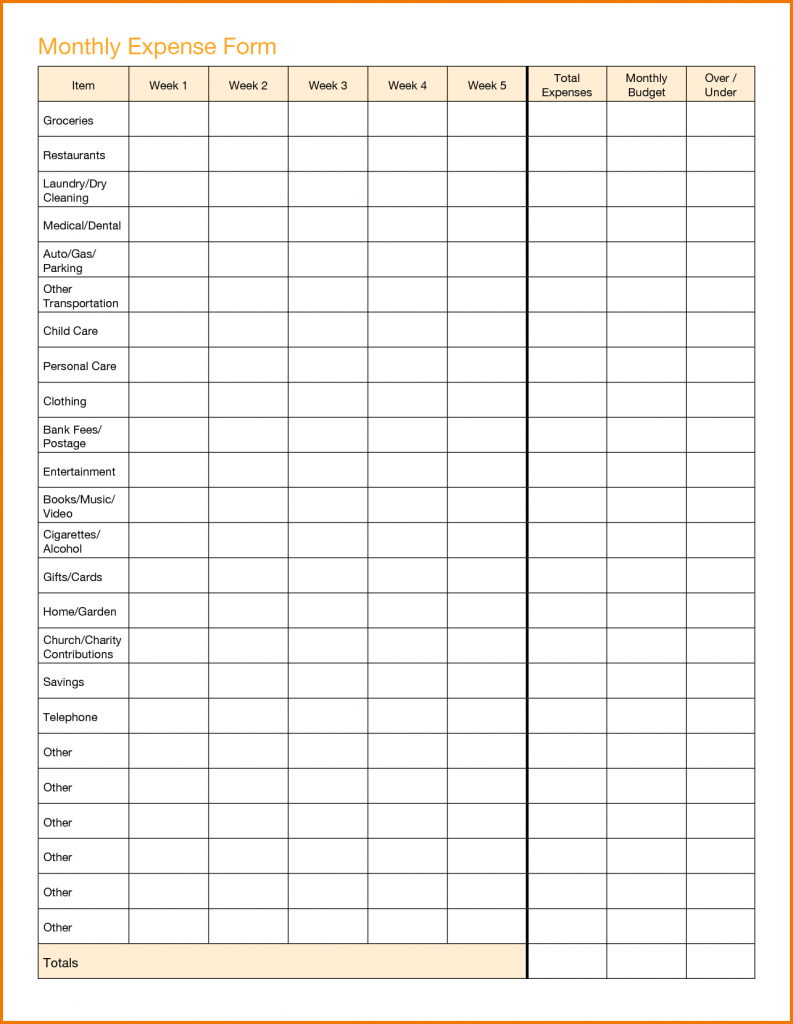

Monthly Living Expenses Spreadsheet Features

Finding Monthly Living Expenses Spreadsheet Online

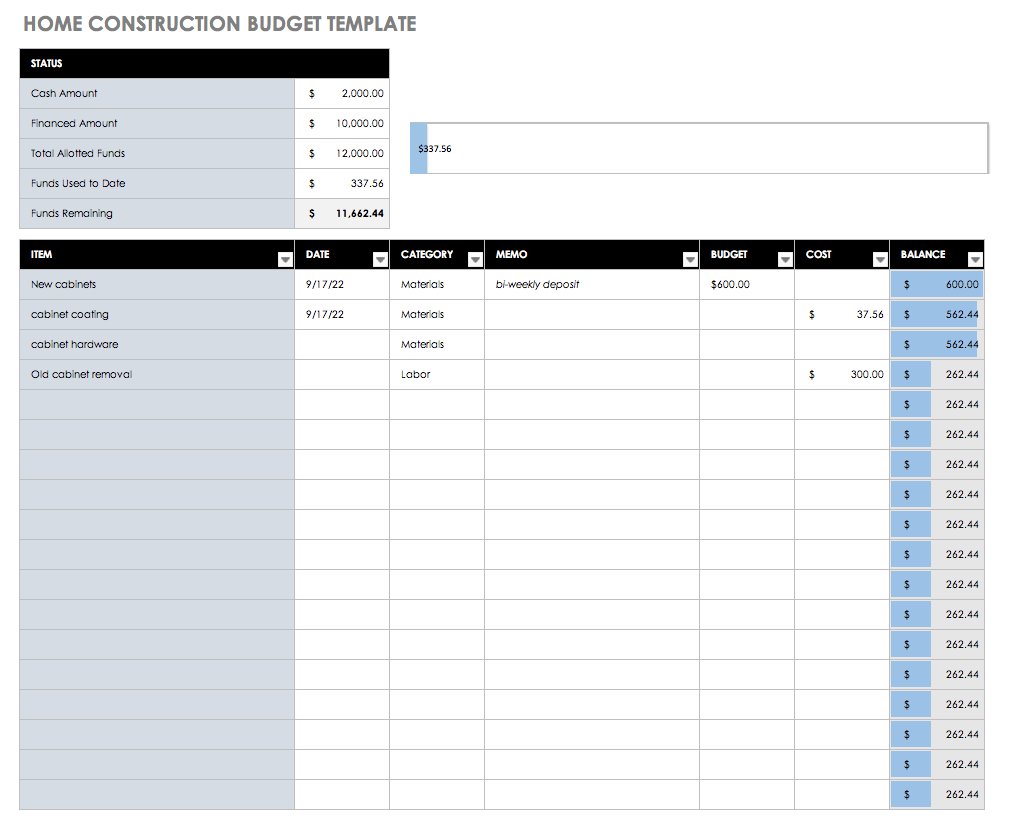

Spreadsheets might even be employed to earn tournament brackets. They might also be published and distributed as a way to supply records or documentation. Utilizing the budget calculator spreadsheet can help you determine different varieties of expenses that you want to plan for and what things to save for each.

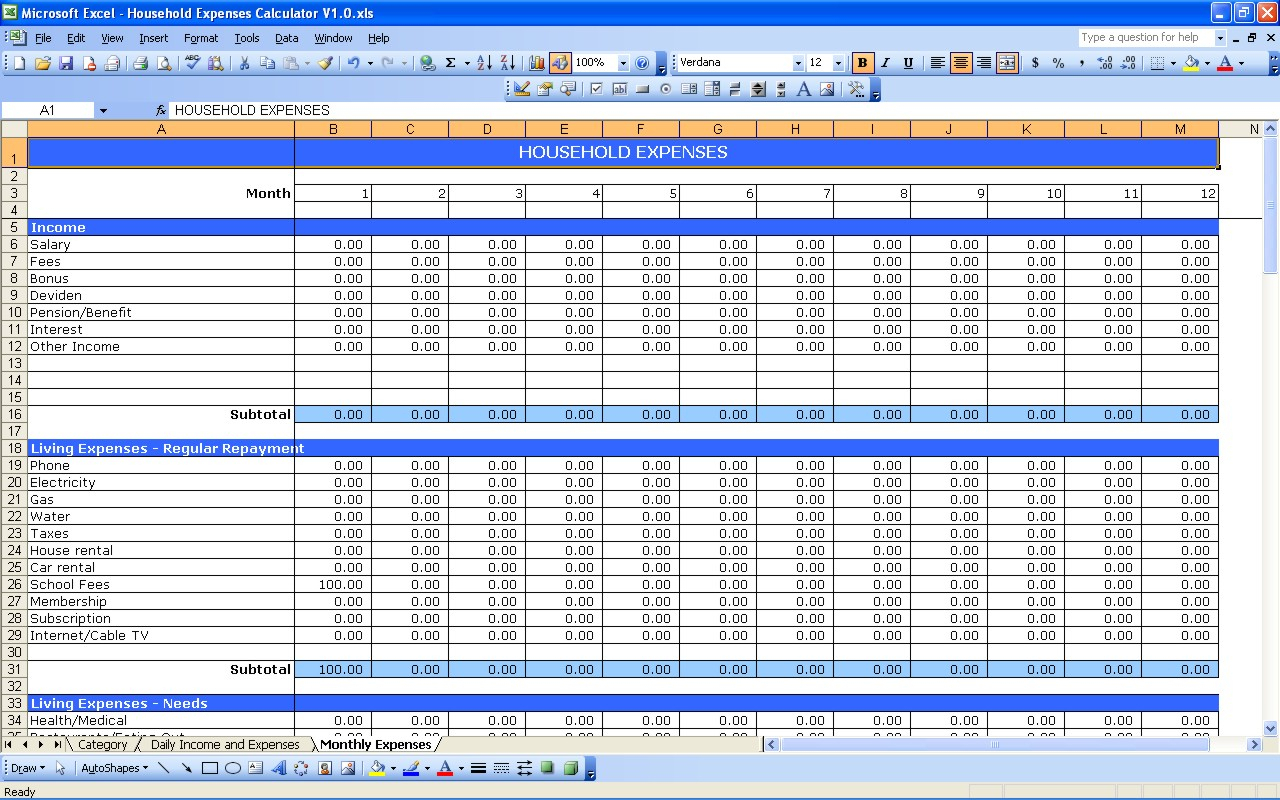

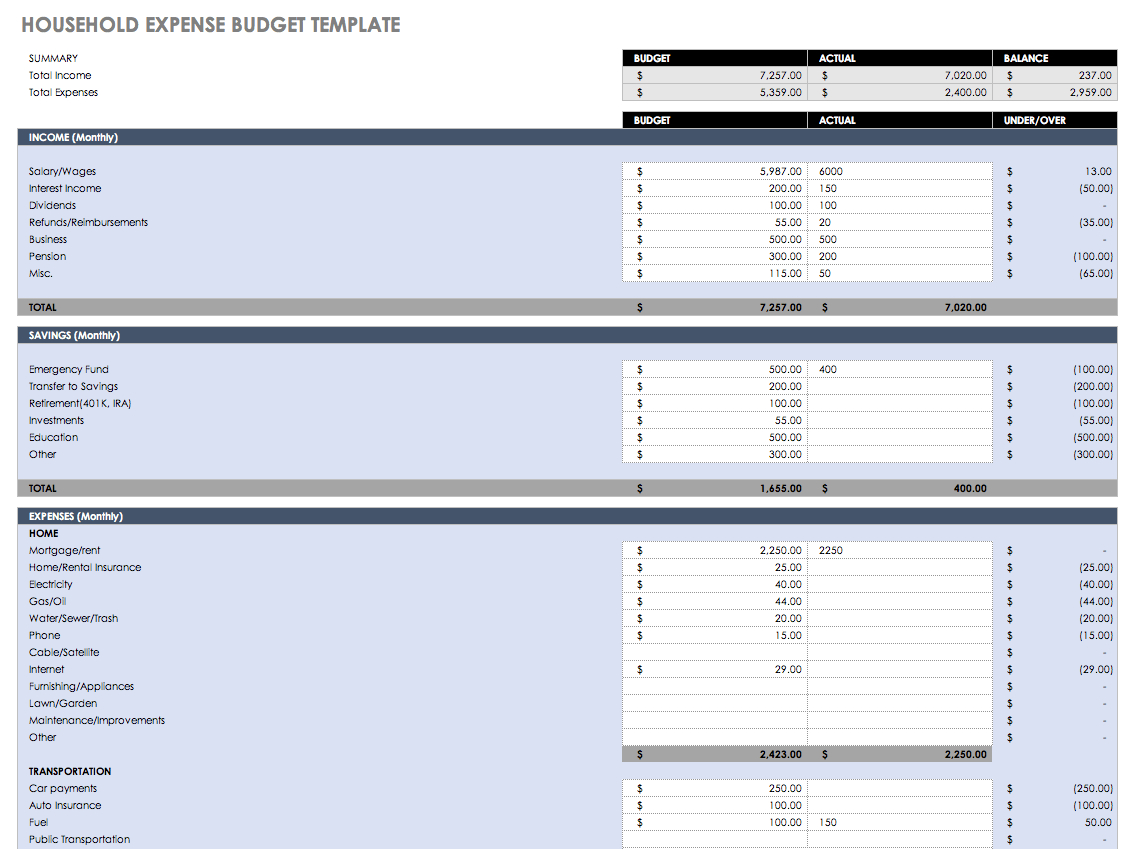

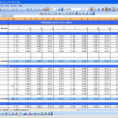

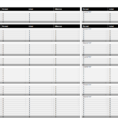

If you’re not keen on making your own tracking worksheet to take care of your family finances, I strongly advise starting with a template that’s already prepared to use. You may begin to customize your spreadsheet by heading to category worksheet and define your categories. The spreadsheet was created for monthly income and expenses. It has several worksheets. It contains entry lines in which you can add income derived from other sources not already listed. Excel spreadsheets and Access tables permit you to customize the way that your data is recorded.

You’ll only confuse yourself, and if you become confused, you won’t be in a position to follow your financial plan. If you’re searching for the simplest and best FREE approach to maintain a budget and adhere to it, visit Mint.com. Putting a budget together needs a resource that assists you to organize your finances. Maybe you’re interested in developing a budget for monthly small business expenses or company projects. The budgets shouldn’t be confused with the actual boarding expenses experienced through an on-campus student. Though a month-to-month budget is usually the most reasonable timeframe for which to set up an initial personal or household budget, there are lots of sources of revenue and expenses which do not perfectly adhere to a month-to-month schedule. Possessing a working budget in place can help you identify precisely where you stand with your finances.

Between your monthly debts, daily necessities, and the little things you get on the way, it can be hard to know where all your money goes. You aren’t able to utilize gas money to get that extra loaf of bread. Or pray you may encounter a large amount of money. Naturally, there are several various ways you are able to budget money, depending upon your income supply, family size, and the degree of visibility you want into your finances. If more cash is apparently going out than coming in, a fantastic way to find control is to set aside some opportunity to compute your expenses.

Incurring a debt is seemingly unavoidable in the present age, as a result of the larger expense of living and consumerism. Having too much debt seems to be an issue a whole lot of people nowadays are confronting. Debt repayment is another wild card for which you might must make adjustments. There is likewise an income-contingent repayment which bases your bill on a portion of your real salary.

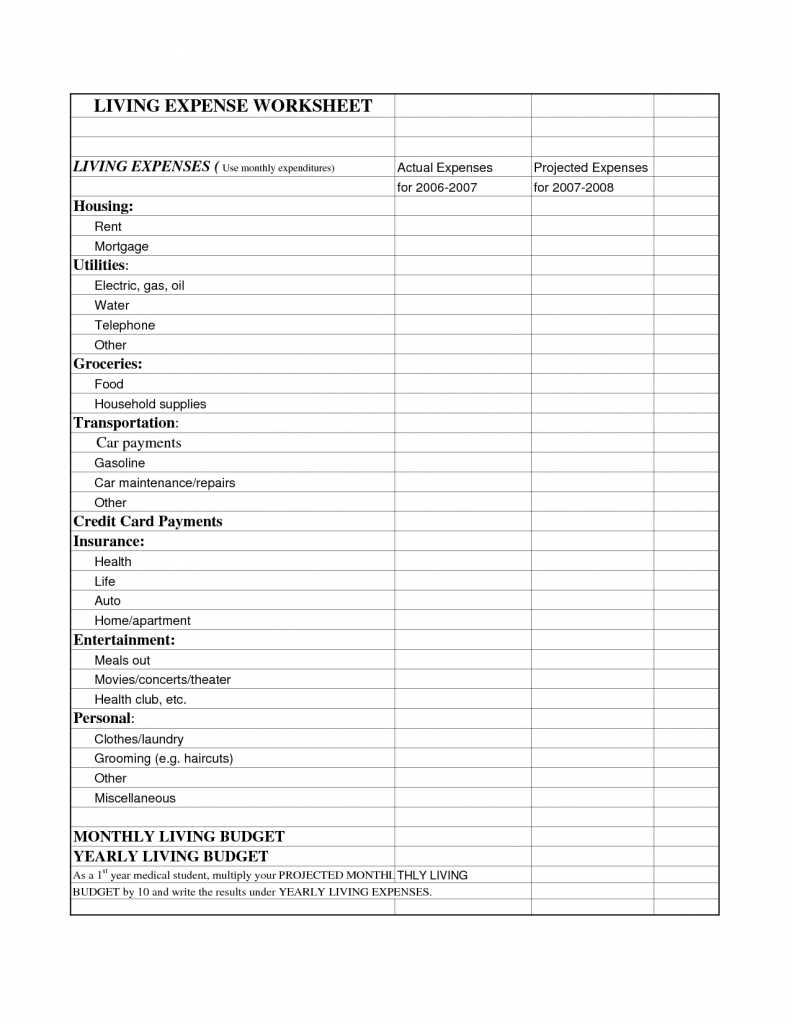

It is possible to claim mileage expenses for the additional distance you drive, Altieri states. Indirect expenses are the costs for housing and other kinds of expenses essential to maintain your family’s lifestyle. Miscellaneous expenses would incorporate any items which don’t fit into the aforementioned categories. Typical monthly expenses can be divided up into several primary categories.

Entertainment expenses incorporate any money spent on having fun. First you have to ascertain how much income and expenses both spouses have on a month-to-month basis. You have to incur the additional expenses to get reimbursed. Monthly household expenses are part of life.