Having a Quarterly Profit and Loss Statement Can Save You Money

While the idea of a quarterly profit and loss statement might seem a little more difficult to grasp, it is not actually that hard to understand and maintain. All you have to do is follow the easy steps listed below.

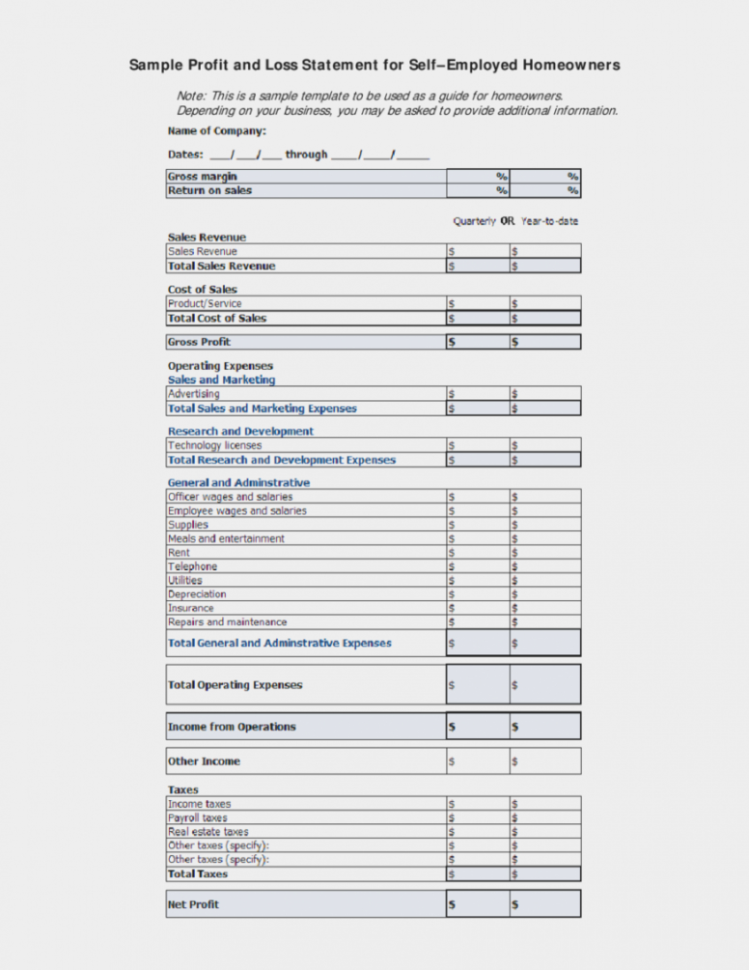

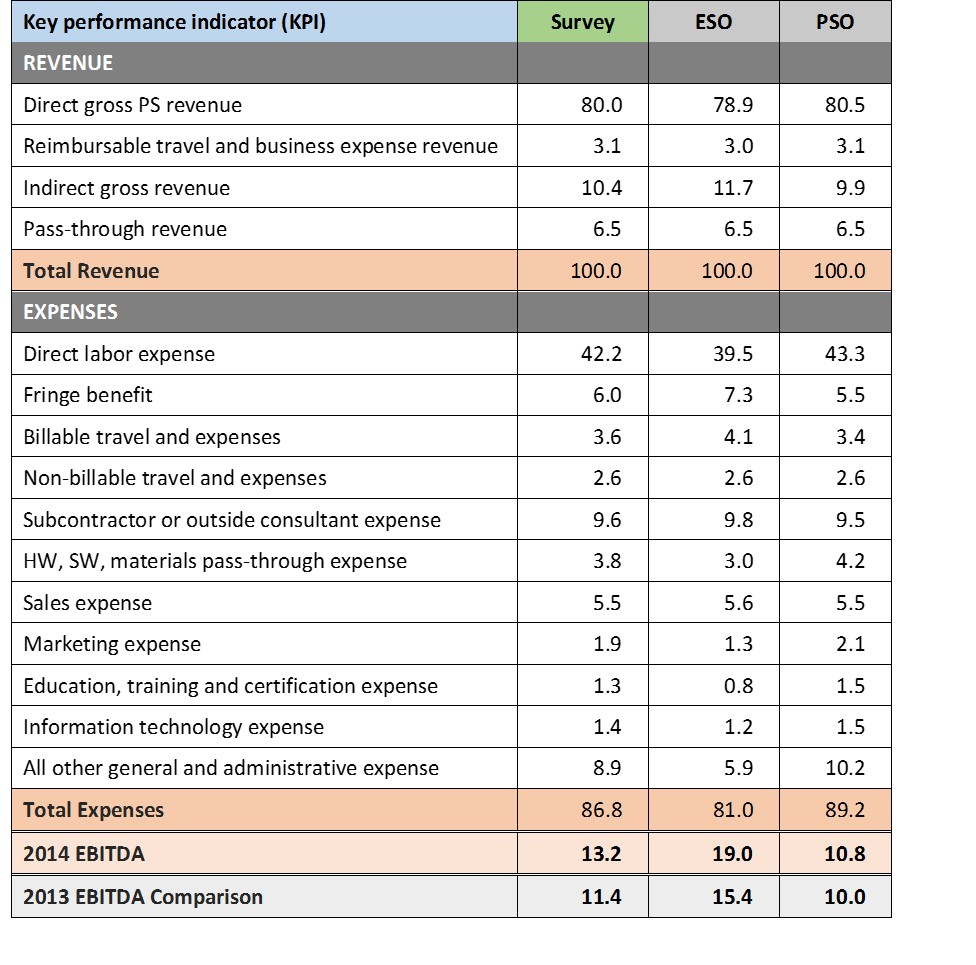

If you are just now becoming familiar with the concept of a profit and loss statement, here is a quick review. A profit and loss statement are essentially a record of your financial condition during the current year.

It will also show the total amount of sales tax that you have paid and income tax that you have collected. There are two components to this statement. The first is a breakdown of your sales (the volume of your sales) and the second is the total income from sales.

For example, let’s say that you sell 10 sheets of toilet paper at a discount on your store. Your gross profit on each sheet of paper would be $20.

On the other hand, if you only sold three sheets of paper, you would only have paid sales tax on the first three sheets of paper, leaving you with no taxes for the rest of the sale. This would mean that you would not have any sales tax for the quarter and would be allowed to claim that you had a profit of $100.

As you can see, this is the basic structure of a profit and loss statement and is a fundamental part of most small businesses. So you don’t have to worry about going over or understating sales by any substantial amount.

Another great thing about a profit and loss statement is that you can easily change it every year by simply following the appropriate steps. However, you will also want to keep a couple of things in mind. You want to have a return policy with your accountant so that they can easily double check your statements.

Some small business owners may not be used to doing this themselves and they are concerned that they will cause a problem. To avoid this problem, you should set up an accounting department and make sure that they have access to this documentation.

After all, you’ll need to go back to your accountant and tell him or her what you’ve done. There are many great step-by-step templates that you can follow to ensure that you don’t end up having problems down the road.

If you are already doing this for your small business, this is one great way to keep your records up to date and accurate. It is also the easiest way to quickly find out when you’re out of the profit and loss statement.

By using a profit and loss statement template, you can quickly review your accounts to make sure that you are on the right track. It will allow you to make some changes and also see how those changes affect your financial status. PLEASE READ : Project Resource Management Spreadsheet

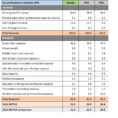

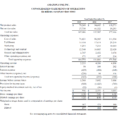

Sample for Quarterly Profit And Loss Statement Template