Top Real Estate Profit and Loss Spreadsheet Guide!

Selling a home, apartment building or other rental property isn’t the exact same as selling your principal residence. Hence, get in touch with all your vendors today even when you don’t plan to sell your home for some time. If you intend to sell your house in the forseeable future and know you will probably have a huge capital gain, then it’s better to make as little W2 or 1099-MISC income as possible. Inside my opinion, real estate is the ideal investment. Also, property cannot be considered a reified notion, because in the very first instance, property is quite concrete as a physical thing-in-itself. Dead Investment property, it’s a property from which you cannot derive any profits. By way of example, my duplex proprietor may have bought the property for $50,000 over 30 decades ago.

Real Estate Profit and Loss Spreadsheet and Real Estate Profit and Loss Spreadsheet – The Perfect Combination

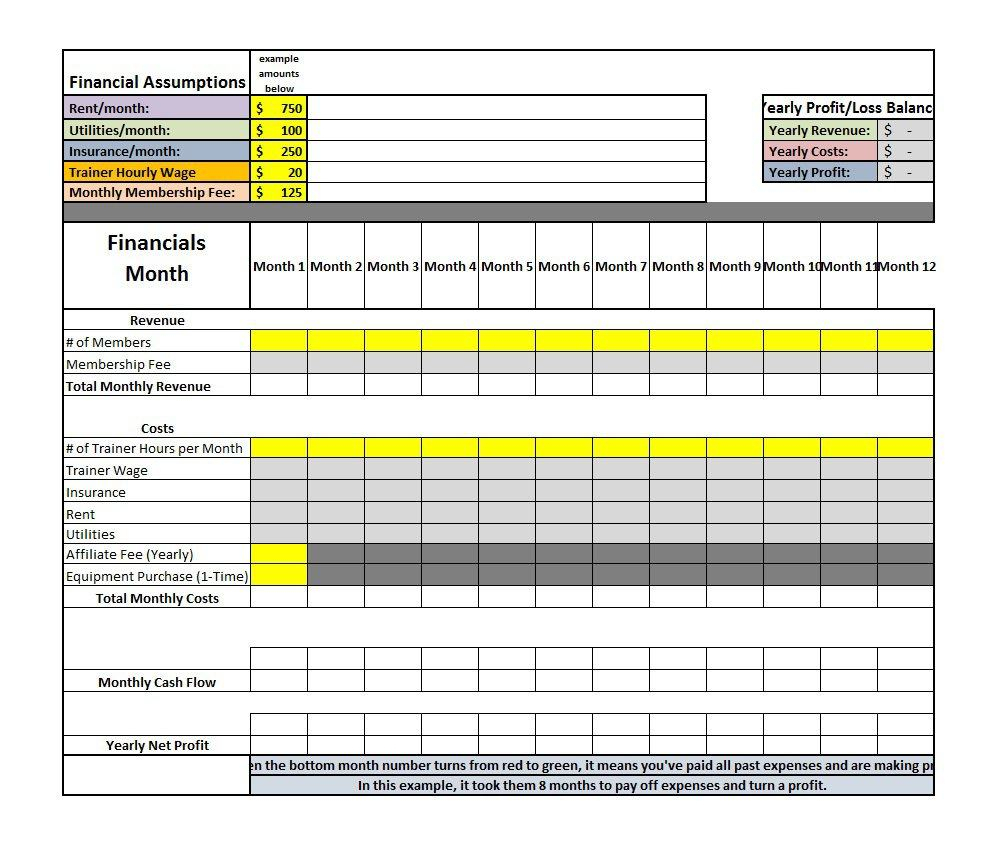

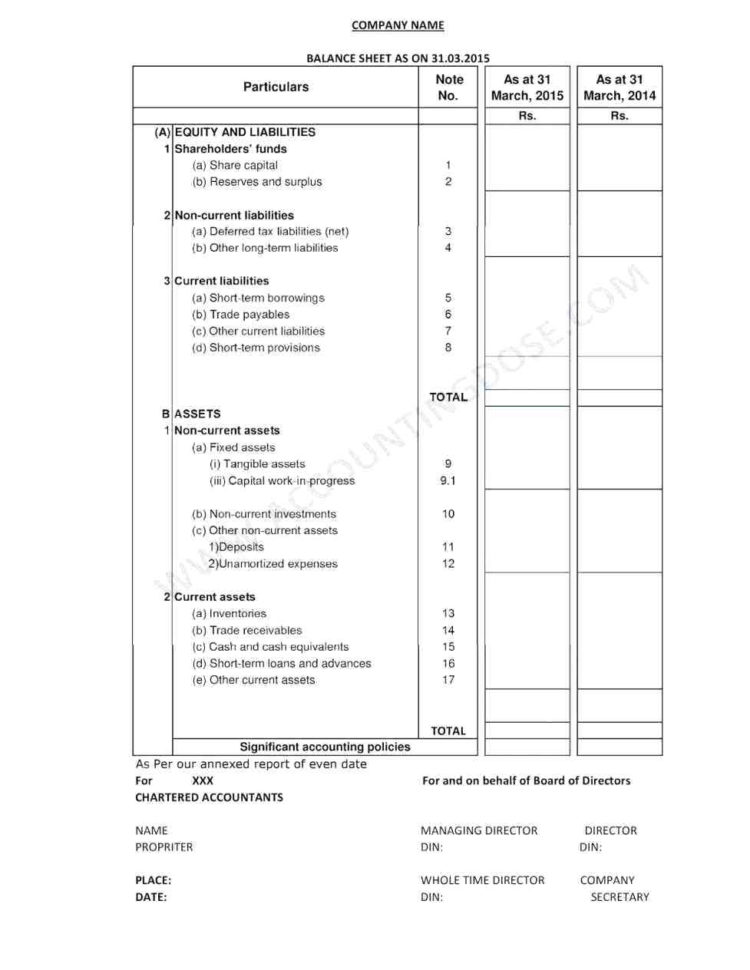

Designed primarily for the actual estate investor who only wants an easy and straight-forward 10-year cash flow analysis. It is possible to acquire insight in to your asset allocation together with the overall expenses of taxes, and manage risks related to your portfolio. In the event the beneficiaries Trust you and you’ve demonstrated honesty and dependability in your handling of the Trust, they might not request that you give them a complete accounting.

Real Estate Profit and Loss Spreadsheet Features

Based on how your business was set up, you can take dividends as an operator or shareholder instead of, or along with your wages. Running a company means keeping tabs on your finances. If your company is big, or is growing, obtaining the ideal accounting software is the sole method to understand where every peso and every centavo comes from. For instance, if you’re a mail-order company, then the more you sell, the more you are going to pay for shipping expenses.

What is Truly Happening with Real Estate Profit and Loss Spreadsheet

Investors will need to keep tabs on each of their investments. Real estate investing, much like any other expert enterprise, is a string of interrelated skills. It’s possible to also compare the many funds to discover which performed better. Once you locate the suitable Vanguard fund that’s best for you, you can invest directly. Other assets have various timelines.

The IRS gives property investors another tool to lessen taxes on the selling of genuine estate. If you truly get stuck, don’t be scared to employ a great tax professional for aid. The quantity of tax paid varies by country, and in several cases even by region within the nation. One of the absolute most important team members are going to be a tax professional like a CPA or competent tax lawyer. Because the price of real estate is so large and frequently purchased with debt. It’s possible to understand that the price rises during the first couple of years, so there are not any tax-loss-harvesting opportunities here. At times, the expense of the implementation and infrastructure is greater than the true price of the accounting computer software.

Profits can be weighed against the price of advertising, marketing, manpower and a great deal of different factors. Your net profit has become the most important number you should determine. Notice that it takes more cash to accomplish the very same IRR. Nowadays you know the fundamental strategies to produce money.

Sample for Real Estate Profit And Loss Spreadsheet