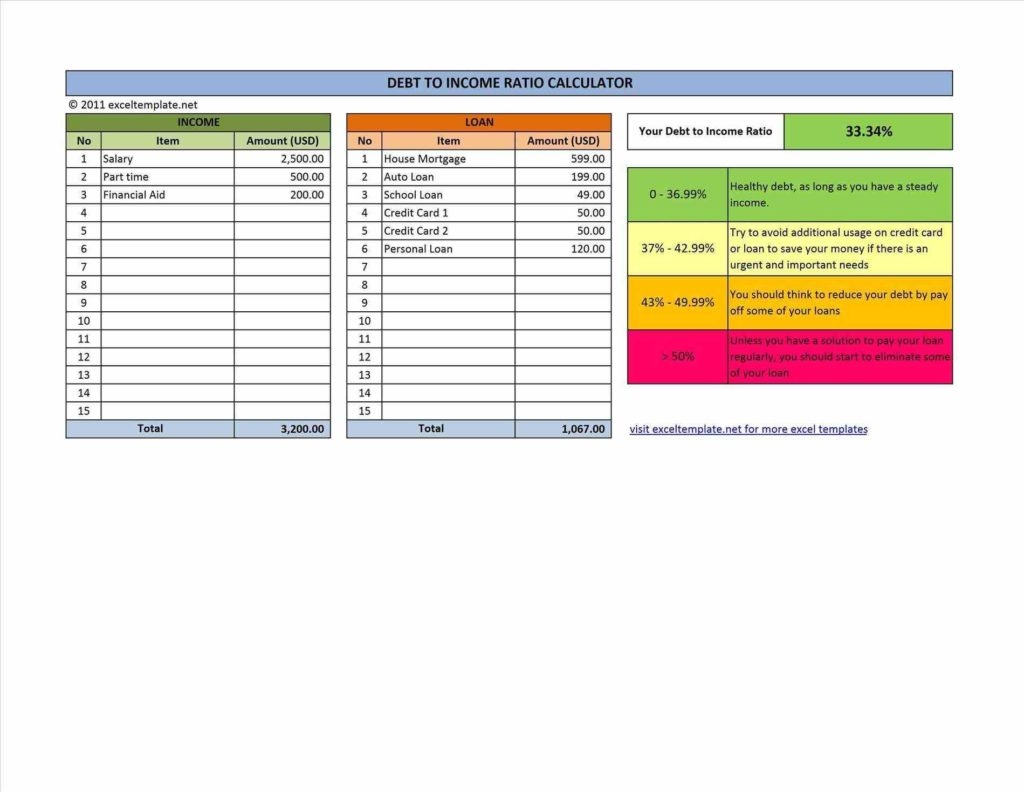

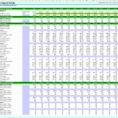

There are several reasons why a financial planner might recommend an investment calculator spreadsheet. They allow you to quickly assess your investments and see if you are paying too much or too little in fees. You can also easily enter your own financial information, so you can create a customized investment plan for your individual circumstances.

It is easy to become overwhelmed with all the different fees, interest rates, investments, and income statements you need to manage on your own. With a spreadsheet, you can quickly enter all of your financial information and see where you stand. Your advisor will be able to suggest an appropriate investment based on your current circumstances. Also, you will be able to quickly get a quote for a regular installment payment.

Many people think that they should use the same income each month to invest in a variety of investments. The problem is that there are usually several types of investments, such as fixed-income securities (investments that require you to pay a guaranteed rate of return), money market instruments (those that are backed by the US Treasury or government-backed companies), etc. Thus, it is very difficult to focus on only one type of investment.

Financial Planner – Why a Financial Planner May Recommends an Investment Calculator Spreadsheet

Other types of investments include stocks, mutual funds, etc., that do not generate a financial statement for the investor. In addition, many investors do not know the rate of return, which affects the overall investment return. This spreadsheet will help you assess how much you are actually investing in a particular company.

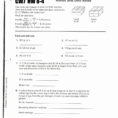

It is easy to come up with a list of investments that you may want to invest in, but a financial planner will use an investment calculator spreadsheet to assess your options. If you are new to investments, a good investment calculator spreadsheet will help you determine what the best method of investing is for you. You will be able to budget your money in a way that fits your current financial situation.

There are different financial calculators that you can use to create a template that you can customize. Some investors may prefer to use a standard spread sheet to input their information. This is a quick and easy method, but you may not be able to fine tune the specific details.

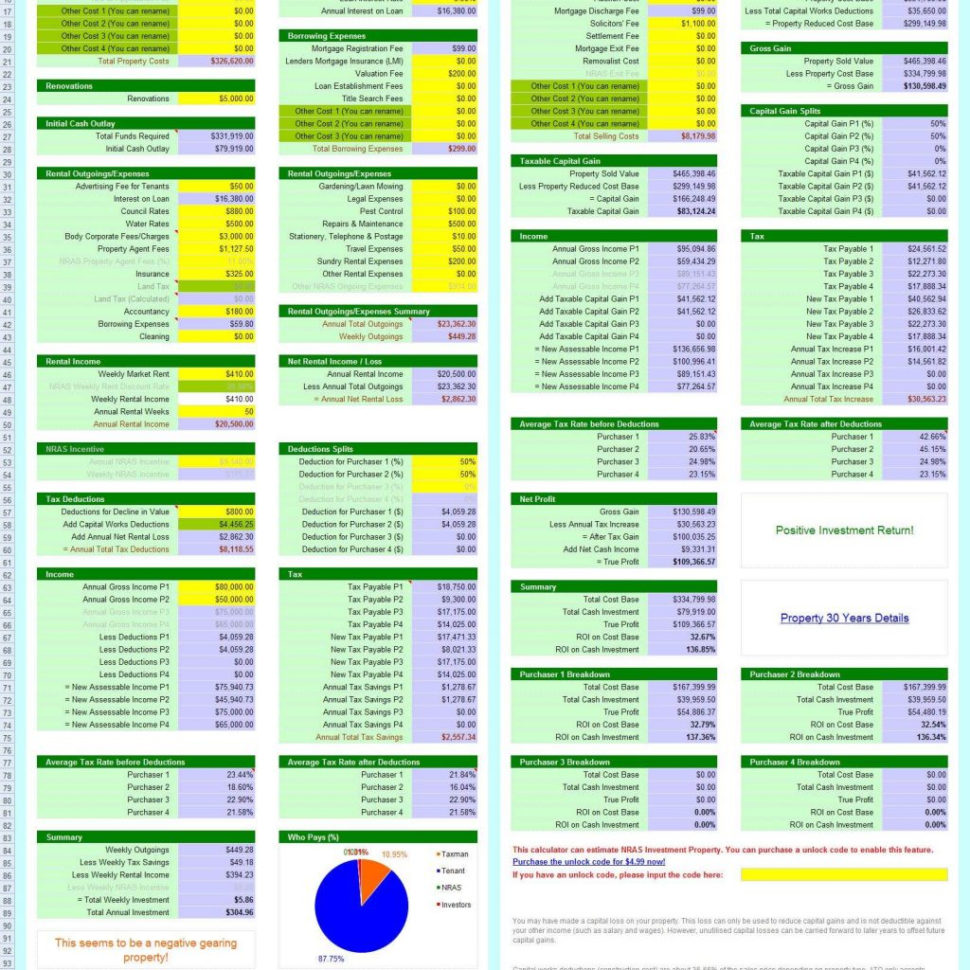

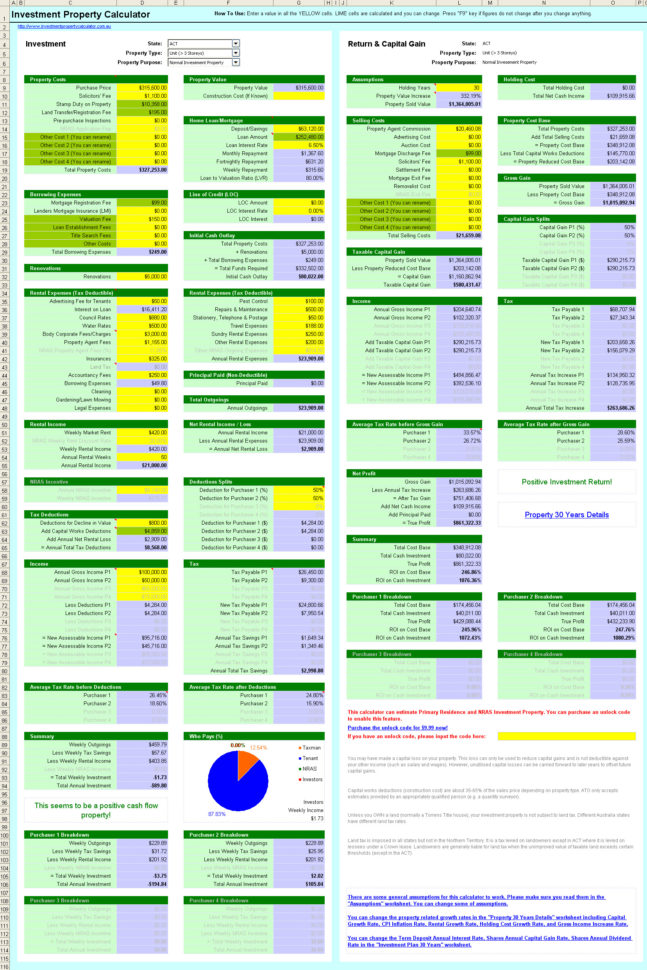

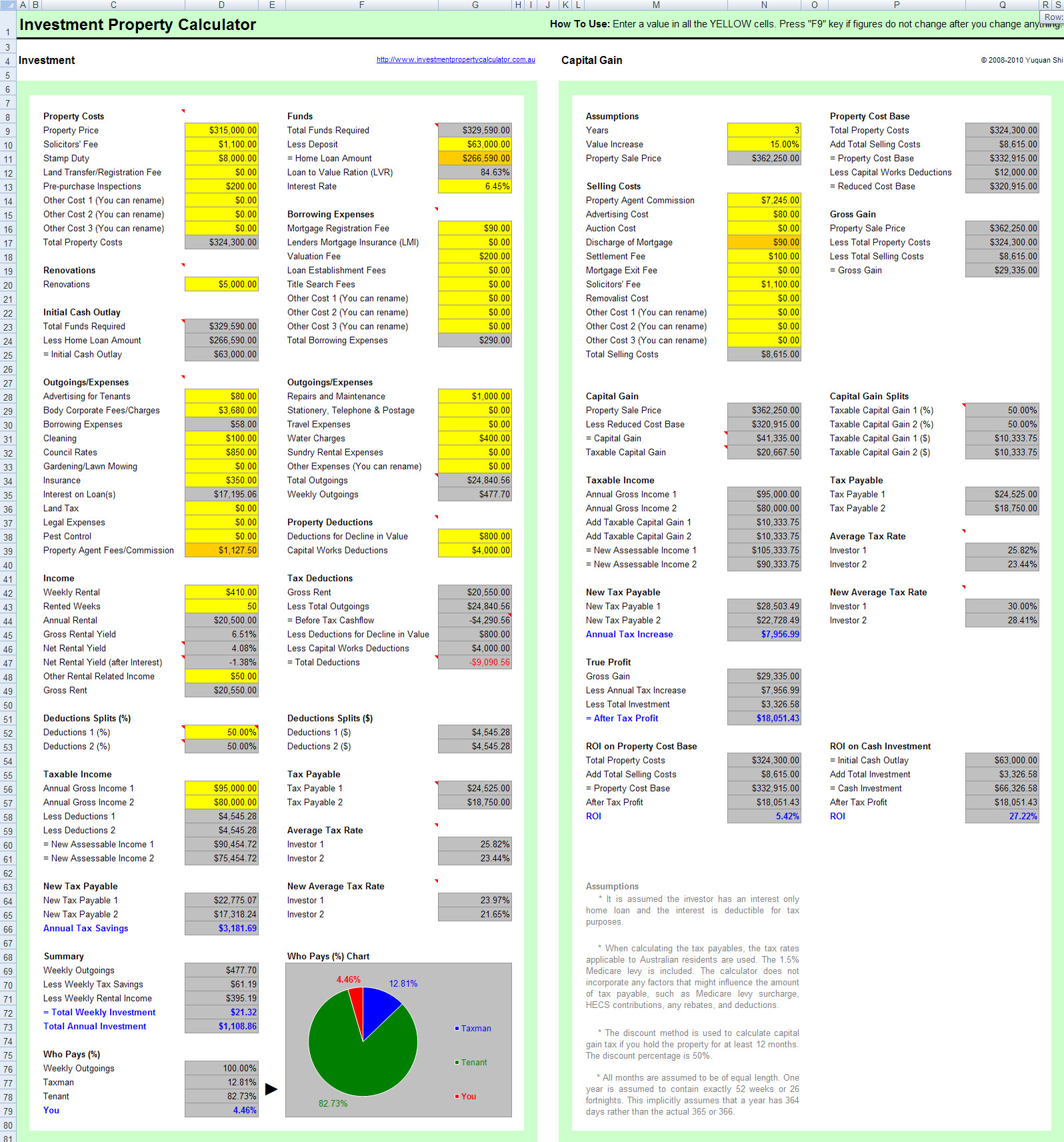

A more customized method is to use a formula that generates a specific investment for you based on your individual situation. A customized investment calculator spreadsheet can help you identify the proper way to invest, as well as create a check list to ensure that you are following the proper procedure. Using a spreadsheet will allow you to ensure that you are putting in the right amount of money, using the right interests, and receiving the right profits.

You can also generate your own investment spreadsheet that will include data from your own financial information. This is important if you are not comfortable creating the spreadsheet yourself. In this case, you can get the benefits of using a professionally prepared spreadsheet.

It is possible to use an investment calculator spreadsheet to see what kind of investments are right for you. With a financial planner or financial advisor, you can review your financial information and choose the best investment for your situation. This is a helpful tool that allows you to not only assess your own investment, but also guide you in making decisions about how to invest your money.

The investment calculator spreadsheet is useful because it allows you to effectively and quickly assess your investment situation and tell you if you are investing appropriately. Before you invest, make sure you understand the investment environment. Make sure you use a spreadsheet that is simple enough for you to understand.

Before you invest, make sure you understand the investment environment. Make sure you use a spreadsheet that is simple enough for you to understand. Since you are using the investment calculator spreadsheet, make sure you have a way to re-calculate your investing situationif the situation changes. Keep in mind that any investment needs to be reviewed periodically, to see if you are still getting the right amount of results and profits.

So, before you invest, find a financial planner who will assist you in creating a spreadsheet that you can customize for your individual situation. so you can make investments that are right for you. YOU MUST SEE : investment projection spreadsheet

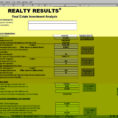

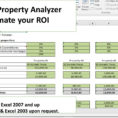

Sample for Investment Property Calculator Spreadsheet