What You Don’t Know About Lyft Spreadsheet

The Tried and True Method for Lyft Spreadsheet in Step by Step Detail

The spreadsheet has a great deal of worksheets. Excel spreadsheets and Access tables permit you to customize the way your data is recorded. It wasn’t the first spreadsheet software. Microsoft Excel is composed of worksheets.

You can name your spreadsheet whatever you desire. Spreadsheets might also be stored as HTML. They may also be printed and distributed as a way to supply documentation or records. The very first portion of the spreadsheet tracks the card details. The completely free spreadsheet is easy to get for downloading here. Creating your very first basic spreadsheet isn’t a complicated task by any means.

The Ultimate Lyft Spreadsheet Trick

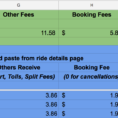

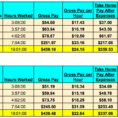

Formulas Do not be reluctant to benefit from the formula options in Excel. After completing your very first worksheet, you can discover how to use different formulas, like Average, Mode and Mean. The SUM formula adds the overall costs to the overall delivery.

Wave Accounting can provide help. It offers free, cloud-based accounting software specifically designed for small businesses. If your company is profitable, you’re able to either take 100 percent of the deduction up front utilizing section 179, or depreciate over the plan of a couple decades, based on the assets. You may also add services like payroll and email marketing to the program, although it costs extra.

How to Choose Lyft Spreadsheet

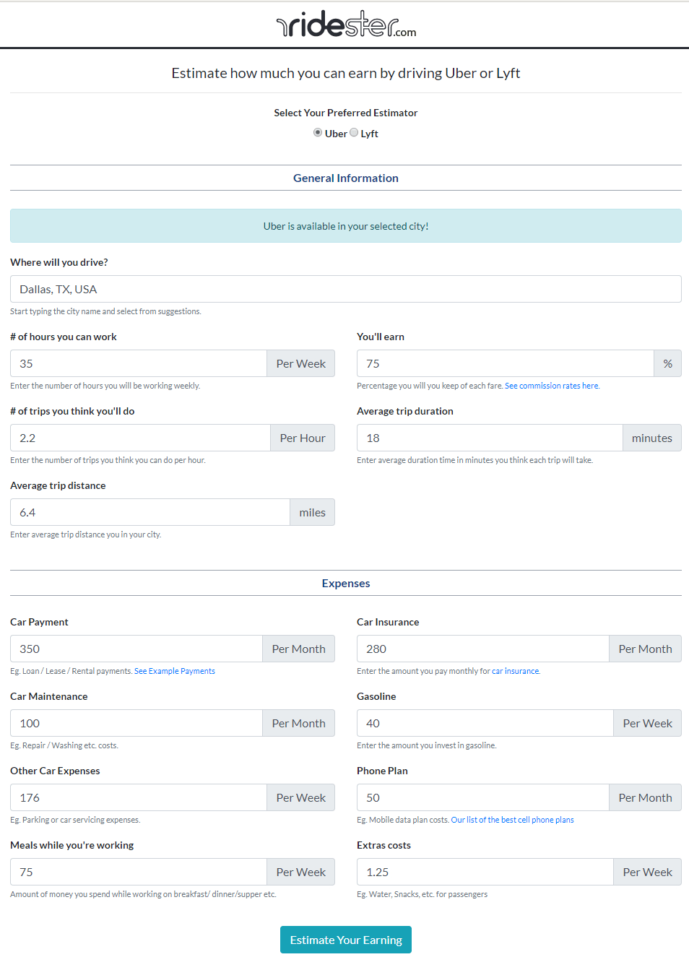

A business budget makes it possible to choose whether you may grow your company, give yourself a raise, purchase additional inventory and assets, and whether you may have the ability to prevent bankruptcy. Possessing a business budget is important for practically any size enterprise. Understanding your own private budget is the very first step on the yellow brick road of wealth.

The procedure for identifying what and how to file deductions is a complex job, and in every circumstance, it is totally dependent upon your facts and circumstances. Your main tax deductions will be costs linked to your vehicle. There are a lot more 1099 deductions you may count so be certain to double-check with a tax advisor to best understand the complete extent of what you’re able to write off based on your specific work. After 2026 there’s no more bonus depreciation. You want to have a deduction for it. Then you receive a deduction for your taxes and fees that you cover your car. You may also claim a deduction on the mileage of your vehicle.

The expense must be made to maintain or improve skills required by your present employment. For instance, you need to use actual expenses if your company uses five or more cars at precisely the same moment. You are able to take that as a business expense, if you would like to be aggressive. To figure the profit for your organization, you are going to subtract your company expenses from your earnings. Additional small business expenses you are able to deduct Every dollar spent on your company can lessen your tax bill, so be certain to keep tabs on everything.

On each form, you record all of your earnings and tax deductions. Navigating 1099 taxes is no simple task! If you’re self-employed you should pay self-employment tax, and you might have to pay taxes quarterly. You would typically study your Net Income to find out whether you are going to be able to enlarge your business enterprise, make large asset purchases, etc..