Using a mortgage rate comparison spreadsheet will help you see what rate you can expect your loan to be for your new home. The first step is to make sure that you are able to do this, and then to find the spreadsheet that will suit you best.

Once you know what the lowest rate that you can expect is, then you can make the first mortgage rate comparison spreadsheet. There are several different spreadsheets you can look at so make sure you find one that works for you and your needs.

Mortgage Rate Comparison Spreadsheet – How To Use One

You can also consider searching the Internet to see if there are any free mortgage rate comparison spreadsheets. There are many sites where you can use a very basic spreadsheet in order to find out what your mortgage rate will be.

If you want to find out more about the right kind of spreadsheets you need to use, you may want to browse through this section of the website. You will find some tips on how to compare a mortgage rates spreadsheet as well as other options you have.

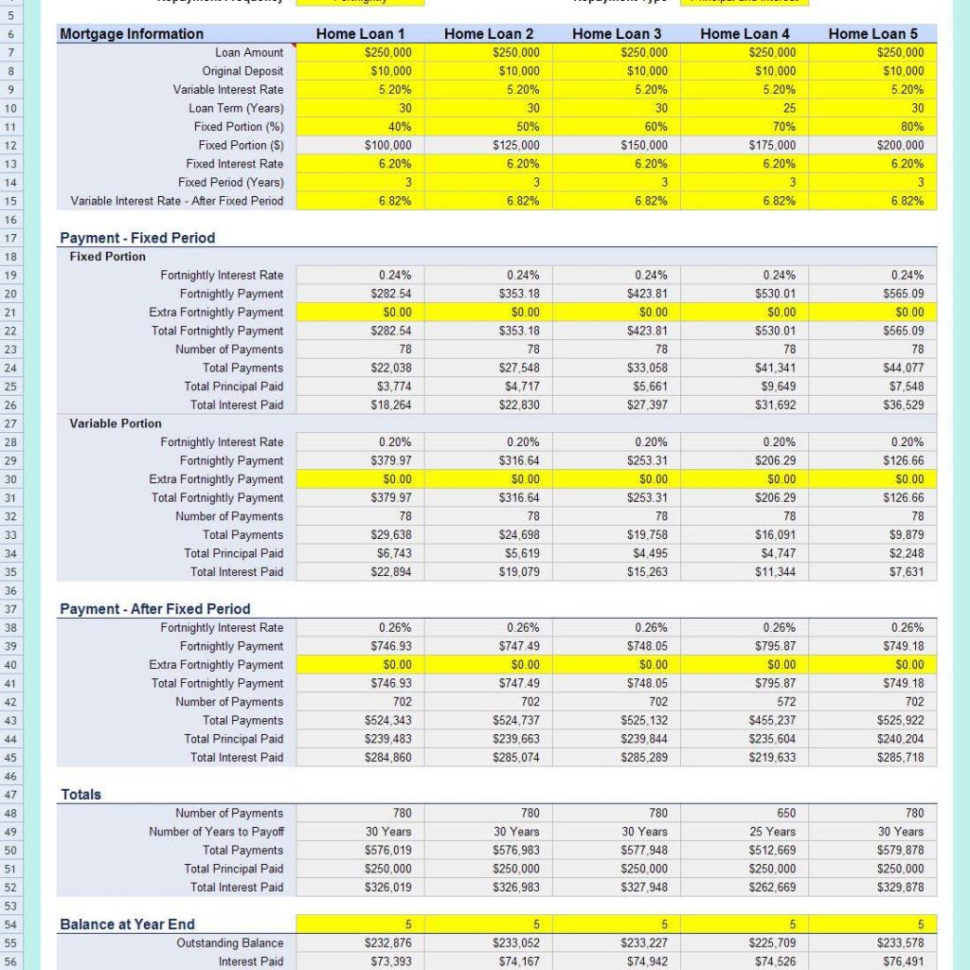

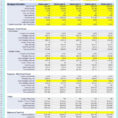

If you want to ensure that you get the best deal possible, then you should compare multiple mortgages for several different lenders. By doing this, you will be able to see what the available rates are for each lender and how they differ from one another.

After you’ve done this, you will be able to see which mortgage rate comparison spreadsheet you would use for your new loan. You should also keep in mind that some of these will have more than one mortgage for you to choose from, which will provide you with many more mortgage choices than you had before.

Remember, there are two things you can do if you want to use a mortgage rate comparison spreadsheet. You can find out what works for you and your lifestyle or you can find out which ones give you the best deals.

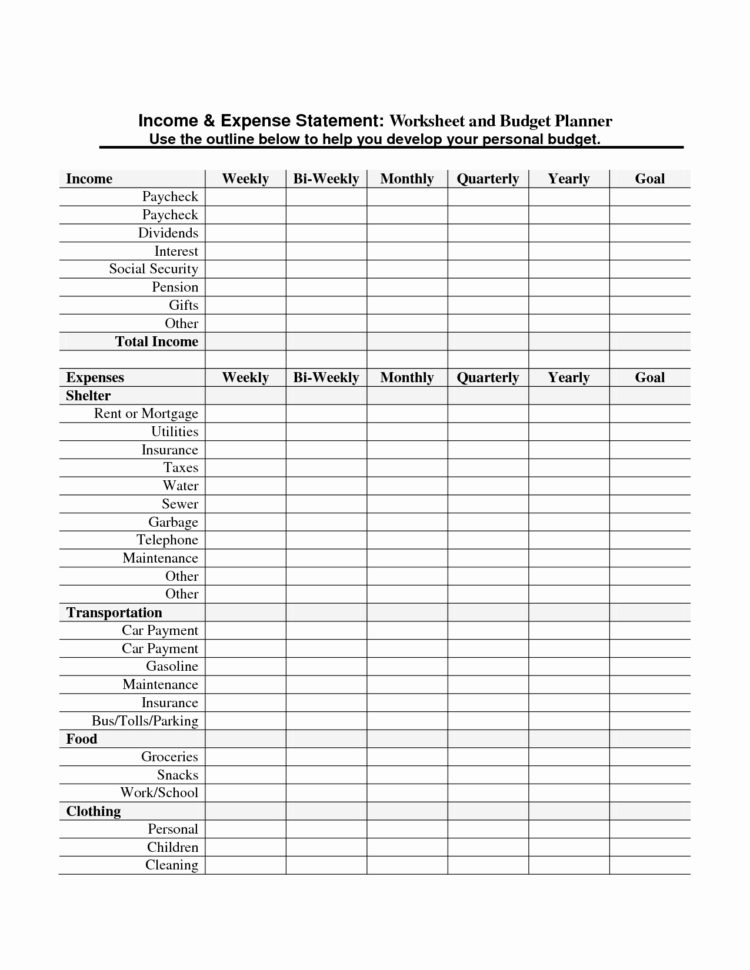

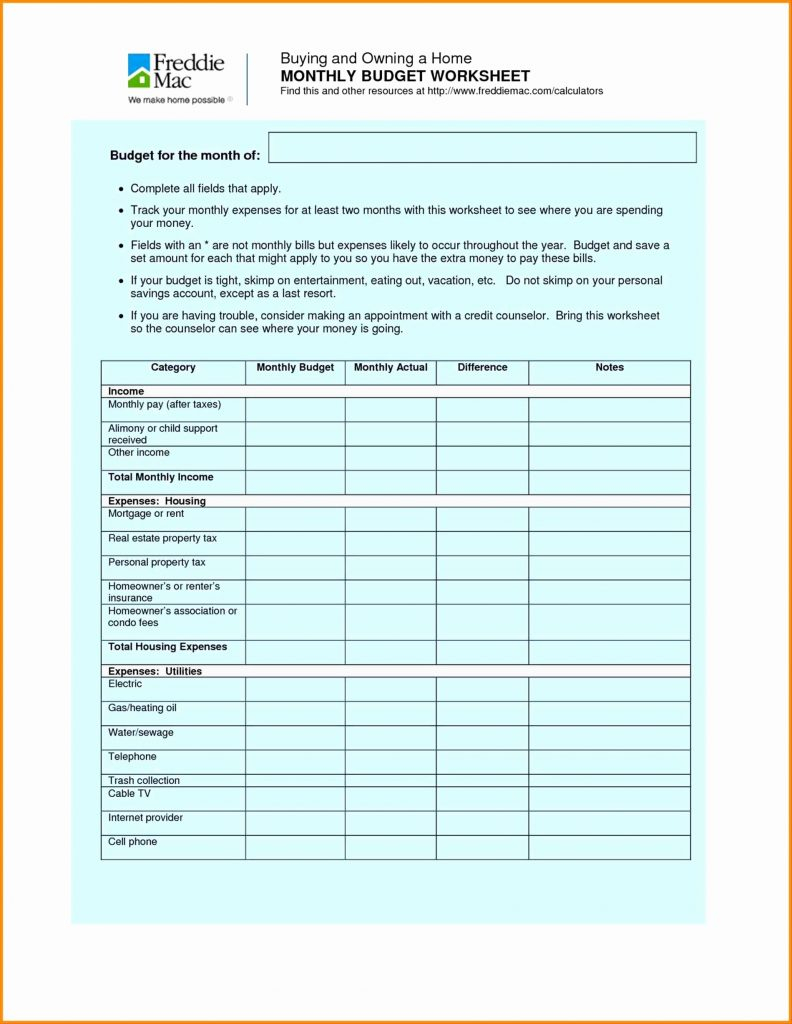

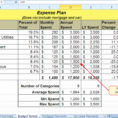

A mortgage rate comparison spreadsheet is the best way to ensure that you get the best deal when it comes to your new mortgage. It will help you see the different rates for different mortgages and will allow you to choose the loan that fits best with your financial situation.

The good thing about using a mortgage rate comparison spreadsheet is that it can be useful to you whether you have the time to do all the research or not. With one simple tool, you can compare the rate that you are currently paying to others and determine which lender can offer you the best deal.

You may be surprised by the amount of different lenders that are available to you through a mortgage rate comparison spreadsheet. In fact, you may find that there are even a few that are completely free to use.

Before you even start to compare any rates, you should make sure that you understand all the details about each option. For example, you should know how many payments you will have to make over the life of the loan, what interest rate you will be offered, and other important information about the different types of loans that are available.

Although you may not have time to do all the legwork that is needed to find the best mortgage rate, you can make use of a mortgage rate comparison spreadsheet to make sure that you are making the best choice. Using the tools can help you save money on your monthly mortgage payments and can help you find a better deal. LOOK ALSO : mortgage payoff spreadsheet

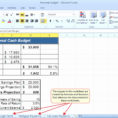

Sample for Mortgage Rate Comparison Spreadsheet