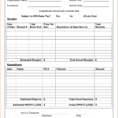

How To Do A Profit And Loss Statement When You're Self Employed (+ Intended For Profit And Loss Statement Template For Self Employed Uploaded by Adam A. Kline on Wednesday, October 31st, 2018 in category 1 Update, Example.

See also Profit Loss Statement For Self Employed Small Business Profit And Inside Profit And Loss Statement Template For Self Employed from 1 Update, Example Topic.

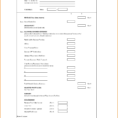

Here we have another image Profit And Loss Statements Statement Self Employed For Template R 03 In Profit And Loss Statement Template For Self Employed featured under How To Do A Profit And Loss Statement When You're Self Employed (+ Intended For Profit And Loss Statement Template For Self Employed. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading How To Do A Profit And Loss Statement When You're Self Employed (+ Intended For Profit And Loss Statement Template For Self Employed.