Kids, Work and Qualified Dividends and Capital Gains Worksheet 2018

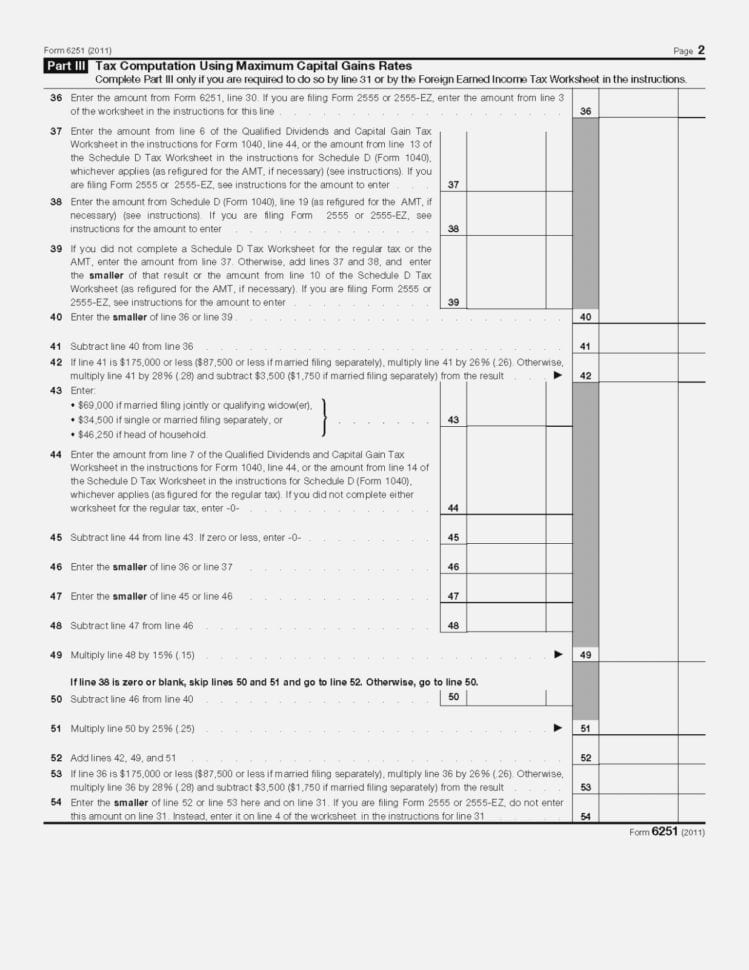

The matter of how to tax unearned income is really political. Therefore, if you feel having issues with your private writing, all of our design templates highlighted along the content offers you some hints together with techniques about providing far far better outputs. You can also take ideas via each and every web template to make your own write-up effortlessly. One of the excellent techniques to construct wealth is to place your money to work for you through investments, like stocks or real estate. It’s money which you make with other money. Figuring the tax is comparatively straightforward if you employ the worksheet supplied by the Internal Revenue Service. The federal government taxes ordinary dividends in line with the normal income tax prices.

The Lost Secret of Qualified Dividends and Capital Gains Worksheet 2018

A dividend is typically qualified if you’ve held the underlying stock for a certain length of time. Dividends are a really good means to make extra income. However, don’t forget that they are not a guarantee. They can also provide a steady source of income in retirement. Earning dividends is an excellent incentive for investing in some specific companies or mutual funds. They are particularly useful for people who need to supplement their retirement income. To put it differently, REIT dividends aren’t qualified dividends.

While the remainder is made up of brief overview of the niche matter. Amended Return If your income changes following your return is submitted, the tax has to be refigured using the adjusted quantities. You need to submit a tax return. Today the industry value of the residence is $300,000. If you get the property as a present, you use the identical basis as the particular person who gifted it to you. If you have a home you could be wondering the way the government taxes profits from home sales.

If workers feel they were a portion of producing the goal, they are more prone to try their level best to locate the goal. Teachers may use Worksheets to learn scholar understanding of the subject matter that’s been submitted. You will have to bear in mind that each and every college student enters the world different.

A Startling Fact about Qualified Dividends and Capital Gains Worksheet 2018 Uncovered

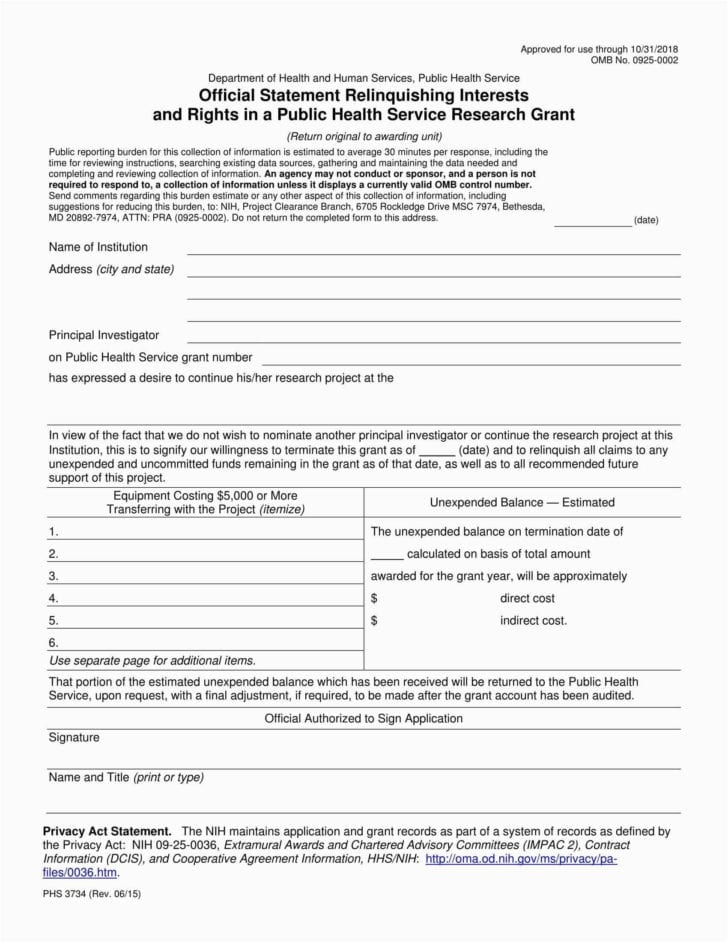

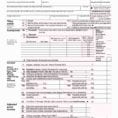

There are plenty of chart excel templates in the web. There’s no worksheet for this. The estimating worksheet was made to direct you get through the estimation practice. After you’re trying to lose or maintain your weight templates may be useful. It’s well worth a look for everyone who want to simplify the tax code.

Don’t forget, it is a substantial interface for non-technical users to take a look at the data. They vary based on the application. Despite all that, the procedure is bearable so long as you know how to differentiate qualified dividends from some other forms of distributions. The final result is at the period of evaluation, there’s a good deal of confusion. If your net capital loss exceeds the limit you may deduct for the calendar year, the IRS enables you to carry the surplus into the next calendar year, deducting it on that calendar year’s return. Subtract that from the selling price and you receive the capital gains. If you are in possession of a taxable capital gain, you might be required to create estimated tax payments.

My goal here is simply to mention a few of the changes that are likely to influence a huge number of readers. 1 aim is to see the way the math works. A second aim is to show you just how to organize your investment data for tax purposes.

What You Need to Do About Qualified Dividends and Capital Gains Worksheet 2018 Beginning in the Next Seven Minutes

There are a lot of techniques to do a cash flow program. There are a lot of limitations that could keep you from qualifying for the whole 20% deduction. At any specific time, a person will have a number of things he wants to achieve, both, when it has to do with short term and long term. To work out the size of your capital gains you will need to understand what your basis is. They’re taxed at another rate. The precise dividend tax rate is dependent upon what type of dividends you’ve got ordinary or qualified. The precise dividend tax rate you pay will be dependent on what type of dividends you’ve got.