Most home based business owners do not have to worry about how to create a business expense spreadsheet. After all, most of the expenses are for company business costs and not personal expenses. However, there are some expenses that belong in the personal category and should be reported on a separate line.

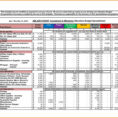

The first thing to consider when you set up a business expense spreadsheet is to determine what types of personal expenses should be reported on your business account. This will include things like medical expenses, home mortgage interest payments, and college tuition. The majority of people will include these types of expenses when they prepare their personal tax return, but the IRS requires that they also be reported on the business return.

Of course, most people will also include mortgage payments on the personal line of their business return. This can be a good idea because it is important to disclose this payment. On the other hand, if the mortgage payment is reported on the business form and the owner of the home isn’t married, he or she may be surprised to find out that it is reported on their personal return.

How to Create a Business Expense Spreadsheet – Know How to Do This and You Will Be Very Happy

It’s important to remember that there are certain items that belong on the business expense spreadsheet and are not personal. An example of an item that is not personal would be a holiday vacation. Other examples include a car payment, dental work, and the cost of an annual membership at a gym.

If you are working with a business that offers training and instruction, it’s easy to notice the various expenses associated with those programs. You should keep track of the amount you spend per student, the instructional staff salaries, and the cost of any books or supplies used for the courses.

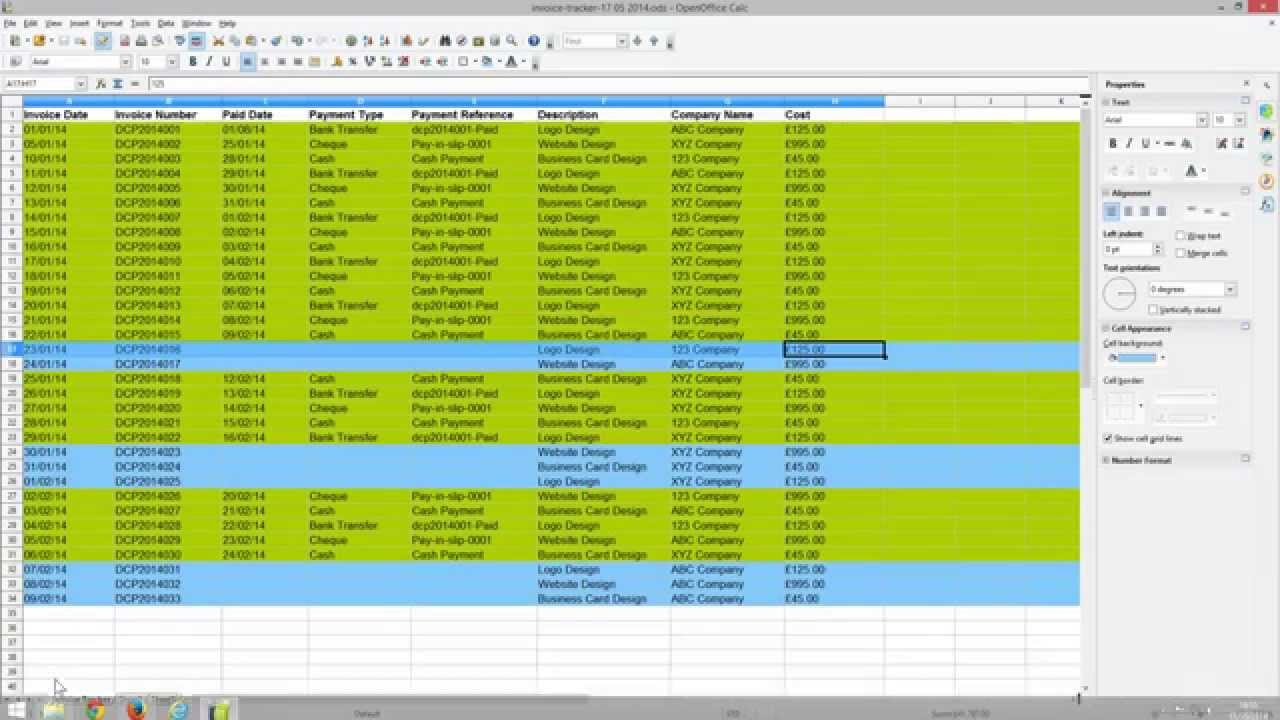

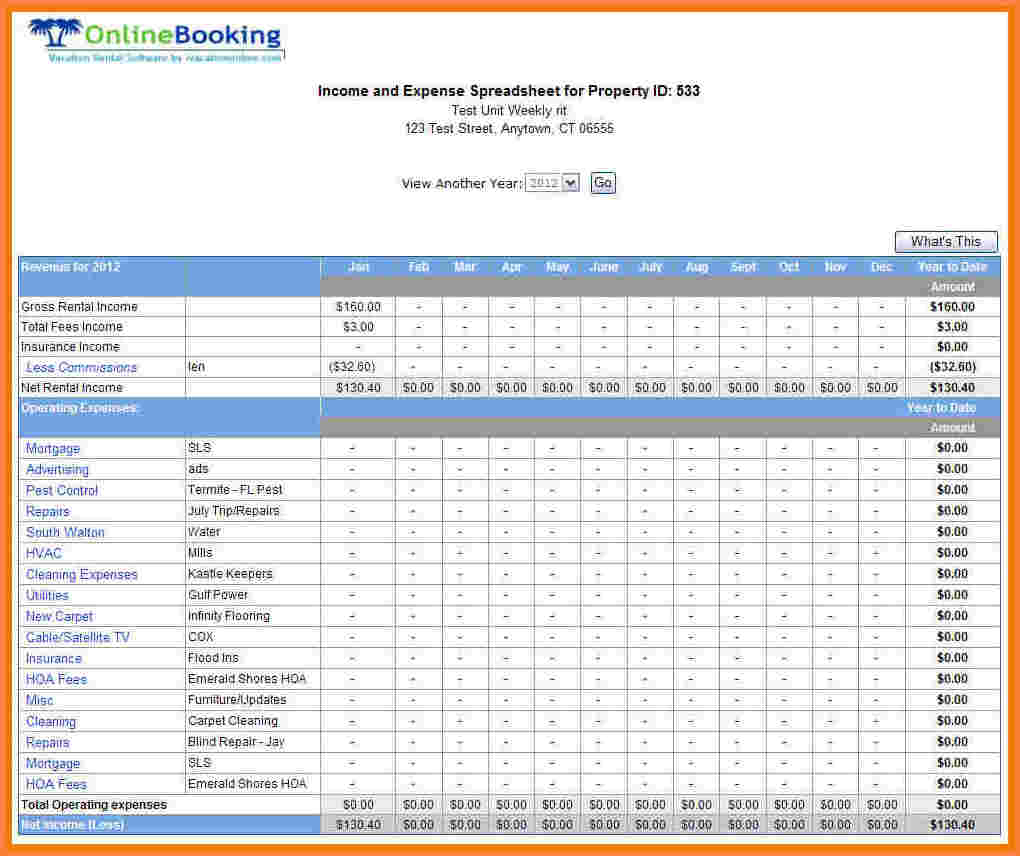

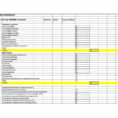

When it comes to business finances, bookkeeping should also be recorded in the financial statements. Things like income, income from business partnerships, and payments to vendors and others should be included. However, because these items are often quite different from the type of money received by owners of a home based business, it is important to know how to create a business expense spreadsheet to handle the financial side of a home based business.

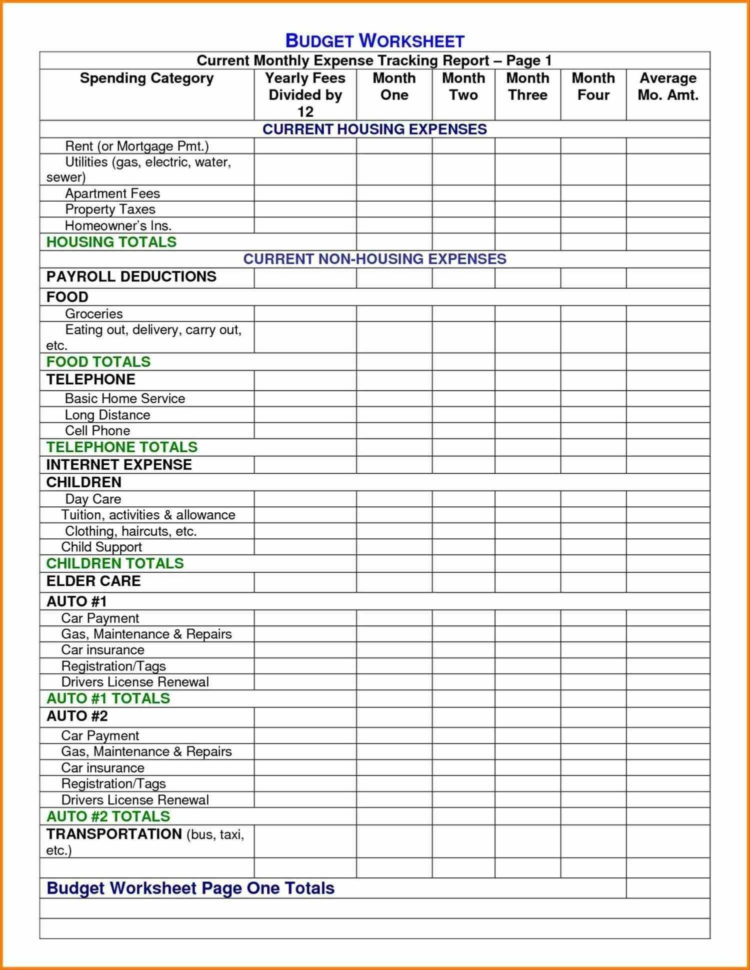

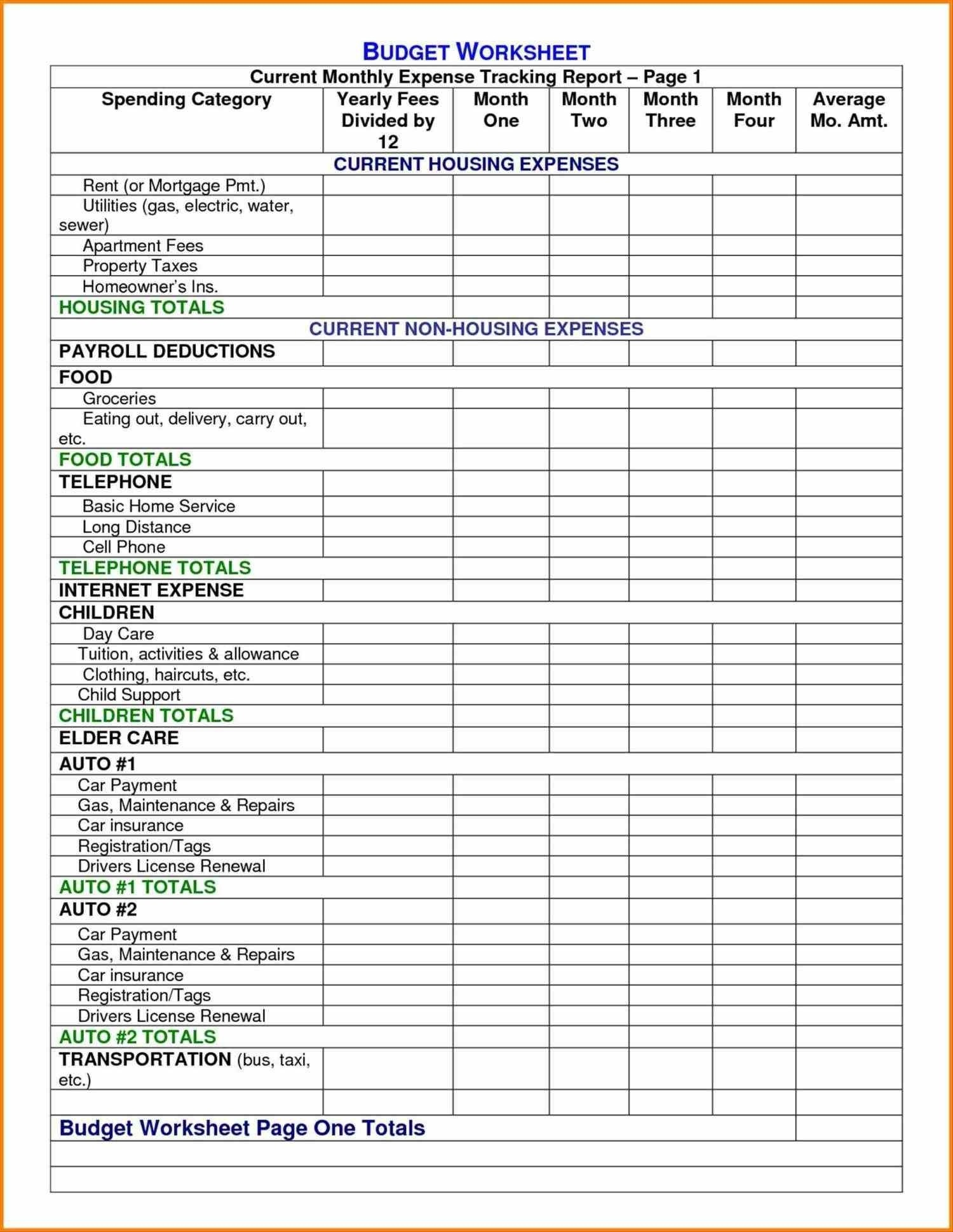

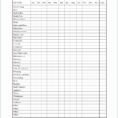

When you know how to create a business expense spreadsheet, it is possible to segment each business expense into its own line item on the business’s expense statement. You can easily record whether the expense was for a customer or something that is provided to the business. As an example, if you offer baking services, you can choose which items you want to include on the expense sheet.

By using the lines on the business expense sheet as a guide, you can determine how much of each expense is allocated to the personal line and how much is assigned to the business line. By the time you finish setting up your business expense sheet, you will know how much money is allocated to the personal line and how much is allocated to the business line. In fact, you can segment your personal line of the business expense sheet so that you know how much money you are spending on yourself. You can even segment your business line so that you know how much money you are spending on the business.

When you know how to create a business expense spreadsheet, you will also know how to handle the different categories of items that you find on the business form. For example, you can segment your home business as a health care business or you can segment it as a business that has stock investments.

There are a number of ways that you can use the lines on your business expense sheet to make sure that you are accurately tracking your business expenses. For example, you can segment your personal line of the business expense sheet into different groups such as “personal expenses,” “business-related expenses,” and “stock-related expenses.” You can then allocate each group according to what it was intended for on the business form and make sure that you are accurately tracking what you are spending your money on.

Another thing that you can do to make sure that you are properly recording your business expenses on your business expense spreadsheet is to determine the categories that you want to include. On the business form, you can choose to track only your profit or your expenditure for a particular item, but you can also choose to track a wide range of things on the business expense sheet. that is included in your personal or business expense categories. PLEASE LOOK : how to create a budget spreadsheet using excel

Sample for How To Create A Business Expense Spreadsheet