There are many times that you have to keep track of your personal business expenses. While it is generally a part of running a business, you still need to be able to keep records of your own business-related expenses to make sure that they do not go over the average business limit that you set.

Before you even begin to enter your business expenses into your personal business expenses spreadsheet, you will want to be sure that you have already budgeted what you can afford to spend on each of your daily expenses. That way, you will be able to know which of your other expenses are being used to help you with paying off the smaller expenses that you have. If you have not budgeted all of your personal expenses and only have an average monthly amount for every day, then this would also work in your favor as well.

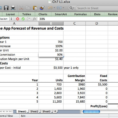

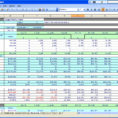

Personal Business Expenses Spreadsheet

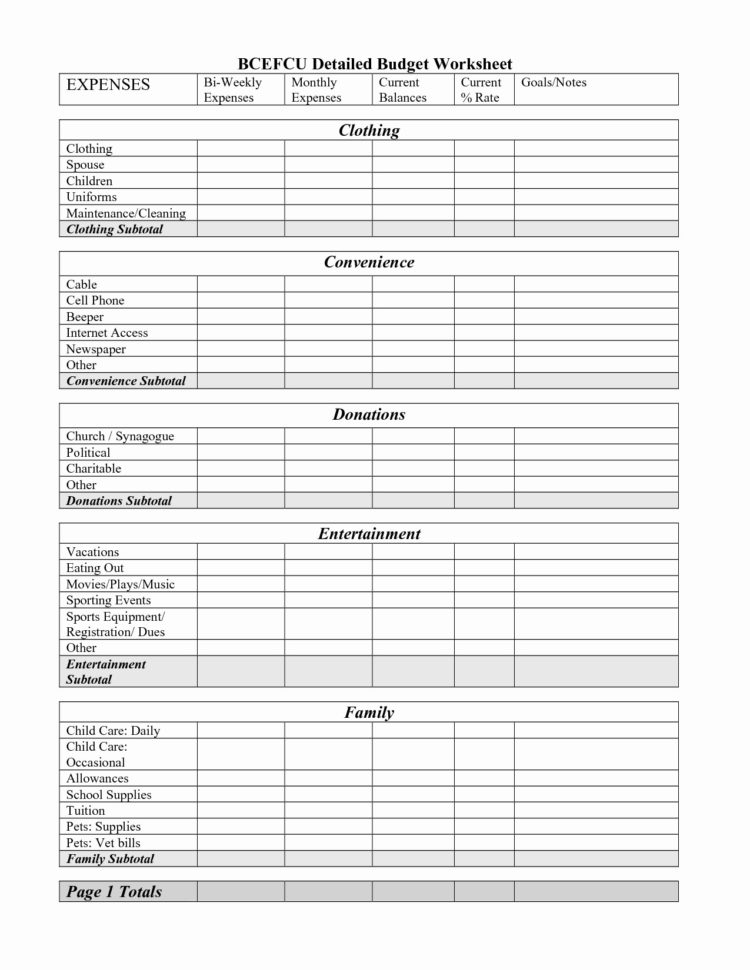

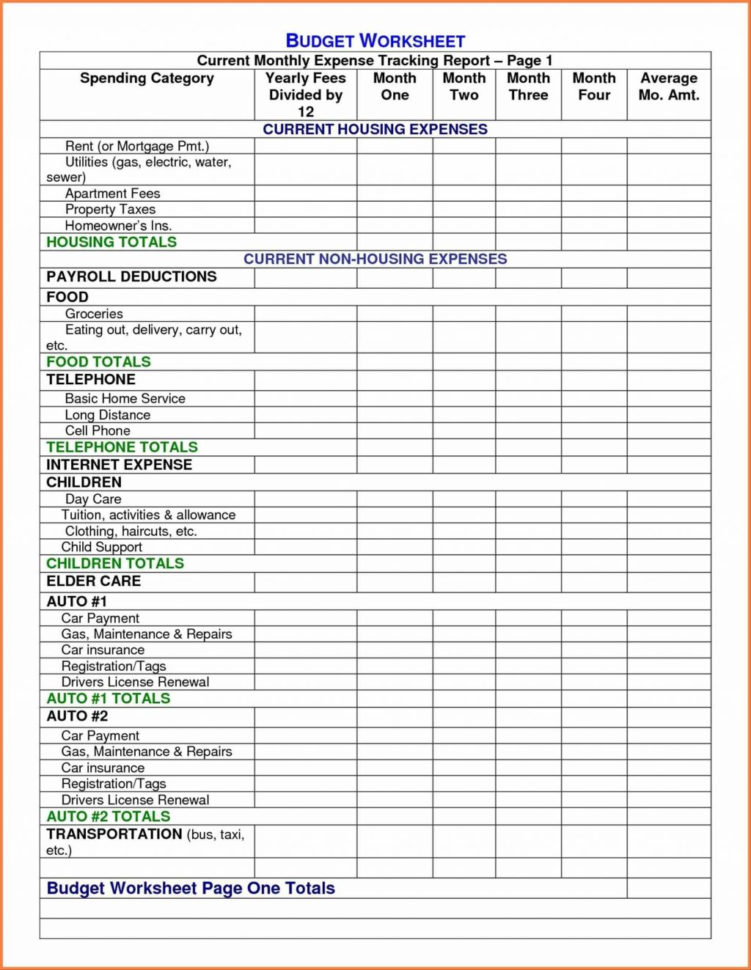

You will want to write down all of your expenses on a monthly budget so that you will know exactly what you have in your account. Some of the more popular expenses to list on a monthly business expenses spreadsheet include: gas for the business, groceries, and personal items such as toiletries and food for yourself. By having a good idea about the expenses that you have, you will be able to budget accordingly.

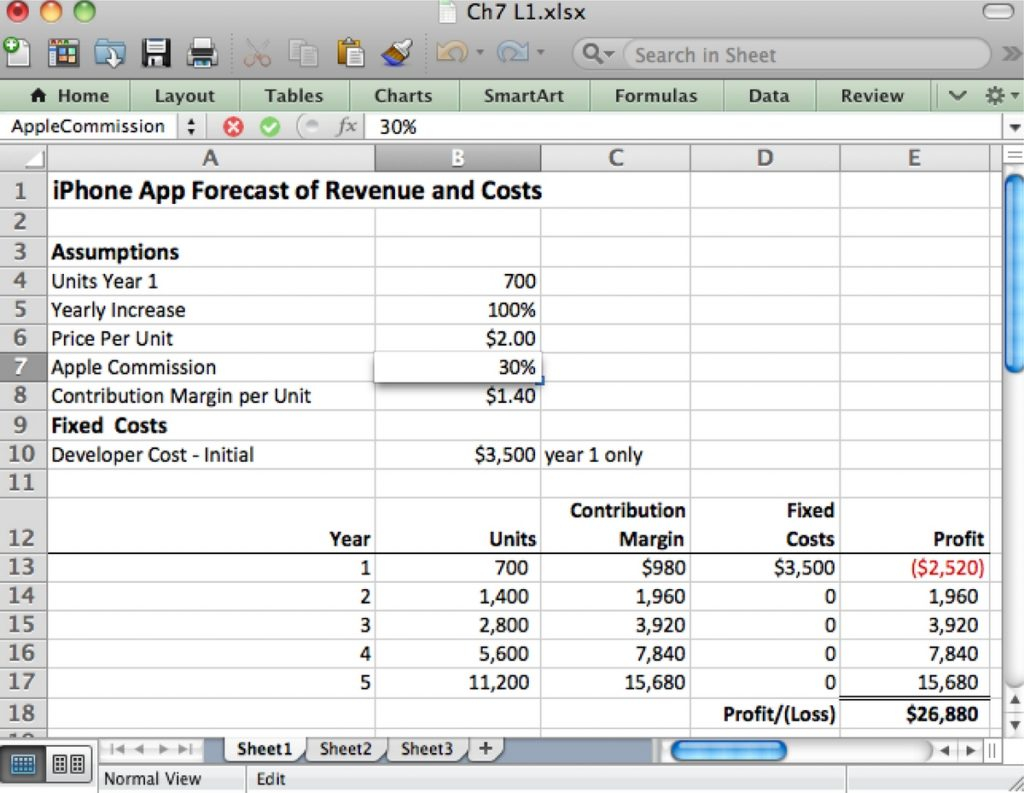

Once you have reviewed your business expenses for the month, you will want to write down all of the amounts that you have spent. Keep in mind that while you might have an average expense for every day, if there are a number of days where you have spent more than you did the previous day, you may need to re-examine your plan of attack. The next step in creating your personal business expenses spreadsheet is to go through your daily expenses and identify the category that you are spending the most on each day. Once you have listed everything that you spend the most on that day, then you will want to put a line between that day and the total amounts that you are spending each day.

In order to determine where your money is going each day, you will need to go back to the spreadsheet that you created a few weeks ago and review the date that you were paid and list all of the different categories that you spent the most on. For example, you might spend the most on your bills each week and then spend a few dollars on the grocery each day. Since those two categories are often related, you will want to separate the amount you spend on the groceries from the grocery amounts in your overall business expenses.

To continue to keep track of where your money is being spent each day, you will want to add up the total amount that you spent on each category that you determined, as well as the amount that you paid in total. The first step in updating your personal business expenses spreadsheet is to go back to the last time that you reviewed your expenses and see if there were any changes that you might have made. If there was, then you should re-review your expenses and make any necessary adjustments to ensure that you are spending the proper amount each day.

It is important to note that when creating your personal business expenses spreadsheet, you are creating a log book as well as a budget. When using this tool to keep track of your personal expenses, you should also keep a written record of any conversations or deals that you may have with clients. This will help to prevent any confusion or hasty decisions that may result from forgetting to record certain expenses.

Once you have a few entries in your personal business expenses spreadsheet, you will then want to update the total amount of each category that you listed. This will ensure that you’re spending on each category does not exceed the average business spending limits that you set.

Your personal business expenses will likely change as your business grows. It may become necessary to increase your daily expenses and reduce your grocery allowance. Even though your personal business expenses may not seem like much now, once you reach a certain point, the amounts can add up quickly and you will be glad that you were able to adjust your business-related expenses accordingly.

One of the best ways to keep track of your business expenses and make sure that they are in line with your personal business expenses is to keep a calendar on which you can mark each day on. With a little bit of practice, you will soon be able to put your weekly expenses in the correct categories and be able to easily put them on your personal business expenses spreadsheet. so that you can get an accurate picture of your business and your personal spending. YOU MUST READ : permit tracking spreadsheet

Sample for Personal Business Expenses Spreadsheet