Use an Income and Expenses Spreadsheet to Improve Efficiency and Reduce Waste

An income and expenses spreadsheet are not just a formula. They help you keep track of your monthly cash flow and expenses, so that you can improve efficiency and minimize waste. You’ll need to use a template if you don’t have access to Excel, if you don’t have a computer, or if you don’t have a lot of time to figure out how to make a spreadsheet.

There are numerous online publications on this topic. You may want to seek advice from your accountant or take a class.

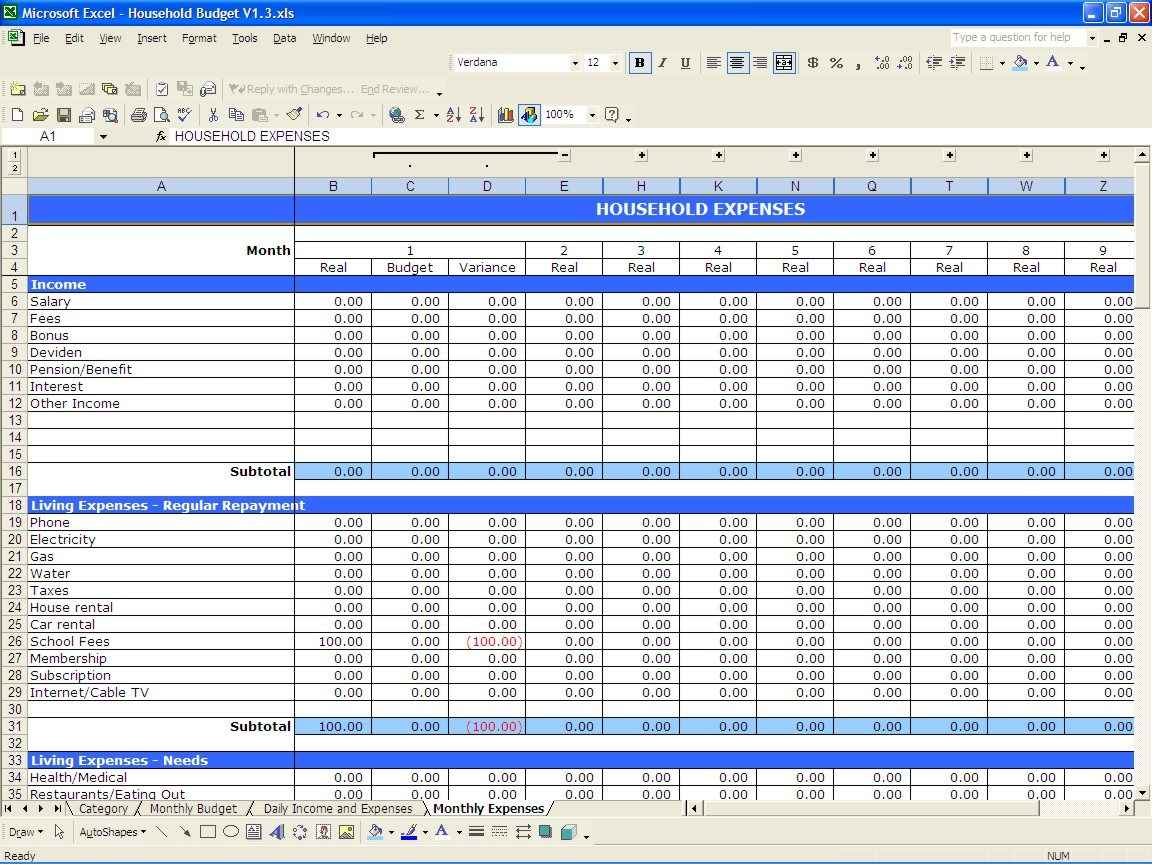

Financial information is crucial to the running of your company. Using an income and expenses spreadsheet can give you a basis to compare different budgets with other businesses. It can also give you a basis to measure the performance of employees and managers.

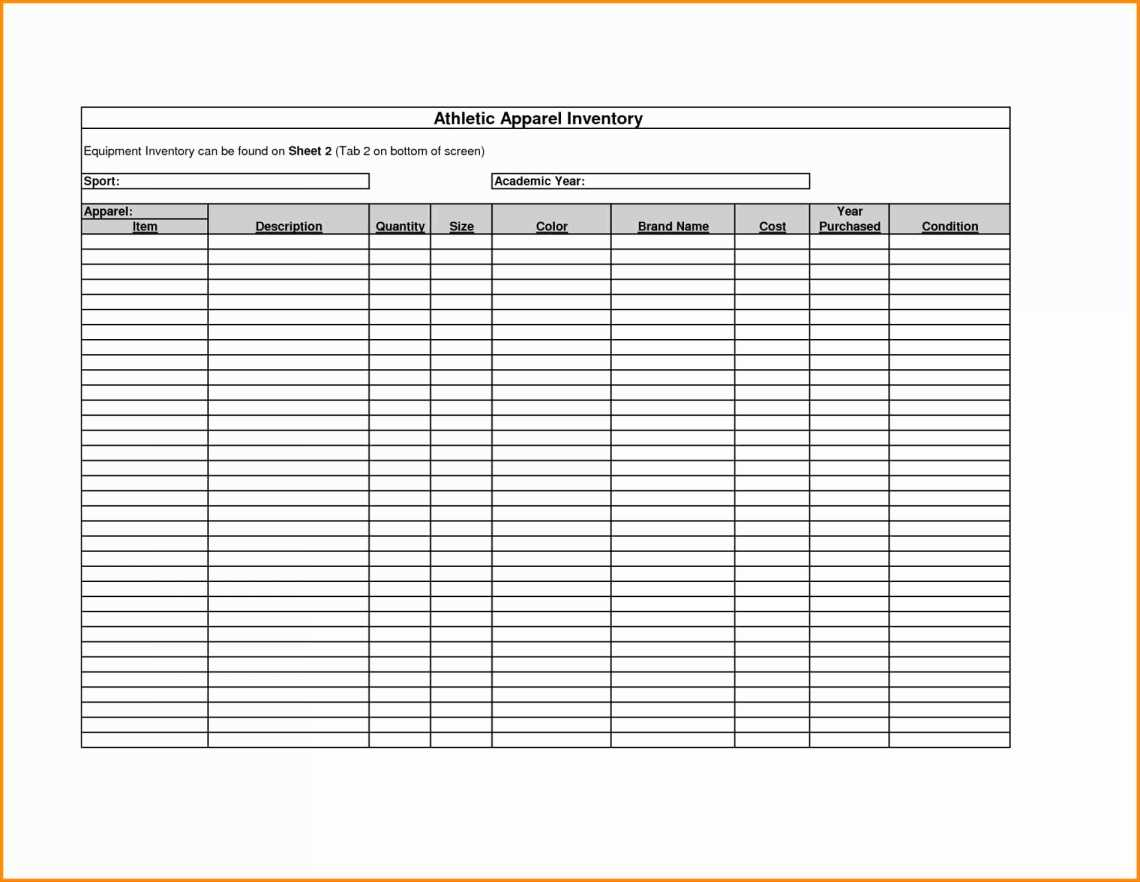

I’ve seen spreadsheet templates that show all expenses and income, even though they would allow you to choose which two are combined. I like to have three columns: income, expenses, and assets. For this reason, the first step in designing a spreadsheet is to decide on the columns you will use and which they will represent.

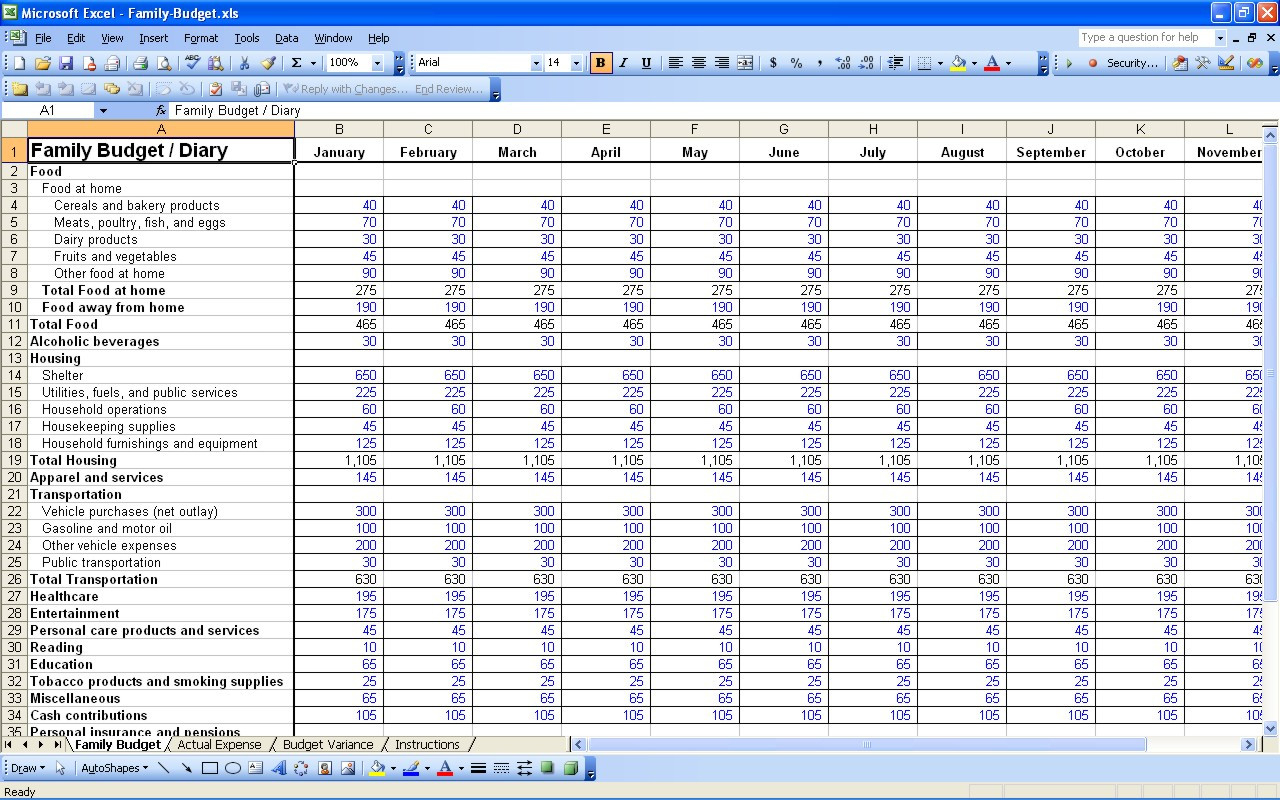

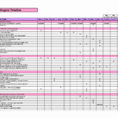

To create your income and expenses spreadsheet, you have to decide which categories you would like to include. There are many things you can include in these categories. Some of the things you may want to include are those you owe, you owe money to, your vacation time, you’re getting paid, your mileage expense and so on.

The easiest way to start is to work with categories that are easiest to think about. These can be Food & Drinks, Utilities, Medical Expenses, Property Taxes, Property Maintenance, Student Loan Expenses, Miscellaneous, Rent and Mortgage Expenses, Insurance, Misc. Taxes, etc.

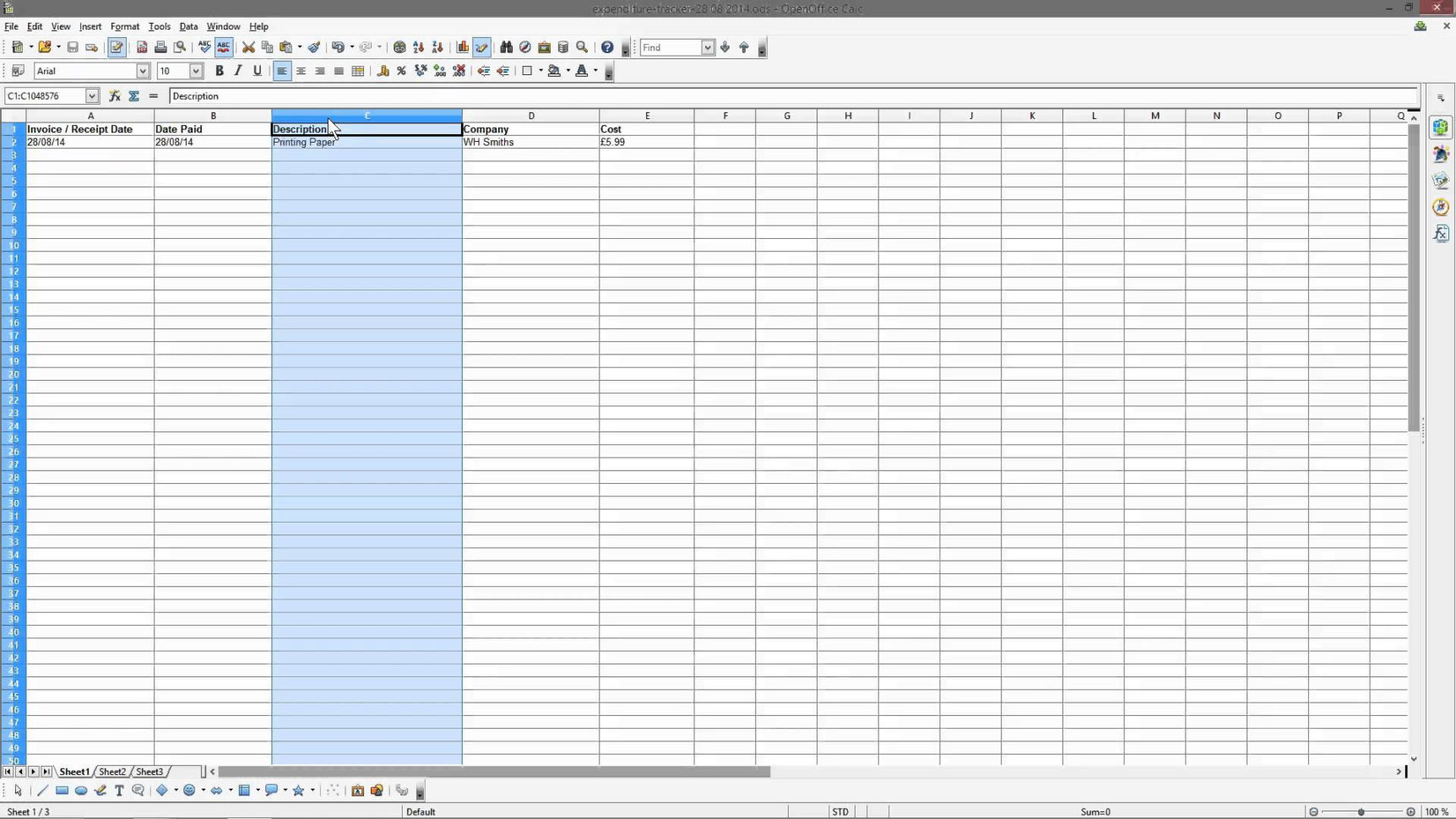

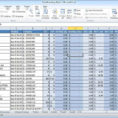

income and expenses spreadsheet template for small business You can create your own spreadsheet with these categories or you can use pre-made ones. You can purchase spreadsheets that you can customize. Use your judgment to decide whether or not you need more than one category to keep track of all your transactions. In my opinion, if you have a problem with organizing your transactions or having a strong focus, then using pre-made categories makes sense.

Once you have your own template, you can design it using the most important features. Some features include color coding, right column sorting, automatic cell formatting, calculation of percentages, total and per column, row and column reordering, pivot tables, language support, auto updates and export options. Your choice of templates should have some features that are essential to your business. You might find it helpful to explore a few templates to see which features appeal to you.

Once you have selected a template that you want to use, you should keep it up to date by checking it periodically for any improvements. This way, you can go back and adjust it when you notice a mistake or problem. Sometimes, changes may be made during the development phase that you missed during the design stage.

If your spreadsheet has any new features, it may be worth making a little adjustment before it goes live. At least once a month, go back and make minor changes until the application is ready for launch.

Make sure you have an income and expenses spreadsheet before you open your company. It is an indispensable tool for running a successful small business. YOU MUST LOOK : how to make a small business budget spreadsheet

Sample for Income And Expenses Spreadsheet Template For Small Business