Top Mortgage Spreadsheet Template Choices

Mortgage loans are among the most often encountered cases that have moved Excel spreadsheets into a more personal field. You are able to take loans against your current property or take a normal home loan. Hard money loans are less difficult to get because they aren’t depending on the credit worthiness of the borrower.

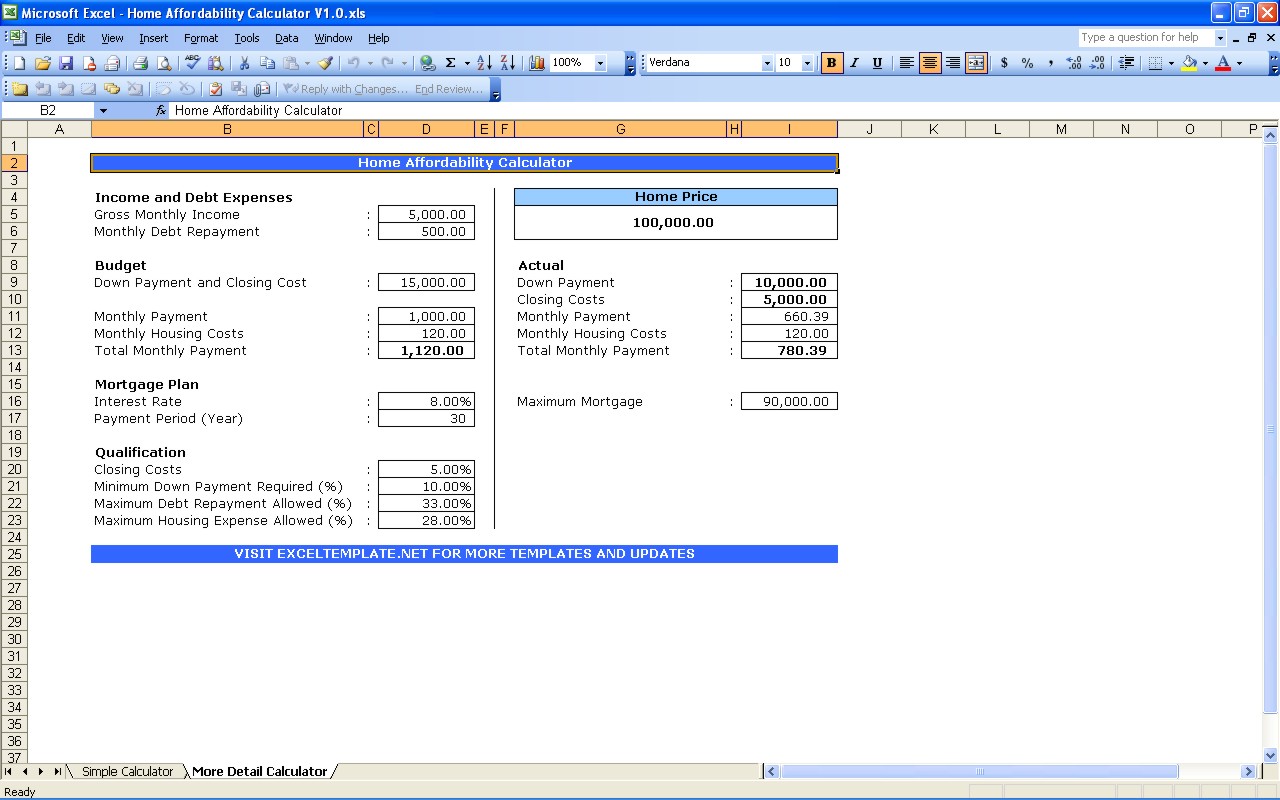

If you own a lot of private debt aside from the mortgage (for example, credit cards), your modification will be tough to pull off due to elevated debt-to-income ratios. Once you are pre-approved, you can pick a mortgage. If you would like to analyze a fixed-rate mortgage, you may also use our Home Equity Loan Calculator, which permits you to estimate the equity in your house over time if you’ve got more than 1 mortgage. Samples Letters Motivation If you merely want to analyze a variable-rate mortgage, you might decide to try our ARM Calculator. Samples Letters Motivation If you only need to analyze a variable-rate mortgage, you might want to try our ARM Calculator.

A fundamental letter of recommendation is offered below. Some very simple recommendation letters are given in the post below. Quite simply, a recommendation letter is going to be written to have the capacity to cite excellent phrases for an individual. Before agreeing to compose, request to acquire all instructions supplied to the particular person who’d prefer the letter composed. Typically, character reference letters are intended for endorsing the positive facets of a person, and are frequently employed for job purposes. Thus, you’re ready to compose an ideal character reference letter for particular functions. You can also alter the title of the amortization schedule from Simple Amortization to another title so that it reflects the part of property that you will need the amortization schedule for.

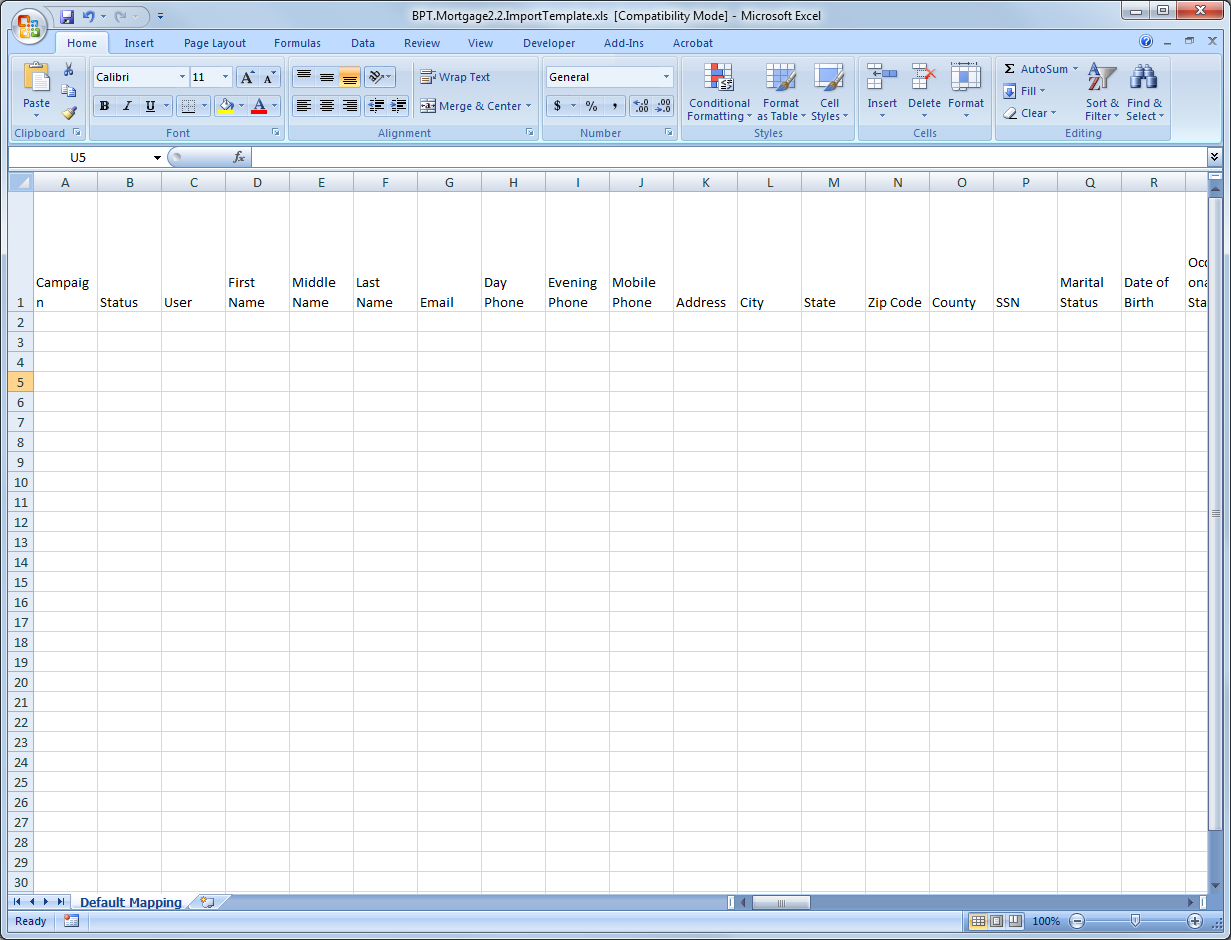

From our example, you can add a few things you might need to finish your spreadsheet. Individuals aren’t likely to obtain a spreadsheet which they can get free of charge. Yes, drafting a spreadsheet will be part of the procedure, but there’s a great deal more besides. You should use a spreadsheet to assist you spending budget in the class of the human body fat instances to get some income padding in the span of the lean instances. You ought to use a spreadsheet that will help you spending budget in the class of the human body fat instances to receive some income padding in the length of the lean instances. Otherwise, you will have to debug the spreadsheet. There are many totally free spreadsheets on the internet.

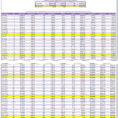

As stated by the above pre-sets, your 30-year loan term is going to be reduced by 2 decades and 2 months, and you’ll save yourself a total of $62,438 in interest repayments a big amount, thinking about the little outlay! Below you’ll find a good example of an Excel mortgage loan template which you may personalise to your requirements. There are lots of numbers and ratios to think about. The outcome and comparisons supplied by the calculator should be taken as a reference or guide only. It’s possible to calculate different mortgage values for improved comparison. Update your bank account values (as you just got paid), be certain that your mortgage is at wherever your plan states it ought to be at and should you truly feel like it, perhaps have a look at what expenses you may want to investigate. Conclusion Exceptionally great price, the payroll process is extremely quick and user-friendly and produces exactly what every employer requires from a little small business payroll solution.

The second strategy is to enter the present mortgage balance and adjust the expression length until the PI payment matches what you are presently paying. Typically it’s also going to show the rest of the balance after each payment was made. An offset account is a transaction account that may be linked to your residence or investment loan. First of all you have to get an offset account linked to your house loan account. You may also enter any extra payments on the schedule that you earn. There are a number of ways to finance your real estate buy.

The details required are the loan sum, the rate of interest, the quantity of years over which the loan is taken out, and the quantity of payments annually. If you wish to observe how they work, look at the aforementioned spreadsheet. Needless to say, having the ability to place a bigger lump sum into the home loan will immediately shave off a substantial portion off the principal sum of the loan, which will also go on to lower your loan term and the entire amount of interest to be paid. Your Mortgage’s Extra and Lump Sum Calculator will request that you present a few essential parts of data in order in order for it to carry out its number-crunch. There are two or three approaches to analyze your present home mortgage. YOU MUST SEE : Monthly Spreadsheet Template