Using a monthly expense tracking spreadsheet can be a very easy way to keep track of your expenses. But it is not as easy as it sounds. You’ll have to know the items you need to track, and you’ll have to know how to do it.

Being able to accurately record expenses is extremely important if you want to keep accurate records. You’ll have to keep careful records of where you go, what you buy, and when you spend your money.

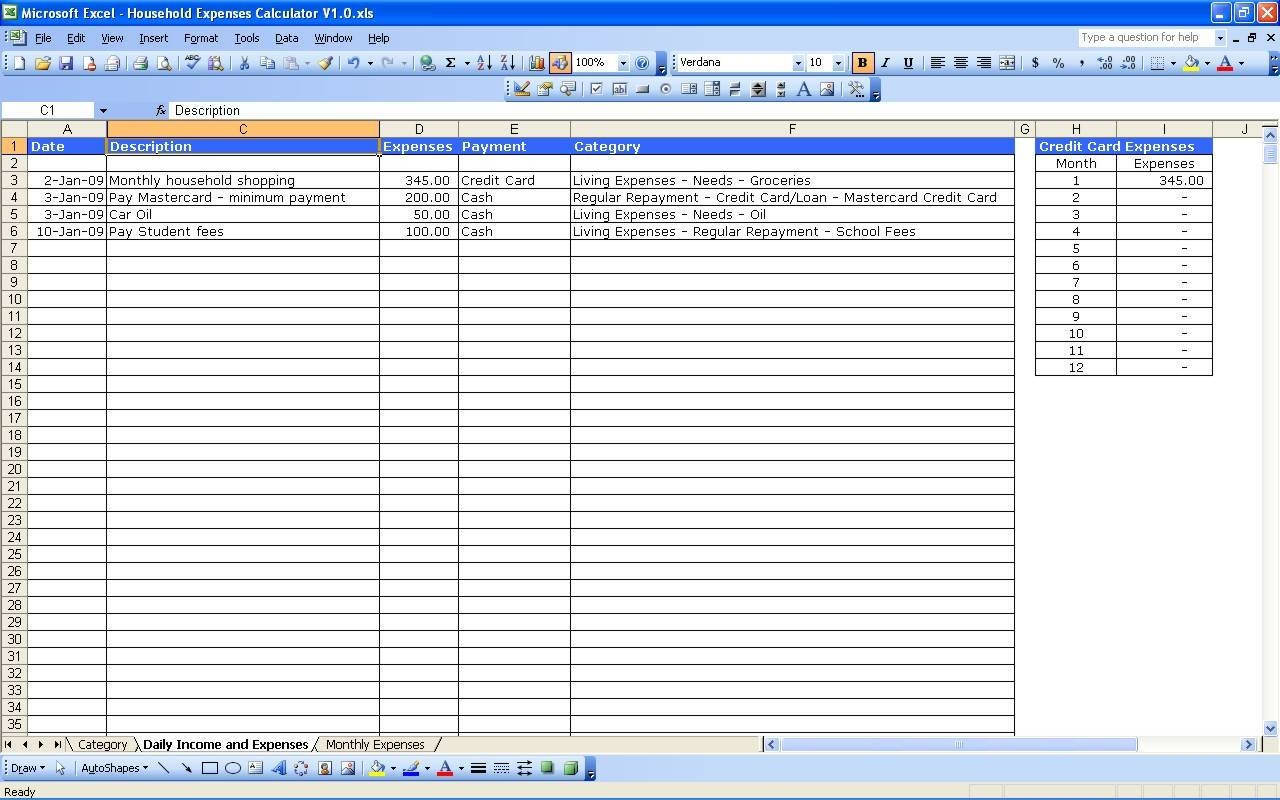

How to Make a Monthly Expense Tracking Spreadsheet

The first thing you should do when you’re trying to make an expense tracking spreadsheet is to review what your job is going to be. What kinds of things do you do on a regular basis?

If you’re a cashier, for example, you might want to make sure that you make copies of all the necessary documents, like receipts, to be used as references later. But if you’re not the cashier, you may be doing something else that requires you to keep a detailed record of your finances.

For example, you may have to keep a record of all your income taxes, or you may be required to keep a record of all your bank accounts. Either way, keeping a document of this sort is a necessity for all those other things.

As long as you keep track of these records correctly, you’ll be able to make a monthly expense tracking spreadsheet for all your financial records. You should be able to cross reference items like credit card statements and monthly sales receipts, as well as your other receipts and expenses.

This will allow you to see exactly what you spent on what items and how much money you made when you paid for them. And this will help you to properly budget your money and to stay on budget. It’much easier to control your budget than it is to get into the habit of spending money without being able to account for it.

When you’ve made your records, you’re going to have to decide which item to categorize and which to leave alone. For example, if you’re keeping a spreadsheet for business purchases, you’ll need to be able to cross-reference credit card statements and expense reports from the business.

In the case of the store, you’ll also need to cross-reference store records with what the receipts show. Remember, though, that you don’t have to purchase everything you need to keep track of expenses.

If you shop at a grocery store, for example, you won’t necessarily have to keep track of every single dollar spent on groceries. But it is important to keep track of these expenses so that you can maintain accurate records of your receipts.

You’ll need to consider where you shop for your items. If you shop at the grocery store, you’ll need to keep a record of your receipts and the amount you spent on the item; you’ll need to cross-reference the receipts and calculate your cost.

If you shop at the drug store, you’ll need to keep a record of your receipts and make copies of each and every receipt. Then you’ll need to cross-reference those copies with your store accounts and make copies of all of them. YOU MUST READ : monthly expense spreadsheet for home

Sample for Monthly Expense Tracking Spreadsheet