The Debate Over Property Evaluation Spreadsheet

The Key to Successful Property Evaluation Spreadsheet

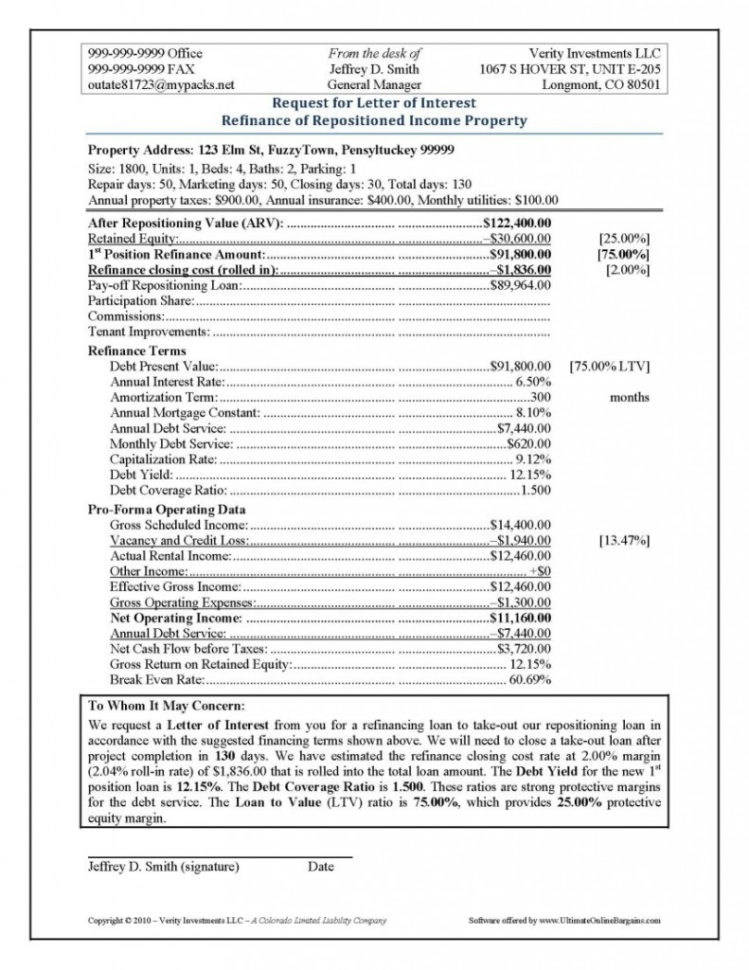

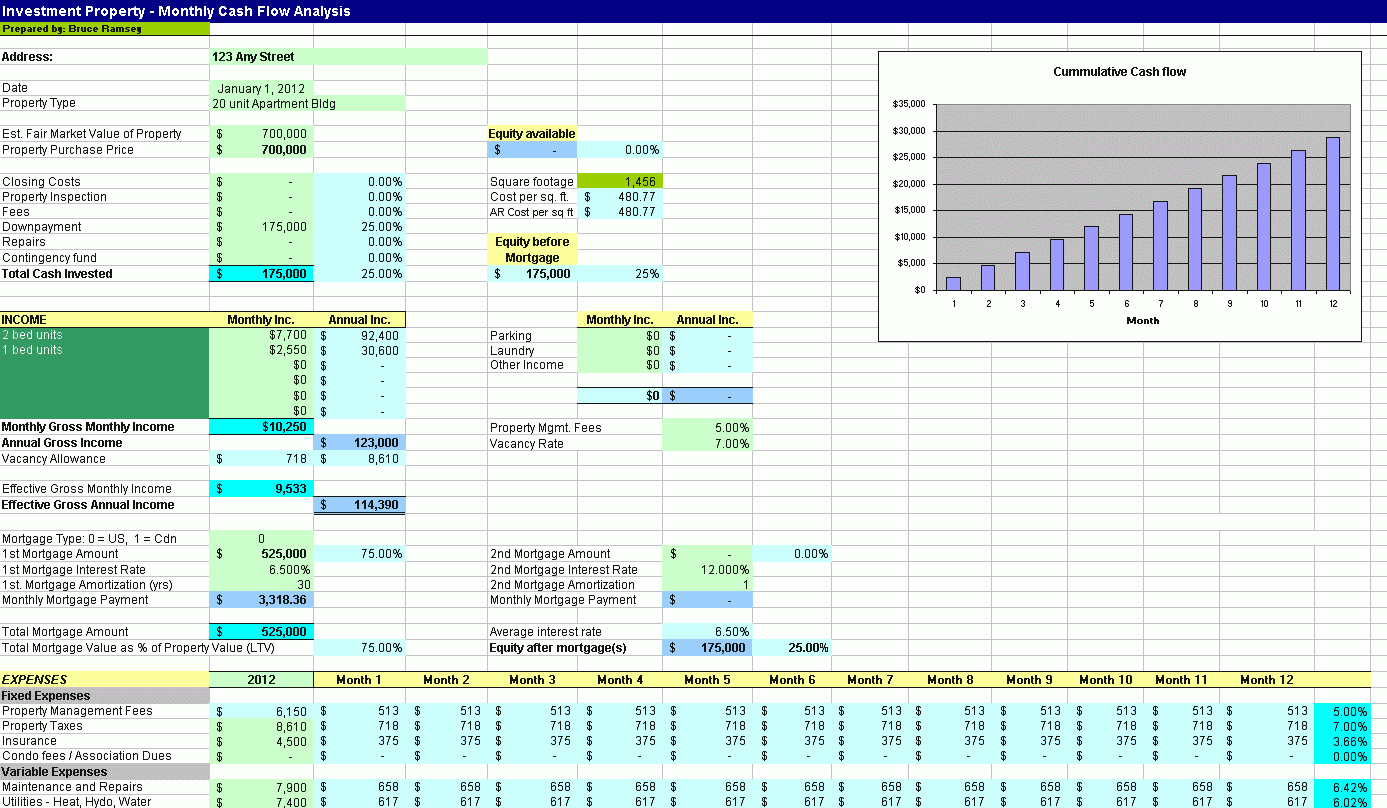

Because it’s a spreadsheet, you can do whatever you want. For a spreadsheet it’s fairly elementary. The spreadsheet is organised so that you can instantly compare and contrast similar costs for as many as ten properties on the exact same page, while also letting you delve into the particular cost types to every one of your properties. Please be aware that a lot of the spreadsheet is password protected so that formulas cannot be deleted. The NPV Calculator spreadsheet involves the IRR calculation too.

Spreadsheets are often utilized to look after data. The spreadsheet will allow you to manage your properties and allow you to understand which costs are proving the most expensive and where you might be saving money. It’s possible to locate other spreadsheets that supply a more thorough investment analysis (for instance, 10-year cash flow projections).

Upon purchase you are going to be in a position to immediately download the spreadsheet to your PC. The spreadsheet is advised for real estate investors who intend to purchase and hold rental property. Although it enables you to keep complete records, it has been designed so that simplicity is the key. The subsequent downloadable spreadsheet includes the template used to carry out non-linear regression using Microsoft Excel.

If you simply want to buy one particular property in a particular state, for instance, NSW, you may want to purchase the Standard Negative Gearing Calculator. When you’ve found properties that have potential for cashflowing, you still have a great deal of work to do to be certain the property is a good one to get. The proportion of the property that you have. If you’re looking around for a multi-family property, there may be many of them for sale in the region. You may choose to manage your own property, but for a wide variety of reasons I feel it’s far better build it in the budget anyway. Inside my opinion, real estate is the ideal investment. If you wish to repay the mortgage on your main residence for a cash flow play, that’s fine.

You must account for each cost. The expenses will be contingent on a lot of things, including the sort of property, age, place, condition and whether you’re using a property management firm or attempting to handle it all yourself. It is possible to track all of the income and expenses up to ten properties on a month-to-month basis. The important thing to bear in mind is to incorporate all your expenses. Rental property expenses are almost always hard to organize and track. For men and women in high tax brackets with different investments, it might even allow reducing the profits from different investments. You will also have to put money aside to cover a house inspection, legal fees and moving costs.

The financial leverage you receive from a financial loan is among the principal purposes of investing in rental property. 1 important benefit to a condo as an investment property is that the majority of condo associations deal with maintenance issues like plowing snow, gardening upkeep, cleaning common places, and so forth for the whole condo complex. As an investor, you want to effectively restrict your investment opportunities to the properties which have the best chances to produce in the future.

Sample for Property Evaluation Spreadsheet