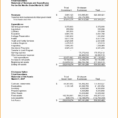

Personal Financial Balance Sheet Template – How To Create Your Own Balance Sheet

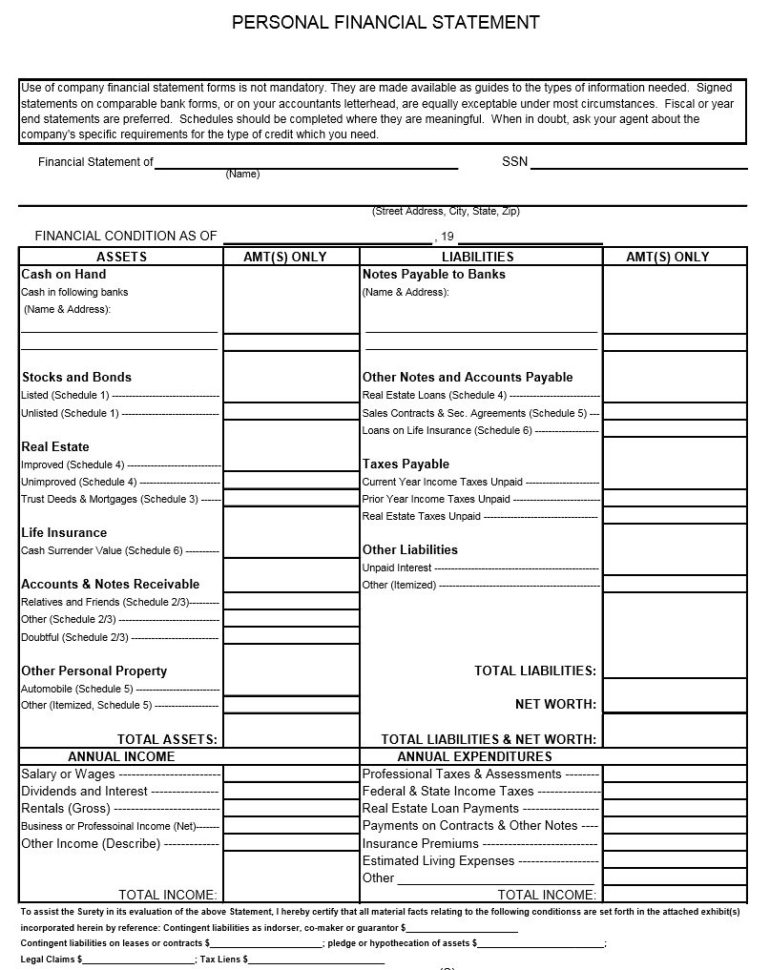

One of the ways you can use a personal financial balance sheet template is to get it and create your own personal financial statements. These statements will serve as your legal documentation for your business, so having them prepared and ready to be filed along with your annual report makes you look more organized and professional.

Creating your own personal financial statements means that you don’t have to hire an accountant to do it for you. The most important reason is that your statements are cheaper to prepare than paying for a good accountant to come in and help you out with the math on your own.

Besides helping you to calculate your personal financial statements, this template also gives you examples on how to add, subtract, multiply, divide, and compare your figures. There are three simple steps involved in creating a balance sheet, which you can use for your personal financial statements as well.

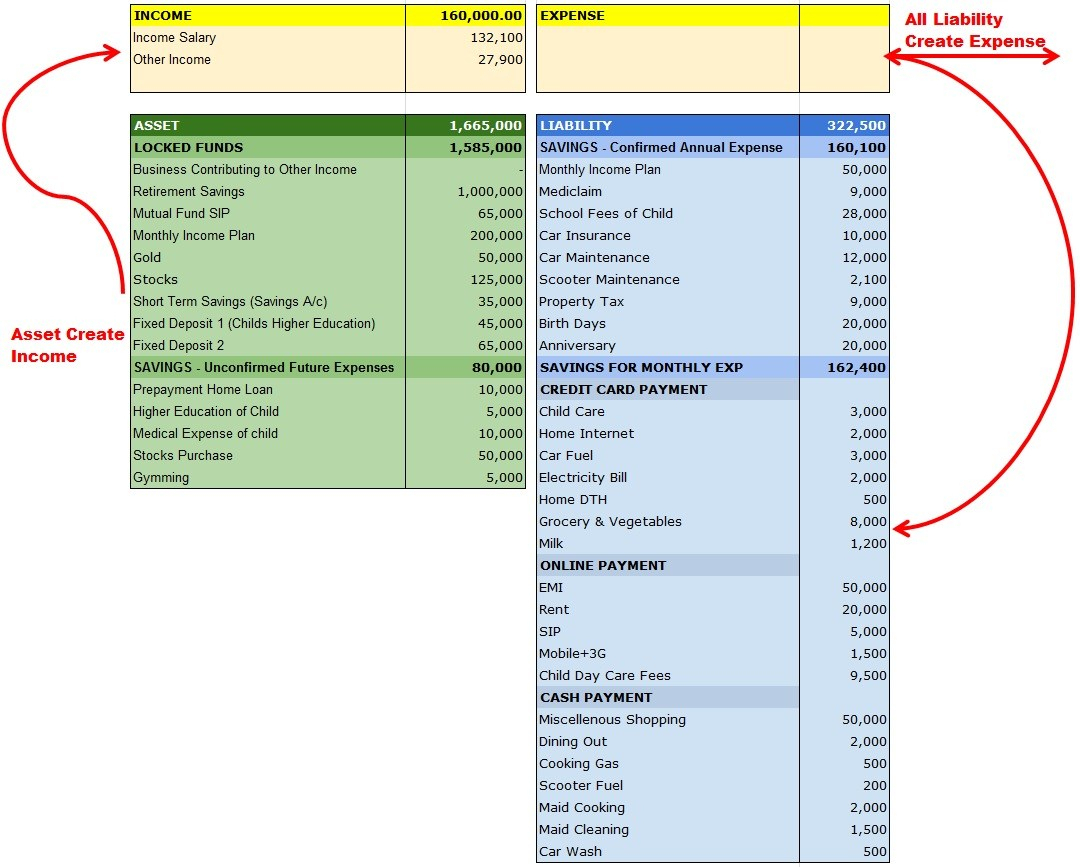

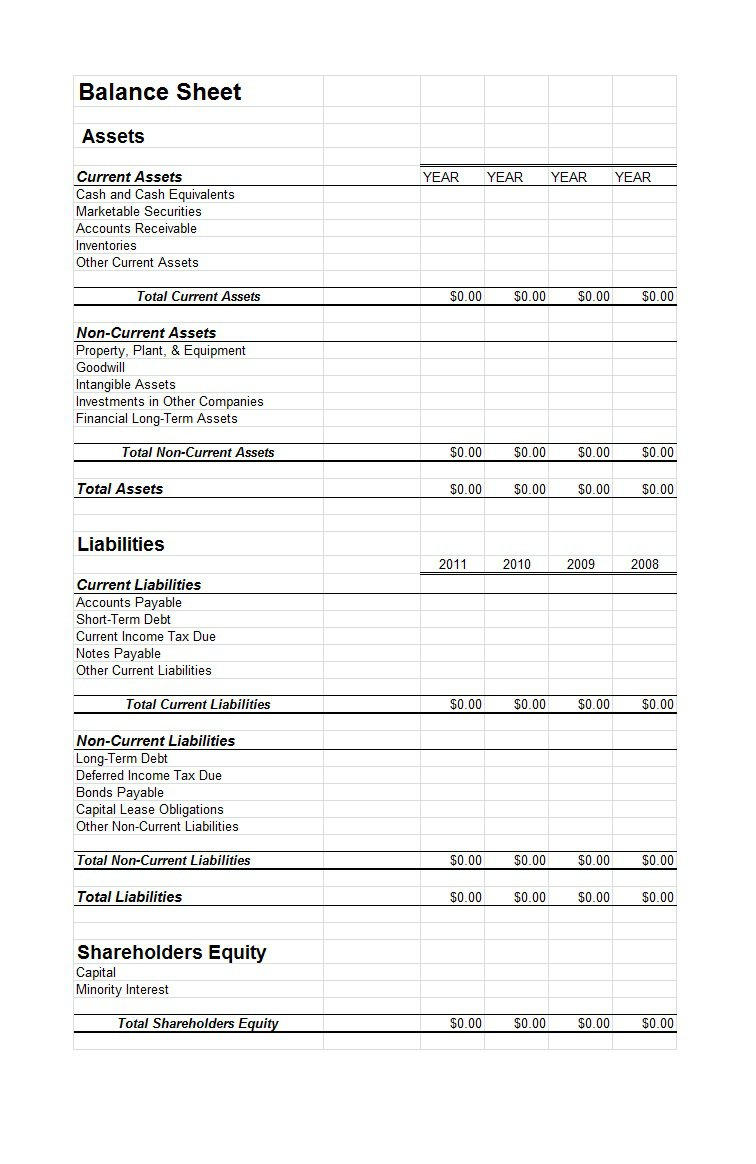

Step one involves creating the start and end balance sheet of your company. The values in these should include all the numbers of money, assets, liabilities, and other information for your company. They must also include the amounts of money that are the accounting entry, as well as those that are the gross profits or expenses.

Step two consists of creating a cash flow statement. This involves developing the cash flow statement to include all the business activities.

In step three, you calculate your gross cash flow. This involves all the income or profit, as well as the amount of money that is going out or coming in.

Using this personal financial statements will enable you to update your previous balance sheet and cash flow statement. Just remember to keep in mind that some of the information that you will find will have to be converted to a currency that you use regularly. One of the most important aspects of a cash flow statement is determining the total amount of cash coming in and going out. Therefore, the sum of your income and the sum of your expenses must be equal.

The next step is to take into account the cash flow from purchasing assets, as well as a sales, plus all the expenses for operating your business. For the expense part, the only way to do this is to go through the income and the sales and see if the expenditure was necessary or not.

The final step of personal financial statements that you have to do is to convert all your financial data into something that you can read and understand. You will then have to estimate your future expenditures, as well as the amount of money that you expect to generate in the future.

You will definitely find this personal financial balance sheet template useful, especially if you need to get a quick and effective financial statement. This template is very easy to use, which means that you can do it in about 30 minutes and it can give you an accurate accounting of your business, even before you know it. YOU MUST LOOK : Personal Finance Templates Excel

Sample for Personal Financial Balance Sheet Template