A monthly household expenses spreadsheet is a great way to get a good look at how your expenses are coming in and what you can do to get your expenses under control. If you don’t have a spreadsheet, take advantage of one and start entering your data today!How to Use a Monthly Household Expenses Spreadsheet

A monthly household expenses spreadsheet is a great way to see what is happening at the home and how much money you are spending on a day-to-day basis. However, if you don’t like spreadsheets and don’t know how to use them, this article will explain how to use this type of spreadsheet to keep track of your financial information.

In order to use a monthly expenses spreadsheet effectively, it is important that you have a copy of the spreadsheet somewhere else besides your computer. This will allow you to work on the spreadsheet and refer to it whenever you need to. It is also important that you are familiar with the methods used to enter your information and what data fields to use in order to make the most out of your spreadsheet.

If you do not already have your own spreadsheet, you should invest in one as it will save you a lot of time and effort from having to refer back to your spreadsheet often. A good spreadsheet should have a number of features that make it very user friendly.

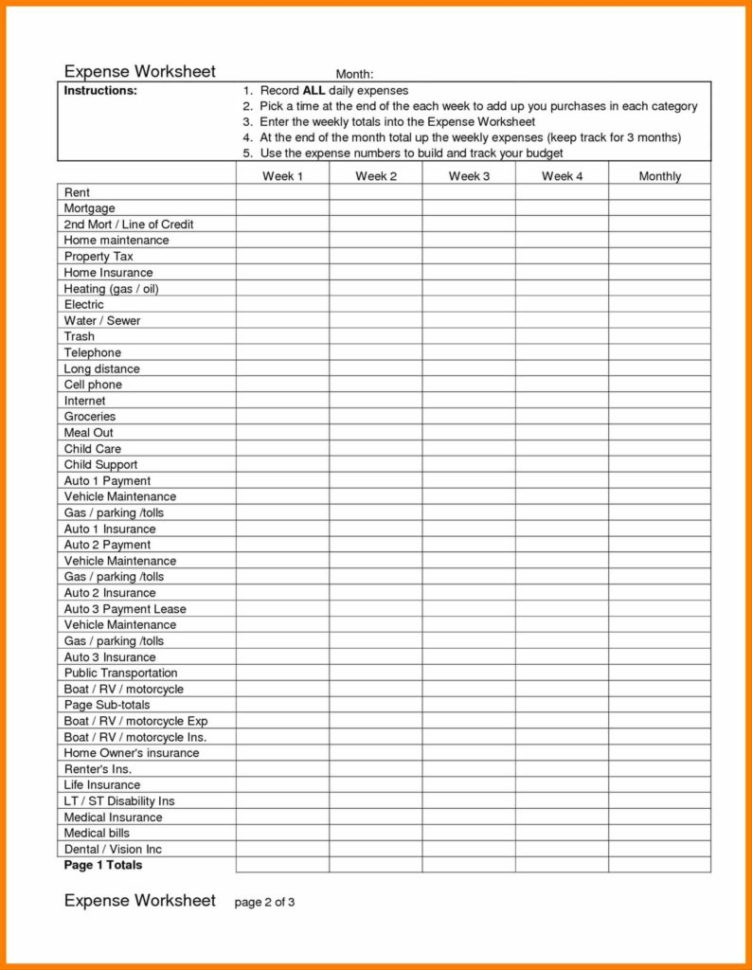

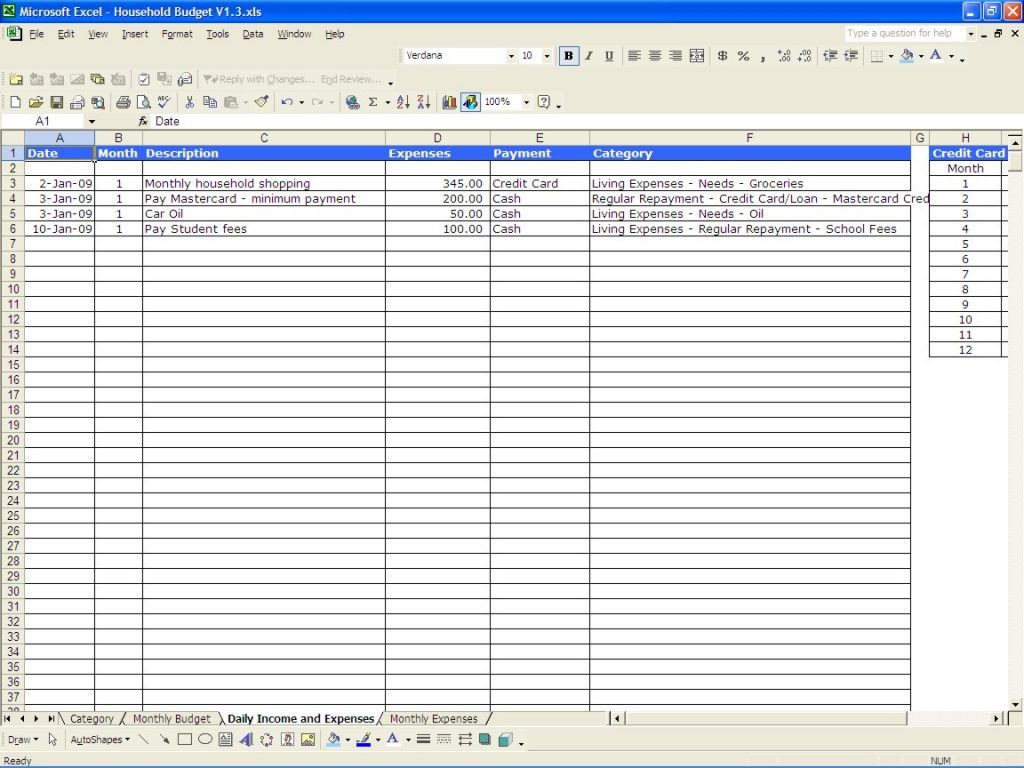

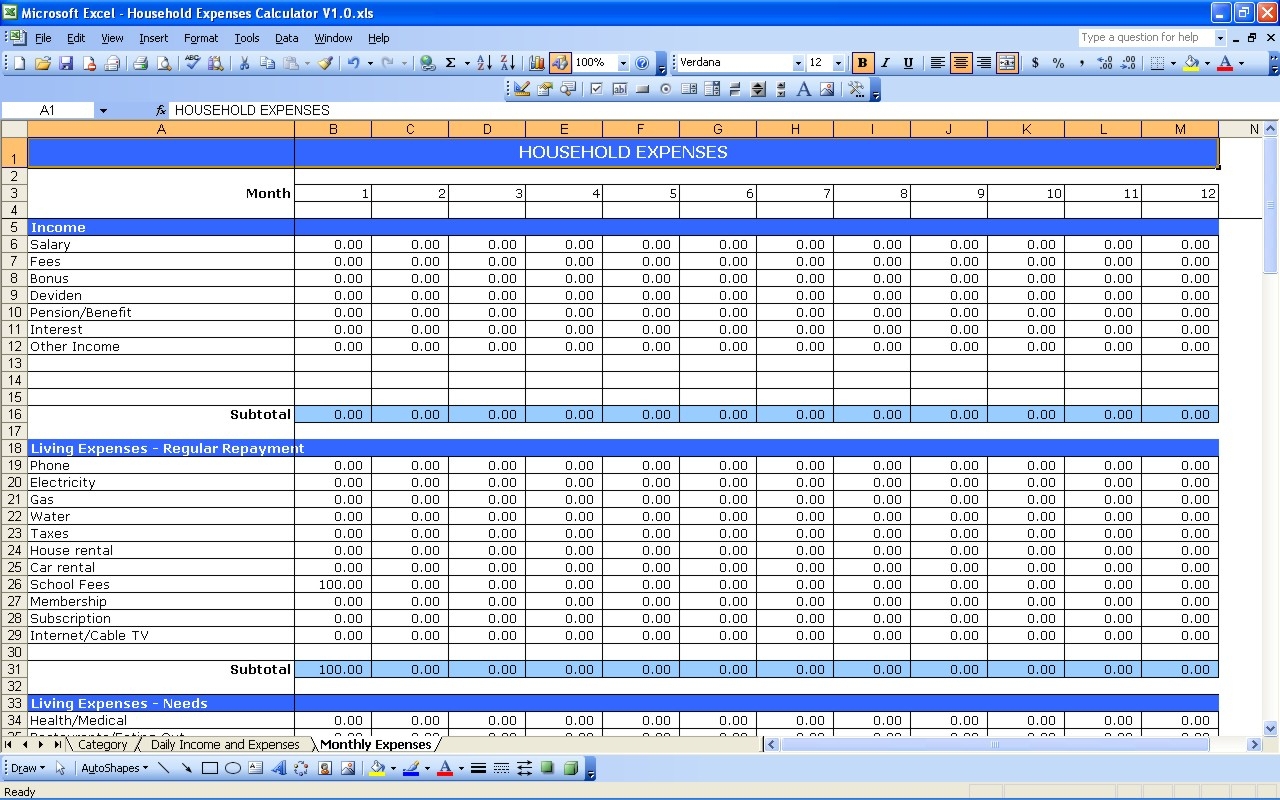

First of all, the spreadsheet should have a data page where you can enter your household expenses. The first data field should be a category, which includes Food, Utilities, Household Expenses, Clothing, and Education. Next, you should input your finances, which should include your income, expenses, assets, and liabilities.

The amount of money that you spend on each category should be entered onto the first column of your monthly household expenses spreadsheet. Use a format such as dollar amounts per category to make the most out of your data entry.

Use this first data entry on your monthly household expenses spreadsheet for each category to note down how much is spent on each category. You can then convert this data into the categories you have defined for each category so that you can easily track your expenses.

Spending on each category should be converted into a percentage. For example, Clothing is a category that is typically entered for each expense. The percentage for Clothing should be calculated by dividing the total of the expenses entered for Clothing by the total of the expenses entered for everything else.

You should also enter any unusual expenses on the monthly household expenses spreadsheet. This includes things like prescriptions, credit card and loan fees, unexpected fines, and gas expenses for long distance driving. These expenses should be included because these can be large amounts that aren’t normally paid for at the grocery store.

Since your expenses for a month are going to be different from other months, you should enter the same amount on each month of your monthly household expenses spreadsheet. Just keep in mind that some items may have increased or decreased in price in a month’s time, and so should be included in the expenses for the new month. You should also add the total of your expenses for the month to your expenses for the entire year to come up with a total.

Any data entry that you want to include should be inputted into columns A and B as well as in the totals on your spreadsheet. These columns should be formatted accordingly so that you can easily enter your data into these columns when you enter your expenses.

When you have all of your data entered into your monthly household expenses spreadsheet, you should save your spreadsheet and refer to it throughout the year. Remember that you need to pay attention to your expenditures each month, so you should keep an eye on your expenses each month. YOU MUST LOOK : monthly expense tracking spreadsheet

Sample for Monthly Household Expenses Spreadsheet