Asking the question how to make a debt snowball spreadsheet can be very useful when it comes to drafting up a budget and tallying up how much money you have to work with. For example, it will help you keep track of all your debts and try to stick to your budget.

You do this in the long run by paying back the minimum amount each month and being disciplined about paying the minimums. In order to make the budget easier, it is best to use a spreadsheet program that will help you organize and categorize your bills and debts.

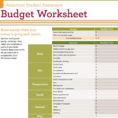

One of the biggest problems in the Budget Master is that the program was designed for a very small family. However, there are many people who struggle with their budgets. This program can be a valuable tool for anyone who is interested in successfully managing a household budget.

How to Make a Debt Snowball Sheets – Budget Excel

The best part about using a spreadsheet program for your budget is that you will be able to find the information that you need easily. Some programs are a little more complicated than others, but the end result will be worth it. Plus, it is possible to get discounts on the programs because they are well designed and provide detailed information that is useful for any budget.

Using a spreadsheet program is a great idea for anyone who struggles with managing a household budget. It will help you streamline your finances so that you will know exactly what you are spending money on and how much you have left over.

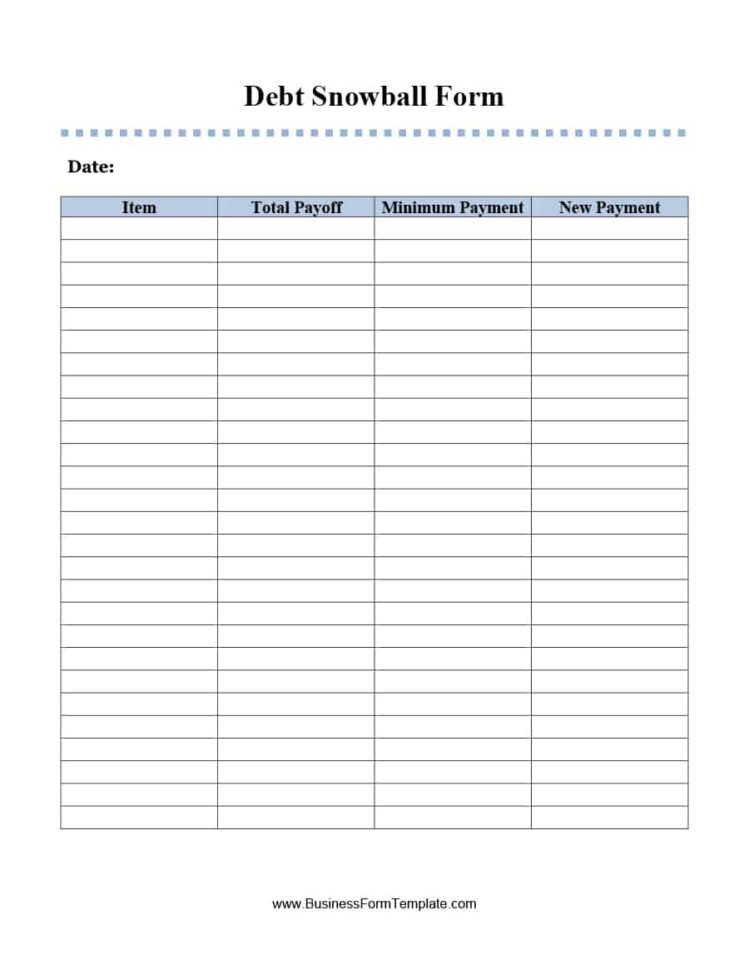

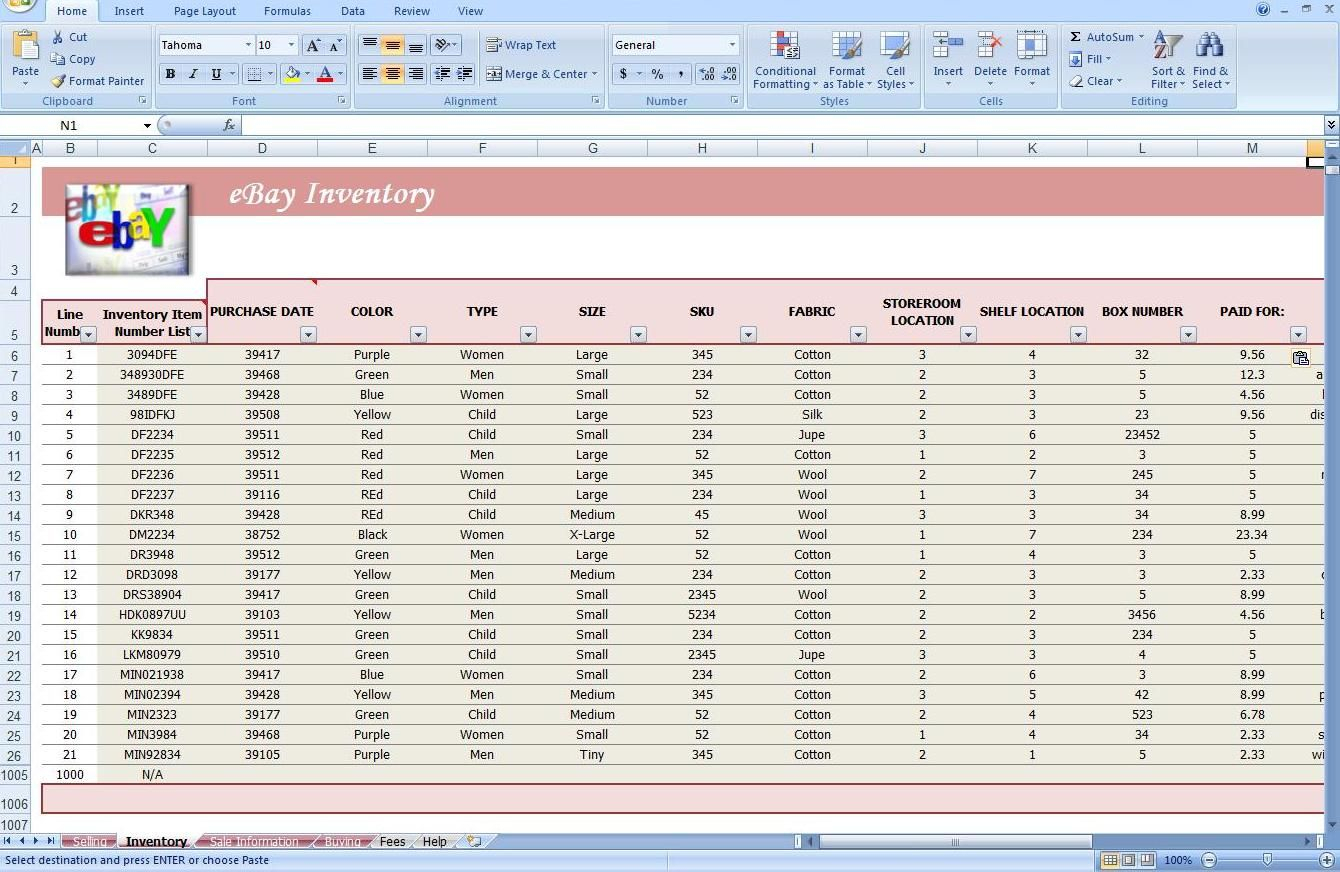

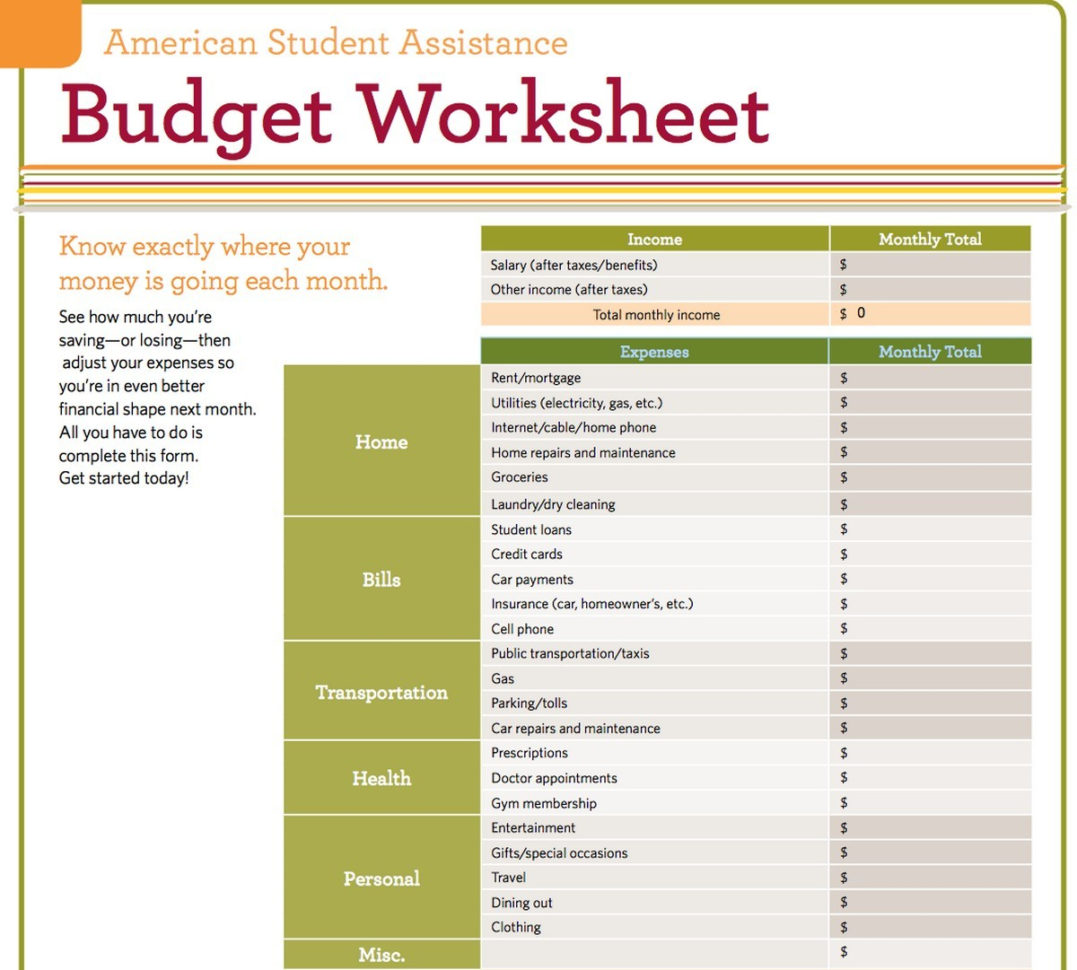

To make how to make a debt snowball spreadsheet easy, start by creating a basic spreadsheet where you input the information for your debts and your income. Remember to include all your monthly bills such as utilities, internet, credit cards, car payments, etc.

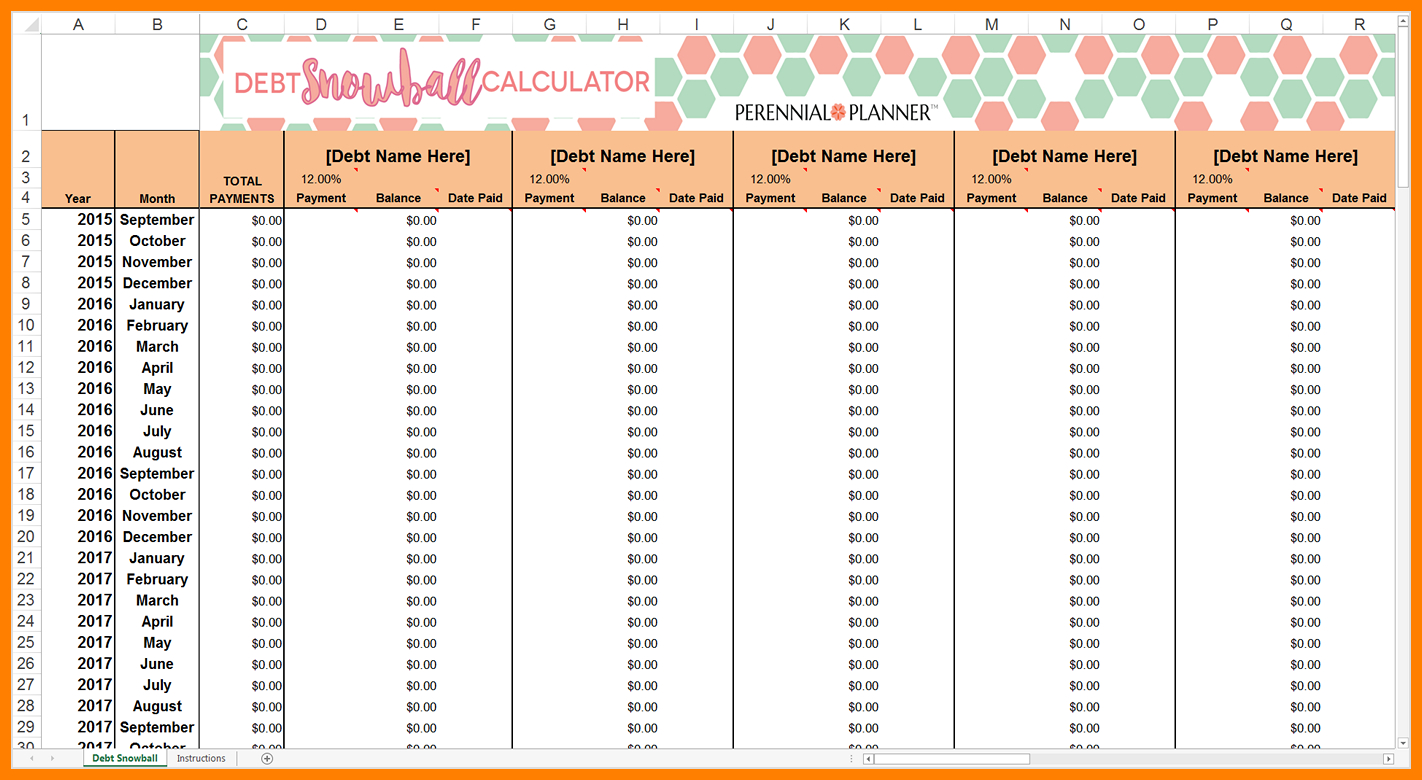

Now you want to figure out how many debt snowball sheets you will need to start with. To do this, start with two. Use the first sheet for all your unsecured debts that are less than ten dollars.

To make how to make a debt snowball spreadsheet easier, you should always divide all your bills into categories so that you have more room to write down your finances. Then use the second sheet for all of your higher interest debt like credit cards, loans, etc.

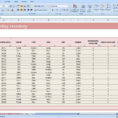

By doing this, you will be able to check your personal financial situation on a regular basis and identify areas where you need to make adjustments in your budget. When you feel that you need to start saving more money, you can use the third sheet for your saving goals.

It will also be a good idea to keep your finances organized in one place as you work through them. If you use a spreadsheet, this will be easier.

When you have everything in one place, you will be able to make decisions easier because you have an easy to read list of information on your hand. You can also set up your own email reminders so that you do not have to remember to send a check every month to creditors and other people.

Just by adding a debt snowball spreadsheet to your financial situation, you will be able to make things easier for yourself. If you think you can do this without help, then by all means, you can do it, but it may take a little time to understand the basics. PLEASE SEE : how to make a cost analysis spreadsheet

Sample for How To Make A Debt Snowball Spreadsheet