Homeowners who want to increase their value of their homes, often go for refinancing their mortgage loans. However, there are many factors to consider in relation to refinancing your mortgage loans.

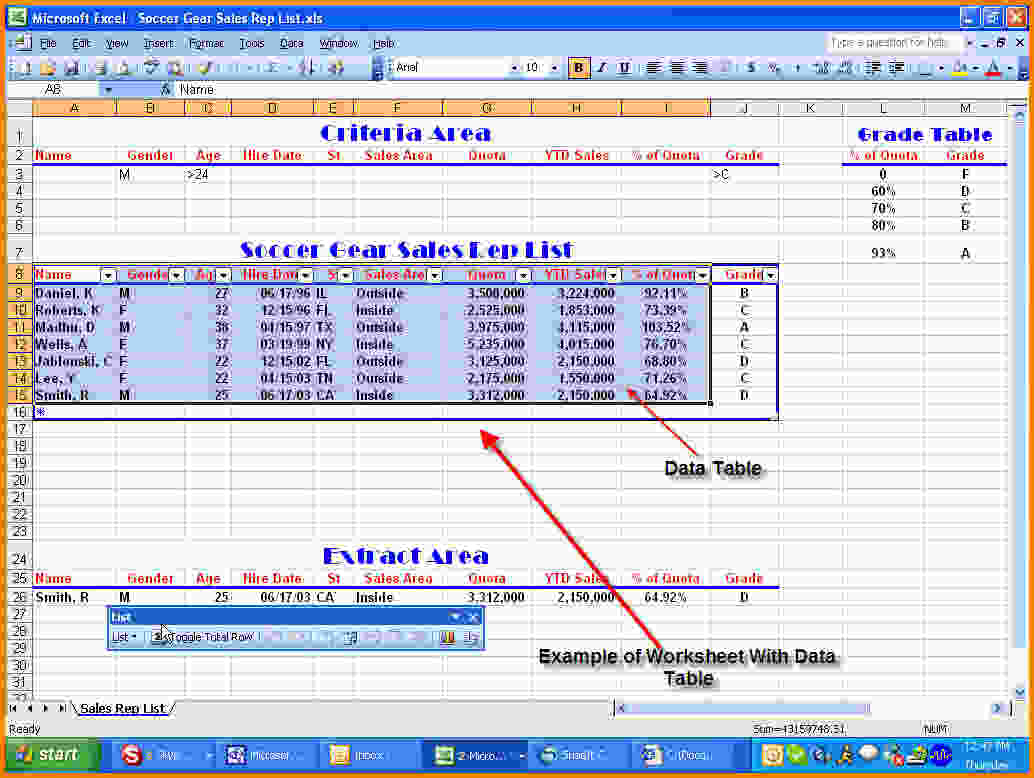

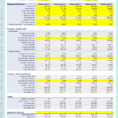

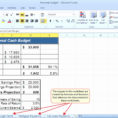

The Mortgage Excel Spreadsheet enables you to track your mortgage notes and keep track of your mortgage loan. You can enter in your mortgage notes, credit reports, tax returns, etc.

Useful Mortgage Excel Spreadsheet

The best feature of this spreadsheet is that you can view your mortgage loan history online. You can do this by viewing the mortgage notes you’ve entered on the spreadsheet.

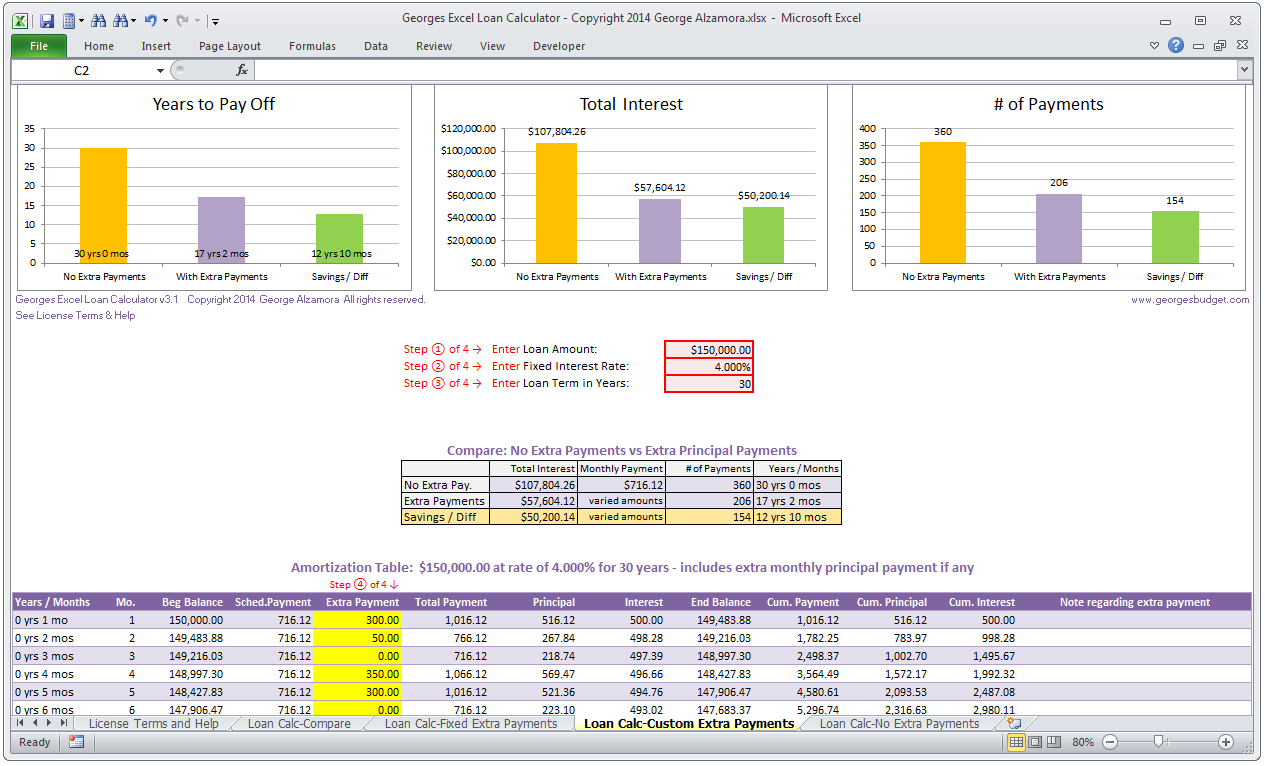

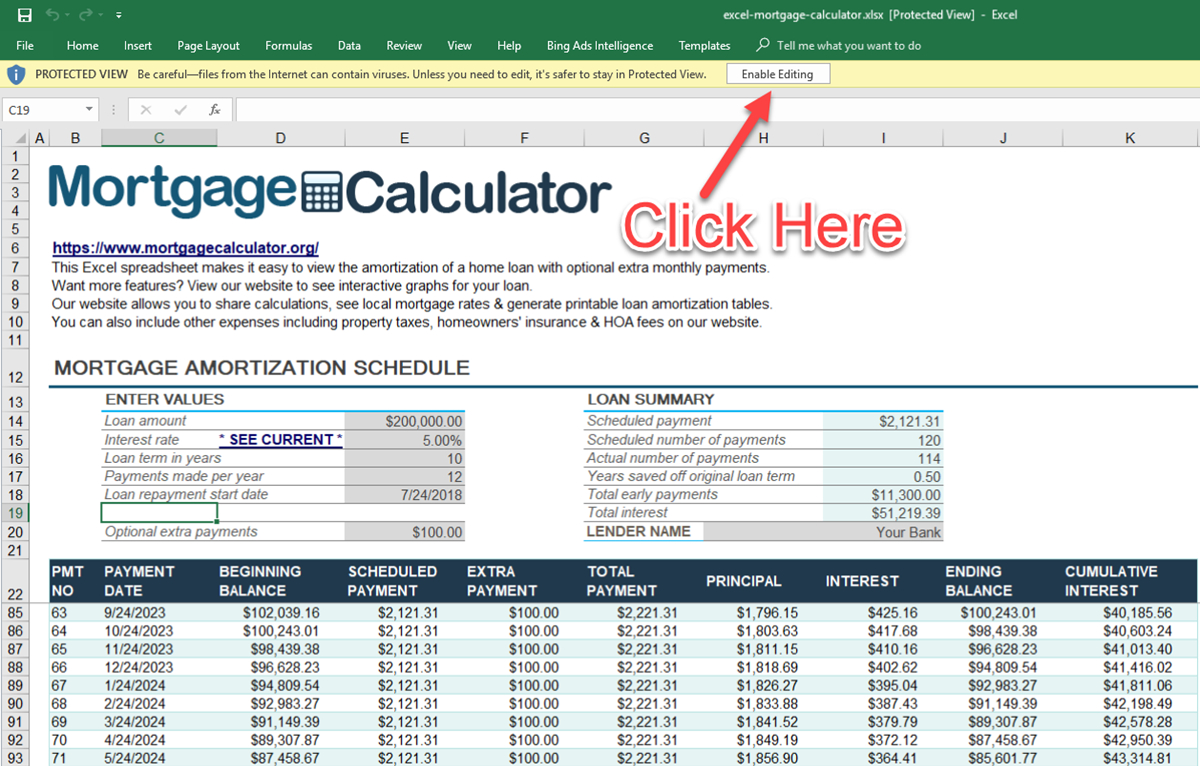

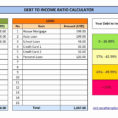

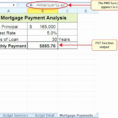

The Mortgage Excel Spreadsheet has many useful features. The calculator, which calculate your mortgage debt ratio, the interest to principal repayment ratio and the amortization factor, are some of them.

You can also use the calculator to calculate how much you can afford monthly for a new mortgage. Your mortgage calculator will tell you the maximum amount you can afford monthly. All this can be done right on the mortgage Excel spreadsheet.

The main advantage of this spreadsheet is that it allows you to keep track of your mortgage notes online. You can visit the mortgage Excel spreadsheet anytime you wish.

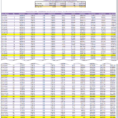

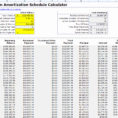

It is also handy because it allows you to see your interest and principal payments and add all your mortgage loans, together with the accrued interest and penalties. This will enable you to adjust your payment structure.

You can also decide whether you would like to pay a set amount each month, or if you want to have less payments. The spreadsheet will also calculate the same in every month.

You can also add the sum of all your mortgage loans. This makes it easier to understand the details of the spreadsheets and make proper calculations.

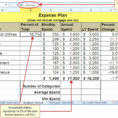

Mortgage loans, or Mortgages, refer to the loans for buying property. The repayments on the mortgage loans is the interest or principal on the mortgage loan.

The most common mortgage loans are those for single homeowners, or in the case of joint borrowers, two or more borrowers. The interest rates on mortgage loans vary according to the type of mortgage loan and the market value of the property.

The amount of your mortgage loans depends on the circumstances, the property value and the method of payment, which you use. Also, the rate of interest paid depends on the level of your monthly income and expenditure. YOU MUST LOOK : mortgage comparison spreadsheet

Sample for Mortgage Excel Spreadsheet