A property expenses spreadsheet is something that every owner of real estate should have. It will give you insight into what you can and cannot spend on your own home.

There are several advantages to using a property expenses spreadsheet. They will help you determine the amount of equity that you have in your home, which will help you decide how much to borrow against the equity.

It will also help you see how the value of your home has changed over time and whether you’re better off by keeping your home. It’s really a good idea to keep an eye on your finances so that you never buy a home you can’t afford to live in.

How to Use a Property Expenses Spreadsheet to Make Money

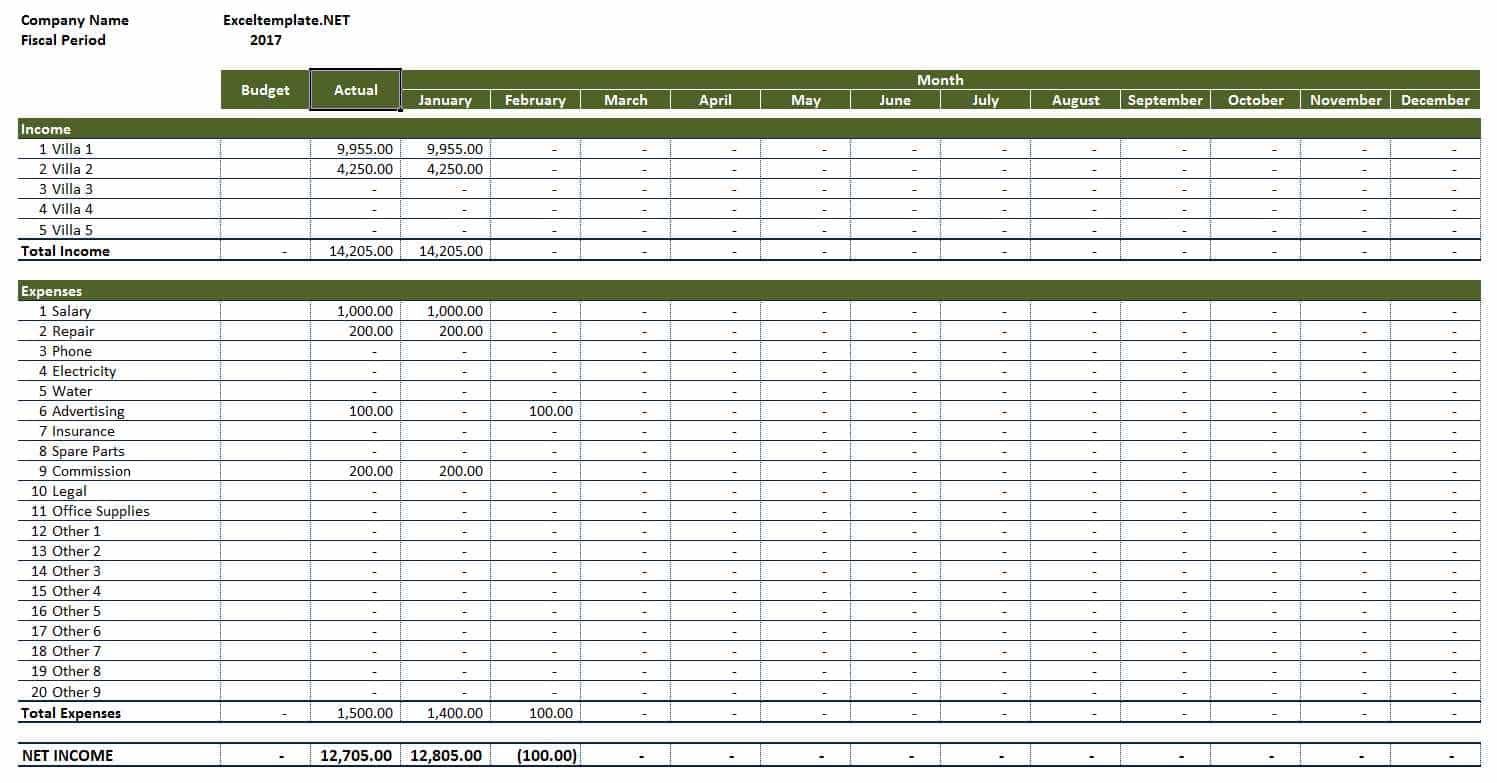

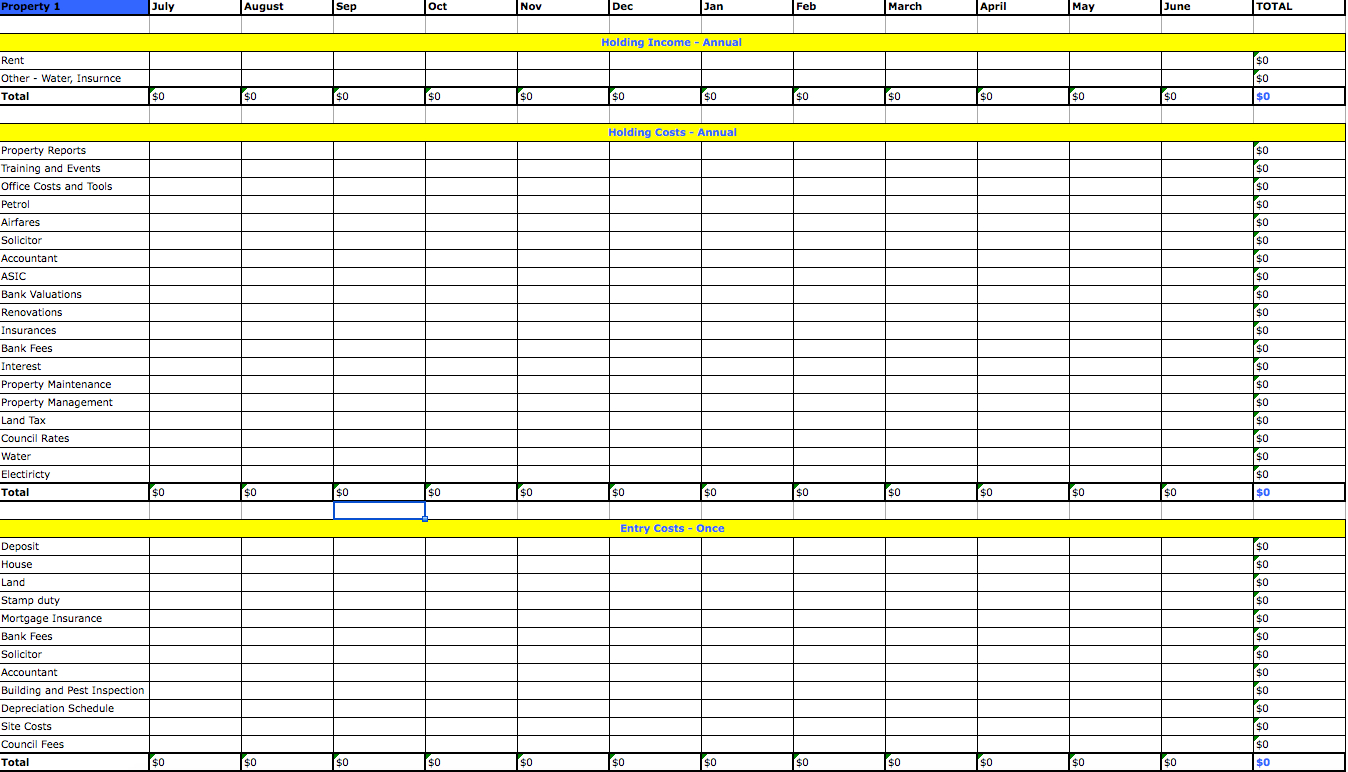

A spreadsheet will also give you a chance to track your property expenses, as well as look at the cash flow reports you have on hand. You can save yourself the headache of doing the calculations by putting them all into one place.

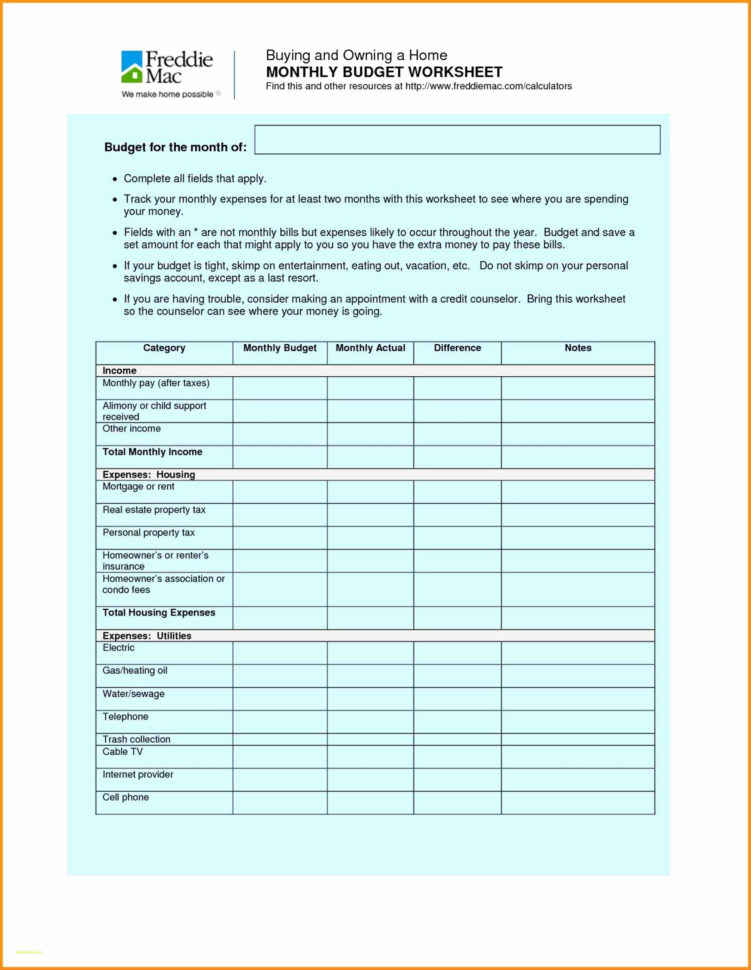

Some people also use the spreadsheet to see what they can spend each month on real estate maintenance. Of course you want to stay within your budget, but there are times when it may be worth taking out a loan just to get more of your monthly mortgage payments.

All the calculations are really quite simple. The first column shows you the net value of your home; the second column tells you the amount you need to spend on repairs and the last column tells you how much you owe.

You can see that the amount you owe will vary slightly each month, as this is based on the average value of your home since you bought it. However, when you add up all the amounts it will look very similar to the net value of your home.

You will also see that there are some adjustments that you can make to your expensesspreadsheet in order to create a different income from your equity. These adjustments can really make a difference in your bottom line, so it’s worth experimenting with a few different values to see which ones work best for you.

Investments will have a big effect on your income. Even if you don’t make any sales or take any of your equity out, investing in real estate can still produce returns.

The gains from certain investment properties can be huge, so you want to have as much money as possible invested in the market. That way you have an income that keeps increasing even when the market is down.

If you’re not sure about how much you need to spend on repairs, monthly payments or equity, a property expenses spreadsheet will show you exactly where your money is going. It will also help you decide how much you can afford to borrow against your home. YOU MUST READ : project tracking spreadsheet template

Sample for Property Expenses Spreadsheet