Using a mortgage budget planner spreadsheet is an easy way to create your own mortgage schedule and learn the tricks of the trade. When you think about it, you really only need a few things to get a mortgage, and there are some things that you might think that you do not have to worry about.

There are some basic things that you really do not need to keep track of when it comes to a mortgage plan. If you only had to make these few decisions every month, then you would be able to take care of everything for yourself.

Using a Mortgage Budget Planner Spreadsheet to Save Money on Your Mortgage

Mortgage plans are something that must be planned on a monthly basis. Everything should be accounted for in one month. Here are the things that you might want to take care of as quickly as possible.

Make sure that your mortgage plan does not affect your credit score too much. The first thing that you can do is to negotiate with your lender and explain your situation. Get them to lower your interest rate and monthly payments.

Pay off your other debts so that you do not accrue any more debt. This way you can reduce your credit card debt and make sure that you do not build up too much debt. Pay off other loans as well as your mortgage plan.

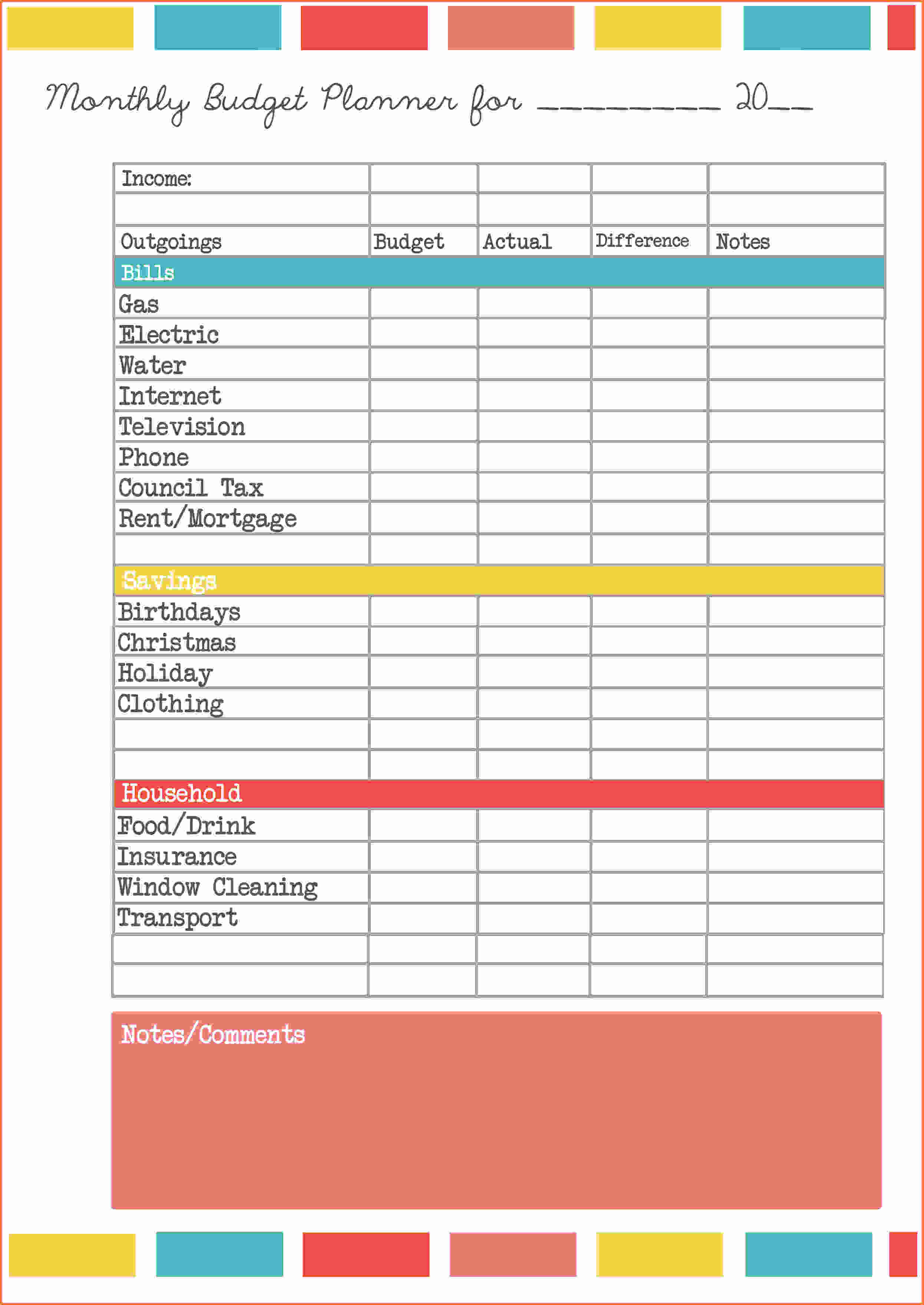

Keep track of your expenses every month. Many people make the mistake of spending less than they make each month. A good method to track your spending is to use a mortgage budget planner spreadsheet.

Make sure that you check off all of the expenses each month. You will be surprised at how many expenses you can actually avoid with the proper planning. Do not let yourself fall into debt over the internet!

Car insurance is not something that you need to pay each month. Most of the time the car insurance premium goes up every year, so why pay for it each month? It is easier to buy a car than to pay the full amount every month.

Car insurances and repairs are easy to handle and will be on your credit report at the end of the year. In this case, your credit score will not take too much of a hit. The payment will also go towards paying off the mortgage.

Make sure that you pay off your credit cards as soon as possible. While you want to use your credit cards to pay for things, they can easily rack up more debt than you will have money for. It is a good idea to only have the minimum amount of debt to make sure that you are not paying for more than you can afford.

You can get cars and trucks when you get married and live with your spouse and small children. Your mortgage will not affect these purchases, so consider getting one to replace your current vehicle. This is a good way to make sure that you can afford the gas.

Once you begin using a mortgage budget planner spreadsheet, you will be amazed at how much money you will be able to save on your mortgage. There are other ways to save, but this will help you see how much you can really save on your mortgage. LOOK ALSO : mortgage amortization spreadsheet excel

Sample for Mortgage Budget Planner Spreadsheet