An option spreadsheet is a list of contracts, that you have with a number of different financial institutions. These are used to determine the value of an underlying asset.

This is usually a contract between you and a financial institution, that the value of an asset will be determined in the future, based on certain conditions. You then get to decide how you want to use the information that they give you about the value of the asset.

An Options Spreadsheet Can Help You Understand How Financial Instruments Are Made

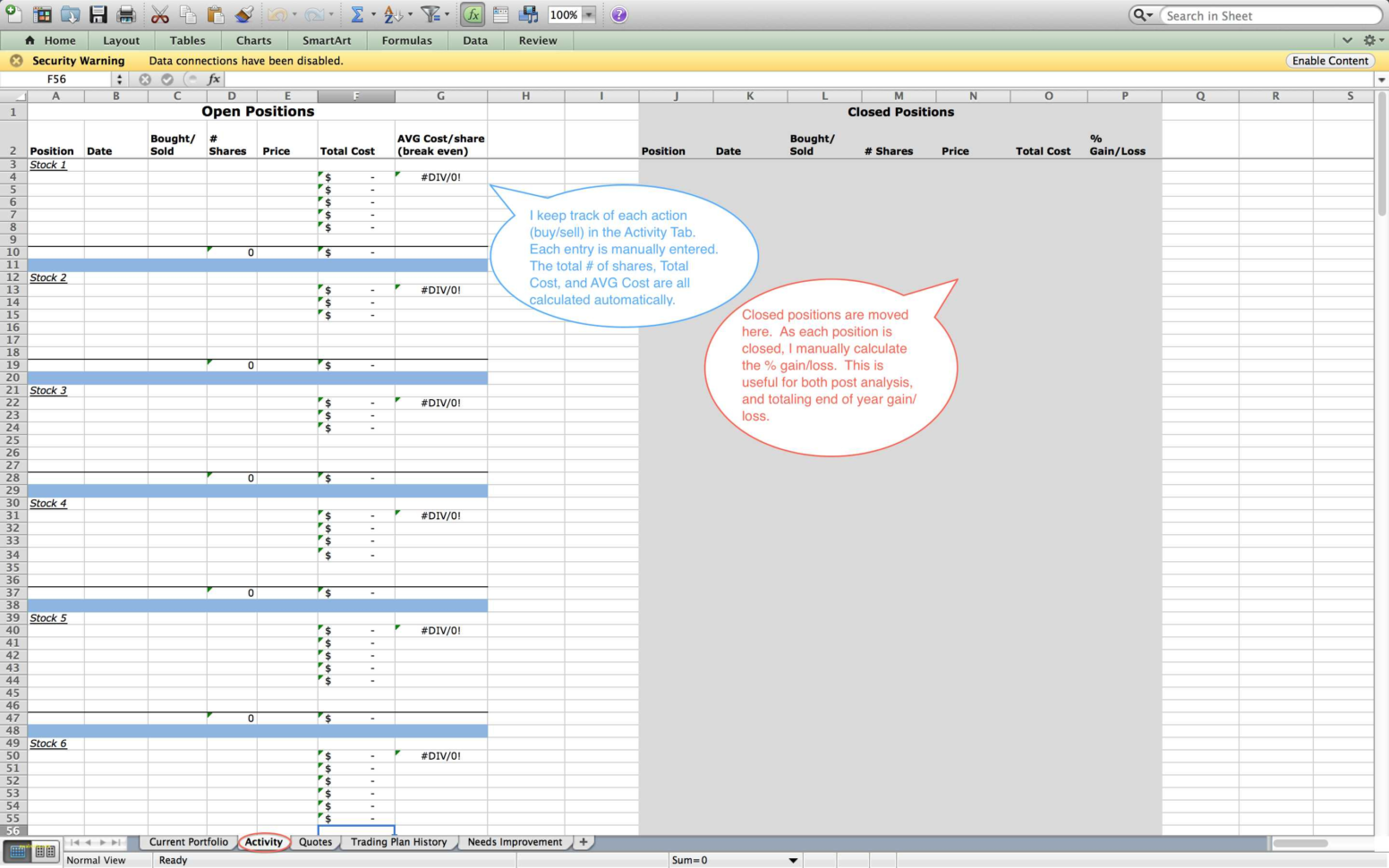

This financial instrument can be used for a variety of reasons. One of these could be for trading purposes. You may wish to keep track of what your options are doing, so that you can make some money from them.

Other times, it may be used as a method of predicting when financial institutions will decide to increase the value of an asset. This would then allow you to choose to increase your position at that time. You could do this so that the asset would go up in value, and you would make money, by selling the assets at a high price.

These financial instruments could also be used as a way of reducing risk. Some people try to reduce their risks by trading with financial instruments that will give them the best chance of success, when the time comes to use them. So, if you understand the system and trade properly, you could minimise the loss you would experience, if the financial instrument you had traded went against you.

Of course, there are other reasons that people are trading financial instruments, such as derivatives. These are financial instruments that would involve two parties, in one transaction. If you understand these financial instruments, you could make money from them, and possibly, do them well.

There are a number of financial instruments that are available on the market today. They include currencies, bonds, equities, commodities, stocks, mutual funds, etc. All of these financial instruments are made up of the same basic components, that make up the assets on the market.

The financial instruments also have several of the same principals, which make them similar to one another. All of these could be used to create financial instruments.

However, there are also differences between the financial instruments that are available on the market today. The differences include how they are constructed, and what the rules and regulations are concerning the way in which they are traded. When it comes to the financial instruments that are traded, you need to know the various things that are involved.

If you want to understand the financial instruments that are on the market, then you need to know how the financial instruments are structured. There are many financial institutions that deal with financial instruments, so you need to know what the different names of the instruments mean.

You need to know who has the right to sell the financial instruments, and who has the right to buy the financial instruments. You also need to know when they are due to be sold, and when they are due to be bought.

If you want to understand how the financial instruments are made, then you need to learn what different types of financial instruments are, including bonds, stock, bonds, options, futures, swaps, and so on. You also need to know how you could trade them, and how you could profit from them. YOU MUST LOOK : optimization modeling with spreadsheets 3rd edition solutions