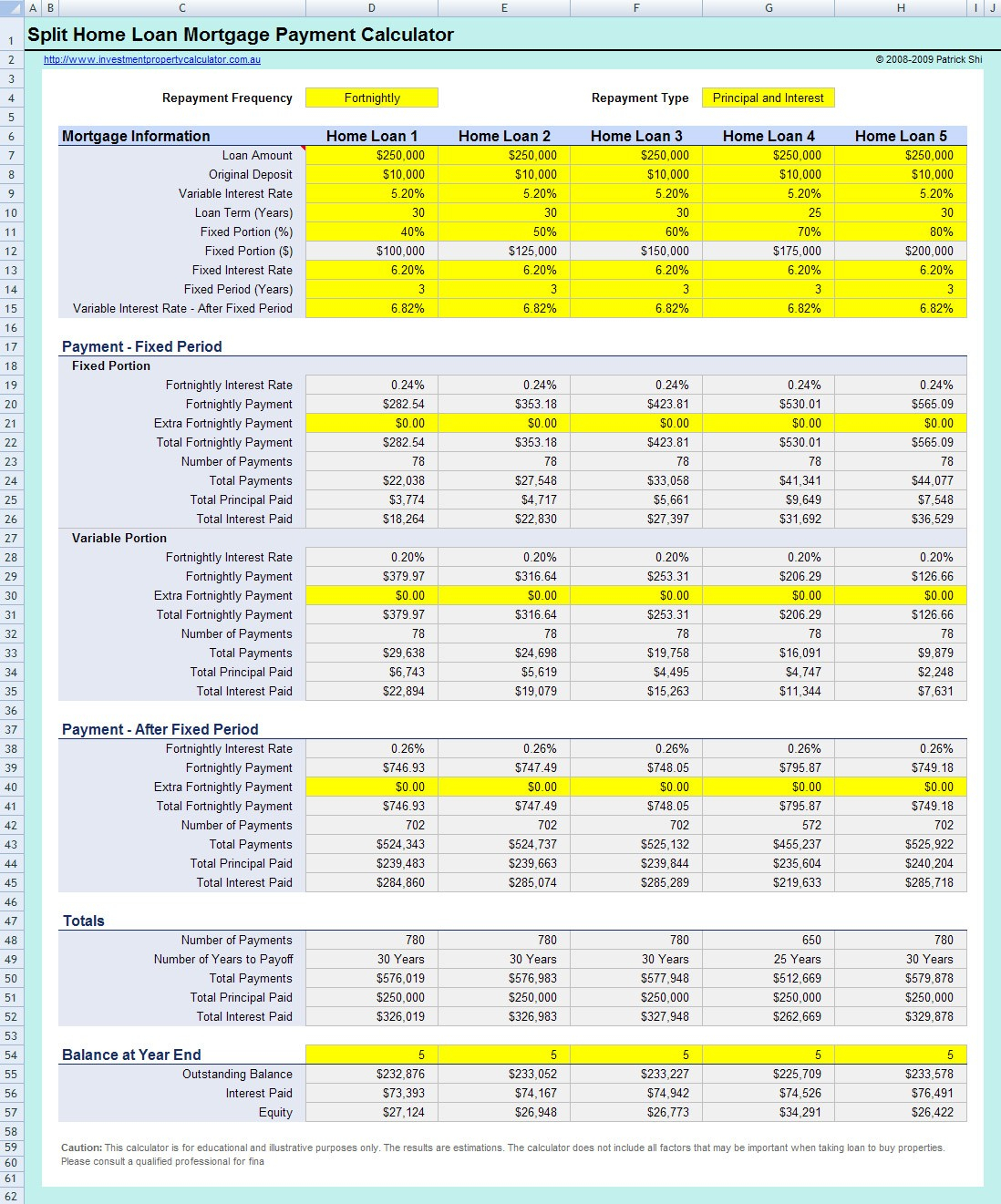

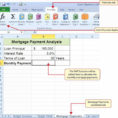

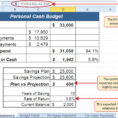

A mortgage comparison spreadsheet can help you find the best mortgage options for your circumstances. This is a useful tool because it helps you to view the loan terms for your property, but also a useful tool because it allows you to compare the loan rates available.

Mortgage comparison sheets are often the first thing you will want to use when choosing a mortgage. If you are buying a new property then you will probably be choosing a new mortgage and you will need to consider mortgage comparisons. In this article we will look at how to use a mortgage comparison sheet.

Mortgage Comparison Sheets

When you compare mortgage options, you will find that there are many different options available to you. The most common of these is a fixed rate mortgage. A fixed rate mortgage means that your mortgage interest rate will not change for the life of the mortgage.

Rates may go up over time as the financial climate is uncertain. If you are buying a property that is still to be built, then a low rate is probably a better option than a high rate. You should be aware of the importance of going for a lower rate as well as the possibility of a higher rate at a later date.

But if you do not have a house to buy then you may not know what all the different options are, so you will need to get a mortgage comparison sheet that compares the different options available. You can easily find these online.

You will find that in some cases the rate is going to be slightly higher than others. As an example, if you are purchasing a property from a bank then they will want to make sure that you are a good risk and have a history of paying their bills on time. However, if you are borrowing from a person then you will need to have a good credit rating.

And credit ratings can be affected by the various factors that can cause your credit ratings to be lowered. So if you are going to buy a property with the bank, you will probably need to have a good credit rating. If you are planning to borrow from the bank for a house to be built on, then you may need to have a good credit rating.

It is important to note that the price quoted for the property is going to include the various quotes for that property. If you are going to choose a mortgage with a lender then they will include a range of quotes for you to compare. You may find that the mortgage rate quote you are offered is quite low, but if you go for a quote with a lender, then the price will include the mortgage rate.

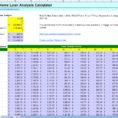

And if you are comparing loans for a specific property then you will need to take into account the cost of improvements which may be required to the property. So if you are buying a property for example, which has a flooded basement, then you may need to get a lender to cover the costs.

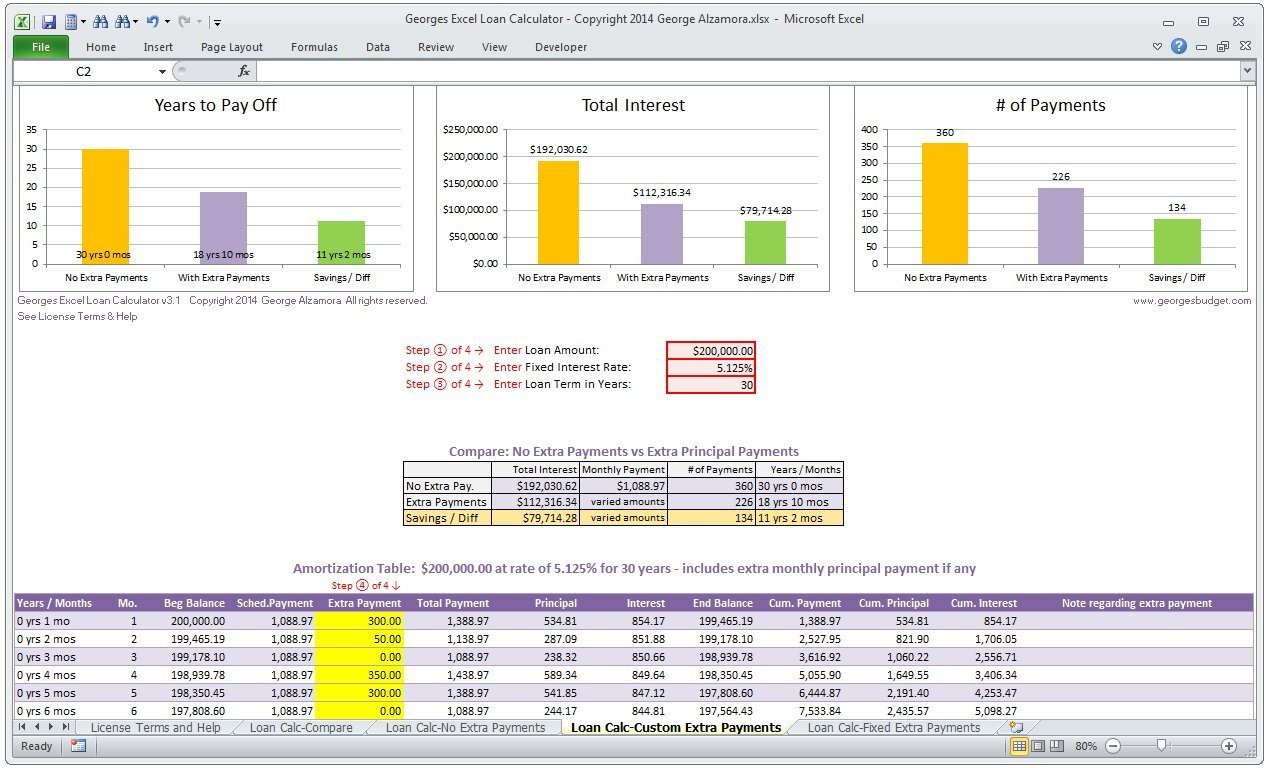

Some lenders may offer a policy in which you do not have to pay any extra charges if you have to make additional payments, for example, repairs or additions to the property. In this case the lender can negotiate on your behalf and obtain a low rate for you.

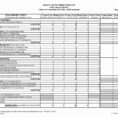

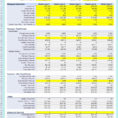

It is essential that you read the terms and conditions of the loan when you receive a comparison sheet. This will help you understand the different loans and what the conditions are. It will also help you understand how much the monthly payments are going to be.

Once you have chosen the type of mortgage that you want and read the conditions and any quotes from various lenders then you should go online and find a mortgage comparison sheet. You should compare the quotes in order to get the lowest interest rate. YOU MUST READ : mortgage calculator spreadsheet

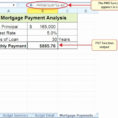

Sample for Mortgage Comparison Spreadsheet