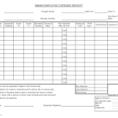

When an accountant is a part of a business, the responsibility of making an office expense report is shared. After all, when an accountant performs their work, the money that they get to spend will be the same as the money that a business owner has to spend. However, to an accountant, an office expense report is quite different than what most people see.

Since there are no employees, there is no account, but this does not mean that the money spent by the business owner should be handled as if it is an employee. An accountant should not be held accountable for office expenses that are not reported. An accountant will have to give details and numbers on every expenditure made.

This is because in order to produce a proper expense report, there is the need to figure out whether or not an employee performed the expenditure or the money was just meant for the business owner. In this case, the business owner can also check to see if the expenses are indeed that of the business owner or just for the accounting company. If you are the accounting firm and do not take ownership over the money, you are not doing the accounting properly.

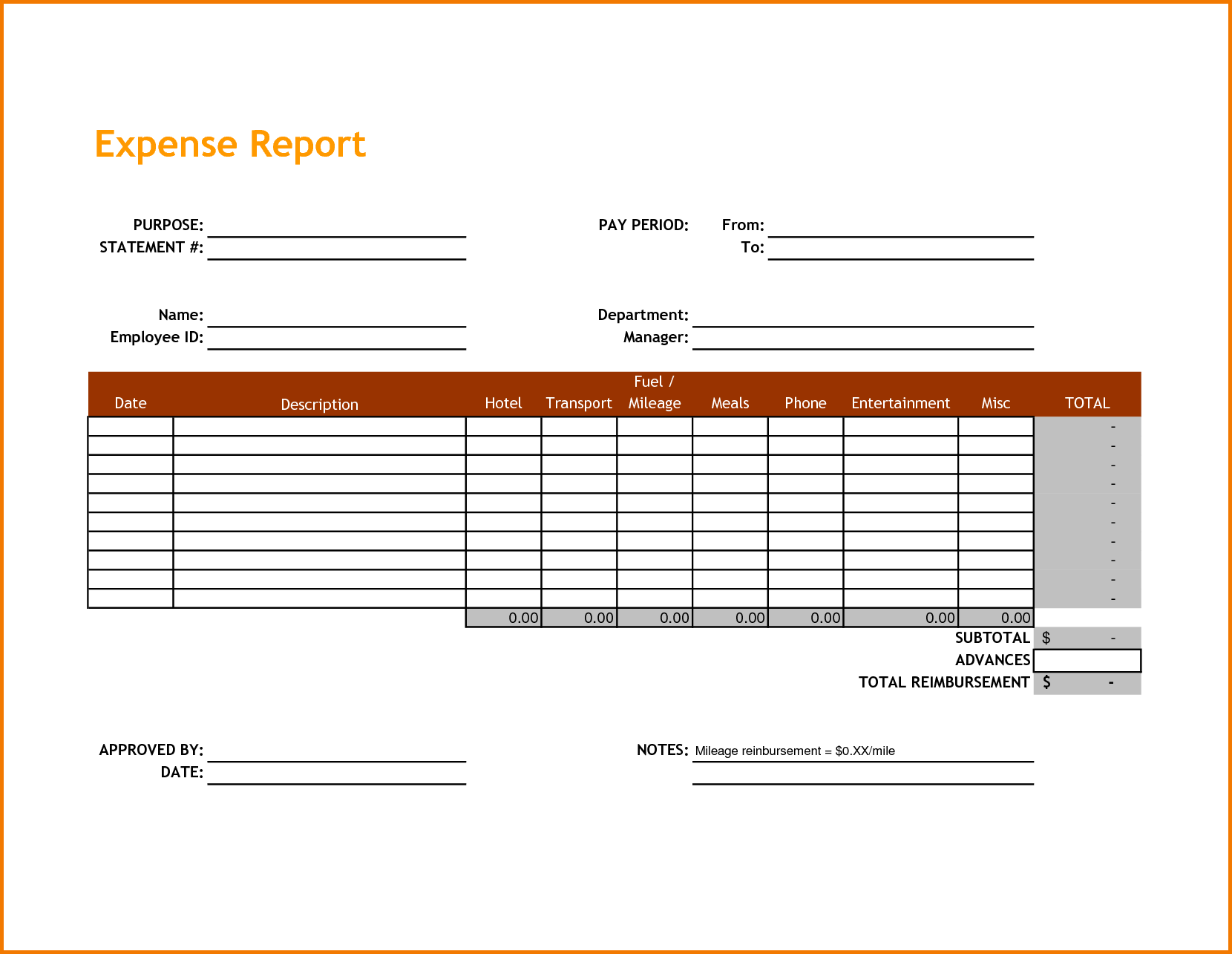

Office Expense Report

To get the details, you will have to have the data that is in your own database. However, with the advent of the internet, these days there are plenty of websites that offer to compile all this information from all over the world. The disadvantage of this is that it may require a lot of time to gather the data. To save time, you may decide to hire a firm that would have all the information on their websites in one place.

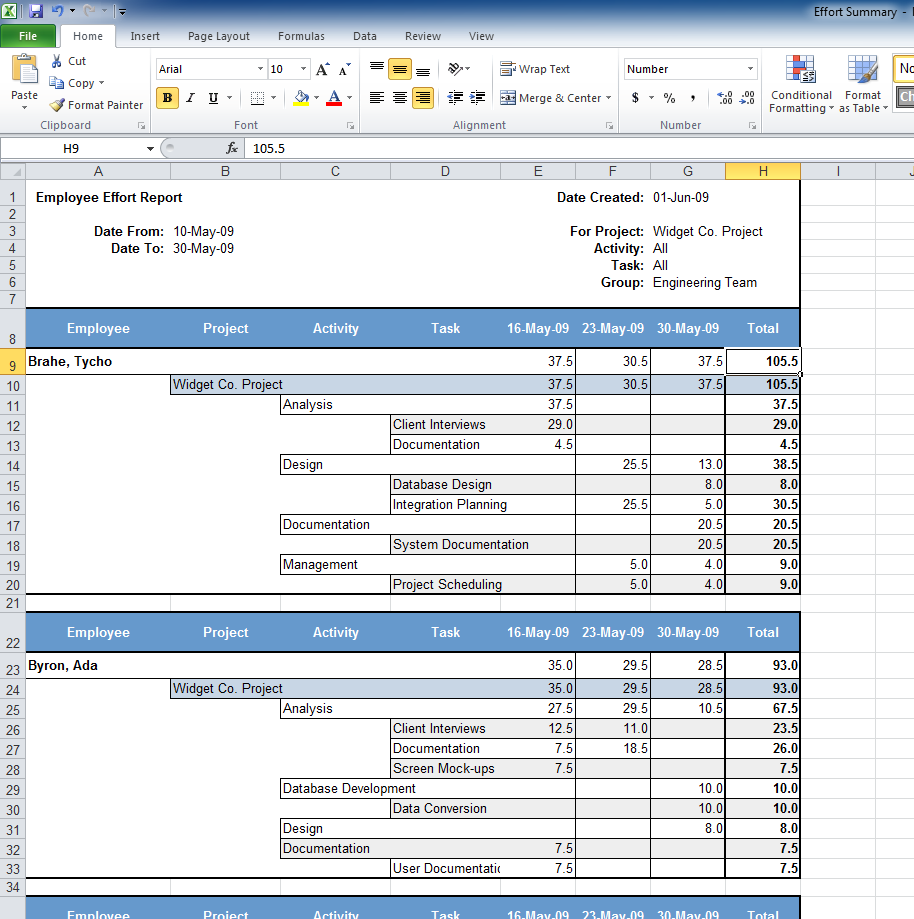

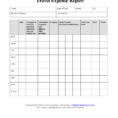

It is good to find out what is happening in your office right now and how much money you are spending. Therefore, an office expense report will be more useful if you are willing to make a thorough analysis of all the expenses that have taken place in your office. You need to have a place to compile all this information.

The size of the office matters as well. If the office is large, you need to find out the type of devices that are used in your office. What might have been a crucial part of the decision, has now become quite a major expense.

When purchasing software, look for one that has all the important items that you may need, and which are available for free to you. There are many software companies out there that do not charge for their software, although they are capable of providing some great deals for their customers.

Some business owners do not want to rely on their colleagues, as they say that they do not always know what is happening at home. However, the fact is that even in your home, there are activities that you cannot stop. For example, the maid might have some programs that are downloaded and you might find them at the very time when you are using the computer.

Just like in the case of the computer, your business is worth your time, energy and money. If you want to keep the balance between work and home, it is advisable to have everything at your finger tips, which is why having online reports is helpful.

Business owners have the right to manage their businesses accordingly, but being a business owner also means that you are responsible for the consequences. As long as you are using the time and resources wisely, you do not have to worry about the people around you, or the unruly children who are running around your office.

By applying all the knowledge you have acquired, you can become a good business manager and a great accountant. However, in order to become a good accountant, you also need to get to know what is actually happening in your office. YOU MUST LOOK : monthly invoice template