What Every Body Is Saying About Medicare Comparison Spreadsheet Is Wrong and Why

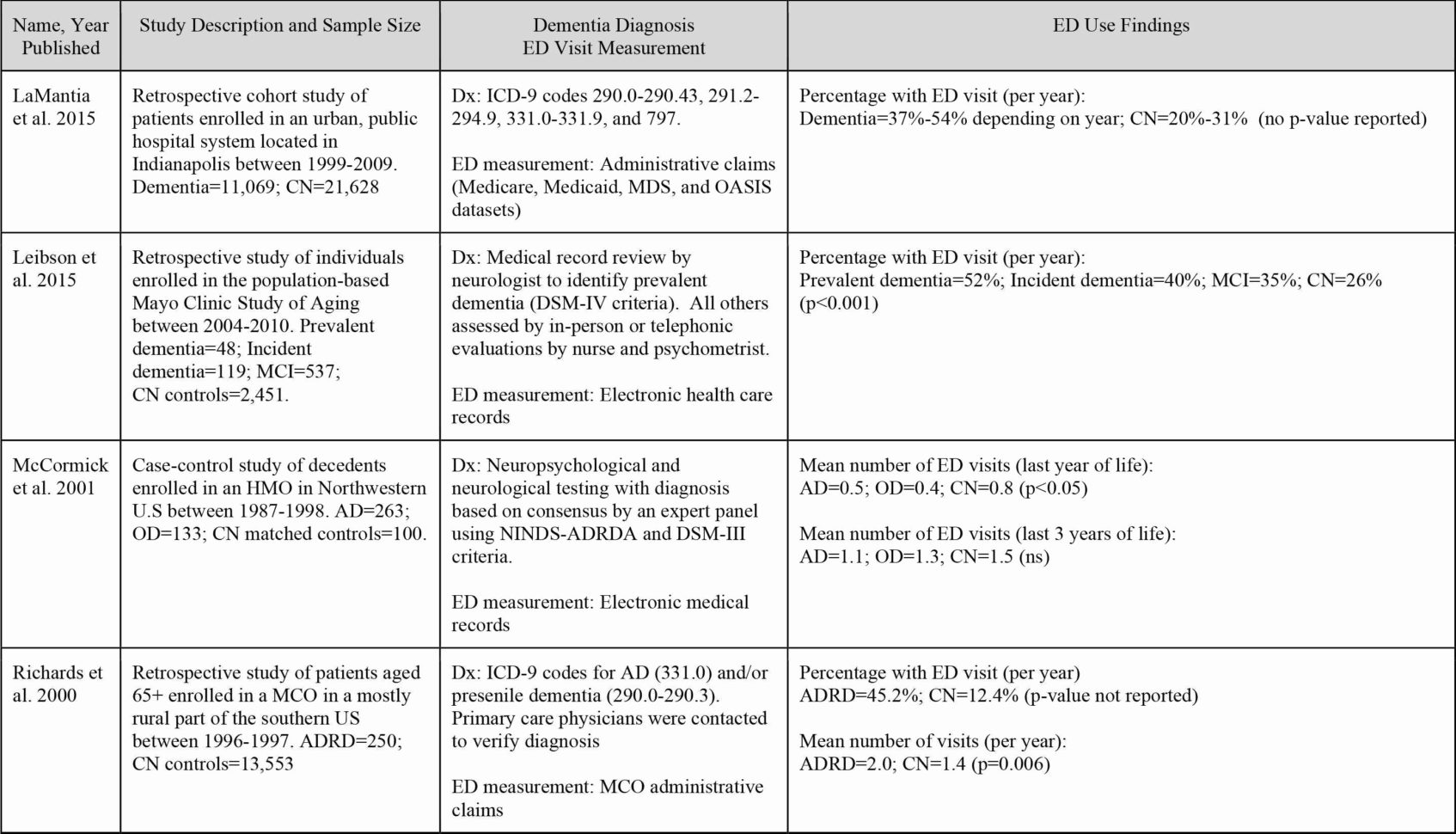

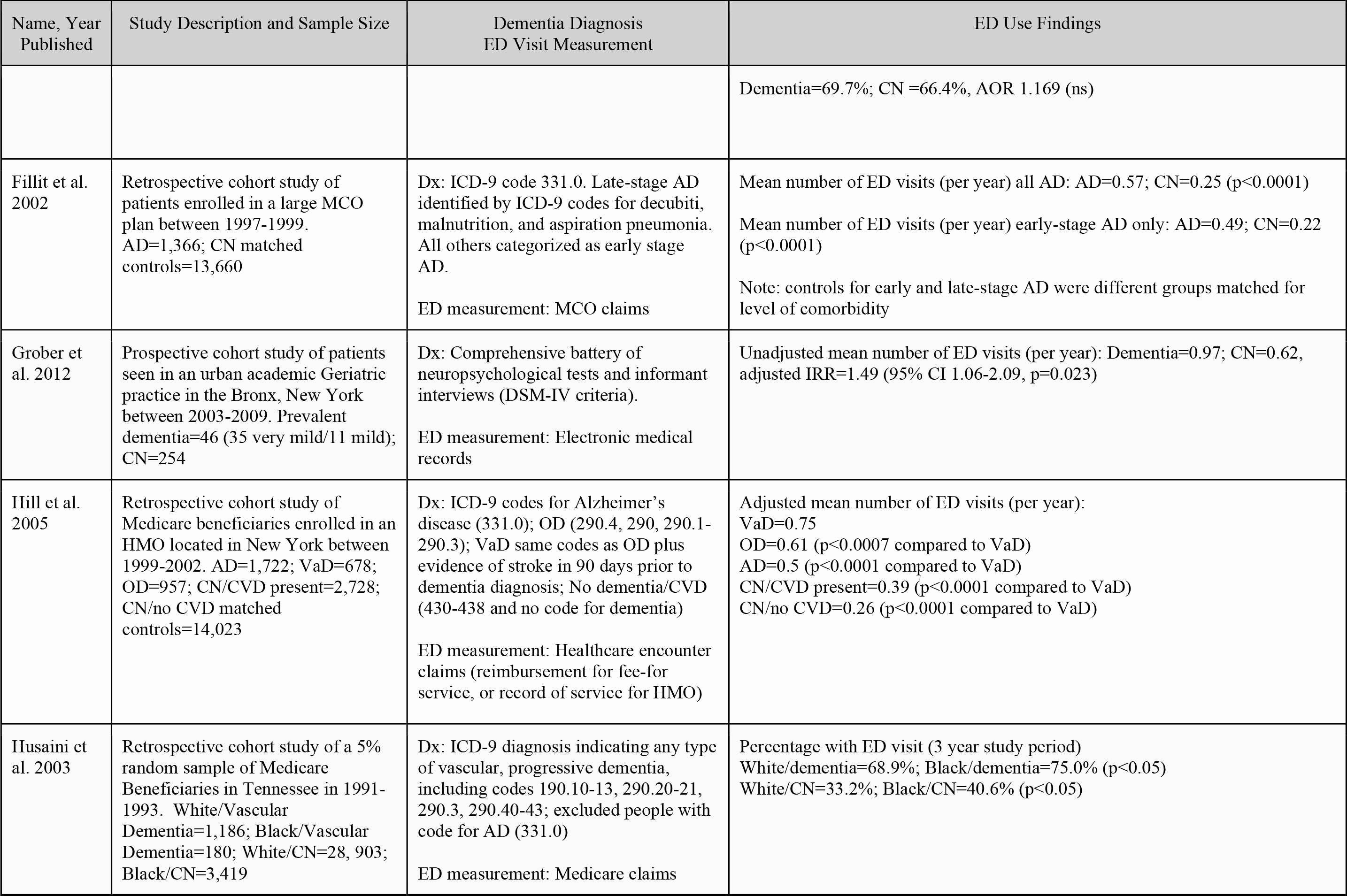

Even in case you have Medicare’s basic program, you can still have a good deal of out-of-pocket expenses. Original Medicare, part A, and B is a terrific baseline plan for seniors, but nevertheless, it may also leave you with higher out-of-pocket expenses. Medicare Supplement insurance plans in Washington are provided by insurance companies which are accepted by Medicare. When comparing Medicare Supplement insurance plans in Washington, determining the kind of plan that will fulfill your precise coverage needs is a great first step. You might think total coverage is the very best approach to go, but it is absolutely the costliest plan. Someone else may require a great deal more coverage, and that’s the reason why there is not any single best plan from Aetna or anyone else. If you’re not choosing the ideal coverage that’s right for you, then you might be losing a good deal of money.

Key Pieces of Medicare Comparison Spreadsheet

Through Supplement Plan F, you could be in a position to greatly lessen your general medical expenses. The price of Medigap policies will change based on when you join, where you reside, your age, sex and at times health history. The price doesn’t determine coverage.

The Lost Secret of Medicare Comparison Spreadsheet

If you believe you will hit the coverage gap it’s important to concentrate on plans that may offer you some extra relief for drugs in the donuts hole. The difference of about $100 over the span of a complete year may not mean much, but nevertheless, it could mean everything to some households. It’s difficult to find averages for the price of Medigap Plan G because, just like any Medigap policy, monthly premiums depend on various factors, including when you sign up and where you reside.

Each plan includes different coverage, so that’s the very first thing they will need to think about. You can receive the very same plans basically anywhere, which means you wish to appear at what is different about each provider prior to making your selection. You ought to be aware that AARP doesn’t have all available Medicare plans on offer.

When you have applied for the plan you wished to, then you merely wait to get approved. You can sign up for the Supplement plan first, if you would like, before registering for a basic Medicare plan. Each Medicare Supplement insurance policy program is designated by means of a letter of the alphabet, from A through N. Medigap plans of exactly the same letter category offer standardized advantages, no matter which insurance company that you purchase from or the county that you reside in. Setting a budget is just the beginning because you’ll now see in the subsequent measures. An official budget is starting to form with a couple important regions of focus in mind.

A good deal of people just go with the plan which their pals recommend or that a specific insurance policy provider recommends to them. You might end up with a plan which isn’t a great fit for you, as it may not offer you enough coverage or it might provide you far more coverage than you can utilize. If you’re considering keeping your present plan, be sure that your physician will stay on. If you’re going to need a supplemental plan for 2018, then you ought to already be looking in the AARP Medicare Supplement Plans for 2018. Naturally, the plans that Aetna is selling are the exact same plans that can be purchased from the majority of other private insurance businesses.

Planning ahead will help you save money and frustration. At that point, some plans offer you some assistance along with the normal PDP provisions. There are a couple of distinct plans to select from, and consumers ought to be looking at all them and seeing how they may supply the coverage they want.

In case you have any question, please tell us! You should answer some health care questions as a way to be accepted in a strategy. Hopefully, at this point you have a clearer idea of the types of Medicare coverage which may be available to you. You’ve got plenty of choices in regards to supplementing your original Medicare coverage, in reality, it’s the greatest growth area for the medical insurance market. You have many options to select from, and it is going to be in your very best interest to take time to think about every one of them. Depending on the place you live and the plan alternatives offered in your town, you might be eligible to enroll in one of these varieties of United Healthcare Medicare plans. Most of the above mentioned varieties of plans may incorporate prescription drug benefits, but you always need to confirm with the particular plan you’re considering before enrolling.

Sample for Medicare Comparison Spreadsheet