A Deadly Mistake Uncovered on Portfolio Rebalancing Excel Spreadsheet and How to Avoid It

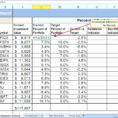

If you’re proficient with Excel, a spreadsheet might help you keep track of all of the essential trades. To begin with, you may use Excel. An individual might utilize Microsoft Excel. Microsoft Excel is a favourite spreadsheet program that’s been created by Microsoft.

Essentially, rebalancing can help you stick with your investing plan whatever the market does. You also need to believe in rebalancing. There are lots of things to fret about with rebalancing, but actually employing your strategy should be somewhat straightforward.

You are able to stop anywhere along the way and you’ll still have a fair asset allocation. The best thing of it is you will understand why you wind up with a specific allocation. Maintaining the correct asset allocation over time is among the 3 keys to investing success over the very long term.

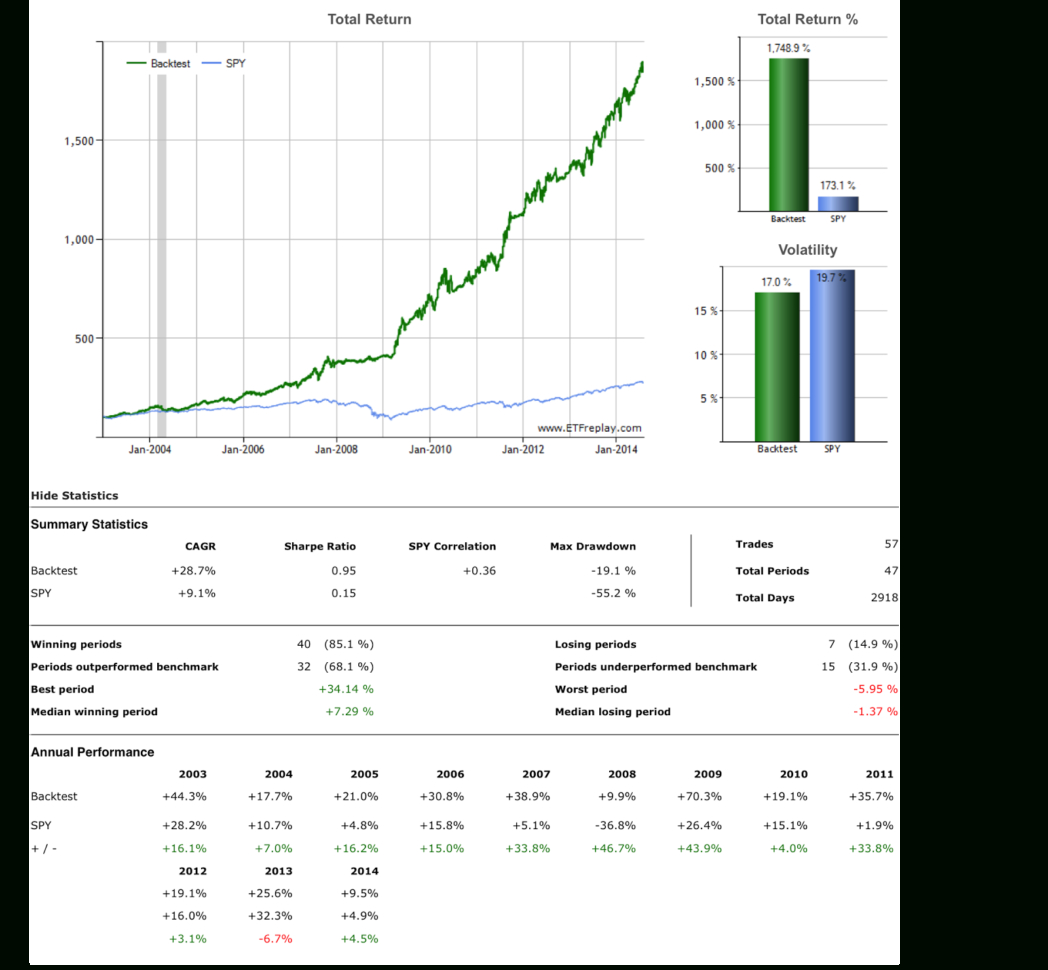

Without both, a portfolio isn’t going to have the ability to withstand various market climates and could swing wildly to and fro even if the general market appears to be calm and collected. It’s also essential to note that rebalancing a portfolio doesn’t indicate it will necessarily boost the capacity for higher portfolio returns, but is done to ensure the portfolio maintains the exact amount of danger you’re comfortable with, he explained. Balancing your investment portfolio can be easy if you just have a couple of accounts. Now, you might believe the market rebalanced your portfolio for you, but that isn’t the situation. The most significant thing is you don’t let your portfolio get too heavily weighted to an allocation, he explained. It’s possible for you to create a highly diversified international portfolio in numerous different asset classes and sub-strategies with just a couple of low-cost funds.

The larger share of the total market an asset has, the bigger share of the general portfolio yours takes. Therefore, if you have the majority of your assets in one account, finding your general return may be as simple as logging into an internet site. If you’re going to hold all your assets in equal weight, you have to be extremely selective regarding the assets you pick for your universe. On the flip side, if you didn’t have any cash assets you may be scrambling for liquidity in case of a huge expense like a health emergency or period of unemployment.

Get the Scoop on Portfolio Rebalancing Excel Spreadsheet Before You’re Too Late

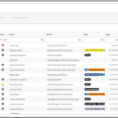

PORT’s fully incorporated portfolio construction tools enable you to perform analysis of the effects of hypothetical trades on your portfolio’s fundamental and risk characteristics in actual moment. The computer software will log in to all of your accounts and update your latest info. The general on-line tool is totally free to use, and it’s extremely powerful. In truth, it is but one of the finest free on-line tools for individual investors.

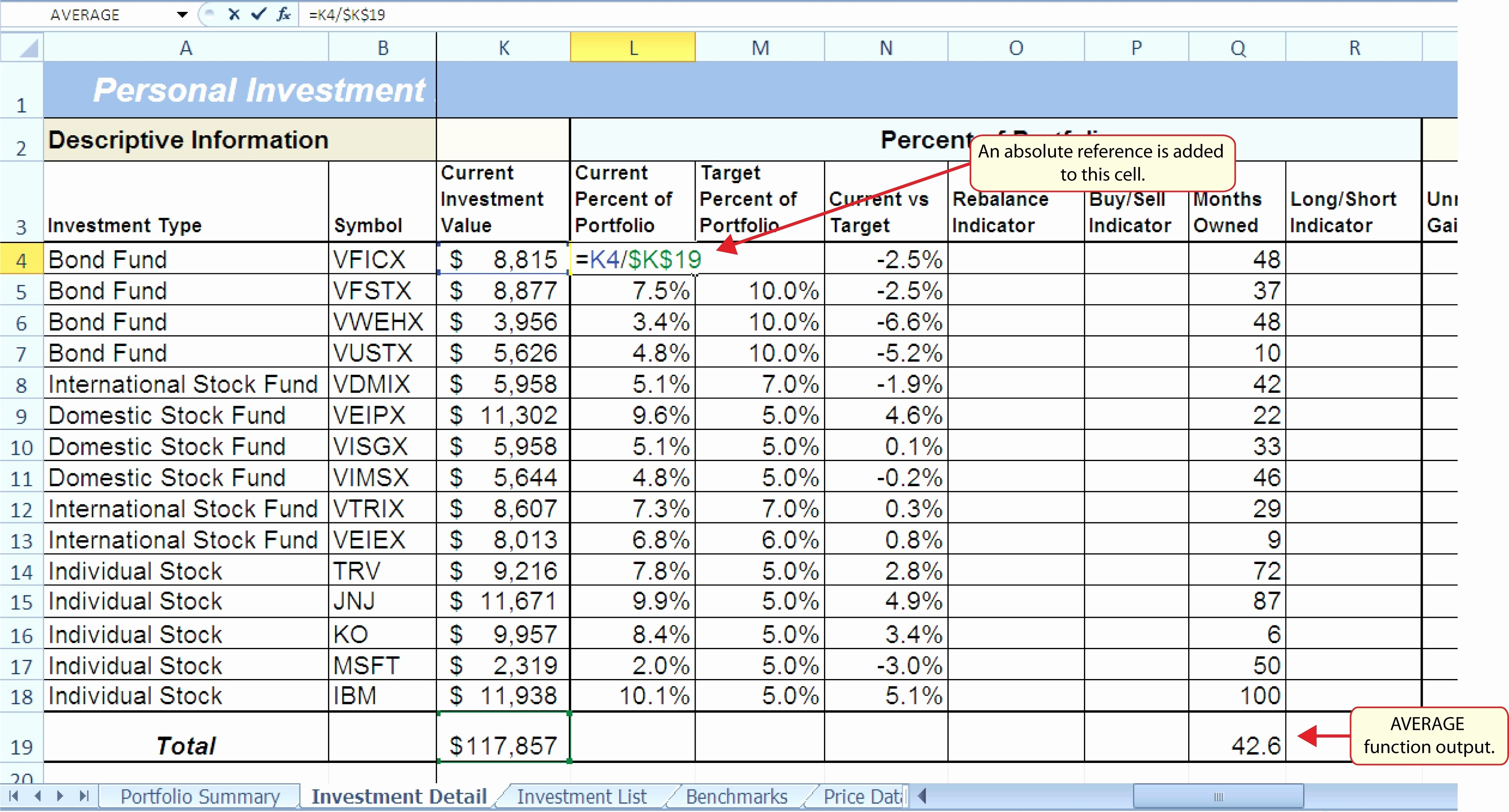

Two spreadsheets are easily available. They are available. The spreadsheet only works on google and should you download it and utilize it in microsoft excel it isn’t going to get the job done. To start with, you must ready the spreadsheet in Google Apps. To begin, you can observe the spreadsheet by going to this website. To be able to rebalance your own portfolio, you can establish a spreadsheet very similar to the one which you see here.