How to Get a Tenant For Free Using a Landlord Spreadsheet

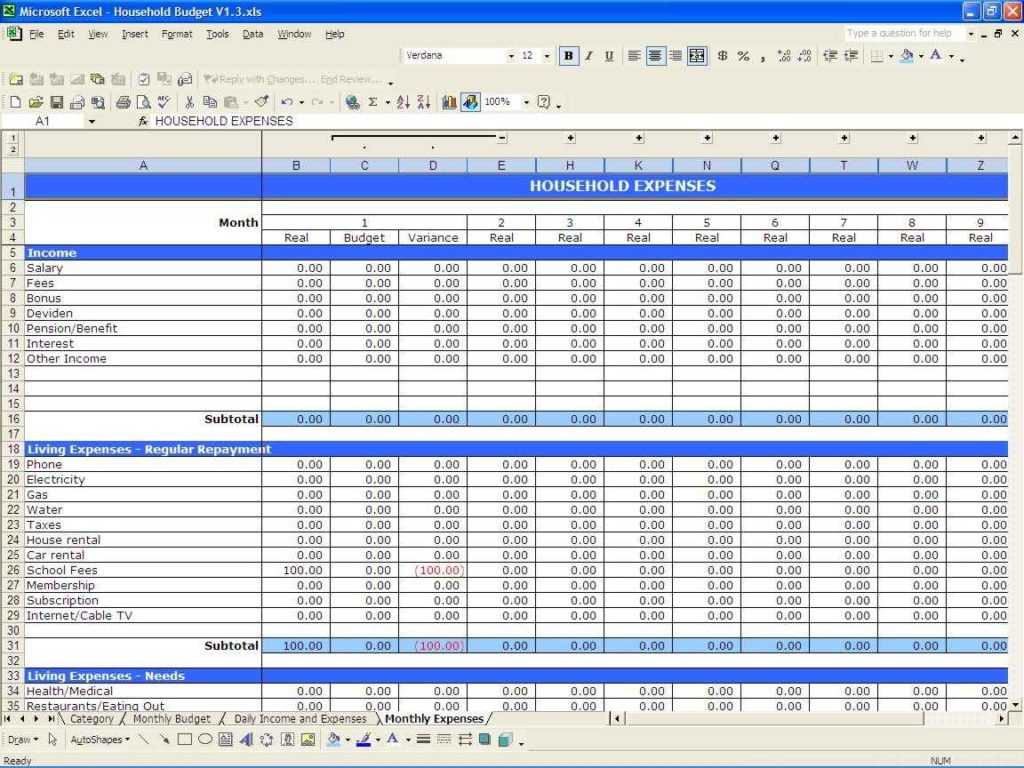

In today’s uncertain economy, with foreclosures and owner-occupancy having become a major issue in the real estate market, many landlords who have lived in their home for decades are taking the time to make a spreadsheet of all their assets, to ensure that they have enough money to pay their mortgage. After all, one’s real estate investment means something more than just paying the mortgage.

However, there is more to owning a home than paying the mortgage. While a landlord can buy the property and resell it for as much as he can to make money, he may not need to pay off his mortgage for years after he has sold the property. The landlord could choose to rent out the property for a profit.

There are financial risks involved in both scenarios. For one, the tenant pays a higher rent, which means more money in the landlord’s pocket each month. It also means the landlord is responsible for insurance, which means even more costs for the landlord and landlords are doing everything they can to avoid this by investing in their own security.

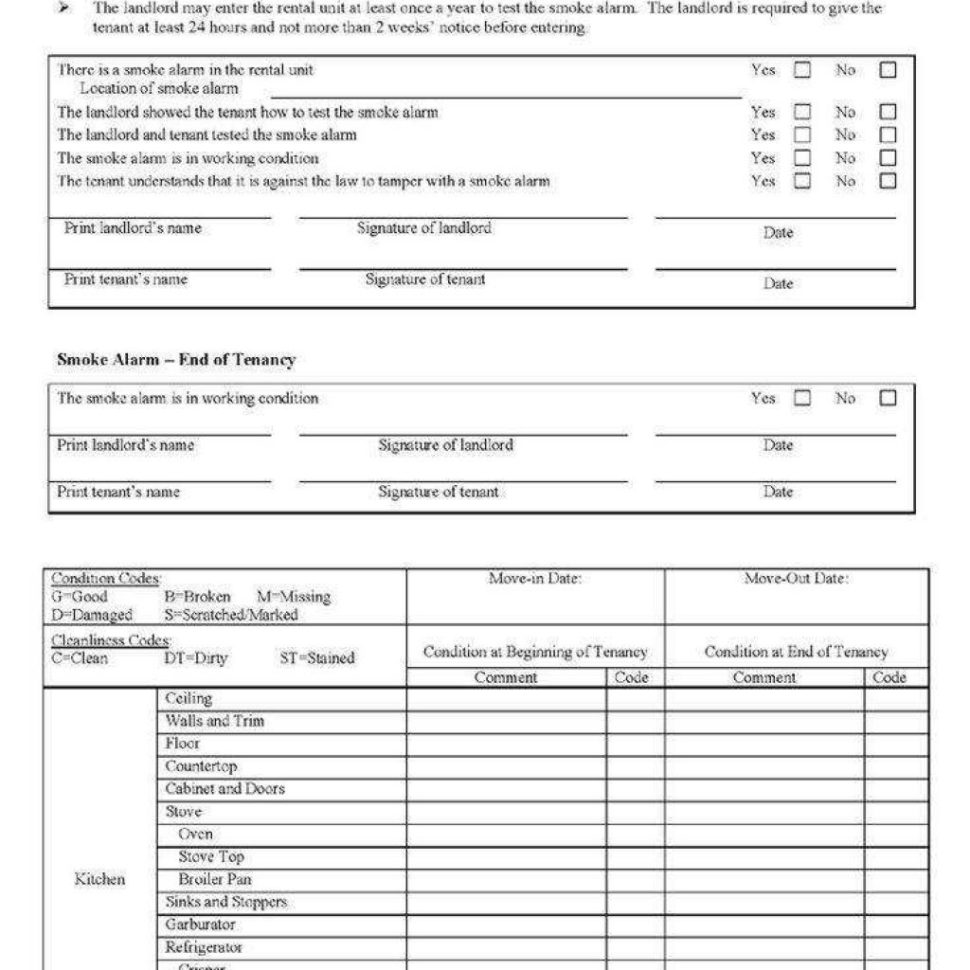

Nowadays, if landlords are going to rent out the property, they must be able to find a tenant willing to pay the rent on a long-term basis. If they cannot, they could lose their home. So, the big question is, what types of people can they lease the property to?

The landlords want to sell as much of their property as possible, but they don’t want to spend too much on advertising the property so they decide to find tenants that are willing to pay a portion of the cost of the lease upfront, so they do not have to pay for the entire amount up front. This can be a good thing for them, if they have secured a tenant that will pay the rest of the rent over time.

However, as a landlord, how can you advertise the property without spending too much? If you use an online marketing company, you can place ads on Craigslist, or you can create a blog, where your tenants can leave reviews of their experience.

Either way, if you are renting a property and find that you are paying more than you would have on a month-to-month basis, you can easily deduct the amount from your income taxes. All you have to do is complete the IRS form 709, landlord-tenant business expense form. Once you file, it is made readily available for the IRS.

As a renter, you are probably aware that tenants often change their plans and cancel their leases. You might wonder what type of tenant you should be looking for, and even if you have to be on the lookout for a renter that will pay for the first few months before they start paying for the rest of the lease.

This type of tenant is likely to be a longer-term tenant, meaning they will be in the property for at least three years. This means they will be able to make the same monthly payments over the life of the lease, and you won’t be spending extra on advertising the property each month.

Keep in mind that while using online marketing and blogging are great ways to advertise your property, you also have to have a real estate agent that you can talk to to see if they can help you get a tenant or sell the property. This can help you in the long run, and you can add more income to your household.

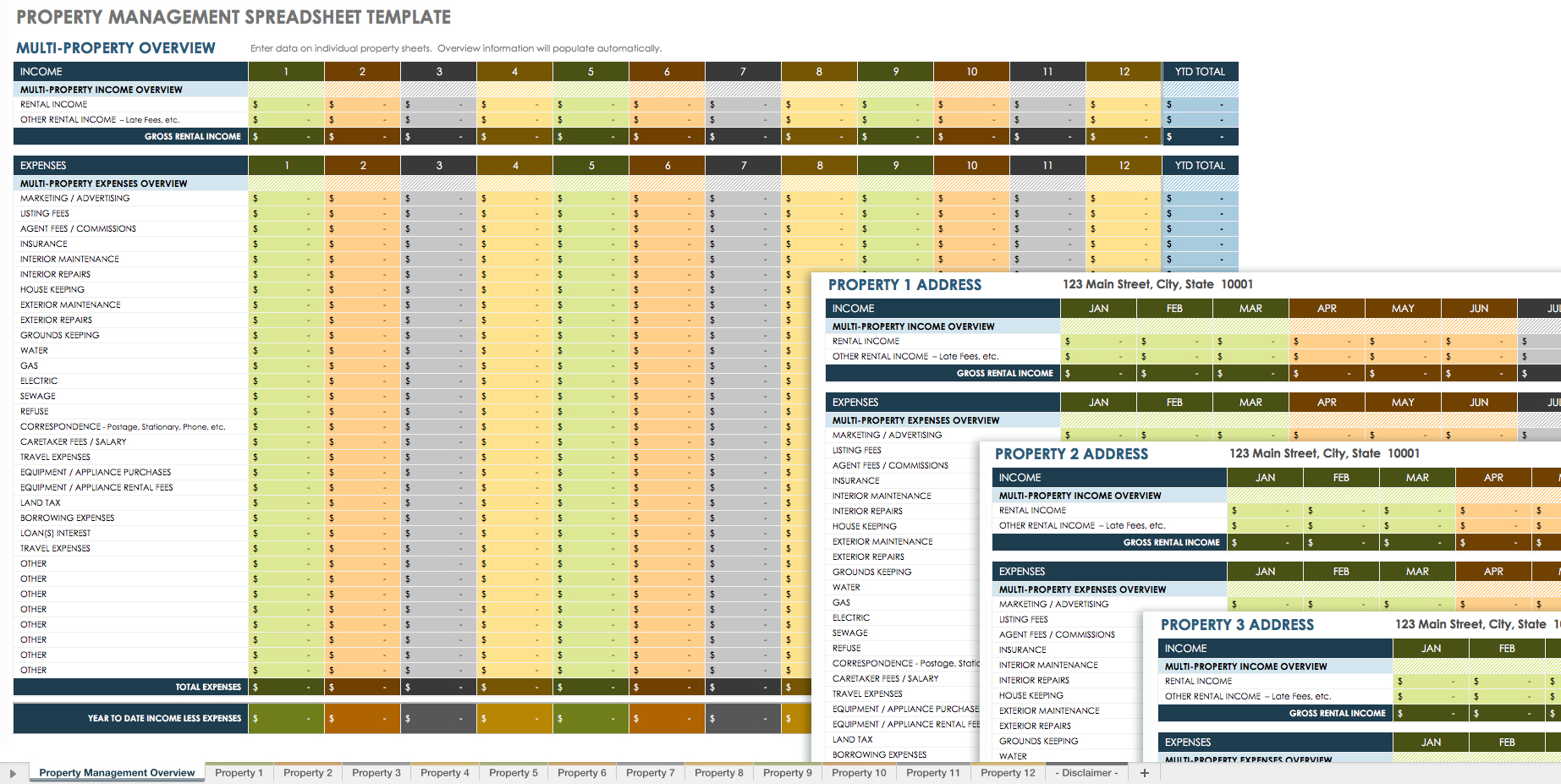

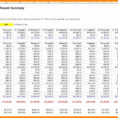

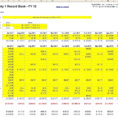

Of course, you can also use a real estate agent. That way, you can decide if you want to hire an agent or not, and how much to charge for their services. YOU MUST LOOK : landlord accounting spreadsheet