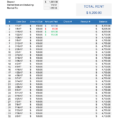

A rent payment Excel spreadsheet can be a good resource when entering payments and tracking expenses. It is essential to have one if you own a business or are running a business, as the rents and security deposits that tenants pay each month can often add up to more than you know what to do with.

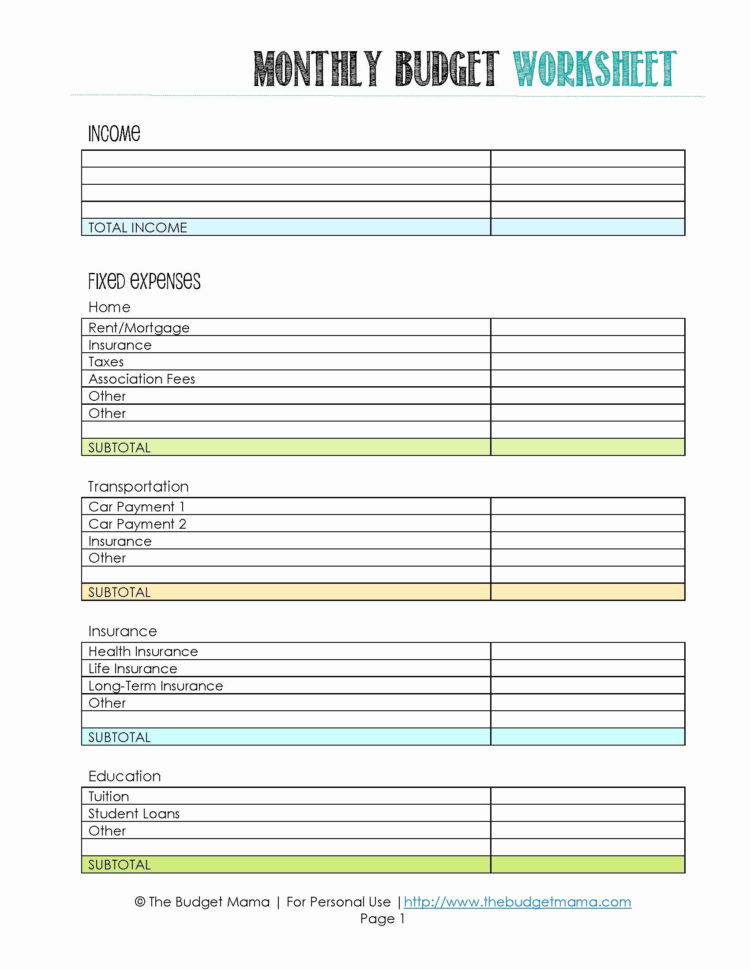

The fastest way to lose track of your expenses is to not have any kind of budget. With no way to record all of your expenditures, you can end up spending way more than you intend to over the course of the year. For instance, if you buy groceries but forget to save receipts for it, you could end up spending three times the amount you originally budgeted to purchase your groceries for the week.

A Rent Payment Excel Spreadsheet Can Help Keep Track of Your Expenses

You can make a rent payment Excel spreadsheet for each tenant to keep track of all of their finances so that you can know exactly how much they owe you, and when they can expect to pay it back. This will help you track the rent payment as it comes in so that you can make sure that the amount you pay them each month is correct, without having to go through the hassle of having to find the receipts yourself.

Even if you have never used an Excel spreadsheet before, you can quickly get into the groove of using this type of software for managing your finances. You can also use it for other purposes as well, such as tracking expenses related to your rent payment.

To create a rent payment spreadsheet, you will need to have all of the information required for the spreadsheet including the tenants’ names, addresses, and phone numbers. If you have more than one tenant, then you will also need to list the type of lease or rental you have for each one of them.

Leases may include one or two years, whereas leases for a specific amount of time (such as tenancies for a year) may require you to choose between one or two options. For instance, if you own a property that you rent out to tourists, you might have a one-year lease, and a longer lease for tenants who rent the property out for a longer period of time.

You will also need to include all of the different types of financing that you offer, such as bank loans from a lender. Many landlords prefer to use a bank loan to finance the initial purchase of the property, while others like to use a mortgage. Whatever you choose, make sure you list the terms of each so that you will be able to record the monthly payments.

Rentals include the cost of utilities, such as water and electric, as well as other rental fees. You should also include these amounts as well as any additional fees such as maintenance fees and late fees for property insurance.

You should also enter in the exact amount of rent each tenant owes you each month, along with how many months are left on the current lease. This will help you to keep track of the rent payments as they come in so that you will know how much money you need to come in each month to cover the rent.

While you cannot input a rent payment Excel spreadsheet for every tenant, you can enter an excel workbook for each tenant. You can add a tenant to the rent payment sheet, and the spreadsheet will record all of the tenant’s information including their name, address, phone number, lease, and rental amount.

Once you are finished creating the rent payment sheet for each tenant, you can easily get the information you need for each one of them and insert it into the Excel spreadsheet. This will ensure that you are tracking and accounting for every dime that each tenant brings in, and that every penny is accounted for.

If you are looking for a way to make sure that you areproperly handling your finances and keeping track of your rent payments, you should consider making use of rent payment Excel spreadsheet tools. It can also be a good way to help keep track of your expenses for tax purposes as well. SEE ALSO : rent collection spreadsheet template

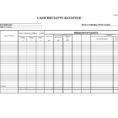

Sample for Rent Payment Excel Spreadsheet