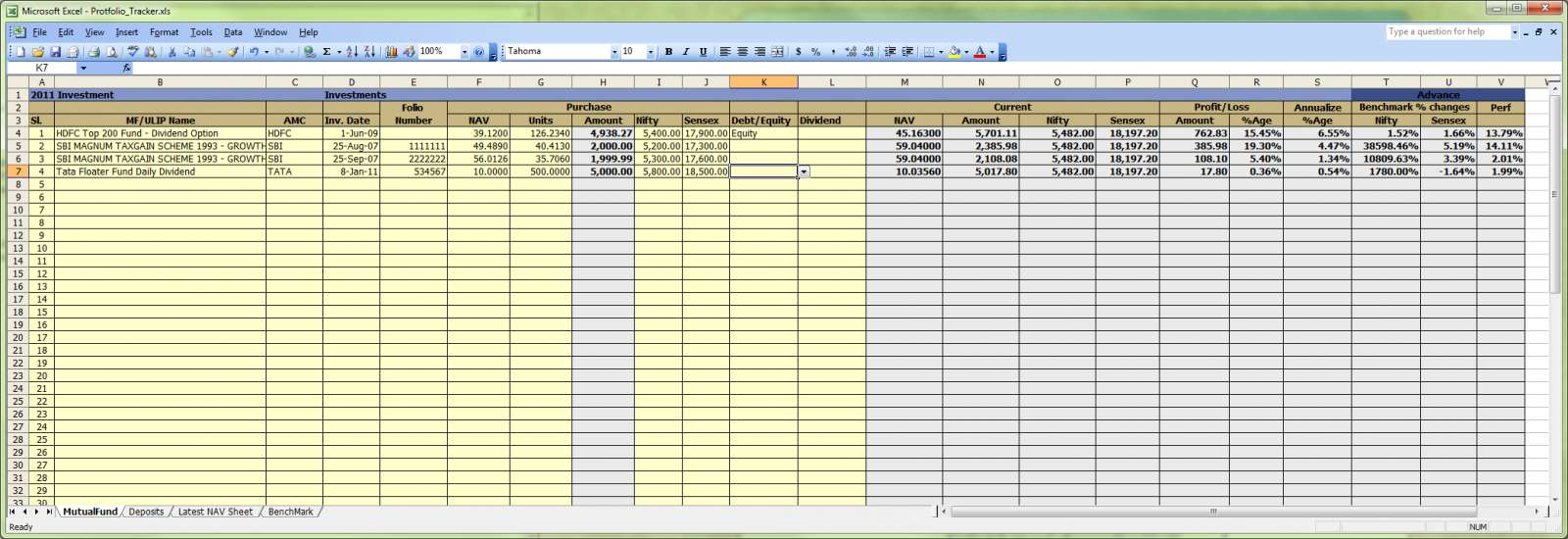

In a world where everyone is getting a little older, and has trouble with their memory, there is an income spreadsheet available that can help them keep track of their investments, their salary, and the items they purchased for themselves or others. With this new technology, these individuals no longer have to go through the trouble of filling out dozens of forms, hoping that the information they have will be stored properly.

Income accounts have been around for a long time. In fact, they were developed way back in World War II, and they have been improved upon in recent years. The changes to the Income Spreadsheet are so many that they are becoming an important aspect of financial planning and investing.

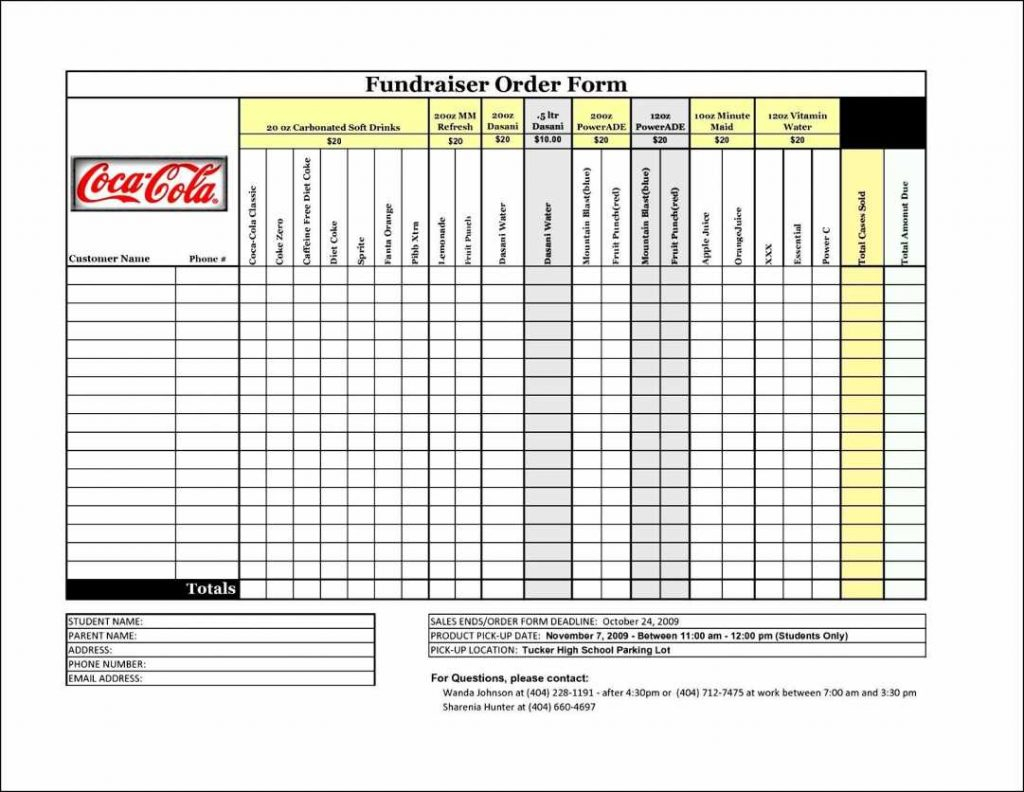

For starters, an individual can fill out the Income Account. This includes information such as how much is being paid to each employee, how much of a salary that person is making, how much money is being spent on goods and services for each employee, how much money is coming in for each person, and how much money is leaving each year to the owner.

How an Income Spreadsheet Can Help Owner Manage Their Finances

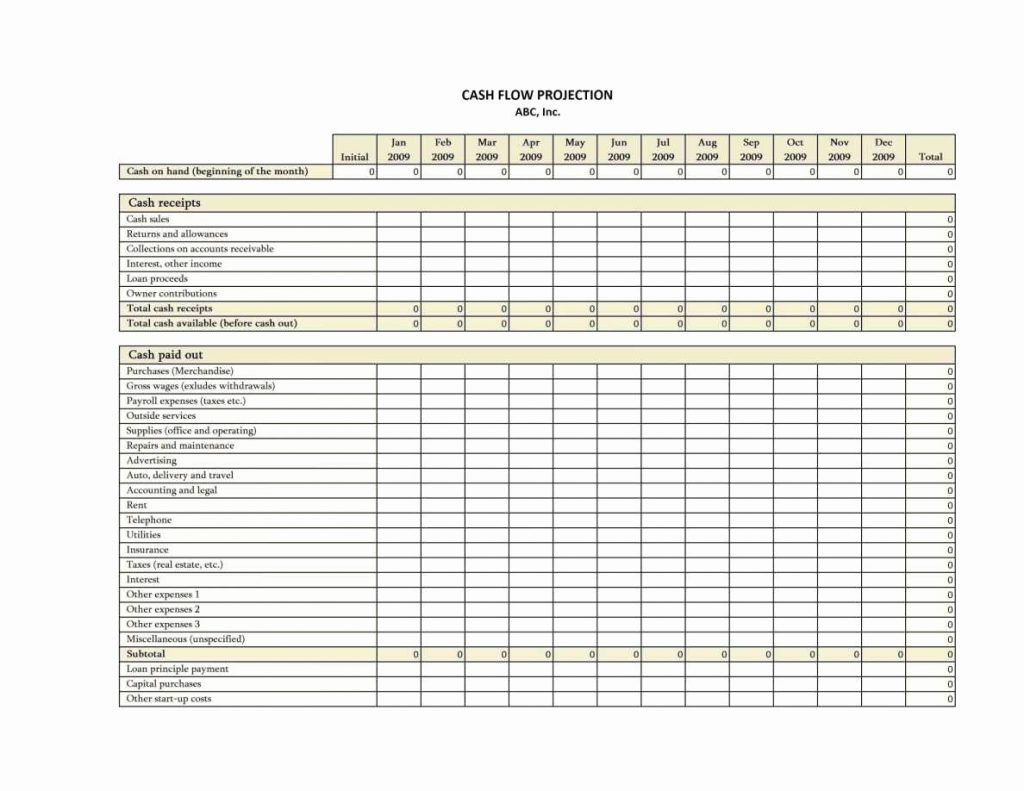

In addition, the owner can type the information into certain accounts, and even record how much income is being made and how much was lost during certain periods of time. This information can then be added to all the other financial reports that are tracked, such as the monthly statement that is made available to the employee or the balance sheet that is made available to the owner.

Income accounts provide a record of all the money that is being used each month. Every time the payroll clerk creates an account, this record is placed onto the account.

There are special accounts that are used by companies and employers to maintain payroll. The accounts include Money Account, Profit and Loss Account, Cash Advance Account, and Revenue Account. In these accounts, the owner can take the information and use it for recording and monitoring how much money is being spent each month.

In addition, the owner can go over the income account and look at each column and note how much money is being spent each month. The owner can also write notes on some columns in order to keep a record of what items they are purchasing for themselves or others. These notes can include how much they spend on groceries, entertainment, children’s clothing, or any other expenses.

The owner can also enter the information into the Income Account, which will give the owner a better picture of how much money is coming in and going out of the account. All this information will then be entered into the proper computer software and enter into the appropriate financial reports.

The common day of the week and month is automatically entered into the Income Spreadsheet. It is important to be able to enter the correct information, as it is important that the owner know how much income is coming in every month, and how much is going out.

With this information entered into the online income sheet, the owner can then compare the income received by the person to the amount that is entering into the monthly account. When a comparison is made, then the owner can see if they are going too fast.

With this information and the sales data, the owner can also use the income spreadsheet to make the proper decisions when shopping for a car or other items. By knowing how much income is coming in and going out, the owner can make an educated decision when purchasing a new vehicle.

The great thing about this type of financial planning is that the owner no longer has to worry about the expense of keeping track of all the records. They can simply use the income spreadsheet and this process is over. PLEASE LOOK : income spreadsheet template

Sample for Income Tracker Spreadsheet