Itemized Deduction Limitation Worksheet is really a sheet of paper containing jobs or issues which can be designed to be performed by students. The Ministry of National Education describes that Worksheets are generally in the form of directions, measures for finishing a task. An activity that’s purchased in the experience page should be obvious the essential competencies that will be achieved. Worksheets can also be students information that’s used to hold out research and issue resolving activities.

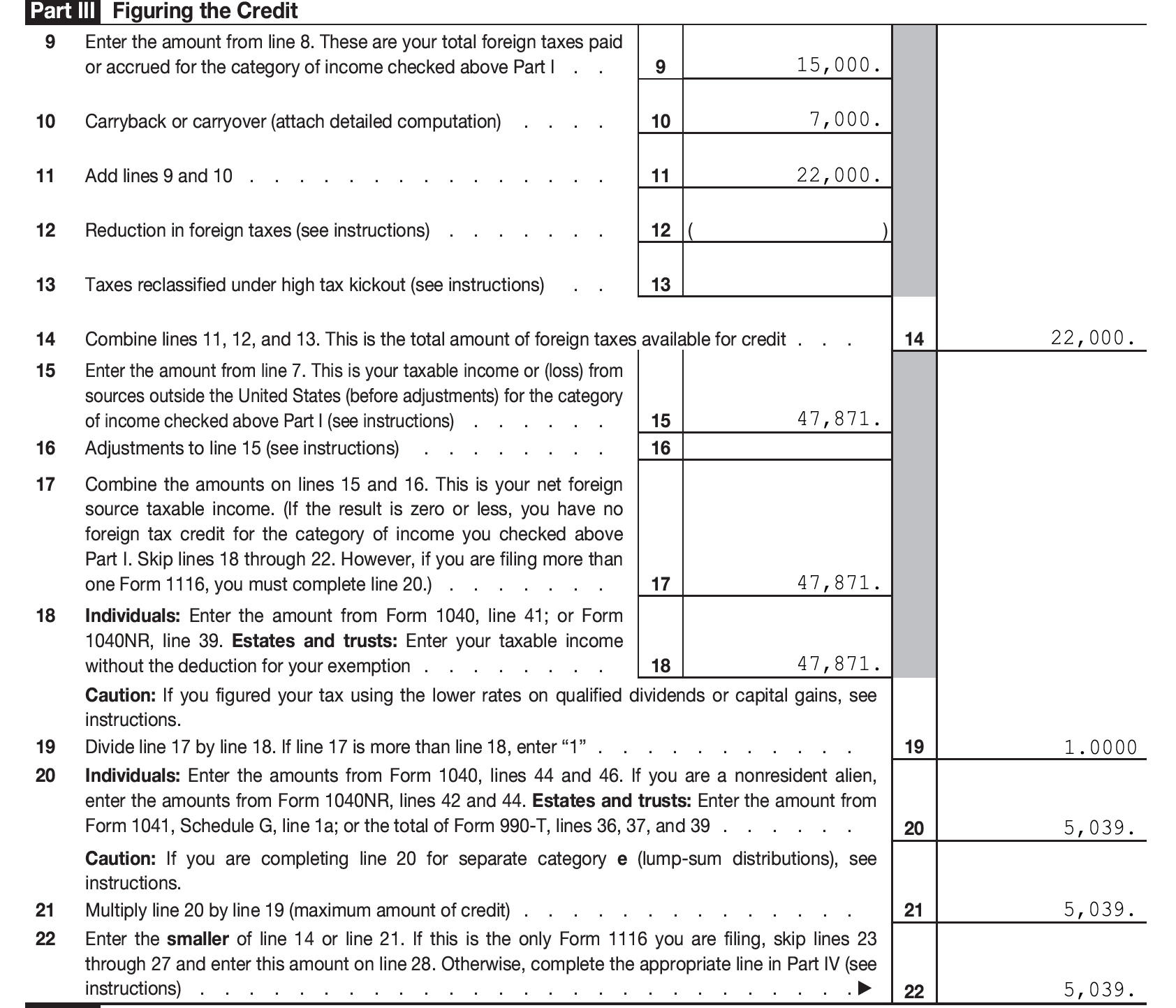

Creating Educational Worksheets must reference the fundamental competencies being taught or at the least relating with the substance that has been taught. Worksheets can be interpreted as function courses for pupils in facilitating learning. The fundamental purpose of applying Itemized Deduction Limitation Worksheet is to offer a concrete experience for students. Helping with studying variations. Generating interest in learning. Increasing retention of teaching and learning. Utilize time efficiently and efficiently. You can look closely at the example Foreign Tax Credit Form 1116 Explained Greenback with this page.

Foreign Tax Credit Form 1116 Explained Greenback Uploaded by Adam A. Kline on Friday, September 6th, 2019 in category Worksheet.

See also Income Tax Deductions Income Tax Deductions Worksheet from Worksheet Topic.

Here we have another image 737 Worksheet Form California Registered Domestic Partners featured under Foreign Tax Credit Form 1116 Explained Greenback. We hope you enjoyed it and if you want to download the pictures in high quality, simply right click the image and choose "Save As". Thanks for reading Foreign Tax Credit Form 1116 Explained Greenback.