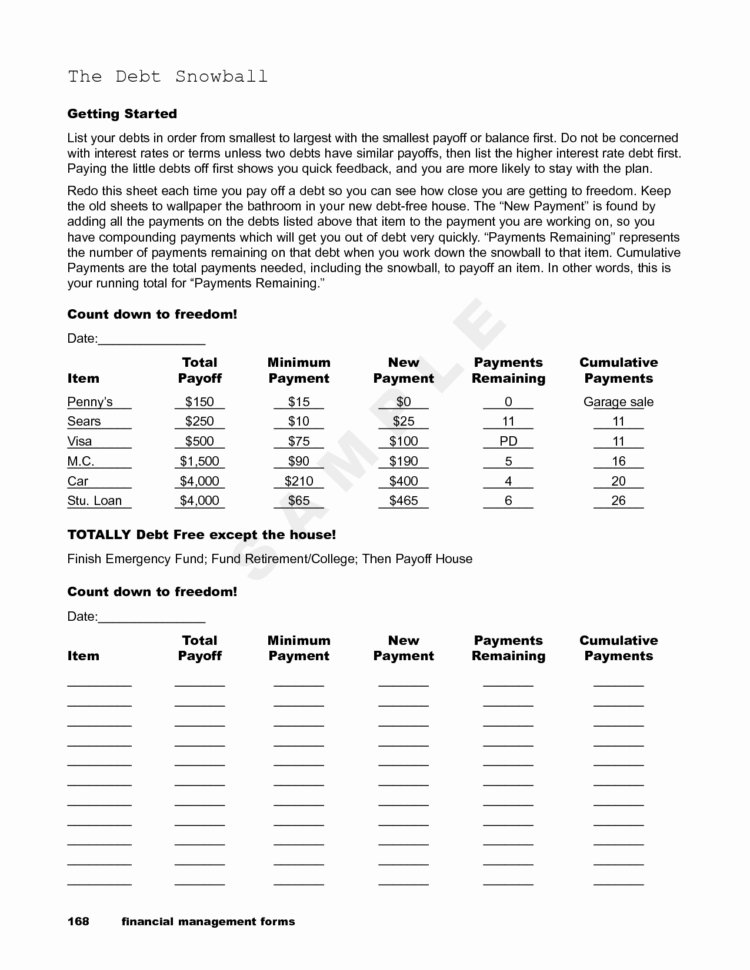

How to create a debt snowball spreadsheet? The best way is by using this formula: Cost of Debt + Interest on Debt – Monthly Payment = Effective Monthly Debt Balances.

You can divide your debt into three categories: Interest on debt, cost of debt and the effective payment. Your debt amount should be taken from your income statement. What is that statement going to look like?

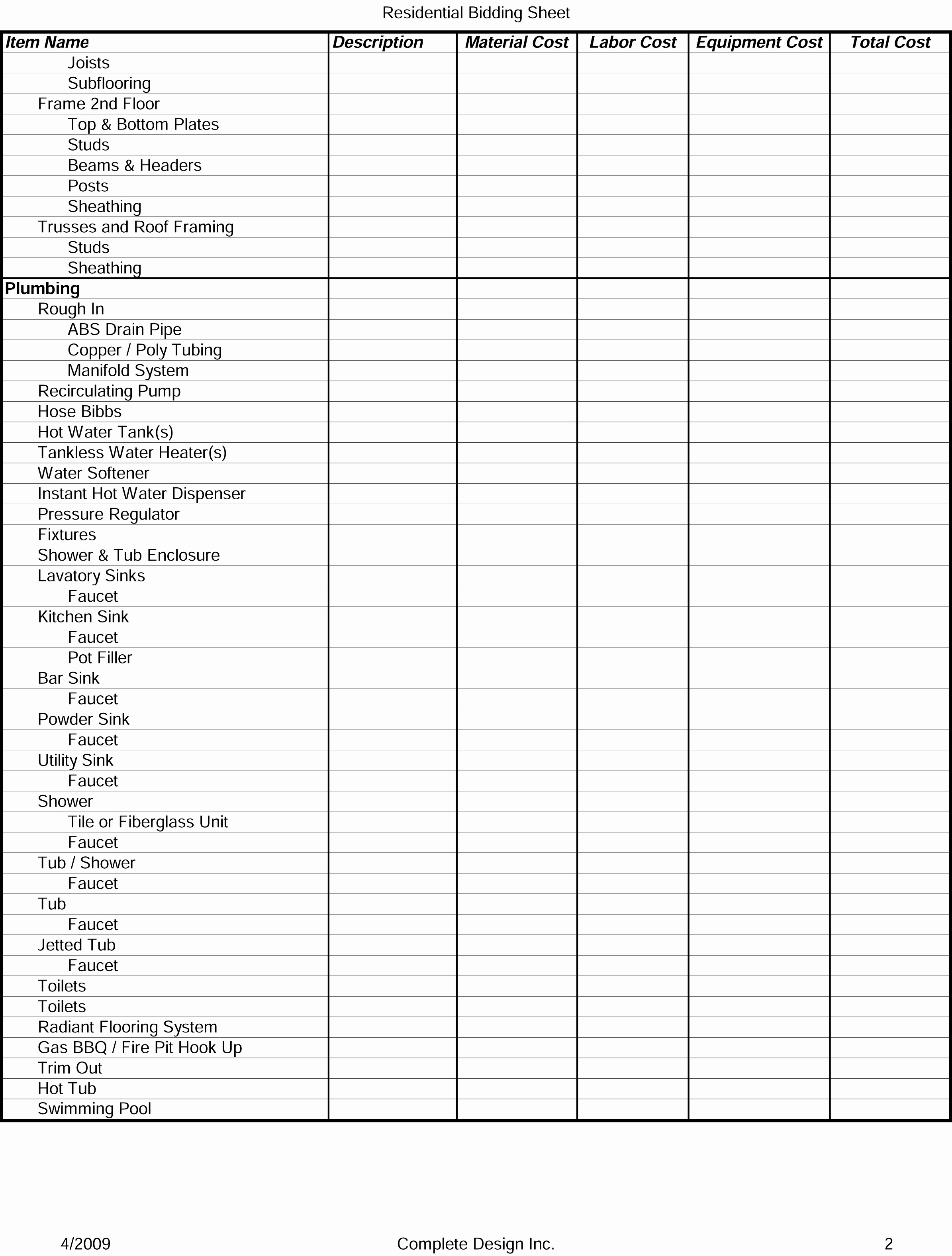

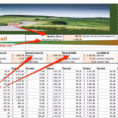

The first column will list the monthly payment. This is the average monthly payment you are making. The next two columns will also have your debt and your payment.

How to Create a Debt Snowball Spreadsheet

The third column will list the difference between your payment and the effective payment. It is important to keep this in mind when figuring out your debt snowball.

The number will be a percentage of your total monthly payment. Using this number will give you a good estimation of how much your debt should be.

Now that you know how to create a debt snowball spreadsheet, how do you use it? Before you start creating your debt snowball, consider the following:

If you have a lot of interest that is due for a short period of time, take that amount and multiply it by three. This is known as interest snowballing. When you add all of the interest you owe, it can add up to quite a chunk of money!

Apply your interest snowball to all of your balances. This is where your calculations come in handy. Remember that the monthly payment is how much you have left to pay. The effective payment is how much of your total payment goes to your debt.

Make sure to deduct the cost of debt from the payment you make each month. This is known as the cost of debt. Most of the time, you can find out what is going on with your balance by running a free debt consolidation online software program.

Start keeping a spreadsheet that records your debt. It is essential that you get this information when it is updated. Whenever you notice any changes, then you can get a hold of your spreadsheet to see what the change is.

There is a very simple debt snowball calculator you can use. You simply need to input the monthly payment you have and the amount of your debt, and you will get the total balance on your debt snowball.

After you have entered the information for the initial month, then you can then make a quick calculation of your credit report. You can find out exactly what is going on with your credit and what you need to do to improve it. READ ALSO : how to create a cost analysis spreadsheet

Sample for How To Create A Debt Snowball Spreadsheet