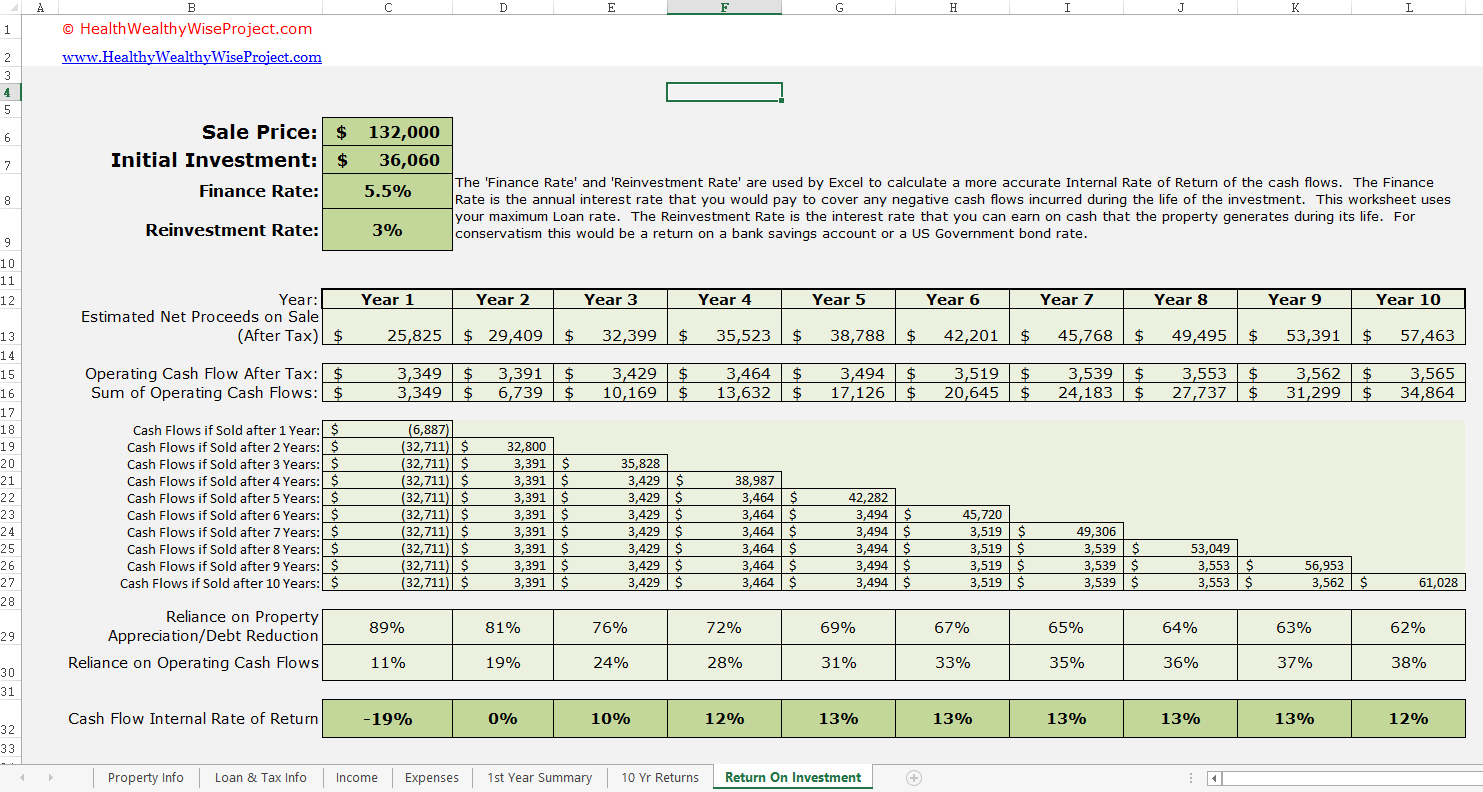

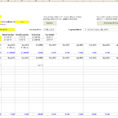

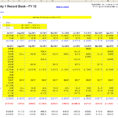

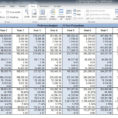

A Rental House Investment Spreadsheet is a sheet you can use to keep track of everything in your investment. You can set up an account that will let you do the details on each house individually.

These are two of the most common investment tools for any investor. They can get very complicated if you are just starting out, but with a little bit of guidance, you can get a handle on what your needs are. Here are some basic investment resources for all types of investors to know.

Renting For Investments

Rental rates are some of the biggest things that will help to determine your investment’s success. The city and state of your property will determine how much it will cost to rent it out. Sometimes you will find great low rates in states like Texas or Florida, where homes are selling for a fraction of the cost of most other cities. You will want to study the rental trends of these areas to see how they are moving.

Economic health can be another big factor. If a new school is being built and housing is so expensive in the area that is being built in, that it makes economic sense to stay put. The same goes for new roads and other construction that are coming into the area.

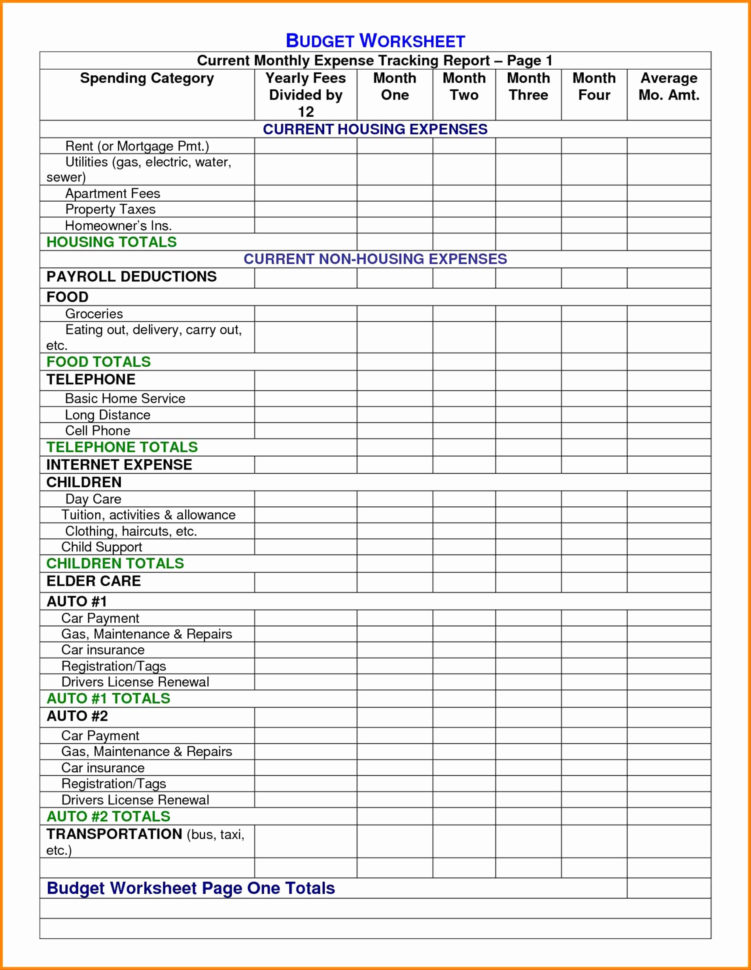

By using these simple calculations, you can be able to decide whether it is time to move. The easy way to keep track of rates is to record the following information in your spreadsheet:

If you plan to buy a rental house, then you need to keep in mind that you will be paying for the property taxes, insurance, etc. This is another area where you can set up your own Excel Investment Spreadsheet that will show you how much you will be paying over the next few years. You can use a couple of different approaches here. If you plan to buy a new house soon, you can set up an account so that you can make sure you are not overpaying.

However, if you don’t have any plans of buying a home soon, you may find that a rental house is just too cheap. In that case, you will be paying for depreciation with your property. This should be an issue for you, but there are ways to get around it. For example, sometimes you can be able to take on a management agreement with the owners of the property, which will allow you to keep the house tax free.

Unfortunately, when it comes to real estate tax, this can create a problem. If you buy a house after you have paid off the mortgage, you may have to pay property taxes before you make the down payment.

There are a few places that you can go to find the best deals on rental rates. To start, you should look online and use a search engine to look for the best quotes for homes available in your area.

Next, go to your local real estate agent and find listings of rental houses for sale. Once you have some decent options, call a few realtors, and ask for current rates. Make sure to ask for monthly rates, too, so you can have a better idea of what to expect in the future.

Remember that you are only getting current rates, and that is why it is important to look at them in the past and the future. Try to compare rates between months in order to see which ones are best for you.

Finally, you may want to start your search by visiting one of the many online real estate website. By signing up for a free account, you can start monitoring your information without ever leaving your home. That alone should be incentive enough to find the perfect investment property. YOU MUST SEE : rental house expenses spreadsheet

Sample for Rental House Investment Spreadsheet