Uncommon Article Gives You the Facts on Llc Capital Account Spreadsheet That Only a Few People Know Exist

There are a number of ways to establish and maintain bookkeeping. As a consequence, LLC accounting can be much more complex than the following might suggest. Recent assets are assets which are used within one year. There are other kinds of current assets, but those are the most frequently experienced. Fixed assets are assets that is going to be around for longer than 1 year. Usually, at each meeting, you wish to examine your financials and performance. It’s important to managing the finances of the company, and it prevents accidental commingling of your personal and company assets.

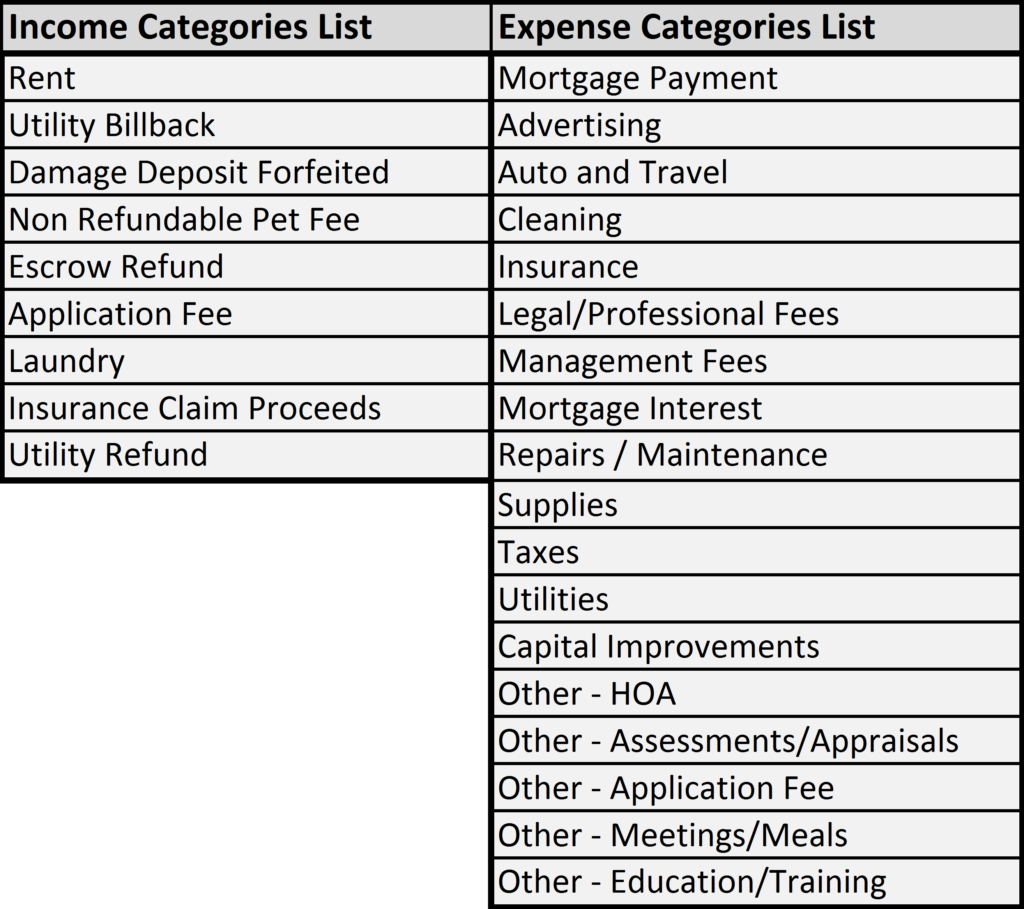

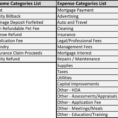

Suddenly, you receive an idea. One of the fantastic things about LLCs is that the members can agree to produce allocations and distributions in any way that they desire to fulfill their business requirements. Fortunately, there are usually leasing options offered for the expensive items and several landlords will work together with you on leasehold improvements. It’s possible to find application forms anytime they’re submitted. The template is setup to help you in determining these critical costs. To assist you, the company cost template comes pre-populated with many of the most typical expense categories.

Spreadsheets are somewhat more versatile than word processors connected to their ability to manipulate huge amounts of columns and rows of information. This spreadsheet can help you to prepare a projected cash flow for your company, in a format acceptable for inclusion in your Business Plan. It will help you to analyse the overheads your business is likely to incur, in a format suitable for inclusion in your Business Plan. It will help you to record and analyse payments made by your business. It will help you to record and analyse petty cash expenses for your business. It will help you to record and analyse receipts made by your business. It’s important to have a well-formatted spreadsheet for the reason it helps decrease the possibility of errors, inconsistencies and misinterpretations.

If you’re the only member, you can take out what you want, but you have to leave enough money in the company for its typical operations. Whatever you select, make certain you feed your members! Try to remember, when you have too few members, as a way to acquire enough capital you’re all going to get to contribute more income. In case you have too many members, it might be very challenging to deal with and have an effective meeting. When you’ve found some possible members, you have to setup an organizational structure for your investment club. The very first thing you ought to do is find and organize prospective members.

Whether you’re establishing a limited liability company or some other small business entity, a good bookkeeping process is critical. As you get your company going, you might want to think about utilizing a more comprehensive small business budget and other financial statements. A whole lot of business owners like LLCs because these sorts of businesses provide limited liability for those owners. Calculating business start up costs ought to be part of starting any enterprise. Whether you anticipate starting a small company or a bigger franchise, you could possibly be surprised by the whole start up cost. Internet Business Startup Costs A web based company might be among the least expensive businesses to begin, particularly if you can do the internet development work yourself.

The Unexpected Truth About Llc Capital Account Spreadsheet

Because you don’t have a huge advertising budget, you choose to just go ask a couple of your neighbors should they want your services. These costs are one-time costs related to getting your business ready to go. As you add your own expenses or expense categories, the template can help you understand whether you’ve got adequate funding.

The capital account is a means to measure what individuals receive if the organization is sold. It can keep track of each member’s investment in the company. Capital accounts aren’t the exact same as bank accounts.

Because company creditors have to be paid before final distributions are created, members must realize that they may receive less than that which they originally contributed to the company in the event the business dissolves. Even better, if you meet the requirements for the home office deduction, now you are able to write a number of these items off as business expenses. A lot of other deductions from wages also need to be calculated. Another form of liability is every time a provider receives payment for a good or service they haven’t delivered yet. An Operating Agreement may provide for additional essential capital contributions in the event the business demands additional funds. It may provide that members must contribute additional capital in accordance with a budget that may be established in the future. In that instance, you require a partnership agreement and operating agreements.

Sample for Llc Capital Account Spreadsheet