A mortgage loan spreadsheet is a spreadsheet that helps you manage your mortgage loan as well as all the other related mortgage loans and personal debt. You may be tempted to invest in software programs that can help you with your mortgage. However, as we are already aware, mortgage software does not come cheap.

The advantages of using a mortgage loan spreadsheet is that it can help you track down all the fees that you have paid on the mortgage loan. This information will be very useful if you intend to sell your home soon. Furthermore, it can be used by the applicant to determine whether or not they qualify for a new mortgage loan.

Mortgage Loan Spreadsheet – Important Tips

Mortgage applications are often delayed by several weeks because of overpayment. As a result, you must understand the various fees that are applicable when purchasing a home.

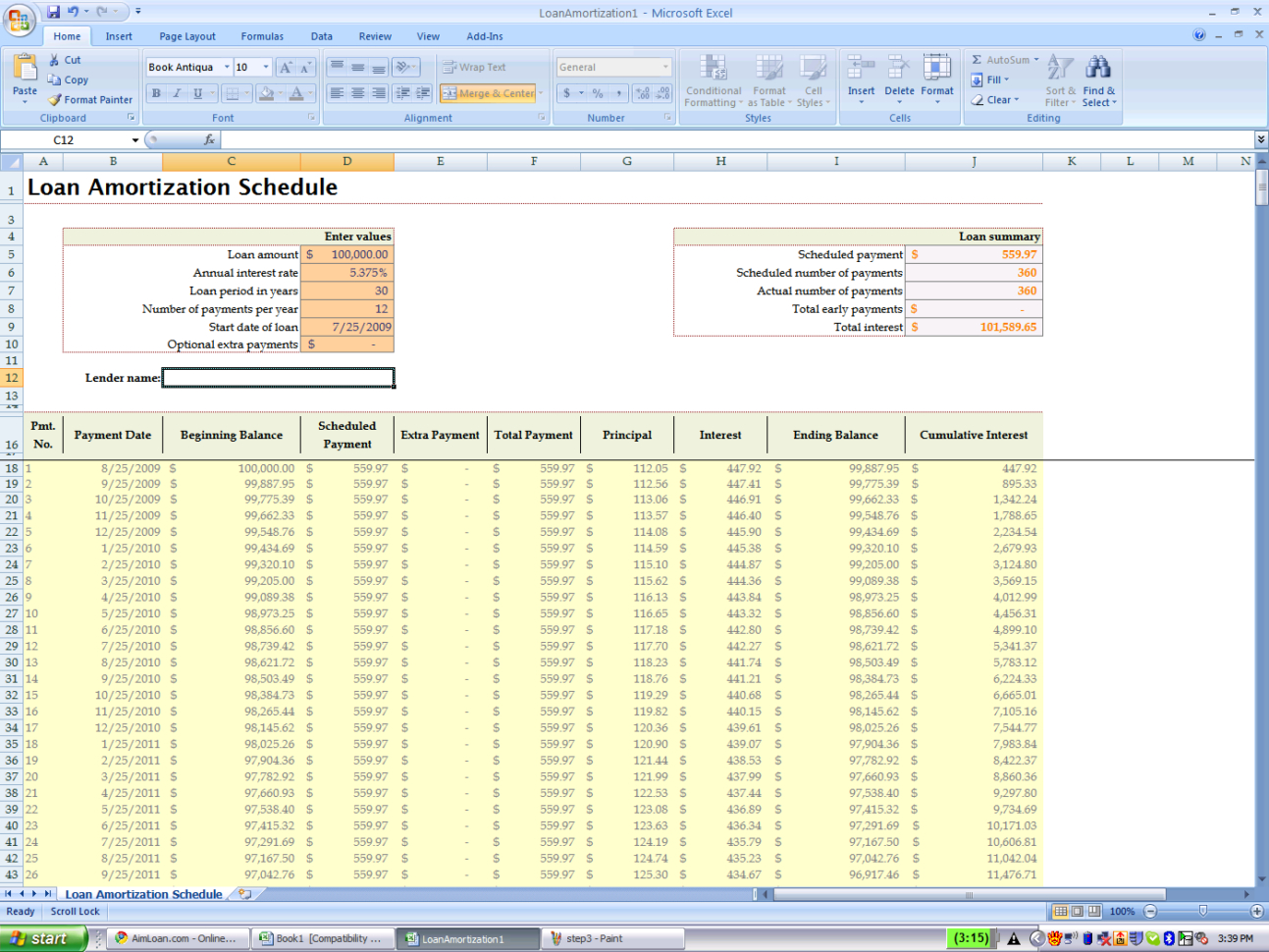

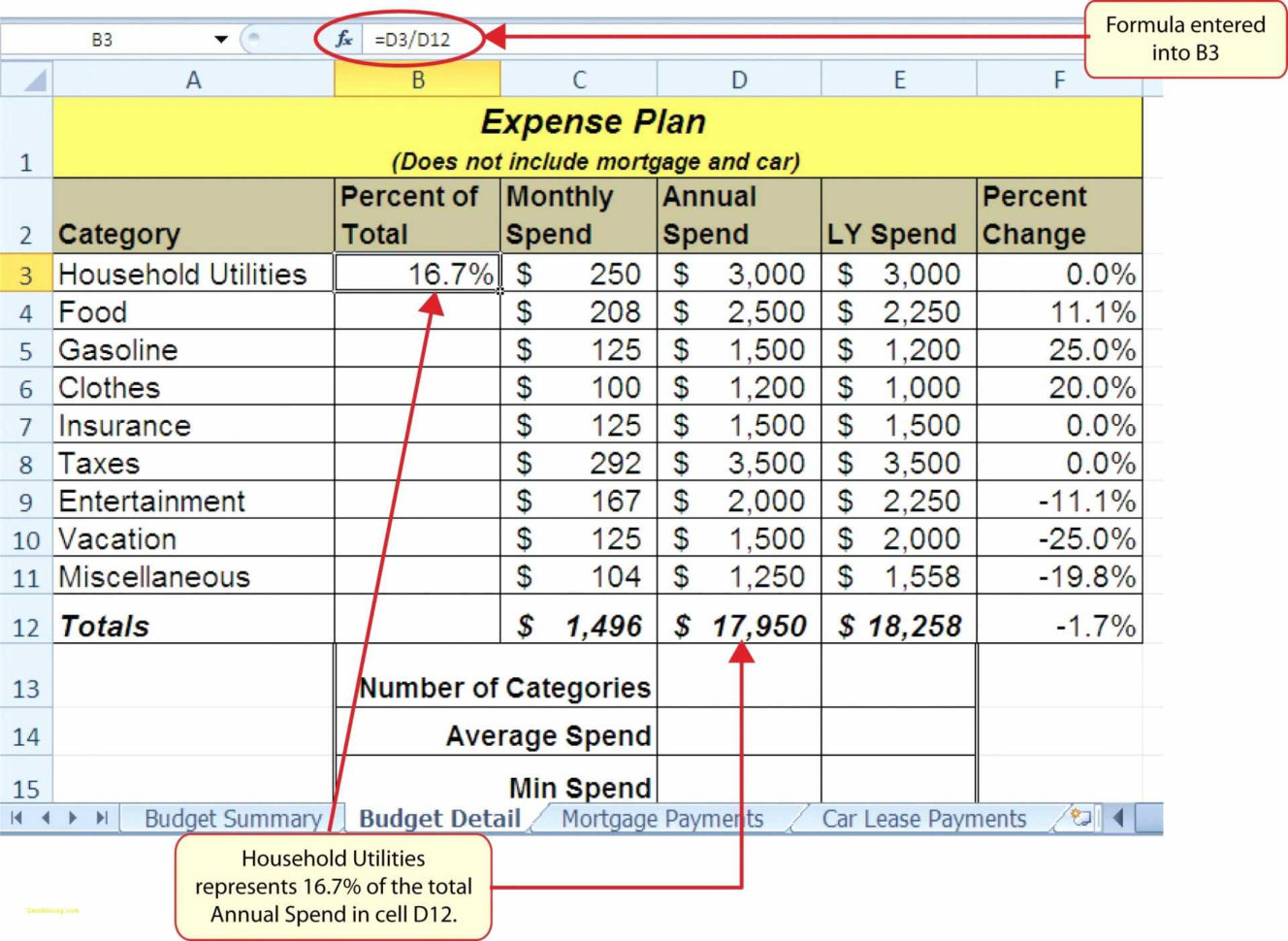

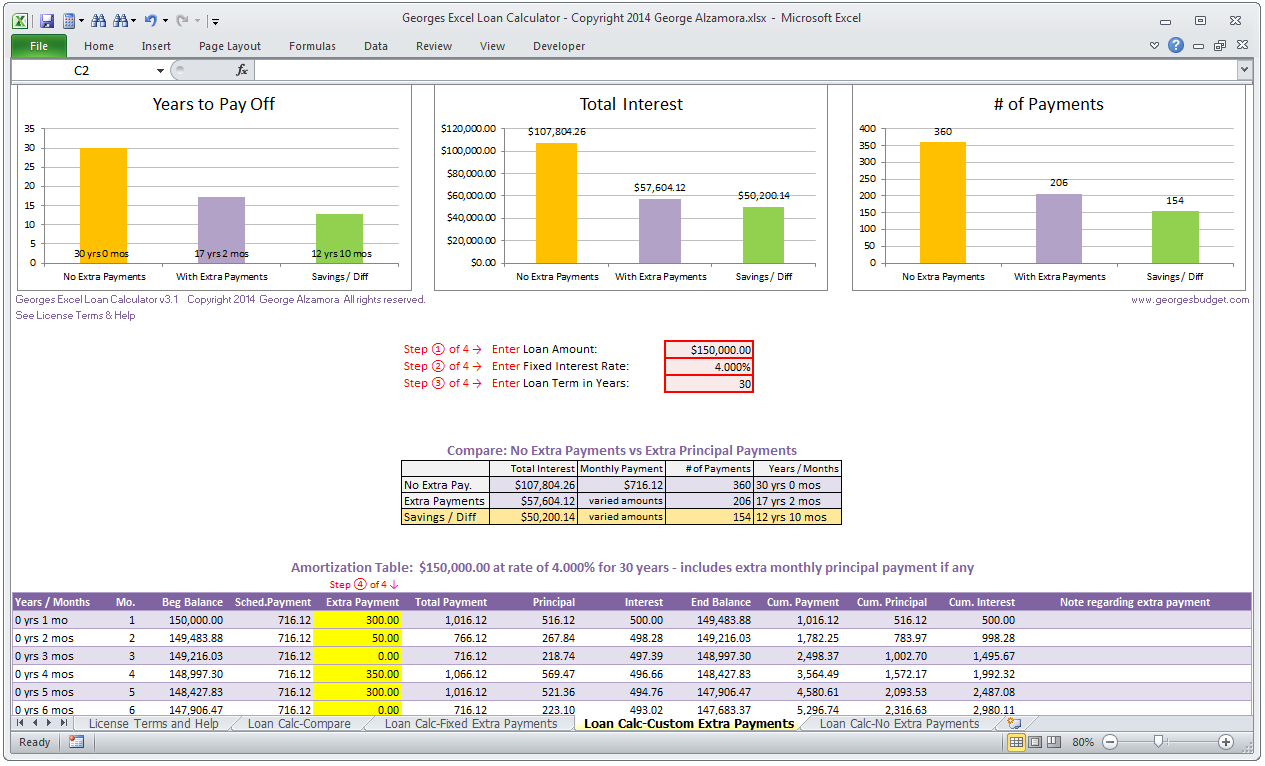

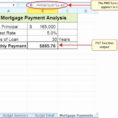

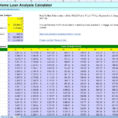

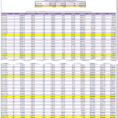

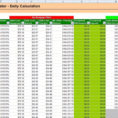

Interest, the repayment period and the penalties can all contribute to the overall cost of a home. With a mortgage loan spreadsheet, all of these factors can be easily analyzed and tracked. They can be budgeted and managed accordingly.

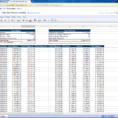

Mortgage programs can also be targeted to current homeowners with multiple loan mortgages. They can be paid off and the monthly payments can be calculated. You can also calculate what amount of monthly payment you should expect to receive.

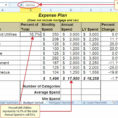

To meet your financial goals, it is always important to keep a close eye on how much you owe. Instead of making costly mistakes, it would be much better to use mortgage loan spreadsheet to manage your mortgage correctly.

It is not only about managing your mortgage loans correctly. It can also help you manage your other finances too.

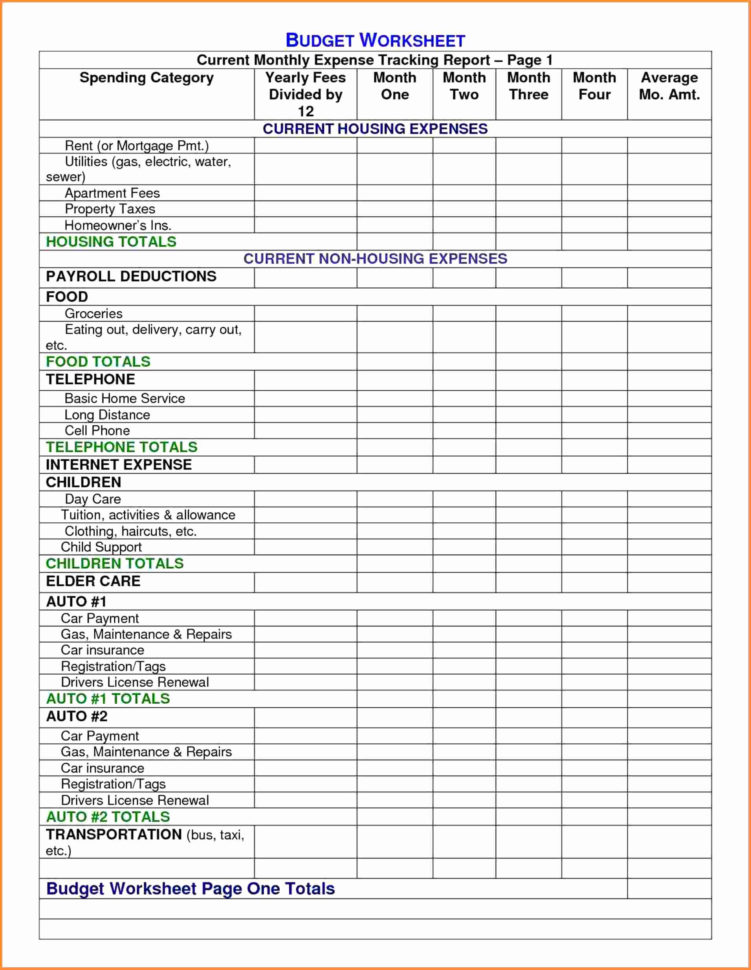

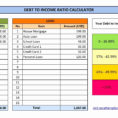

A mortgage loan spreadsheet will include information regarding your mortgage loan. It will also include details about your loans. It will also include information regarding property taxes, insurance, homeowner’s association dues, liens, sales tax, and other relevant charges.

In addition, the spreadsheet will contain details about the criteria used to determine your eligibility for a mortgage loan. When you use this software, you will be able to quickly see the true impact of any changes made to your credit report.

Mortgage loans can have a significant impact on your income. Therefore, it is important to make sure that you know what you’re spending and how much money you earn.

When you apply for a mortgage loan, you must be prepared for a lot of red tape and paperwork. While the process may be stressful, it will be much easier if you use a mortgage loan spreadsheet that can help you organize your finances in an organized manner.

A basic mortgage loan spreadsheet will contain a questionnaire and a range of basic mortgage loan options. This will help you navigate the application process without being overwhelmed. PLEASE LOOK : mortgage lender comparison spreadsheet

Sample for Mortgage Loan Spreadsheet