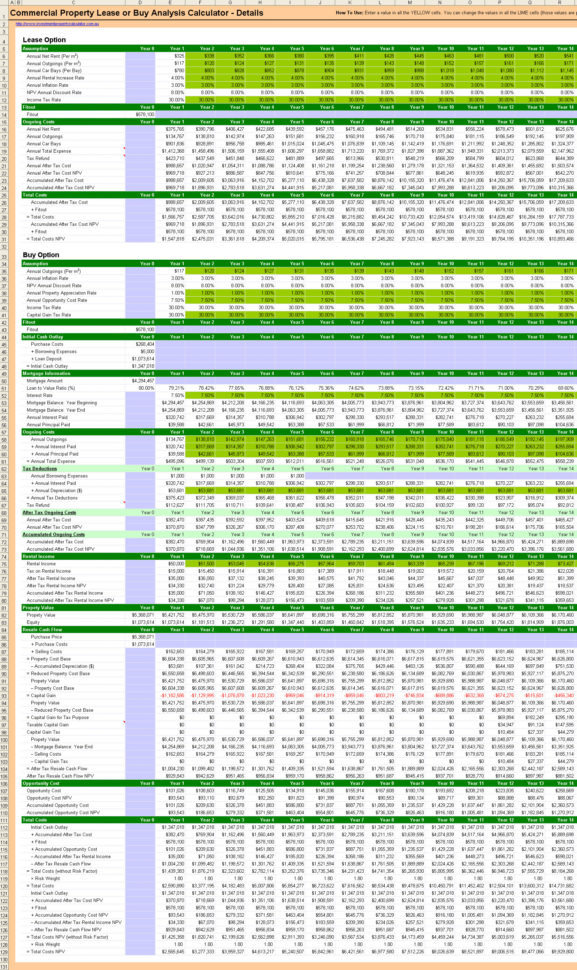

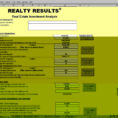

A Property Cash Flow spreadsheet is one of the first financial tools to develop in a cash flow analysis. Although the spreadsheet is not a substitute for professional advice, it can be a useful financial tool. An excellent example of this is when the investor looks to buy or sell property.

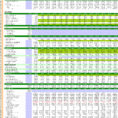

There are two types of data in the property cash flow. One type is the gross revenues generated from the property and the other is net rents and payments. The idea is to have a good comparison between the two so that any relevant changes can be made before making a decision to sell or purchase the property.

Using Property Cash Flow Sheet

Using the property cash flow spreadsheet can help you see the differences between the two and then make a decision based on the data. The next step is to compare the two figures. If you have an amount to hand and have decided that you are going to buy or sell, a spreadsheet can help you determine what the differences are and how they affect the decision. This will help you make your final decision.

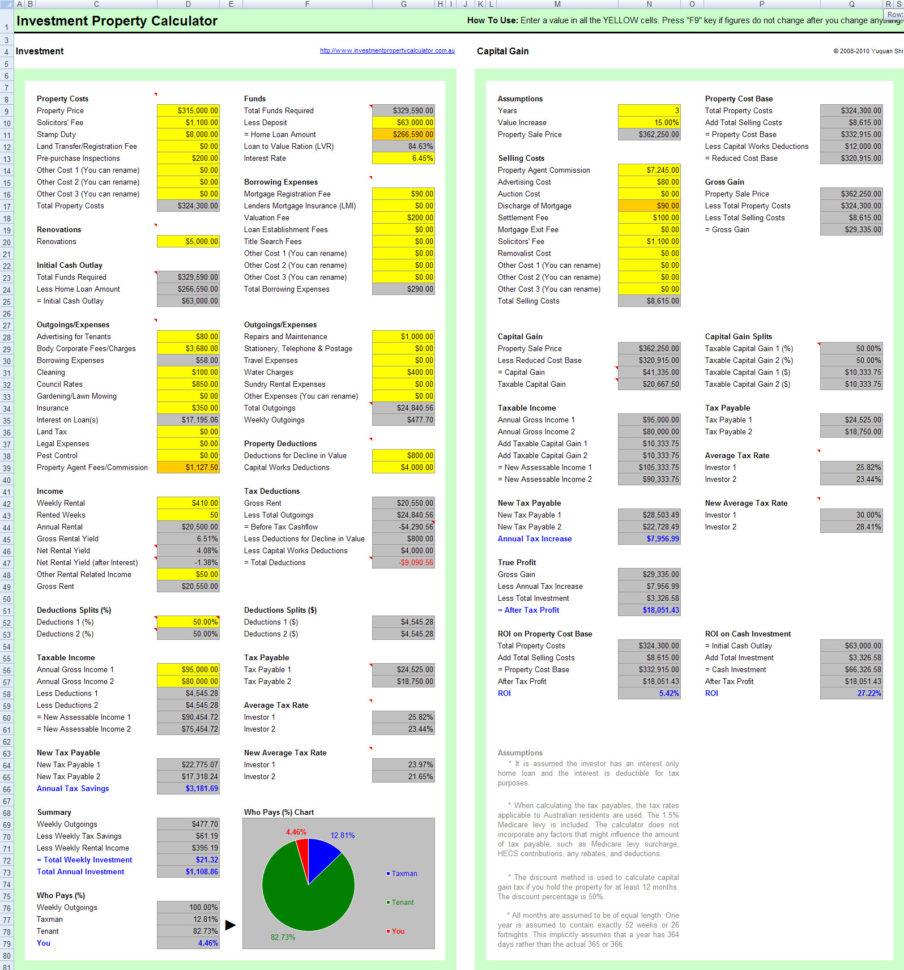

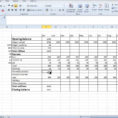

One way to look at the property cash flow is to examine the sales of the property. Generally you will see that prices decrease as the buyer becomes a seller. The lower price does not mean that the property is no longer suitable. It simply means that there are people looking to buy the property at a reduced price.

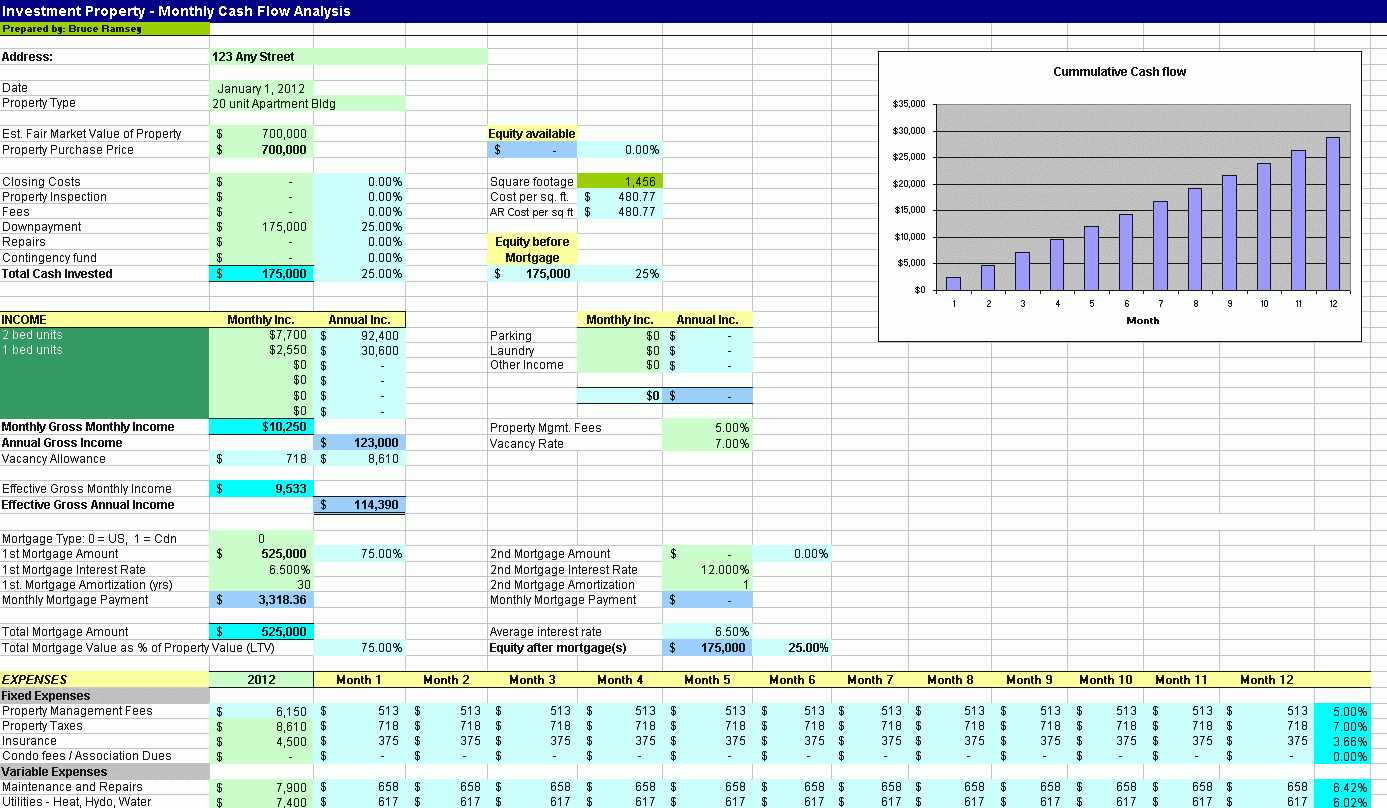

If you want to be informed before selling or buying, you need to understand the small print in the contract. In the event that the sale goes to a court, you will need to find out if you are still liable for damages. The document can also state that the title to the property has been transferred.

If you are looking at investing in investment properties, the property cash flow will help you decide whether or not you should proceed with the purchase. By knowing how the transaction is going to go, you will be in a better position to take charge. When buying a property, you should always read the contract carefully. There are also some documents which have clauses that are difficult to interpret.

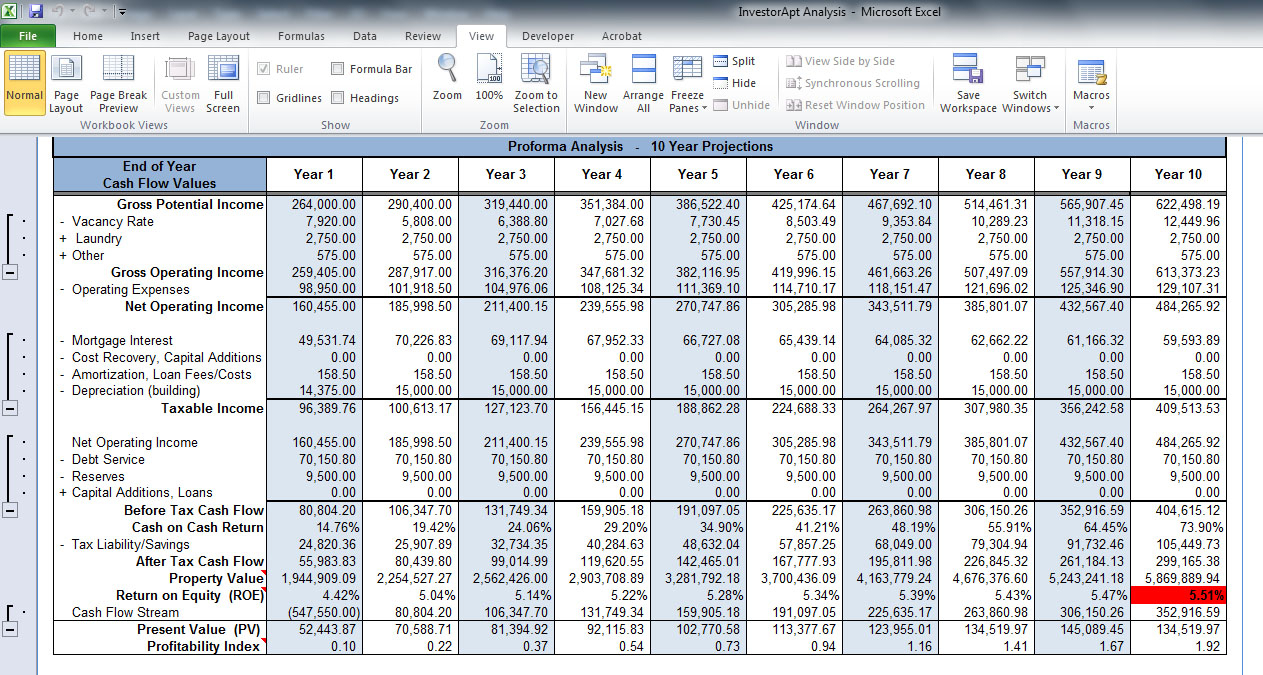

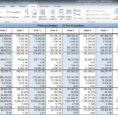

One thing that is important to consider is the rental payments. Rent payments are usually a consideration in purchasing. The property cash flow can help you consider the best period for the purchase. The payback periods for the mortgage can also influence the property cash flow.

In the contract for the sale of the property, you should consider the property cash flow as well. Many of the deals that you are negotiating have clauses that require an escrow. This is a form of funds that can be used to provide for any unforeseen problems. The escrow can be used for repairs, other legal fees, etc.

In addition to looking at the different properties and their gross revenues and payments, you should also look at the property cash flow. This is especially true if you are looking to purchase or sell. There are a lot of things that can be added onto the property as a condition of the sale. It is possible that you may be interested in one of these things but do not have the time to do so.

By reviewing the property cash flow, you can see what problems you can avoid. You can also look at where the property’s capital improvements come from. There are often areas in the contract that state what this will be.

As well as looking at the property cash flow, you should also look at the profit and loss account. This is where the profit comes from and the losses come from. This allows you to see where you are making the money and where you are losingit. This should be a part of the contract.

The first step in using the property cash flow spreadsheet is to look over the information and determine whether it is correct. The spreadsheet will not function properly if it is not correct. Once you have determined the correct information, you can start working with the data. READ ALSO : property cash flow analysis spreadsheet

Sample for Property Cash Flow Spreadsheet