Profit and loss statement software is increasingly popular with the business professionals. This type of spreadsheet has made the daily calculation of a company’s sales, expenses, and cash flow more accurate.

So, what exactly are companies need to calculate this type of accounting? Here are some of the typical accounting requirements for Profit and Loss Statement Software:

What Is Profit and Loss Statement Software and Why Do I Need It?

Cash flow and income statement are one way to measure the financial health of a company. Through its calculation, the businessman will be able to view the investment that has been spent and the return that the company can receive in the future. This document is not easy to prepare and it has two parts.

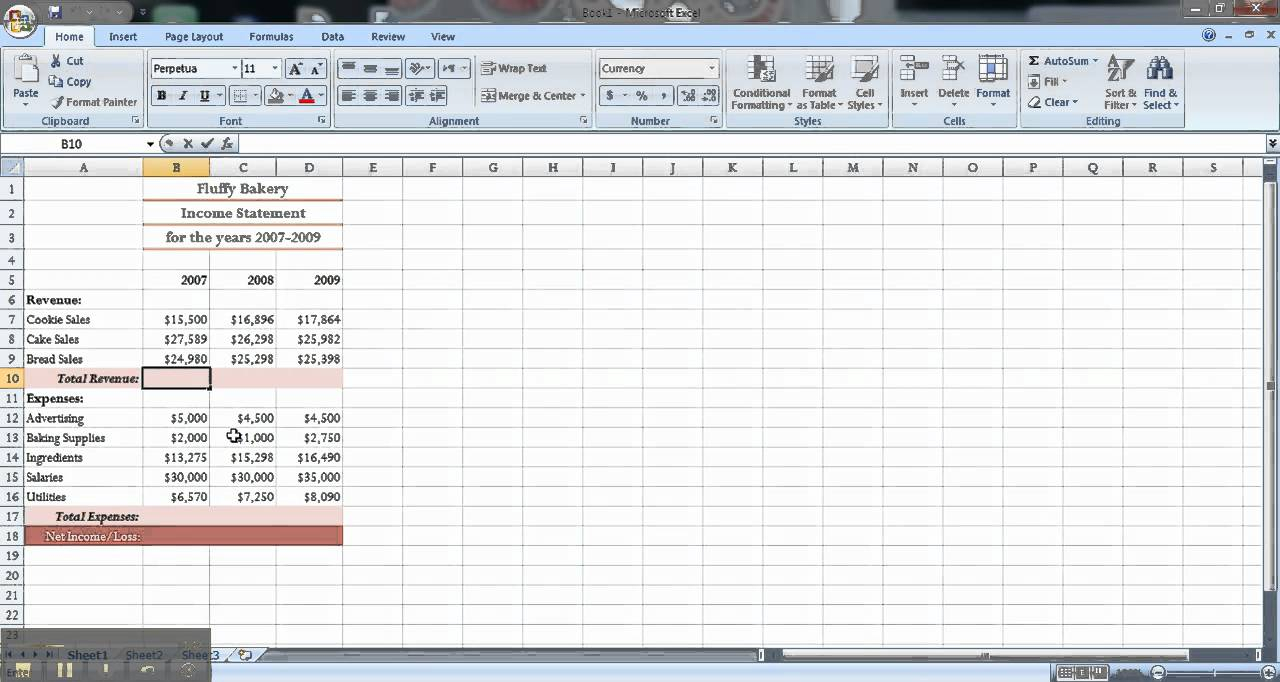

An expense statement is needed to calculate the business’s expenses. These expenses include salary, overhead, investment and long-term maintenance. Expense statement makes you have an idea of how much is being spent on daily activities of the company and how much is coming in.

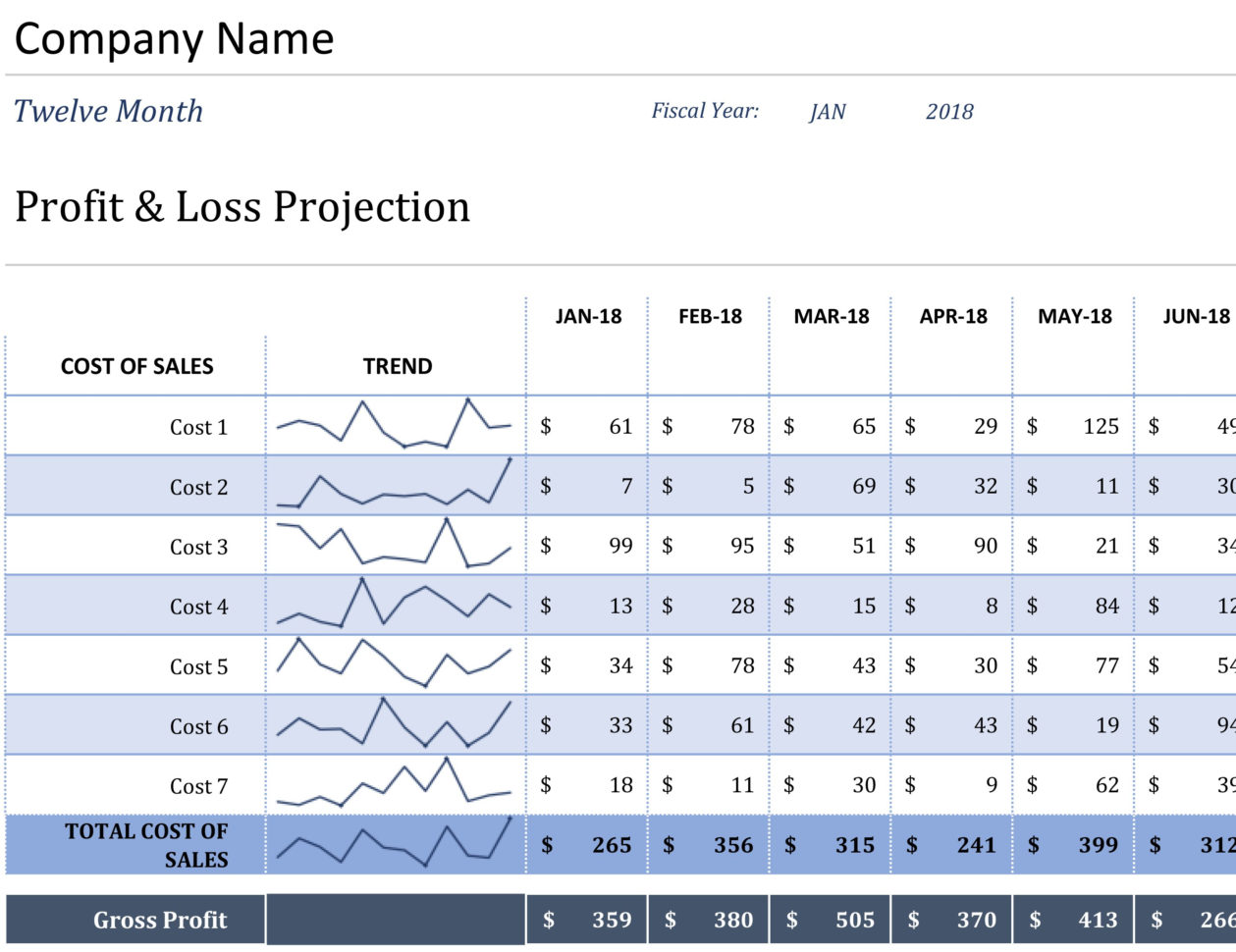

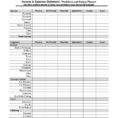

Profit and loss statement is needed to determine the amount of profit that a company can have. It has two parts and it can be easily prepared by the businessman by using the Excel spreadsheet software.

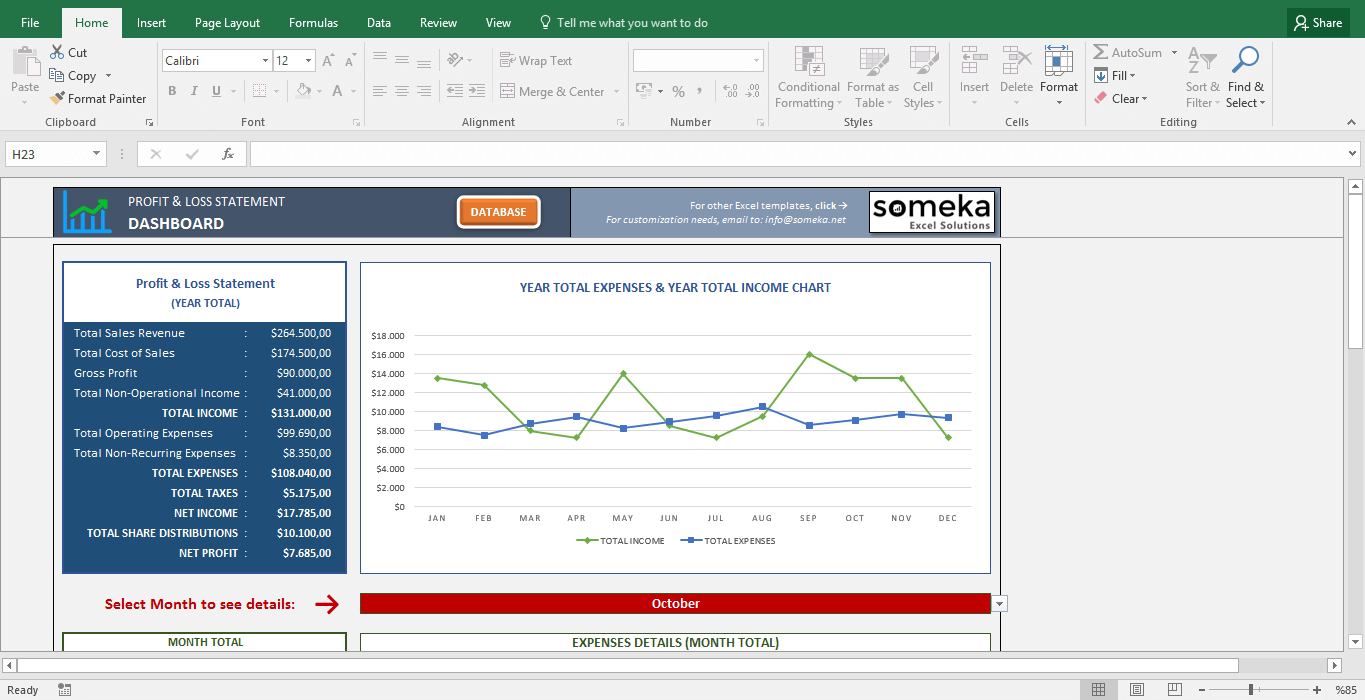

A Profit and loss statement can be done with the help of the profit and loss statement calculator or with the help of the spreadsheet. This statement analyzes a company’s cash flows and expenditures to see whether or not a company has a profitable or unprofitable venture.

Profit and loss statement is mostly used to compare how successful the businesses have been and how it has fared over time. It helps the businessman to take a snapshot of the business in order to plan the future.

There are many free programs that can be used to produce a good and accurate profit and loss statement. A few of these free programs are Excel, Microsoft Word, Sage and other basic accounting software.

Profit and loss statement is one of the most basic accounting forms that any business owner can use. It helps the businessmen to effectively use their resources.

The business owner can determine the profitability of a particular project before starting the business. It helps the businessmen to determine how much money is needed to be invested into the venture.

Profit and loss statement also makes it easier for the businessmen to understand the profit and loss ratio of a certain company. It helps them to know if they are making profits or losses or making too much profit and too little loss.

This Profit and loss statement allow the businessmen to quickly look into the cash flow of their company. It makes it possible for businessmen to conduct detailed research about their businesses. PLEASE SEE : profit and loss spreadsheet small business

Sample for Profit And Loss Statement Excel Spreadsheet