An important part of a real estate deal analysis spreadsheet is to study the past. The past will give you a sense of what will be different in the future. It is all too easy to look at the present and forget that the future is always open to new opportunities.

Look back at the past to see what was different. What were the positives and negatives? This will show you how to assess the potential for future gains. Often, the negative aspects are present now and it is simply a matter of addressing them.

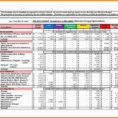

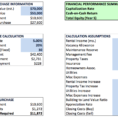

Real Estate Deal Analysis Spreadsheet

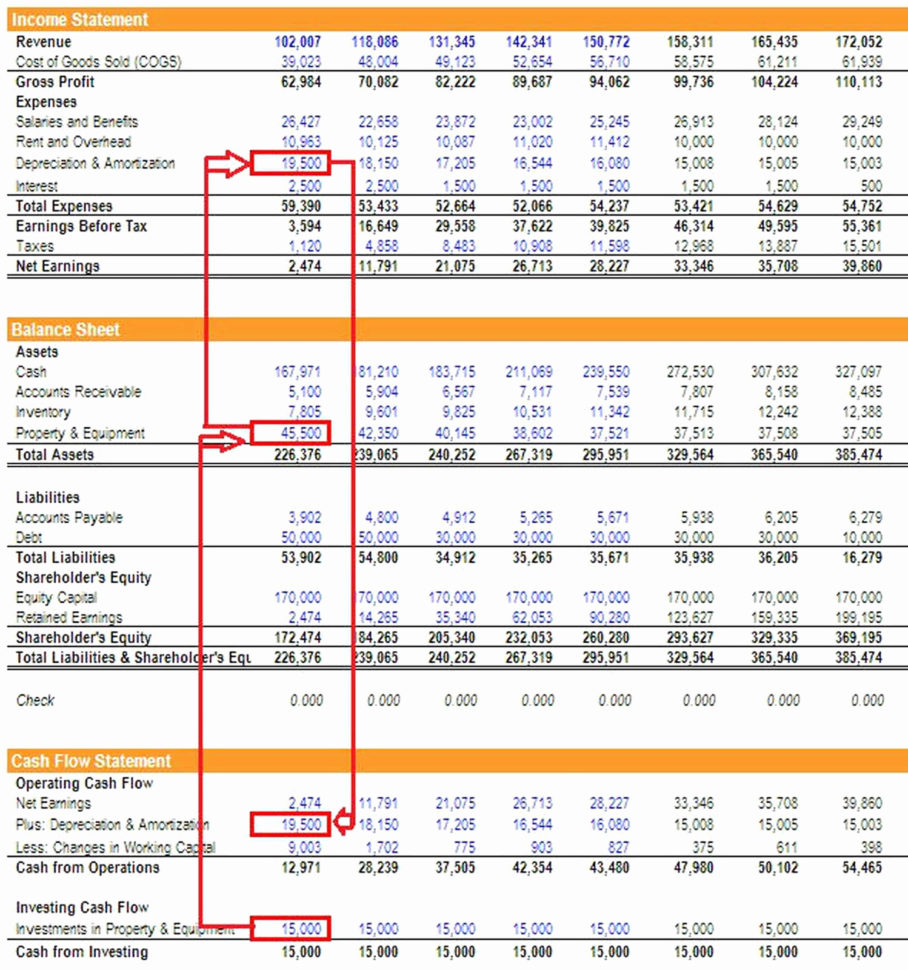

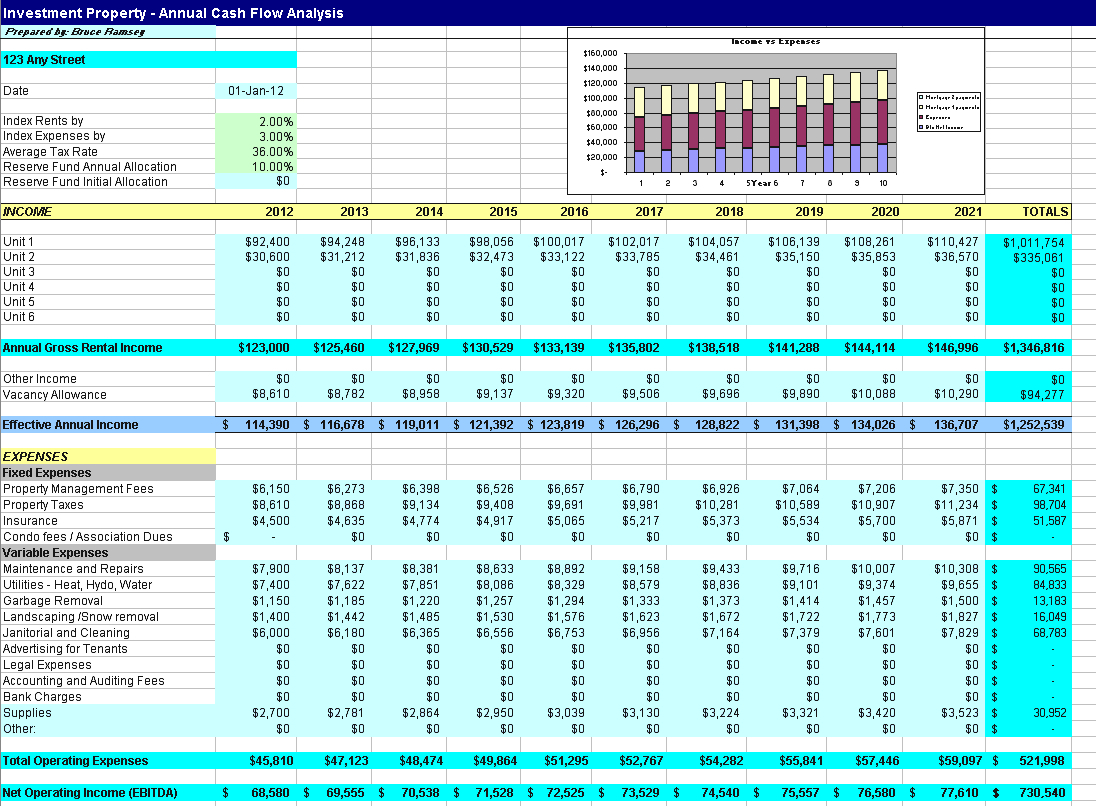

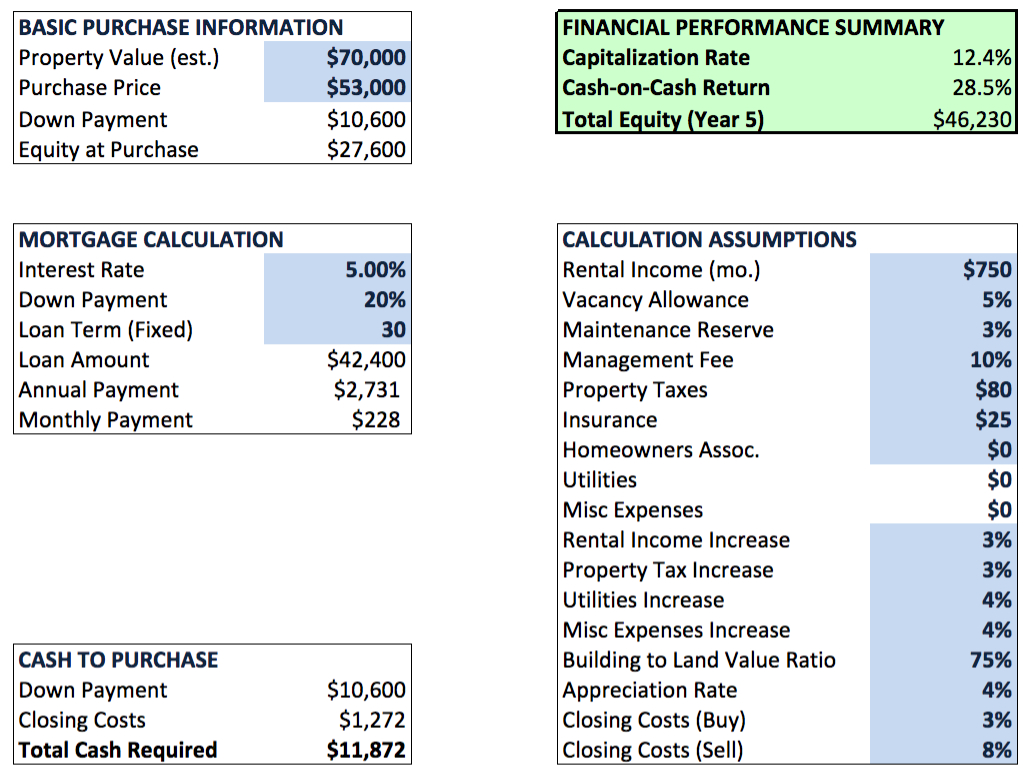

A real estate deal analysis spreadsheet allows you to quickly analyze many different situations. While there is much to consider when getting started, these basic tasks are easy to follow. All you need to do is to make a few decisions about what data you want to include and what you want to exclude.

Begin by gathering your list of potential deals. You should begin with the bigger names. Once you have listed the names, you can go back and examine the analysis that they had completed before you purchased the property. The analysis will give you a sense of their personality and how they handled the buyers that bought from them. If you are looking for deals involving condominiums, schools, medical centers, retail or offices, then make sure you start with those types of properties.

You can then decide which data you want to include. Many times, you can find ways to remove the negatives that come from purchasing a property. Other times, you may discover hidden pros that were not obvious before you made your purchase. These are opportunities that may help you make more money.

If you already know how much money you are willing to spend on a real estate deal, then you can start collecting data about other aspects of the deal. It is important to review everything before you make your final decision. Remember, once you have bought a property, you will want to be able to sell it at a profit. That means you will want to know as much as possible about the property and its surrounding area.

Some of the things you will want to consider when reviewing the data include the location of the property, the cost of the property, crime rate in the area, and so forth. You should not be afraid to ask for quotes and compare them to others. This is the best way to find out if the seller is likely to sell their property for a profit or is just trying to get you to buy their property.

When completing your analysis, take some time to go over the entire process. Each step in the process will provide a hint of what to expect. This includes the financing, appraisal, closing and sale. It may also be wise to record the date when you took the steps so you will have a reminder of what to expect.

If you are not sure where to begin with your real estate deal analysis, you may want to begin with the “what if” section. That is, what if the sale did not close? Would you have been better off or worse off if you had done certain things differently? What would you have done to help improve the sale?

Even if you are still unsure of how to proceed, it is a good idea to write down a few scenarios and discuss them with a professional real estate agent. That way, you will have a better idea of what to do and who to talk to.

When working with a real estate deal analysis, always keep track of the information. If you find that a property or group of properties fails to meet your expectations, then you need to correct it immediately. You will end up getting paid for this work by the bank and may never receive the full value of your investment.

Any financial transaction must start with an analysis of the potential customer’s interest in a given property. In the real estate world, a good analysis will help you see where your own interests are in the process. PLEASE LOOK : real estate client tracking spreadsheet

Sample for Real Estate Deal Analysis Spreadsheet