Income and Expenses Spreadsheet – Small Business Tips and Tricks

With today’s economy, every small business owner wants to know how much money is coming in and how much money is going out. The most important step for you is knowing how much money you are spending and where that money is going. In this article, I will show you how to use a spreadsheet for your small business income and expenses to help you plan your budget.

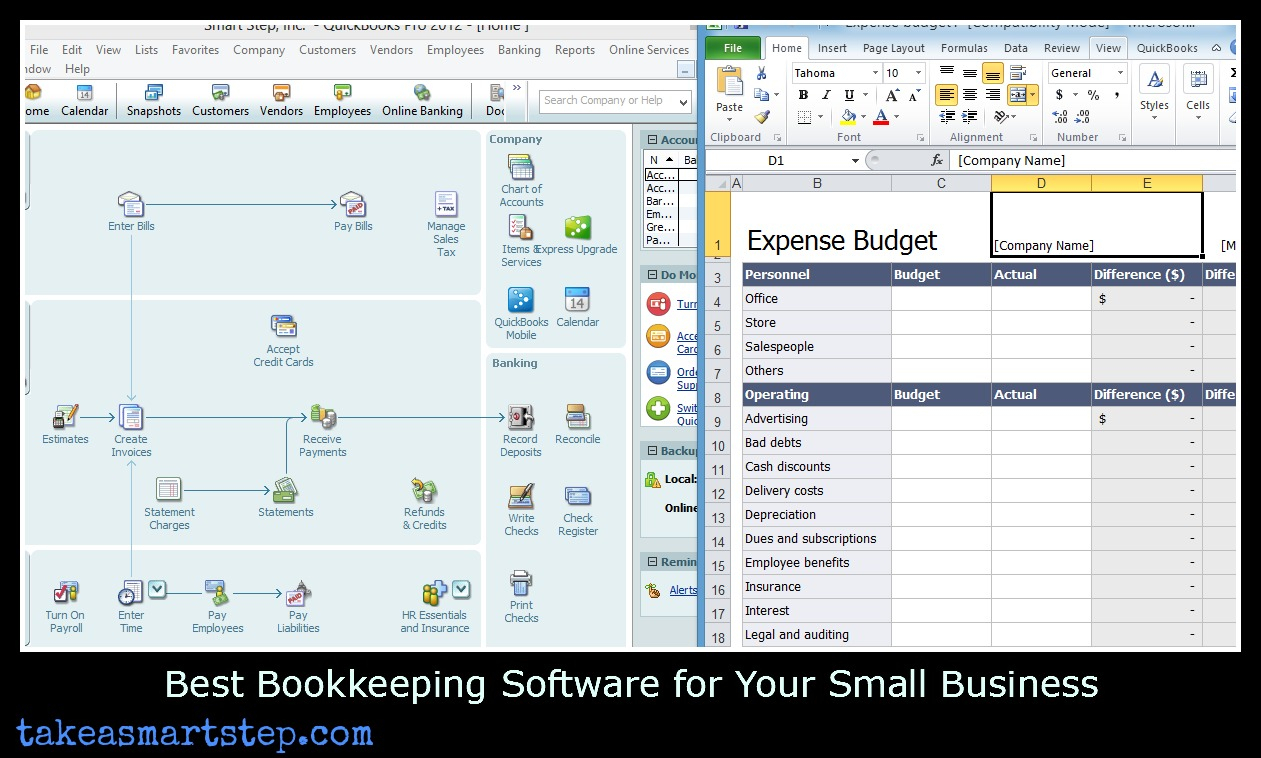

Setting up a spreadsheet for your small business can be easy. You need a couple of pieces of software: One for the sales and expense records and one for the financial information of your business. Once you have these, all you have to do is fill in the columns with the information you want to include. The software will automatically insert the entries for you into your spreadsheet.

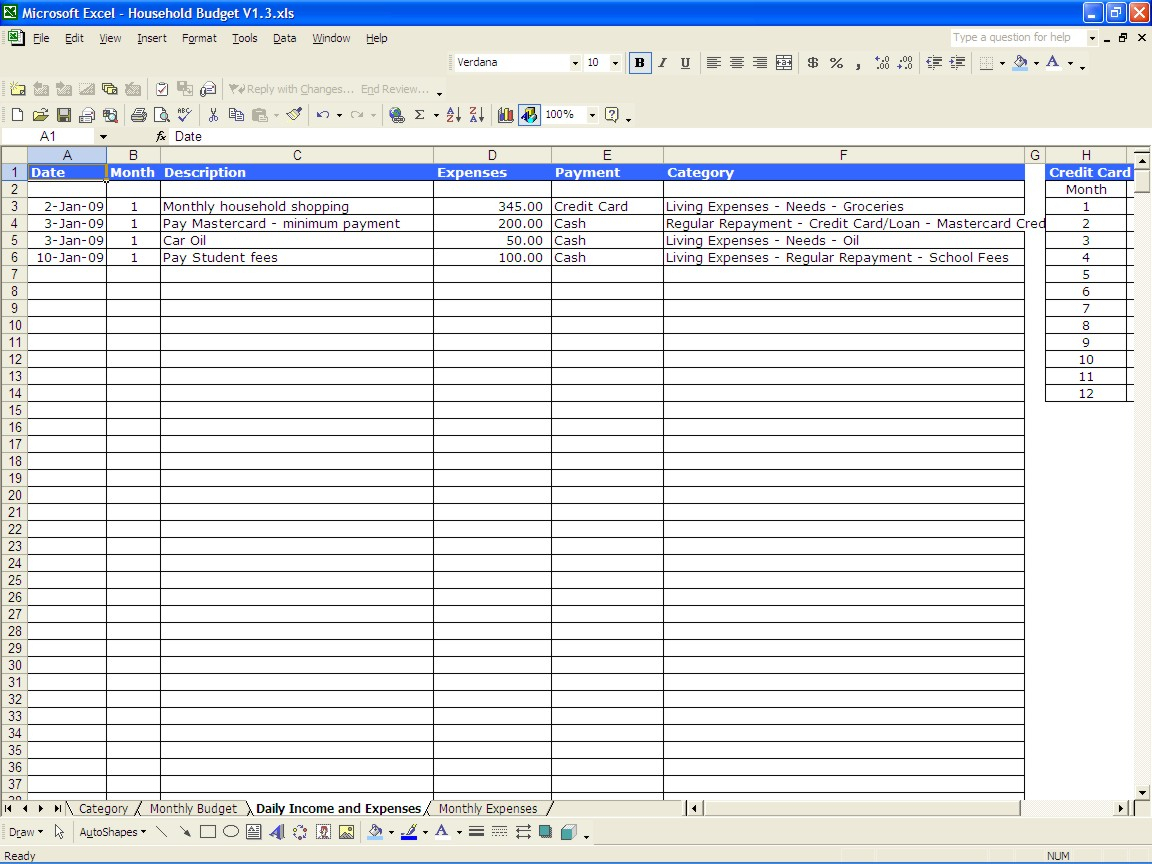

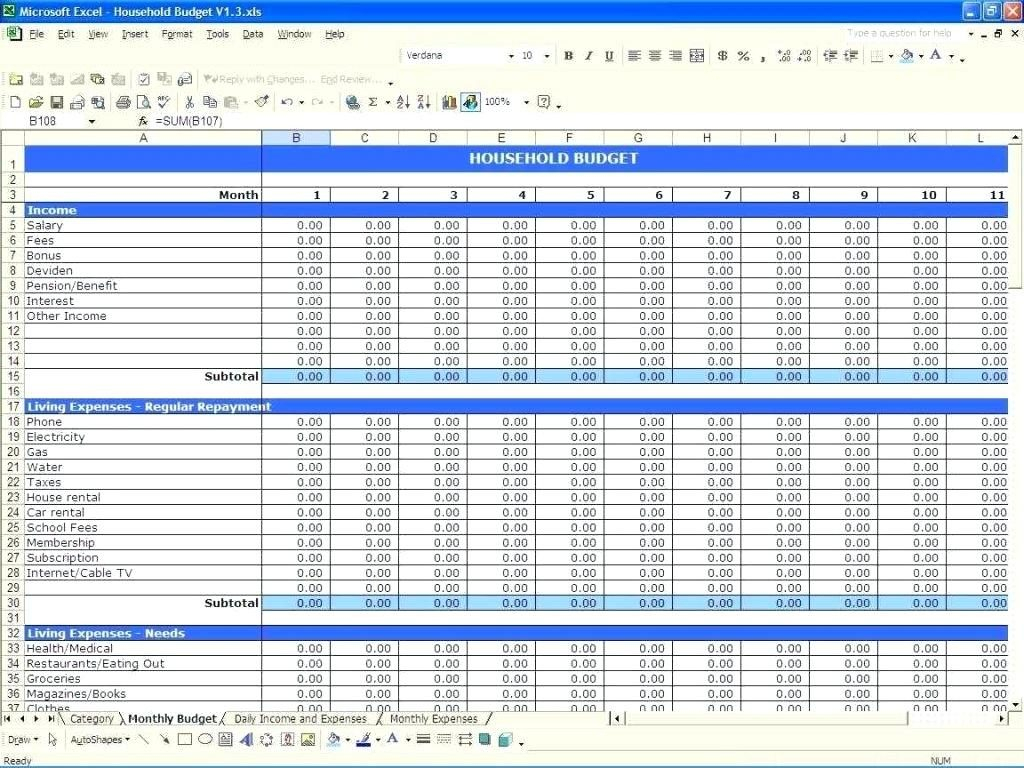

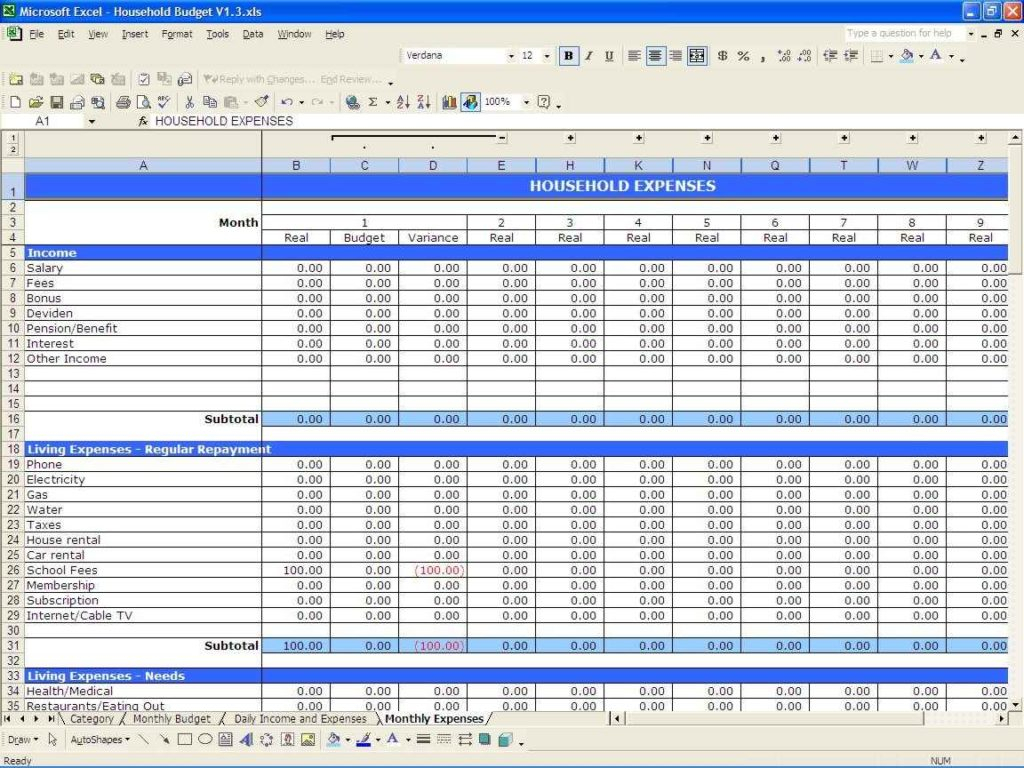

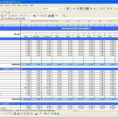

Now that you have all the information ready for your income and expenses spreadsheet, you just need to make sure that it is organized. Each column should have a heading with the appropriate information.

On the left side of the spreadsheet, include the expense columns. This will be the cost of goods sold and the commission paid to salespeople.

Next, on the right side of the spreadsheet, you should include the cash flow column, which will contain the money coming in and the money going out. The columns below should be self-explanatory.

On the left side of the income and expenses spreadsheet, include the Income column, which will list the amount of money coming in from sales or other sources of income. If there is no income, write that you don’t have any. You will get a zero on this column if you don’t have any income.

Next, include the Expenses column, which lists the items that you pay out for or reimburse other people for. If there are no expenses, write that you don’t have any. The items to include here are payrolls, vendors, professional fees, taxes, and interest.

On the right side of the income and expenses spreadsheet, include the Balance column, which will list the total of the column. Write the Balance column before everything else, so you can see at a glance what is coming in and what is going out.

Last, put an item called the Total Assets column on the bottom row of the spreadsheet. This column includes all the cash, stocks, mutual funds, real estate, and anything else that you will need to cover your costs for running your business.

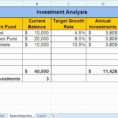

Writing your income and expenses spreadsheet is as simple as filling in the blanks. However, there are some things to keep in mind when creating a spreadsheet for your small business. The first is to always use percentages.

Your spreadsheet should always be based on percentages of income and total assets. If your business requires a lot of stock that is unverifiable, then use percentages to determine the exact figures. SEE ALSO : incident tracking spreadsheet

Sample for Income And Expenses Spreadsheet Small Business