Benefits Of Renting Bookkeeping Spreadsheet Software

A rental bookkeeping spreadsheet is a must-have tool for any firm that sells or rents property. In fact, the very existence of the spreadsheet is proof that a leasing company is in the midst of trying to find ways to make more money on the lease agreements they sign.

These software programs have come as a godsend to the struggling businessmen who make their living renting out houses and apartments. Their effectiveness is shown by the fact that many people will now sign lease agreements with any leasing company that offers them the spreadsheet.

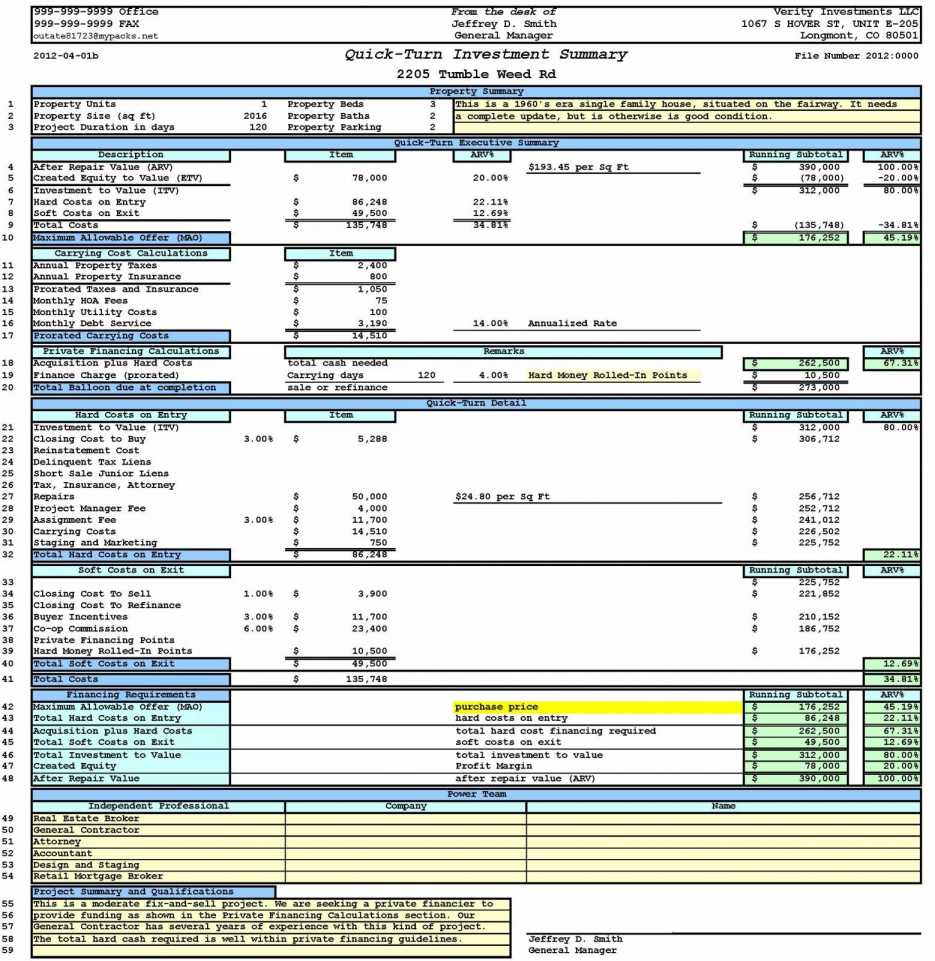

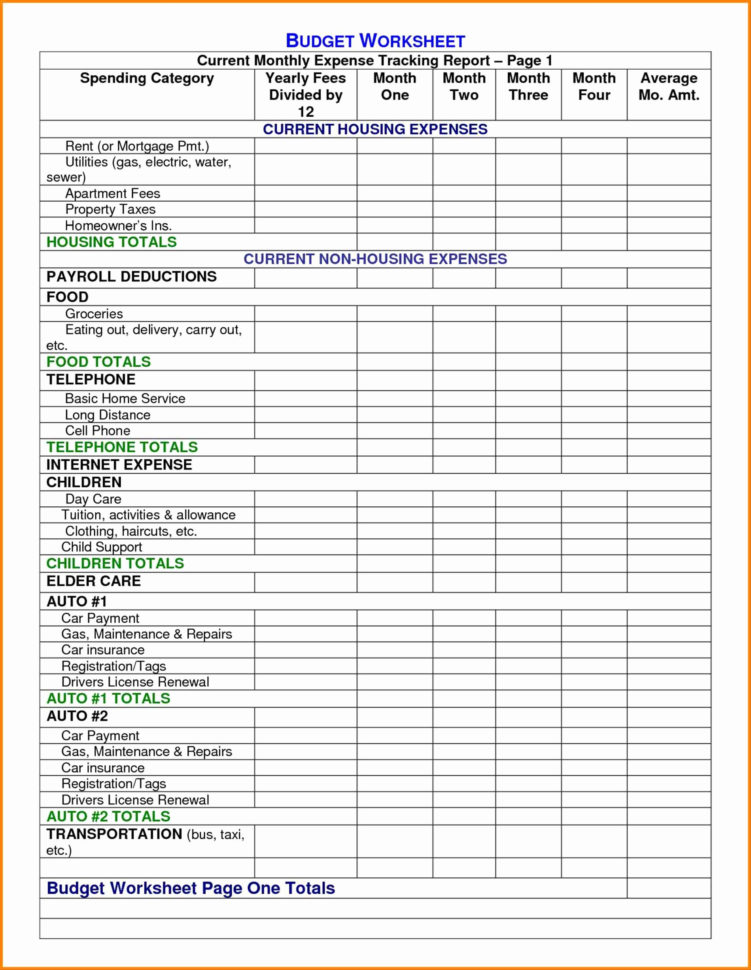

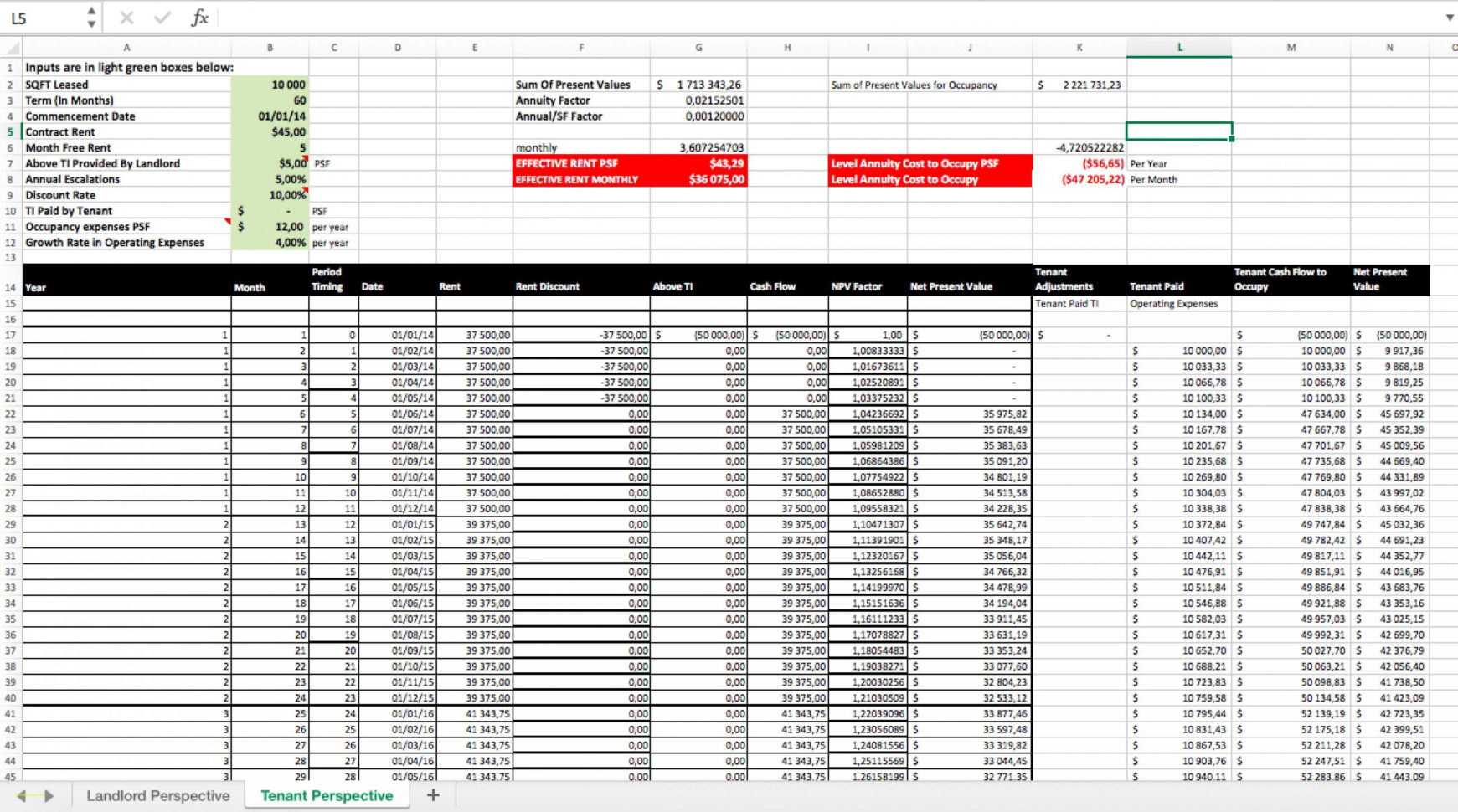

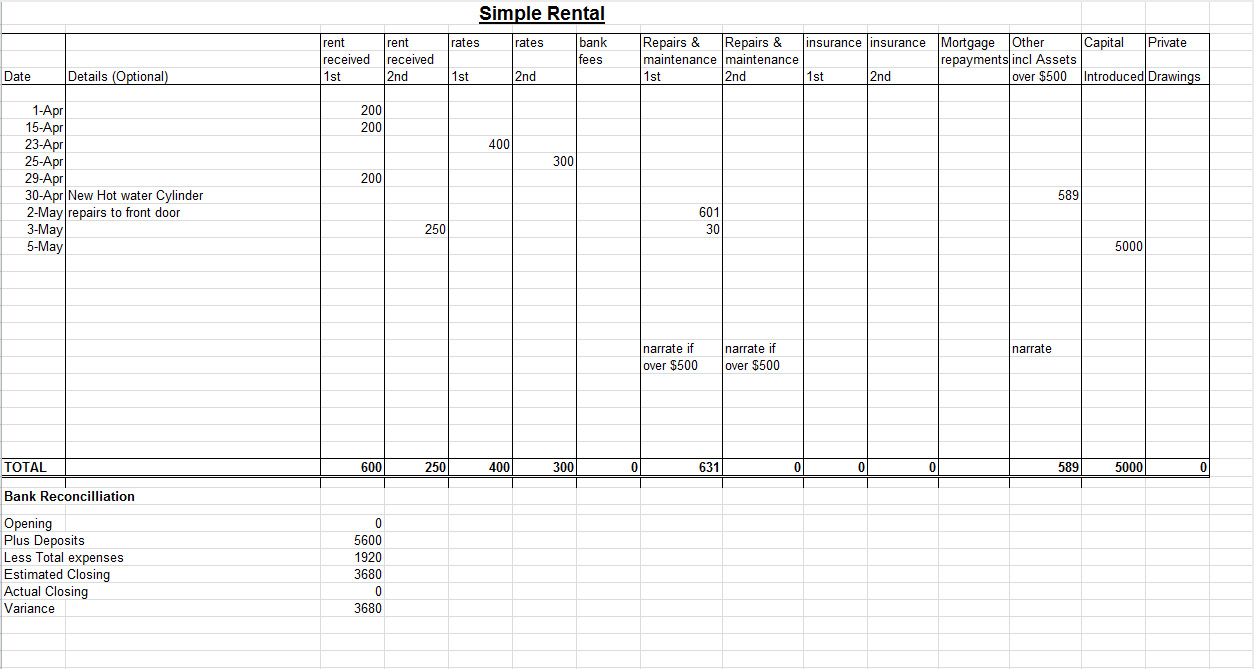

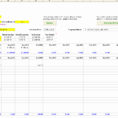

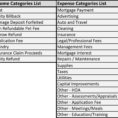

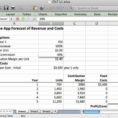

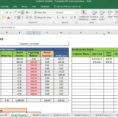

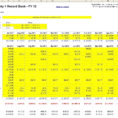

Rental bookkeeping spreadsheet software programs offer the following features. In addition to providing all the important information about the lessee’s payment history, the program includes the service to calculate expenses like depreciation, overhead and real estate taxes. Apart from this, it also gives the vital numbers of the rentals, such as the amount paid in rent and the size of the mortgage, the number of units for which it covers and the net amount owed to the leasing company.

It provides the owner’s report, which lists the payments made and the payments due to the leasing company, and also the return of the entire loan. Some programs even provide the balance of the rent plus any installment which were not paid to the leasing company.

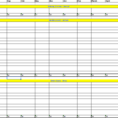

Another great feature of this software is that it shows the rent ledger, which includes all payments made during the first year of the lease. All the necessary information is provided on this table including the name of the lessee, his address, payment date, the amount and the payment method used, the amount of rent paid and the amount paid in advance.

Many leasing companies will create separate accounts for each of the tenants in the lease agreement. However, some will simply ignore the information they receive from the lessee. This creates confusion for the leasing company, who then has to get in touch with the tenant to understand what the leases say.

Payment records, including the amount paid, the amount due and the date of payment are also given. The main reason why such information is vital is that, when the tenant moves out, the leasing company has to provide the next of kin details in order to file the final paperwork with the court.

One of the other features of the spreadsheet is that it will keep track of any repairs done on the property, whether the repairs were made by the tenant or the leasing company. This is very useful in case the leasing company has failed to fix the problem and it has to go through the same process all over again.

All payments made are tracked along with the rent. This can be used to determine whether the lessee has been making monthly payments to the leasing company.

If the lessee fails to make the rent payments on time, then the accounting software can let the leasing company know about the issues immediately, which will ensure a quick turnaround and thus the elimination of late fees. And if the owner gets too angry at the lien holder, he or she can contact the leasing company and request the lessee to correct the problem.

As mentioned earlier, there are many advantages that come with rental bookkeeping spreadsheet software. These advantages will help a firm that sells or rents property to prosper. YOU MUST LOOK : office bookkeeping template

Sample for Rental Bookkeeping Spreadsheet