It is simple to create a mortgage spreadsheet and use it as a tool for business owners. If you already have a mortgage document you want to keep track of for your company, then create a spreadsheet with this format. Here are the basics on how to use this type of software.

Before you start creating your spreadsheet, identify who will be using it. You should be sure that there is a regular person who will be able to access it on a regular basis to keep track of what the mortgage payments are. The spreadsheet should be secure and not very easily identifiable.

How to Use a Mortgage Spreadsheet

In order to use this type of software, you need to download it onto your computer. You may want to print it out and keep it in a safe place. This will allow you to read it at any time. It is best to have an access code so that you can use it without having to copy and paste information into it.

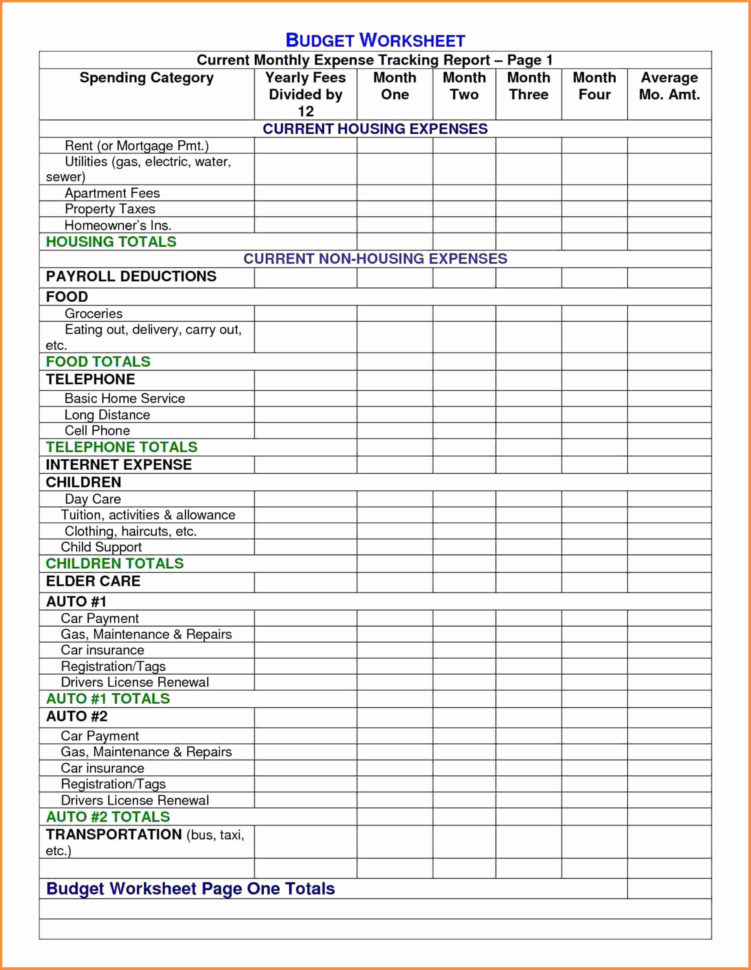

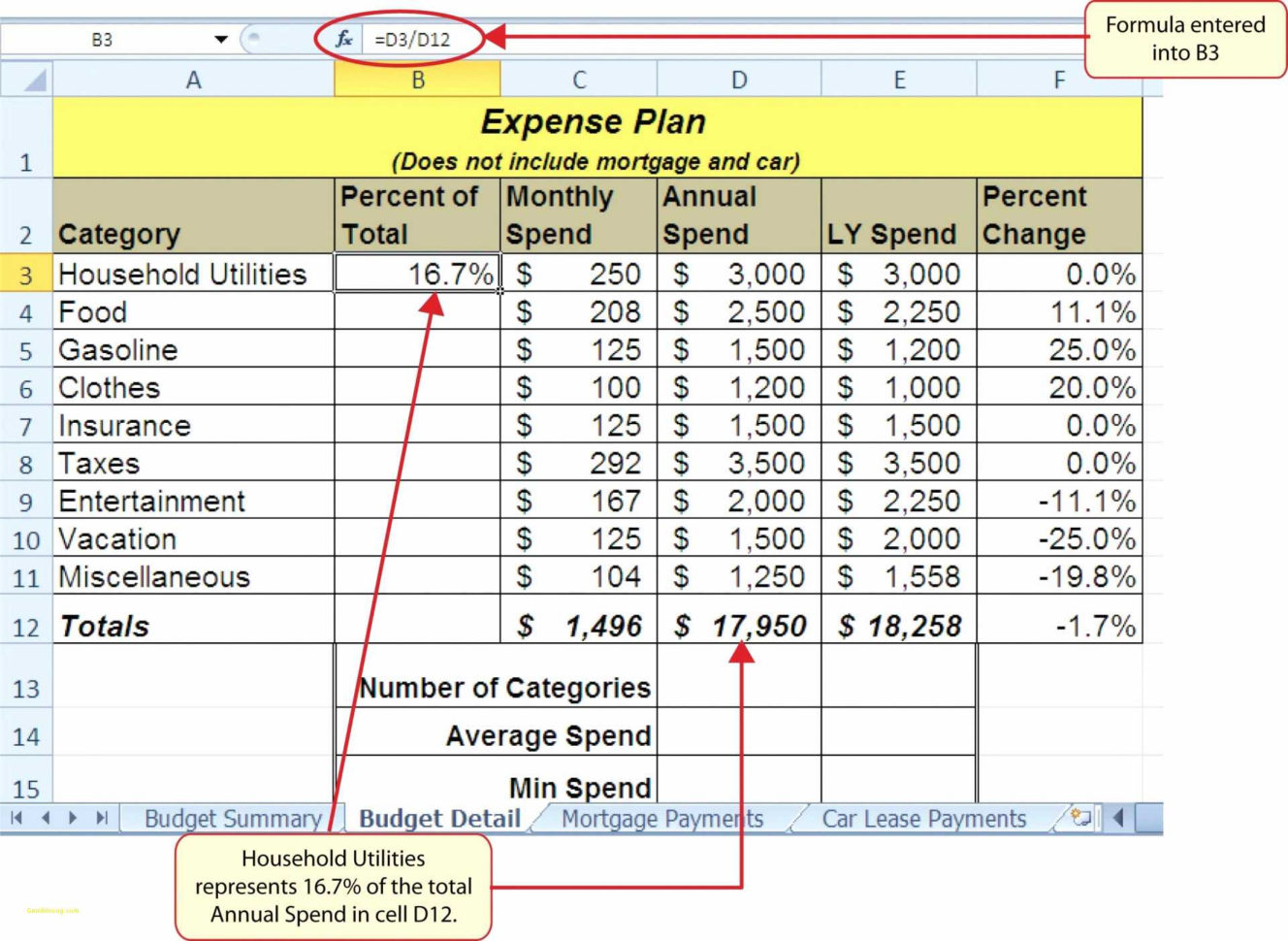

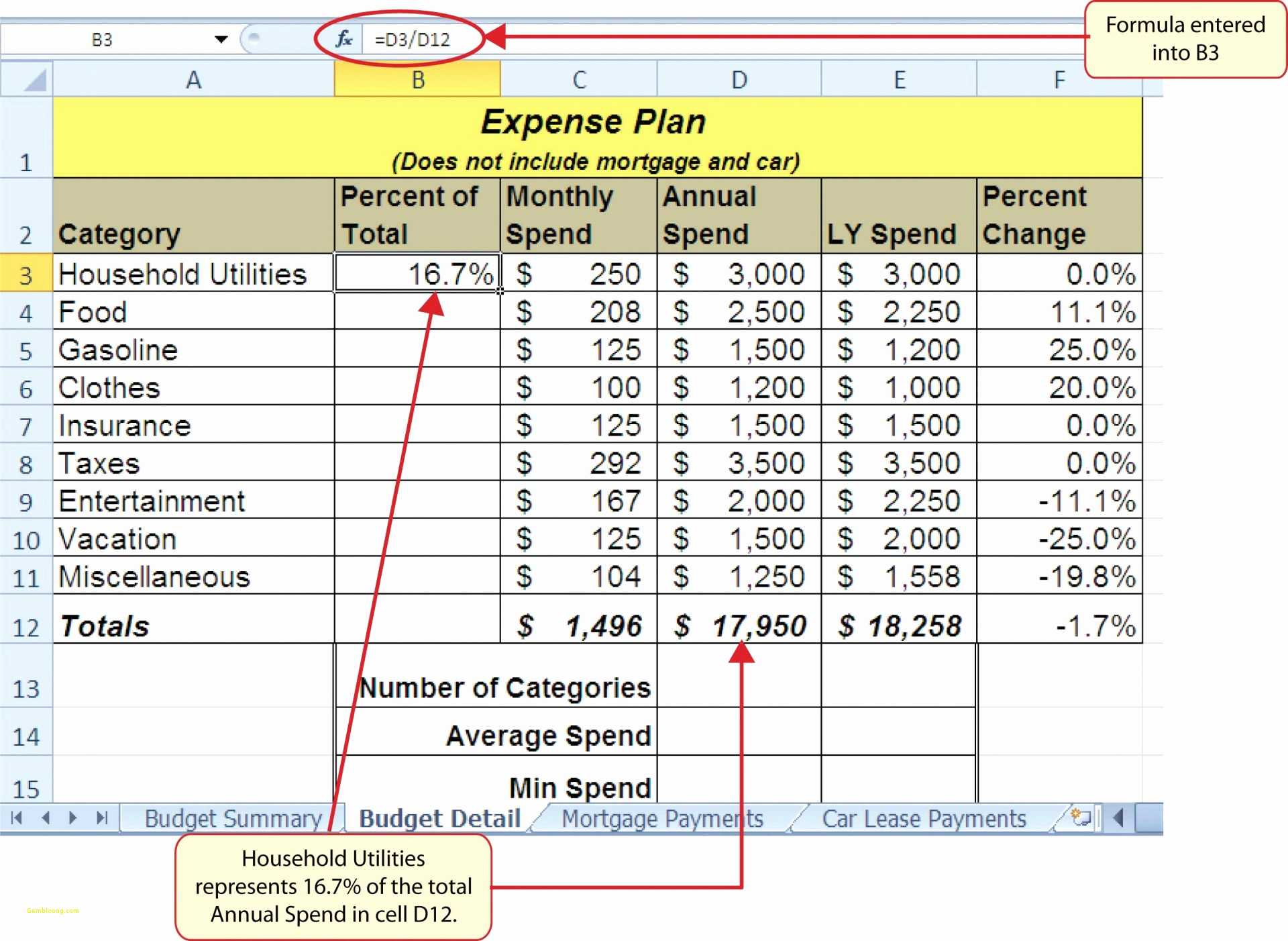

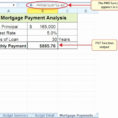

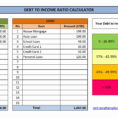

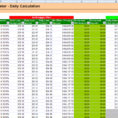

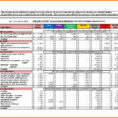

Make sure that you include all of the data on the sheet. This will include the number of months, the interest rate, the current amount owed, the term of the loan, and the current total amount owed. It is a good idea to write down the total and current amount owed at the top of each sheet.

If there are specific terms you would like to track, write these down as well. There are times when you will forget to write down the terms.

Write down any information about fees and interest that you would like to make sure that they are included in the monthly payment. Be sure to use quotation marks around the fees.

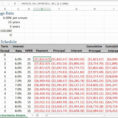

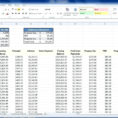

When you are creating the spreadsheet, list all of the payments for each of the mortgages you own. The column containing the first mortgage should be named first mortgage, while the column containing the second mortgage should be named second mortgage. List all of the other mortgages after these two.

You will also want to list the different entries that pertain to that particular sheet. Write the day of the month and note that on the column. This will help you keep track of all of the payments you have been making for the month.

Finally, list the interest rate that you currently pay for each of the mortgage loans. All of the interest rates should be at the same total amount.

When you add up all of the different entries for each mortgage, it will help you determine the monthly payment for each of the mortgages. If you need to make changes to your mortgage spreadsheet, be sure to do so before you save it. Otherwise, you may end up making the wrong changes.

If you are a business owner, you can use a mortgage spreadsheet to keep track of your mortgage loans. This way, you can keep track of your company’s budget, which can help you make sure that your company is running properly. It will also help you see what projects are needed to be done.

If you are someone who has purchased several loans, this is a great way to keep track of your monthly payments. It is also a great way to see how much you owe on the mortgage loans. This is especially useful if you are the one responsible for paying the monthly loan payments. YOU MUST LOOK : mortgage repayment spreadsheet

Sample for Mortgage Spreadsheet