A common question among new marketers is: What is the difference between a Monthly Bills spreadsheet and a pay-per-click paycheck? Both of these kinds of spreadsheets are great tools to keep track of your daily income, sales, or general financial goals. But there are some significant differences in their usage that you should keep in mind.

Monthly Bills Spreadsheet Vs Pay Per Click Paycheck

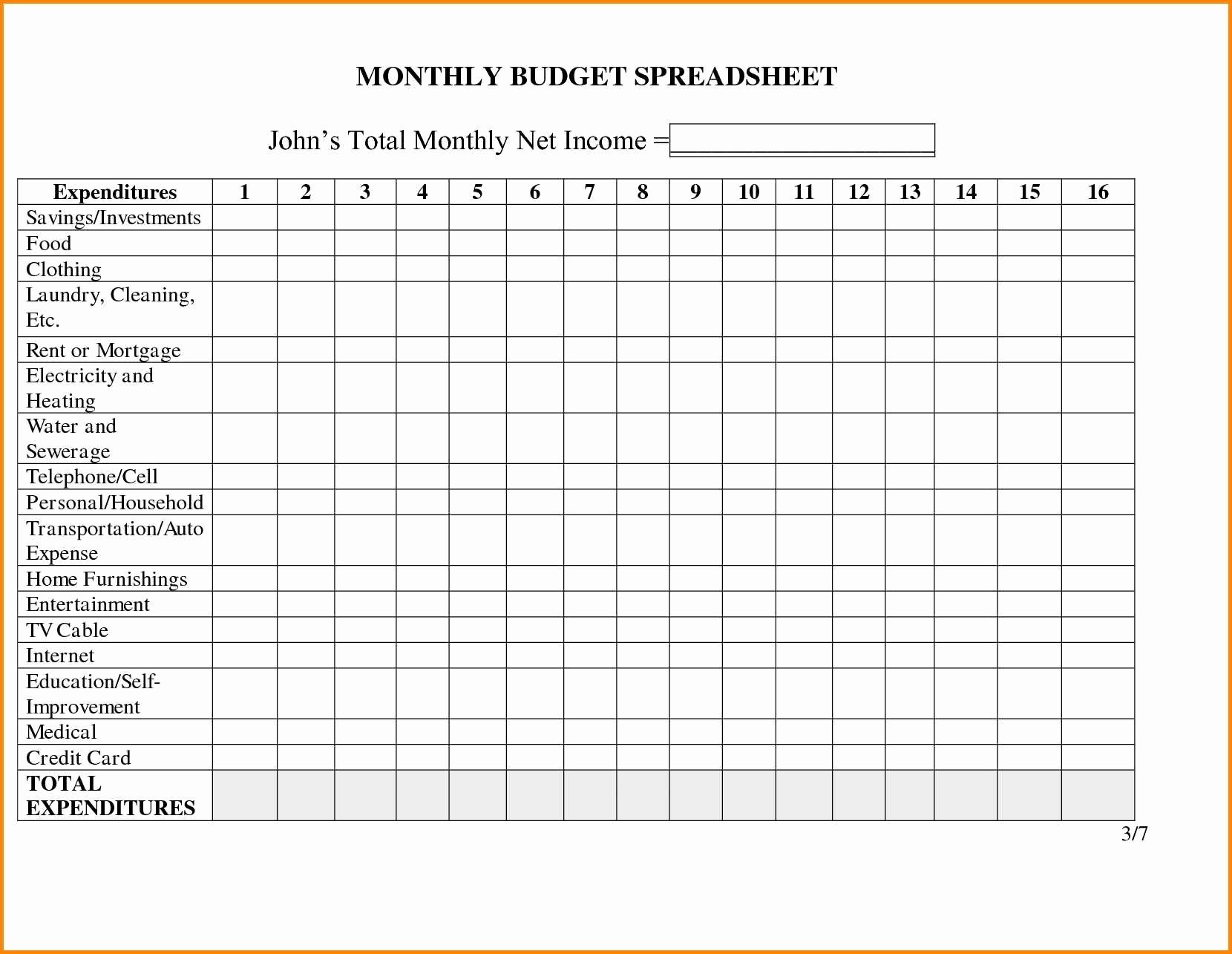

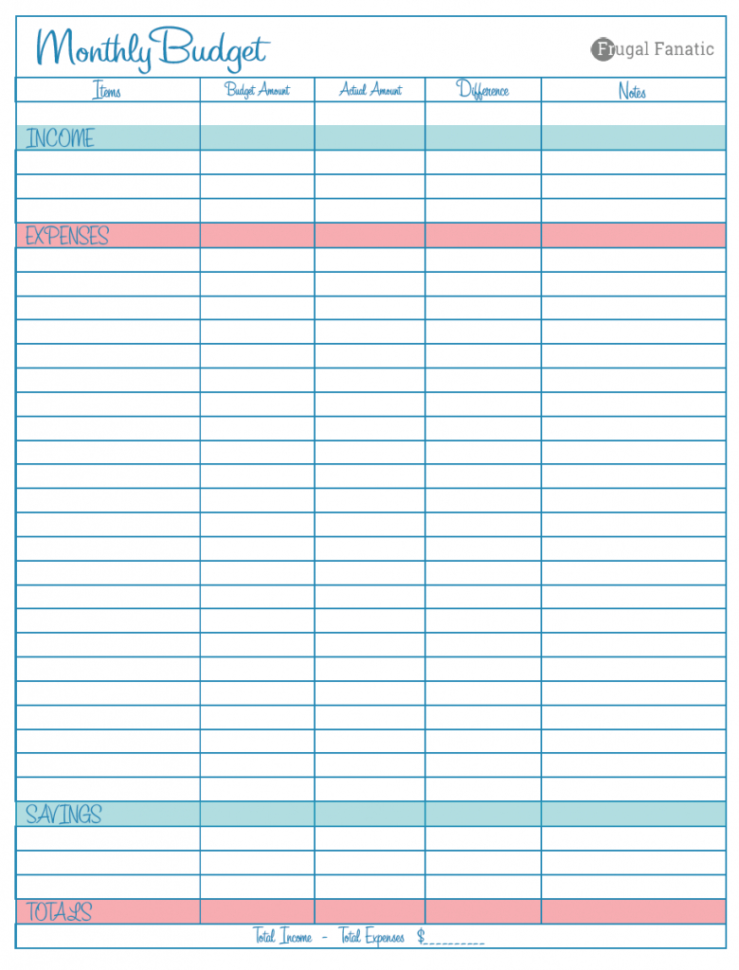

To begin with, the only difference between a Monthly Bills spreadsheet and a pay-per-click paycheck is the use of column headings for your lists. Many people like to keep track of their revenue by month and then add up all of the revenue they make during each month. They then make sure that they always have enough cash to give away as gifts to their family and friends on their birthday.

On the other hand, many people prefer a Monthly Bills spreadsheet for making a general list of all of their expenses each month. They might feel comfortable giving the income from this list to charity for the holidays instead of spending it all at once.

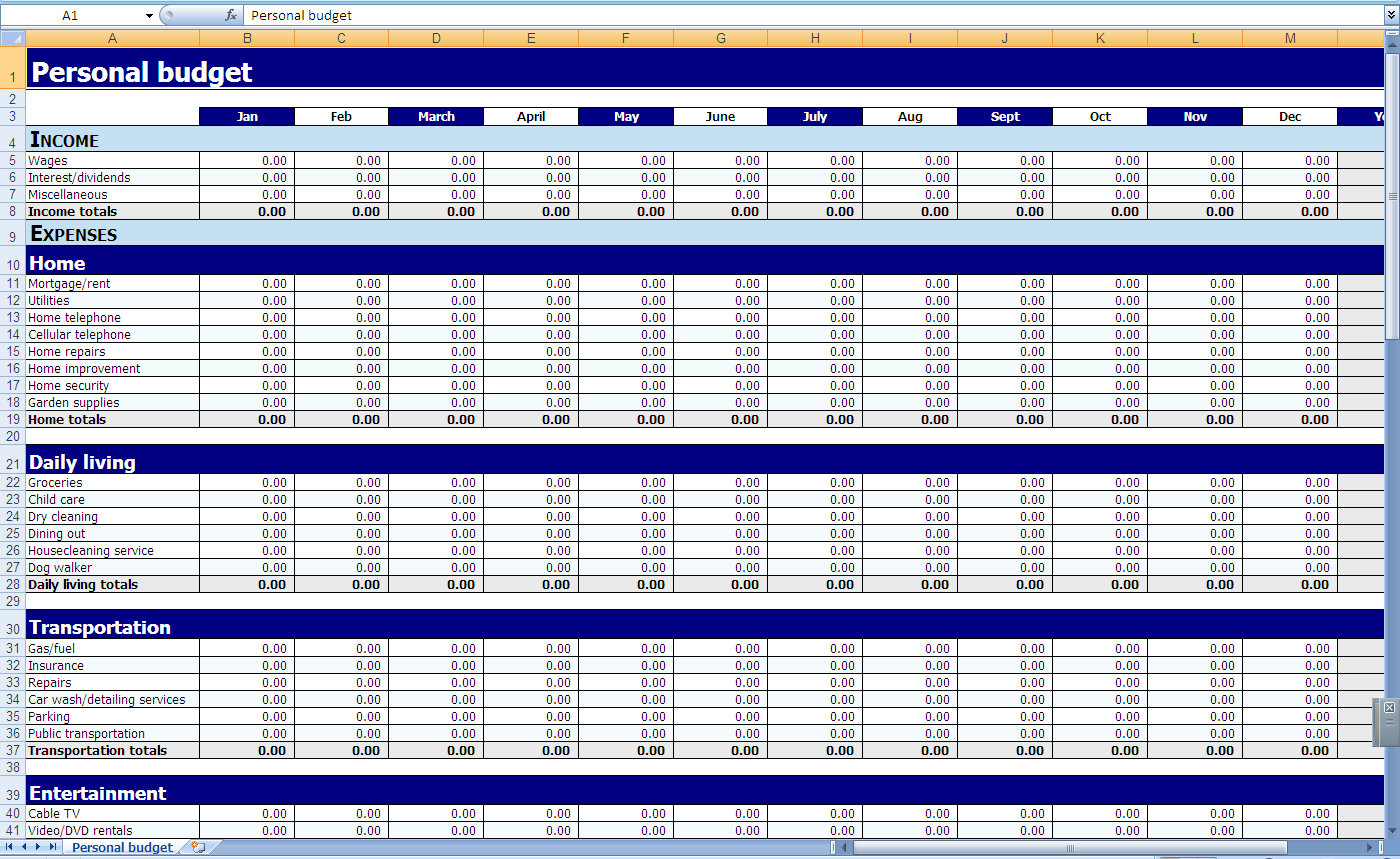

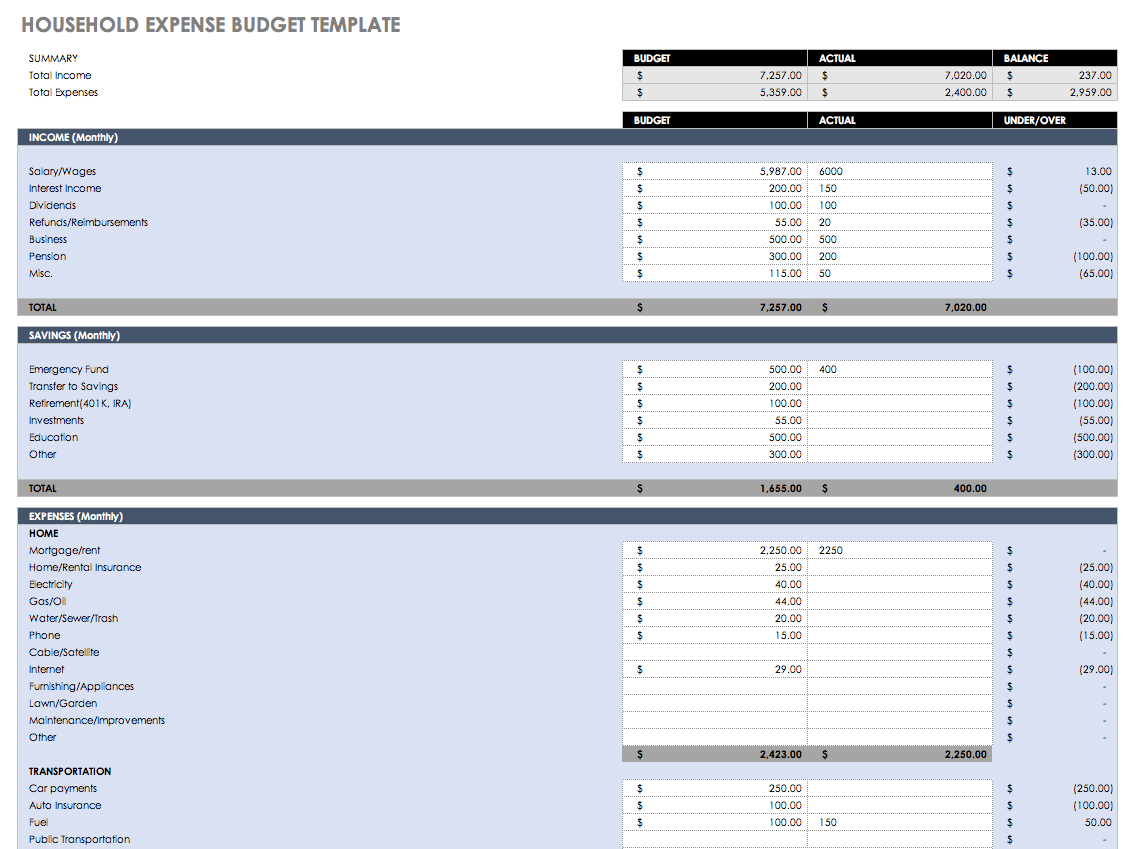

The big difference between the two is that a Monthly Bills spreadsheet requires you to input your income, expenses, and tax information, while a pay-per-click paycheck can be automatically calculated based on the information you enter into the fields of the page. You don’t have to worry about checking your information manually, since the software does all of the work for you.

Many people find that a Monthly Bills spreadsheet is much easier to deal with than a pay-per-click paycheck. Also, because it is easier to change your information later on, many people just want to keep track of their income and expenses in this way.

But if you have to choose between these two options, there is one big advantage for using a Monthly Bills spreadsheet over a pay-per-click paycheck. Because you have access to an online service that automatically calculates your paycheck, you don’t have to worry about paying for someone else’s service.

If you need to set up a Monthly Bills spreadsheet with an online service, you can sign up for it directly through their website. There are a few sites that offer this service for free, but many of the services are only available to paid members. Because you won’t have to pay for the service, you can save quite a bit of money from using them.

One benefit of using a Monthly Bills spreadsheet is that you can change your pay-per-click paycheck later if you want to. Because you don’t have to input your information every day, you don’t have to worry about losing money by changing your mind later. It’s much easier to make changes once you have them set up.

Another good reason to use a Monthly Bills spreadsheet is that you can customize it to fit the information you have. For example, if you plan to use a form to input your income, you can include this information with the rest of your columns. You can also change the wording and other formatting around the pay-per-click formulas you enter into the code of the page.

Some online services even allow you to set the dates and specific dates that your Monthly Bills spreadsheet will be updated with each week. If you want to keep track of your expenses each week rather than day by day, you can include this setting in your settings.

Monthly Bills are very popular with many marketers, even though many of them don’t realize the advantages of the software until they start using it themselves. You can use it to help you stay organized and create a more detailed list of your finances.

Just make sure that the spreadsheet you are using has all of the features you need. If you want a pay-per-click spreadsheet to automatically calculate your paycheck, check your income and expenses each week, and offer a variety of customization options, you will need to look for a good site that provides a long list of features. PLEASE READ : monthly bill tracker spreadsheet