How To Prepare An Income Statement Template For Small Business

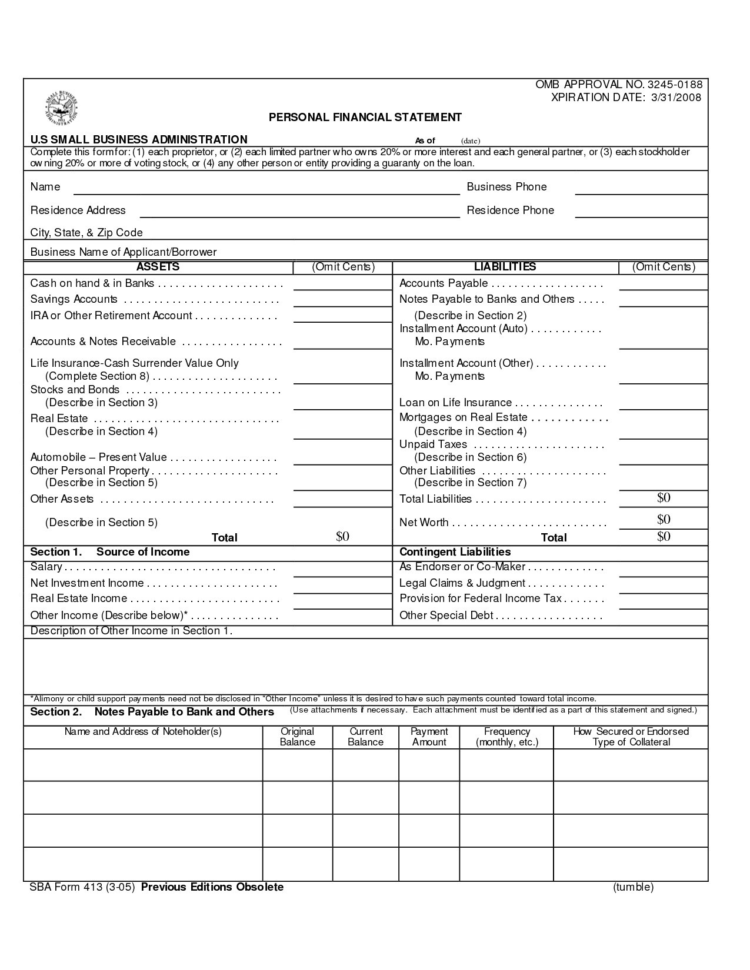

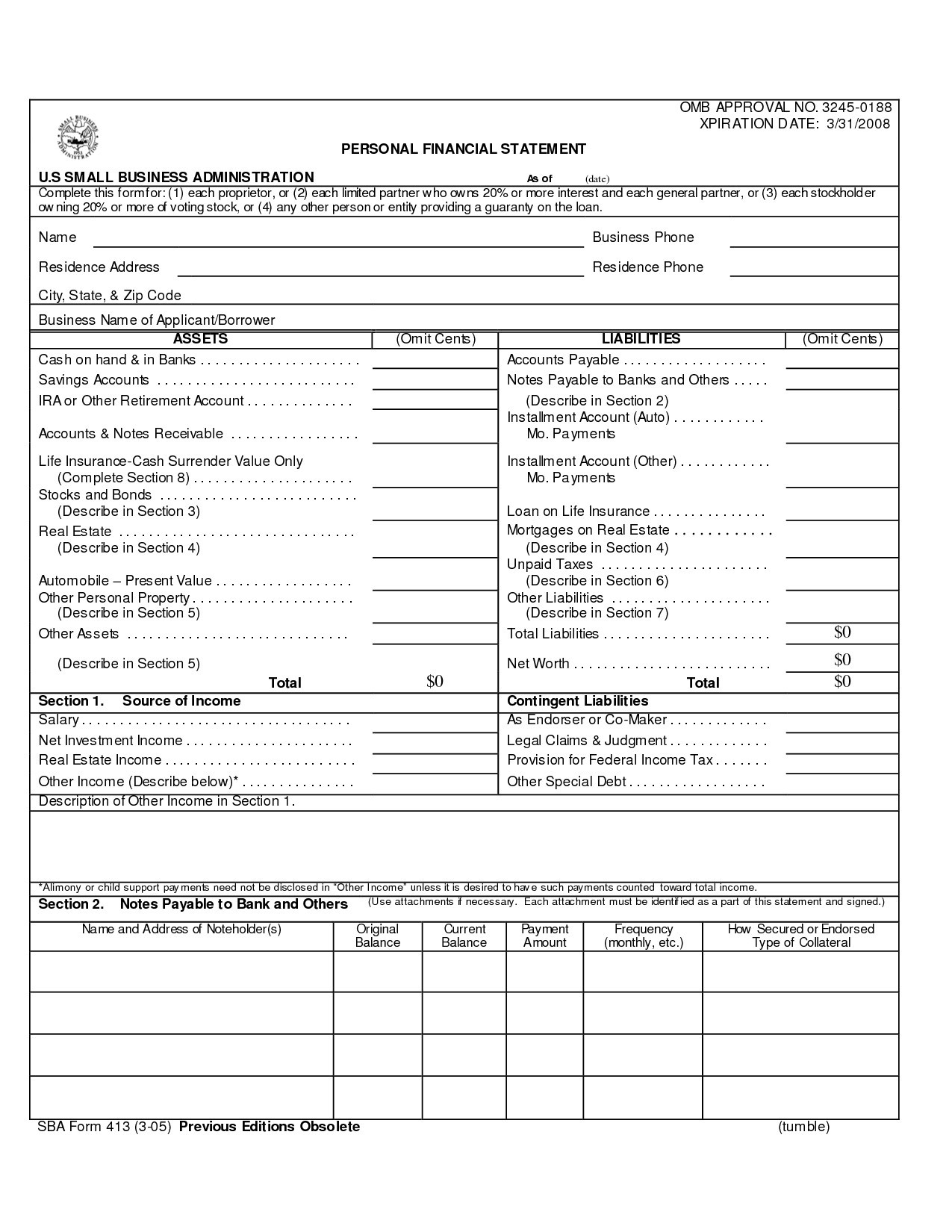

A standard income statement template for small business is a very important document to have. This statement contains all your financial information including the income, expense, and profits. It can also be used as a guide to determine your company’s financial position.

The overall design of this is simple, but it can be difficult to understand. In the beginning, you may find that this document seems rather long and drawn out. Then, as you get used to using the statements, it will make more sense and take less time to write. It will also save you valuable time as you read through it and gather the information.

You need to get started on the income statement template for small business as soon as possible. By having a detailed and comprehensive statement, you will be better able to manage your finances. The next thing you need to do is to put together a budget to follow. If you are a new business owner, this is probably the first step you need to take.

Once you have a completed income statement, the next step is to organize it. This is a very important step and should only be completed once. In order to organize your financial documents, you must go through them one by one. There is no need to contact anyone else if you already have the completed paperwork.

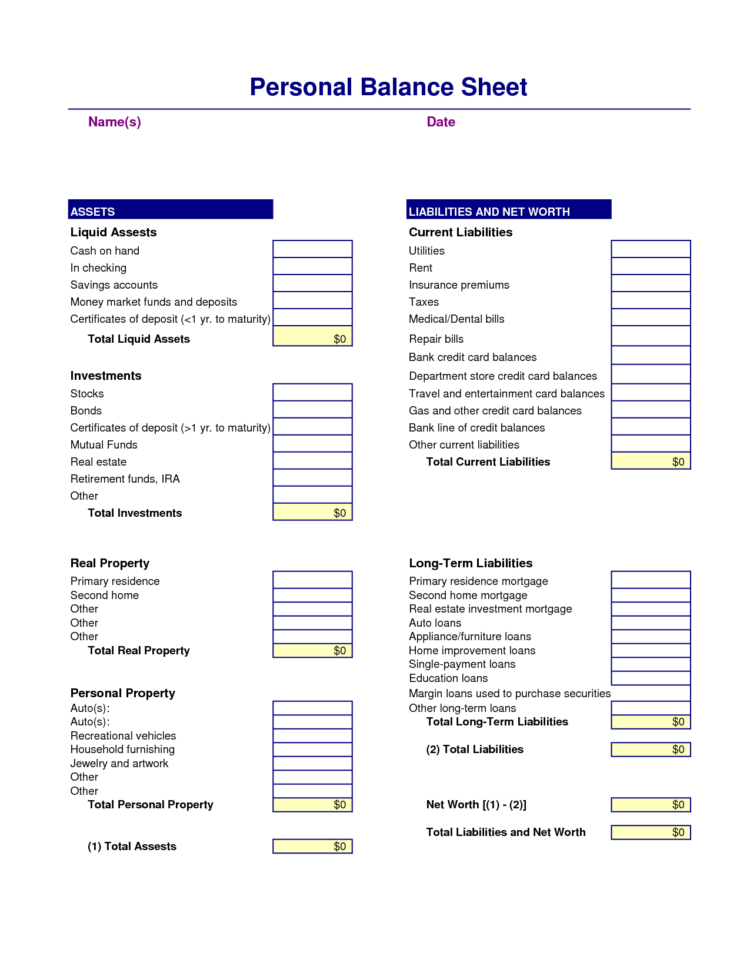

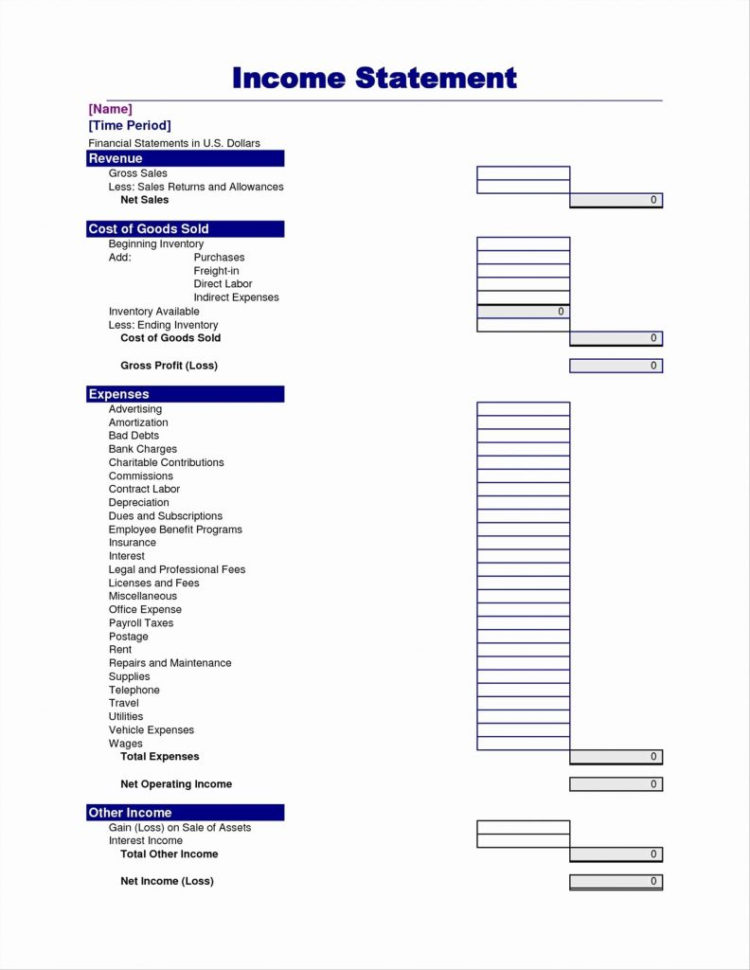

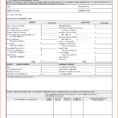

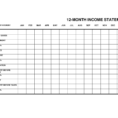

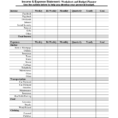

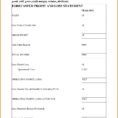

There are two main categories of accounting and financial statements for a small business. First, there are the operating expense statement and second, the income statement. Some businesses use both or add them to one of the two depending on their particular situation. You may find that some of your company’s expenses are clearly linked to income, but other expenses have no connection to money.

On the expense statement, write down the names of all the employees, the types of products they are expected to sell, and their salaries. When you’re done with this part, move to the income statement. This section should include the gross profit, the expenses, and the interest you are paying on those expenses. The amounts of each expense should be noted.

Now, when you’ve collected all the information, this will become your income and that profit will determine your net profit. One of the most important parts of this type of income statement is to establish your expenses, both direct and indirect.

Direct expenses should include things like salaries, utilities, and food. Indirect expenses include your taxes, merchandise costs, and the cost of sales. You must write down the direct and indirect expenses for every transaction and expense for every item sold.

You may find it easier to gather this information yourself than to refer to books or online resources. However, as you work through the statements, you will begin to realize how much of an impact these categories have on your company’s overall financial condition. It is important to emphasize the effect of these categories on your business’ bottom line as you go through the documents.

There are other ways to make this income statement more professional and more effective. For example, you may find that it is more profitable to use spreadsheets and to write down the information manually. If you decide to use spreadsheets, keep in mind that your income statement should be up to date and updated every quarter.

Take your time in preparing your income statement and you will be happy with the end result. Your business will run better and you will spend less time on paperwork. PLEASE READ : income expense spreadsheet for small business

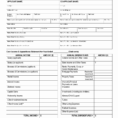

Sample for Income Statement Template For Small Business