If you are wondering how to create a spreadsheet to pay off debt, the good news is that it can be done easily and quickly. In fact, with the proper tools and a little elbow grease, you can get started and pay off your credit card bills within 30 days.

Many people simply do not understand that credit cards have grown in popularity over the past decade. Some people are addicted to the convenience that plastic card offers. And many of these people have unfortunately found themselves deep in debt as a result.

If you find yourself deep in debt, then it is time to learn how to pay off debt. Most Americans are financially irresponsible and are in debt in large part because they take on too much debt. If you have several credit cards, charge it to each one.

How to Create a Spreadsheet to Pay Off Debt

Pay the minimum on each one. As you approach each bill, pay a bit more each month. Each month, you will pay less each month as you continue to eliminate your debt.

I often wonder how many people get behind on their debt and are behind for a year or more. All of these debts have grown so large that it has become difficult to even carry one or two. It is impossible to pay them all off but if you start paying off your minimums, it is possible to create a spreadsheet to pay off debt and not be hit with a bunch of interest charges.

There is no reason to have so much debt when you can use your paper work to your advantage. You want to pay off your debts as soon as possible so that you do not have to deal with the stress of outstanding debt. There are many tools available that will help you.

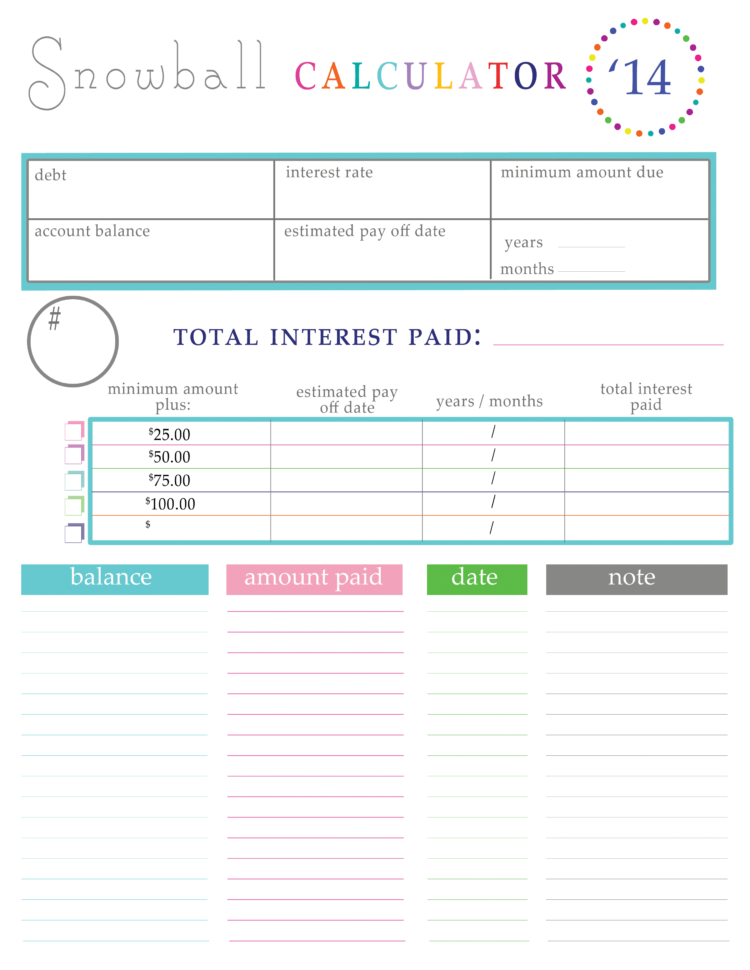

How can you create a spreadsheet to pay off debt? The best way is to get hold of a calculator that will provide you with the formula for calculating your total debt owed. In this calculator, you will enter your income and your expenses. Then you will be able to enter the amount of money that you have coming in each month.

By entering how much income you are receiving each month, you will be able to determine how much money you need to earn every month in order to avoid debt. Once you enter the amount of money you need to earn each month, you will be able to figure out how much debt you have to pay each month. There are other ways to create a spreadsheet to pay off debt.

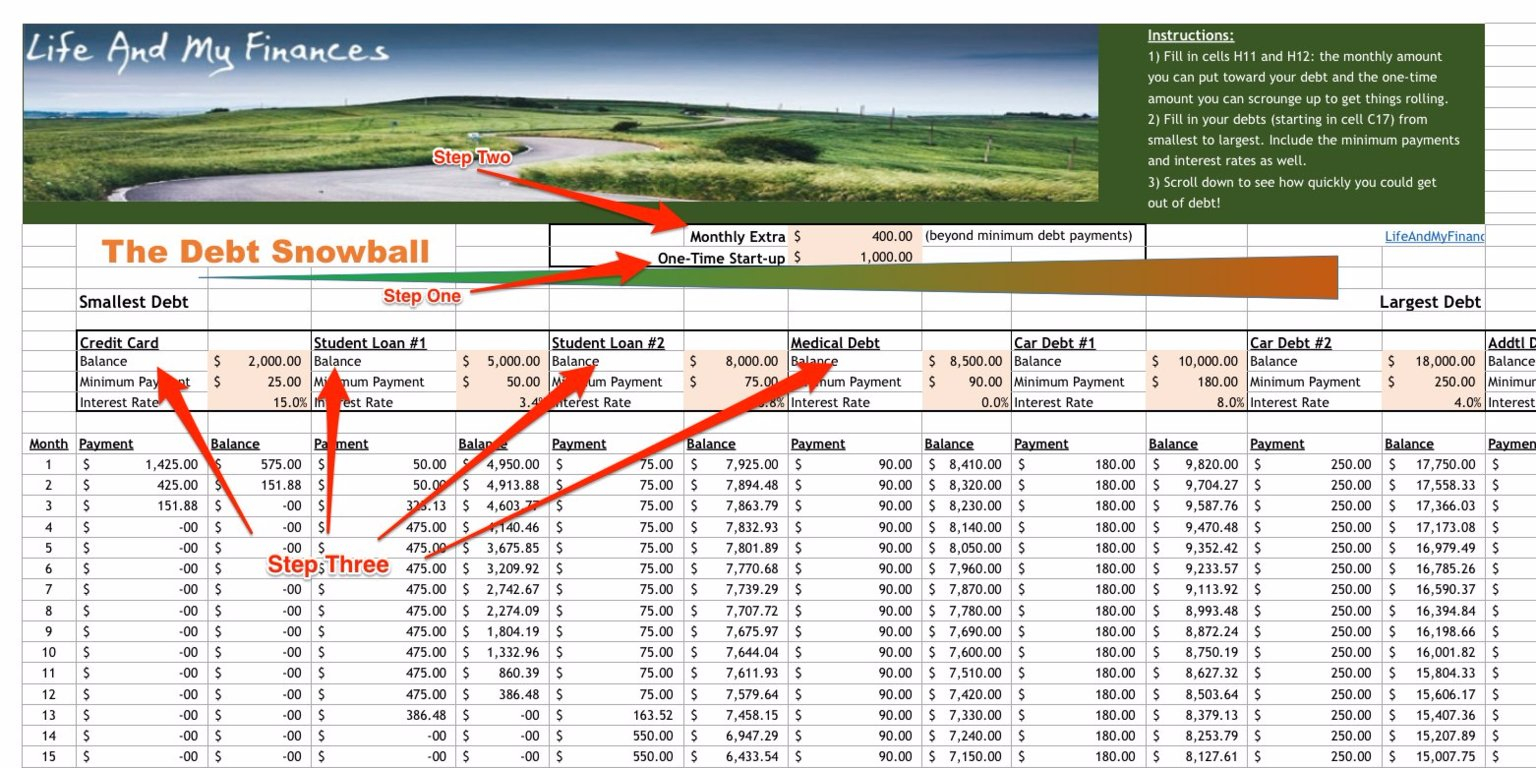

You can also create a spreadsheet to pay off debt by using your spending power to pay off your debt. This process is called debt consolidation. In order to do this, you will need to have a minimum of three loans that you can consolidate.

The third loan is used to pay off the first two. This is accomplished by charging an interest rate on the first two and dropping the minimum payments you were making on the first two.

Then you make only one payment per month to the third lender. In doing this, you will eliminate all of your monthly payments. This is how to create a spreadsheet to pay off debt.

You have done it! You just learned how to create a spreadsheet to pay off debt and paid off all of your credit card debt. PLEASE LOOK : how to create a spreadsheet in numbers

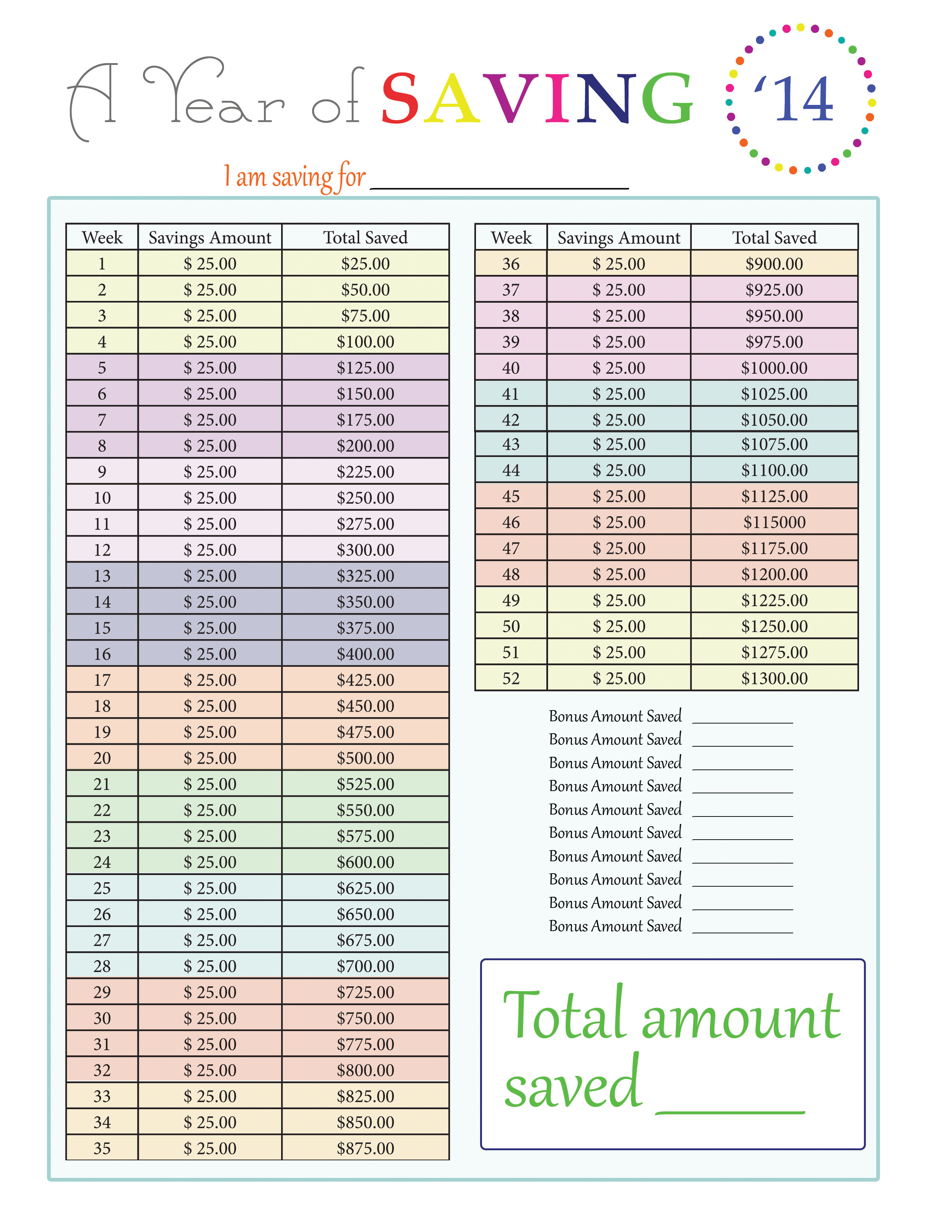

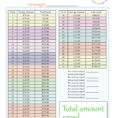

Sample for How To Create A Spreadsheet To Pay Off Debt