If you want to create an effective options trading spreadsheet, here are some quick tips on how to go about it. Here are two important points that you need to bear in mind when you start your Excel spreadsheets:

First of all, you need to get a formula for the “The Option Pricing Formula” which Excel provides for you. This is an Excel function and you can create a formula by clicking on “Formulas” tab at the top right corner of the ribbon. Follow the instructions in the chart drop-down list and enter a formula for the P/E ratio. You can then define the P/E ratio as “enter P/E Ratio”.

Tips on Excel Options Tracking Spreadsheet

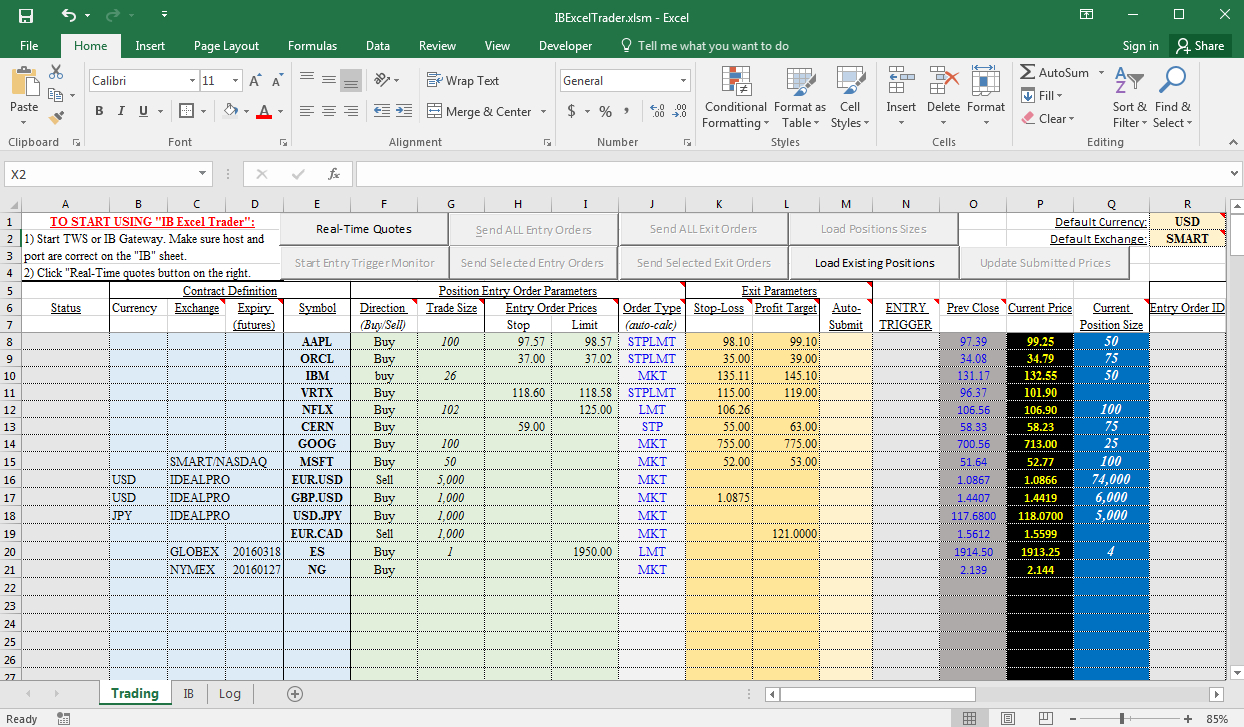

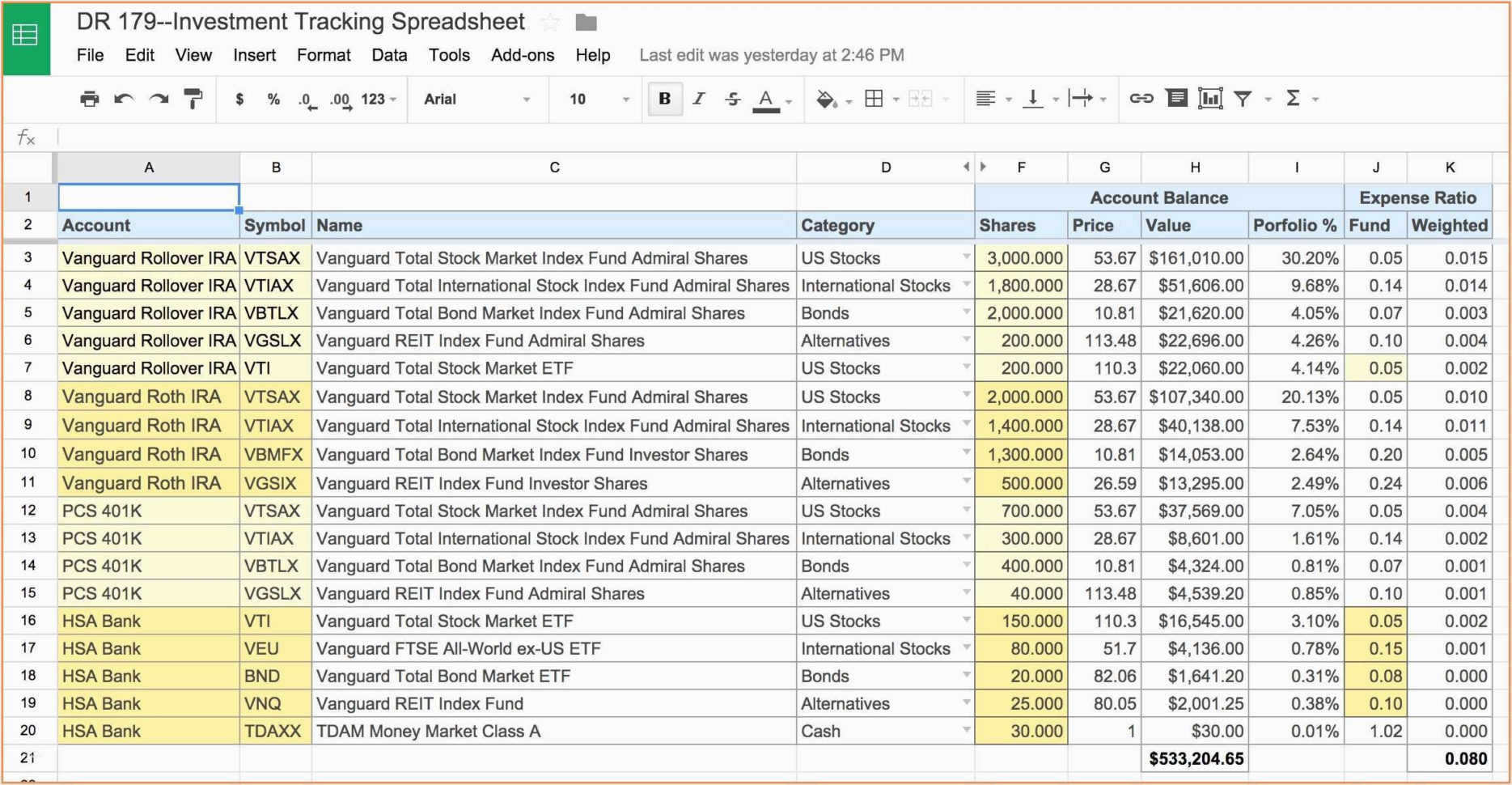

Next, arrange the columns so that they have an impact on the overall profit. Organize the columns by using the column header, price change, strike price, stop loss price, limit price, and open interest.

For instance, a stock option is like a pair of shoes. The price of each pair of shoes, when bought together, is a single unit. If the prices of these shoes change as you buy or sell, they are called “fractions”.

A “fraction” is another name for the CFVAA or the P/E Multiplier. All the stock options trading formulas define the P/E Multiplier as “x”.

That means, when the price of a stock option falls below the strike price, it is possible that the buyer is able to buy the underlying asset for less than what the options buyer invested in the stock option. This makes the options trader better off because they don’t lose money on the stock option investment.

If the price of the stock option rises above the strike price, the investor who purchased the option will profit because the option holder is now able to pay a higher price for the underlying asset. The investor doesn’t lose money, so this makes the options trader better off.

Let’s talk about options tracker spreadsheet, one of the most popular types of stock options trading spreadsheet that you can use. The main reason why this type of spreadsheet is very popular is because it is very easy to use and it lets you keep track of everything in the beginning, as long as you know how to use it.

The options tracker spreadsheet has a unique feature of being able to calculate every stock price change since it was last calculated. There are a few stock options trading systems that have this feature, but not all of them do. Also, if you’re using options tracker spreadsheet, it will be possible for you to see every price change.

If you’re looking for a stock options tracking spreadsheet, you should pick a stock options trading system that has this feature. The good thing about using this type of spreadsheet is that the spreadsheet will provide you with every penny change and it will show you every price change. You will also be able to see every profit, loss, and trade.

However, the problem with this type of spreadsheet is that it is not able to handle trades of certain stock options. It may show you how many shares you should buy and sell and how much you should buy and sell.

Options tracker spreadsheet is helpful for beginners and experts, as long as you can understand its purpose. If you want to learn how to make an options trading spreadsheet, you should get a stock options trading system that has this feature. PLEASE SEE : options spreadsheet

Sample for Options Tracking Spreadsheet