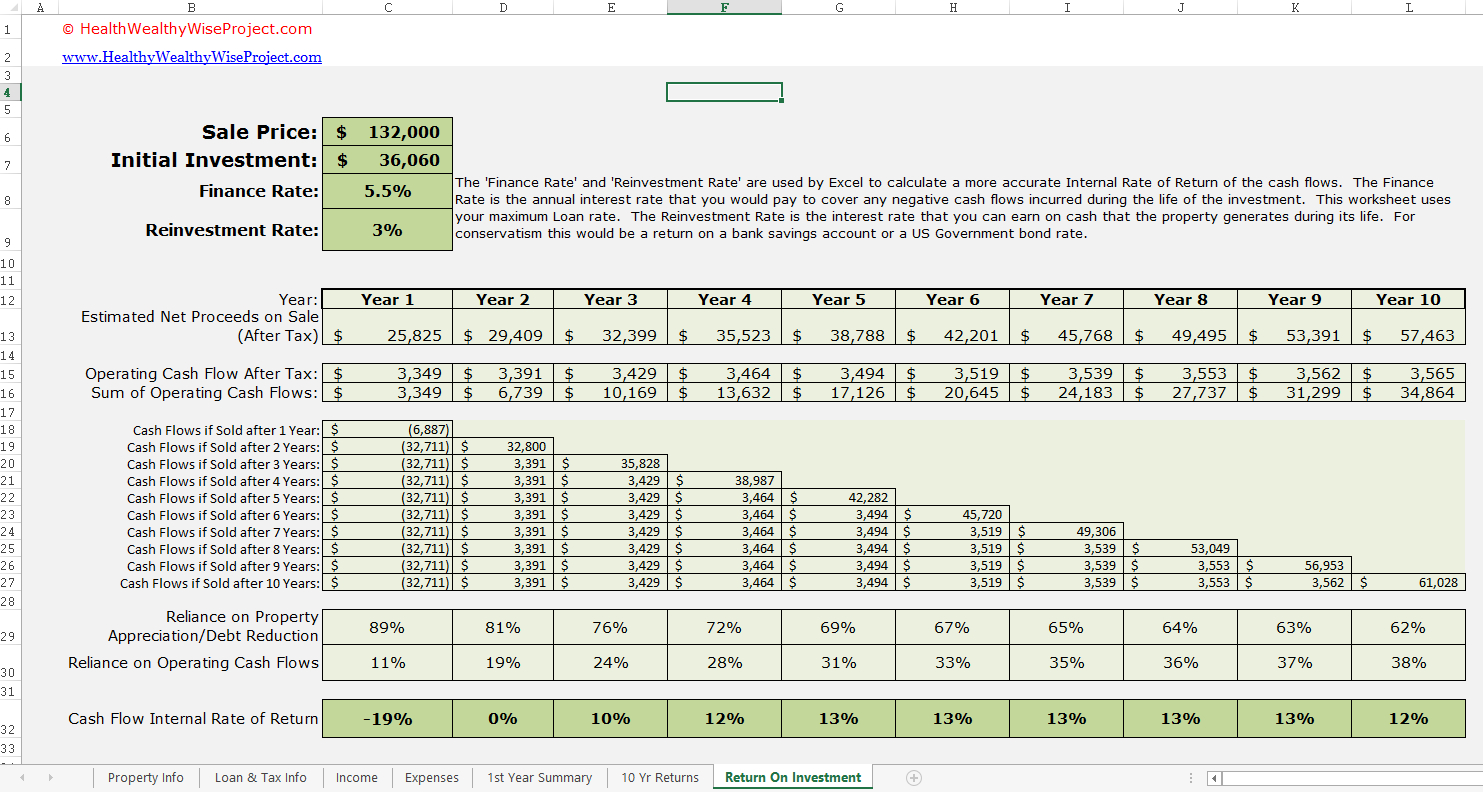

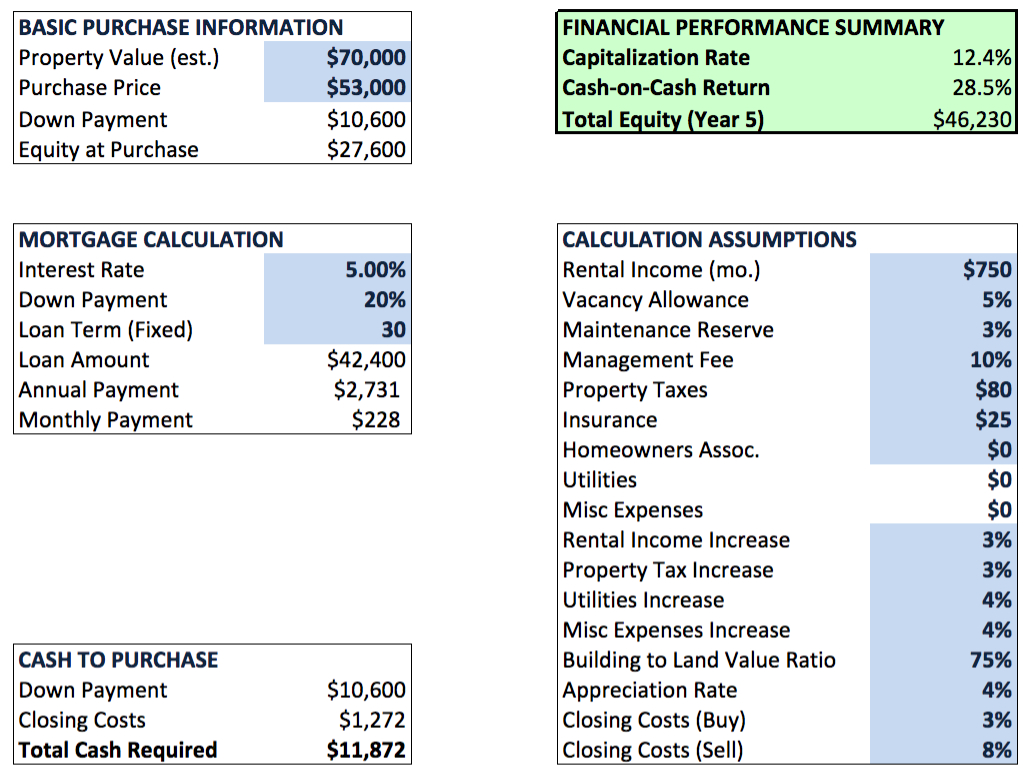

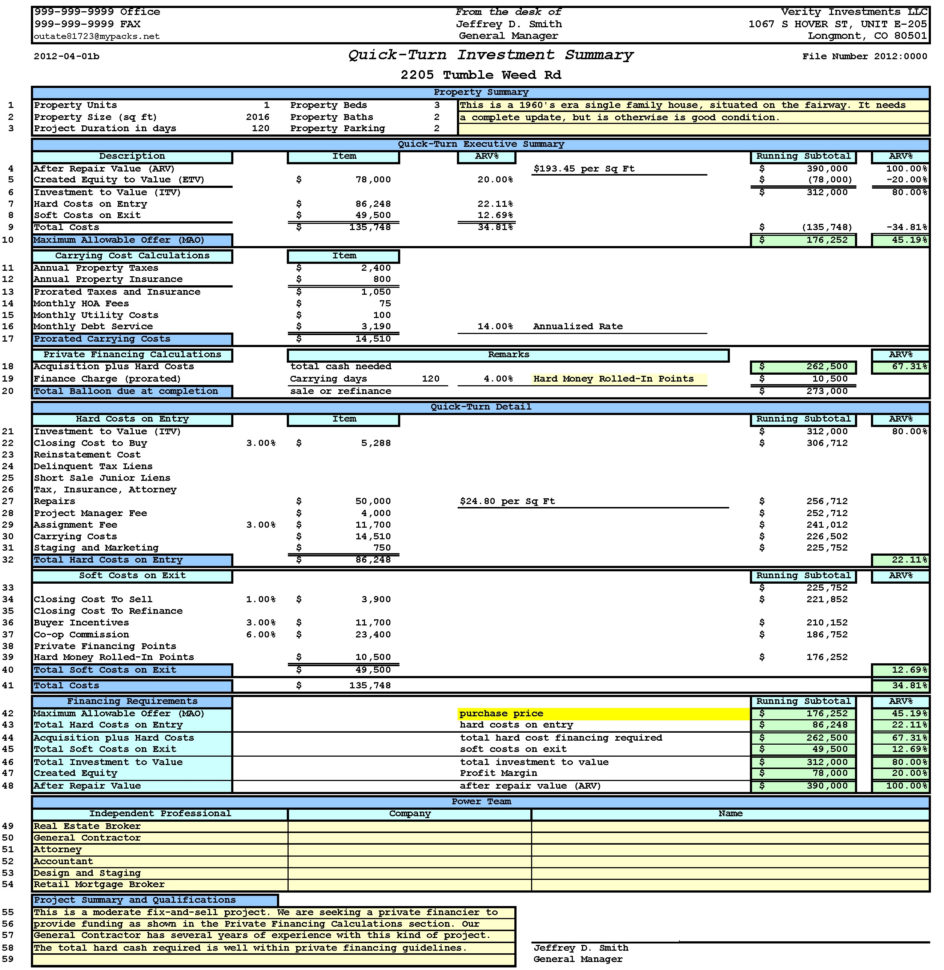

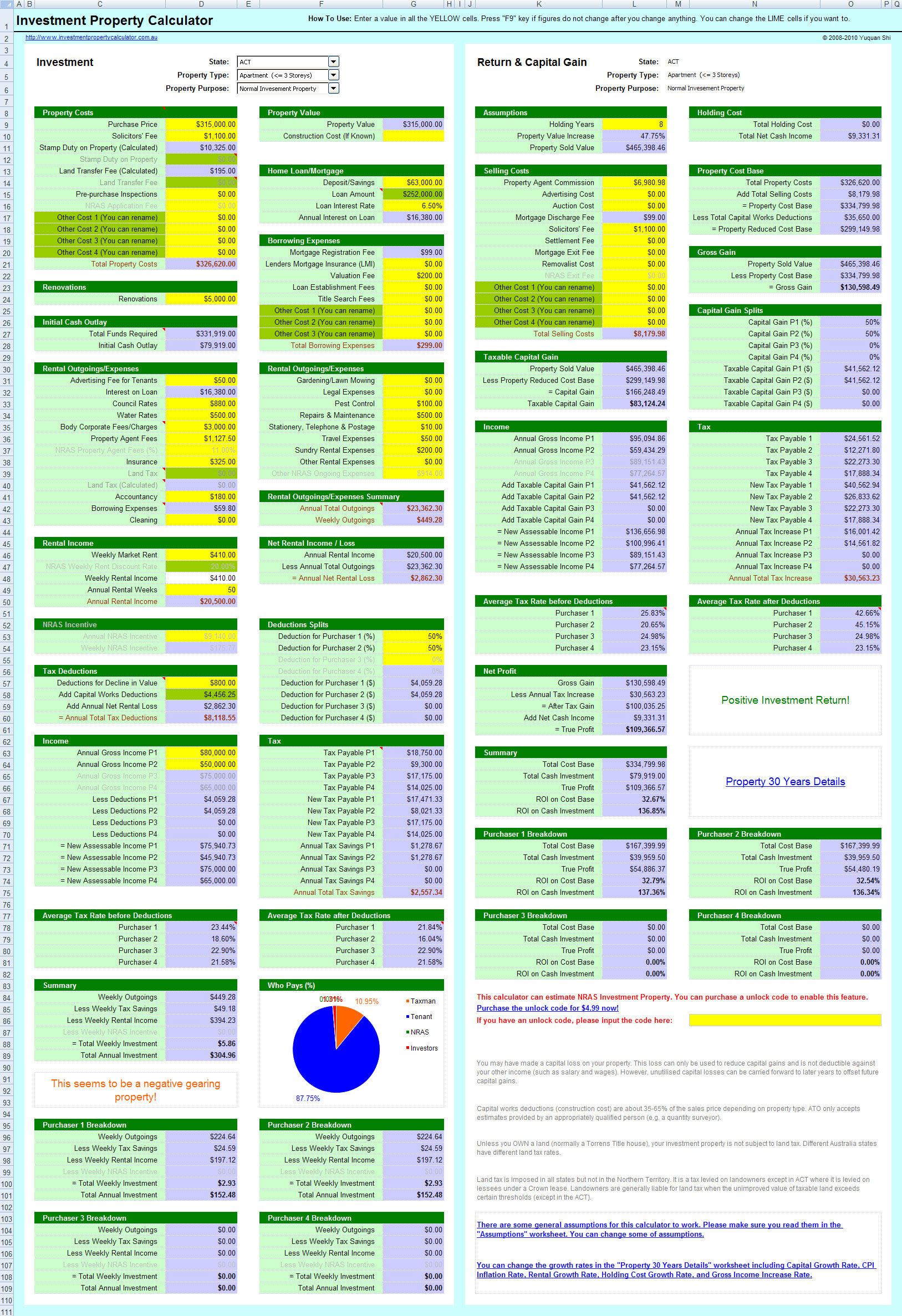

Property investment analysis is an important tool for all investors to have on hand. Whether you are interested in real estate or a different type of investment, you need to understand the critical features that separate the good ones from the bad ones.

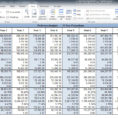

In a nutshell, the basic property investment analysis is a comparison of financial statements and reporting from all of the company owned properties that an investor is interested in purchasing. Some companies do not allow shareholders to check their own financial reports; the ones that do can be very difficult to read. That is why, before investing, it is important to get a property investment analysis spreadsheet from a reputable source.

Understanding Property Investment Analysis and How to Use It

A spreadsheet will make the job of reviewing financial reports much easier. With this kind of information, investors will be able to see what they should be looking for when considering which company to invest in.

Also, since all of the properties that an investor invests in are reviewed, investors will be able to see where their money is going. This can help them avoid investing in something that is not going to make them money. Instead, they can focus on finding good investments that are right for them.

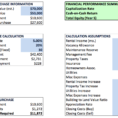

There are two types of property investment analysis. One is a qualitative analysis and the other is a quantitative analysis. Qualitative research focuses on identifying the potential profit points on a particular property.

In contrast, quantitative research analyzes what the return on the investment will be. If a property has poor demographics, for example, the potential profit is going to be low. If the cost of remodeling is high, the potential profit is going to be low.

There are many variables that can affect the potential profit on a property. So an investor must be careful to focus on the good areas and avoid the bad. This means an investor needs to focus on the property investment analysis spreadsheet that includes the necessary data in order to have an accurate picture of what properties are going to be profitable.

For example, there may be a specific demographic on a property that is the most profitable. An investor can focus on that demographic and use this information to determine whether the demographics are going to be profitable. If the demographics do not turn out to be profitable, then the property will probably not be a good investment option.

Because of this, an investor’s risk will be reduced by having this information on hand. When there is enough information, an investor can make a decision based on a general assessment of the profitability of that area.

Now here is where quantitative analysis can help an investor. Quantitative research helps an investor to determine whether a property has good value or whether it will lose money. It helps determine if the property has enough demand to be profitable.

The more quantitative research, an investor can do, the better off the investor will be. But the better the quantitative research, the more time and resources the investor will have to concentrate on areas that are already profitable.

The property investment analysis spreadsheet is the only place to find a comprehensive list of businesses’ profitability. This spreadsheet contains all of the data, an investor needs to understand a specific area of the business. That is why it is important to get a property investment analysis spreadsheet from a reliable source. YOU MUST LOOK : property evaluator spreadsheet

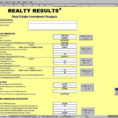

Sample for Property Investment Analysis Spreadsheet