How to Use the Best Household Bookkeeping Template

To ensure that you are using the best possible financial management systems, the best household bookkeeping template is one of the most crucial things you can use. For example, if you are struggling to make ends meet and have decided to file for bankruptcy, chances are that your debts will stay and there is a possibility that they could spiral out of control.

The best thing about the best household bookkeeping template is that it has been specifically tailored to your particular circumstances and is very easy to implement and adjust to your specific needs. You can therefore apply this to all your financial transactions and be sure that you are making the most of every pound you put into the system.

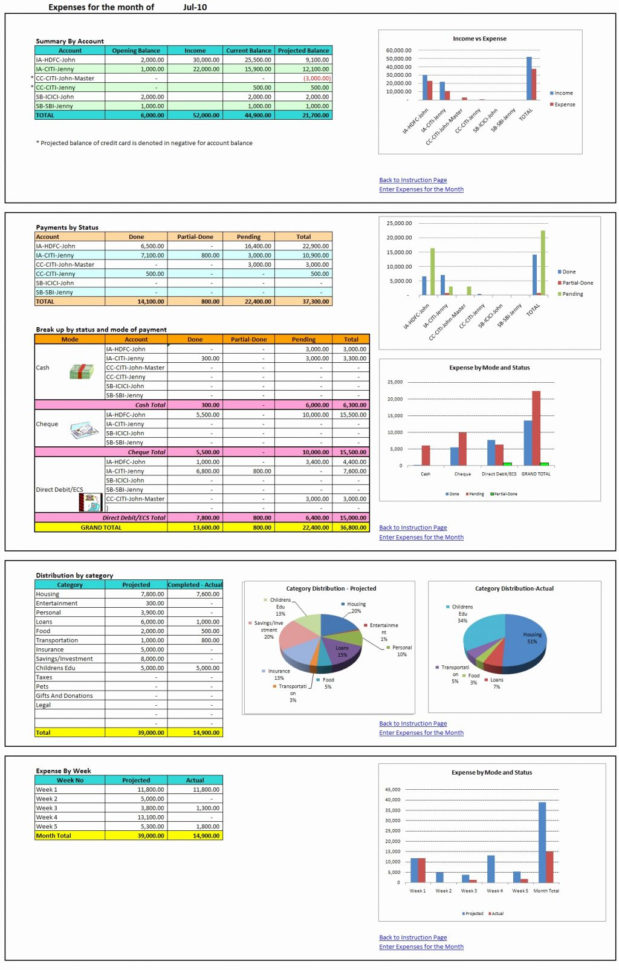

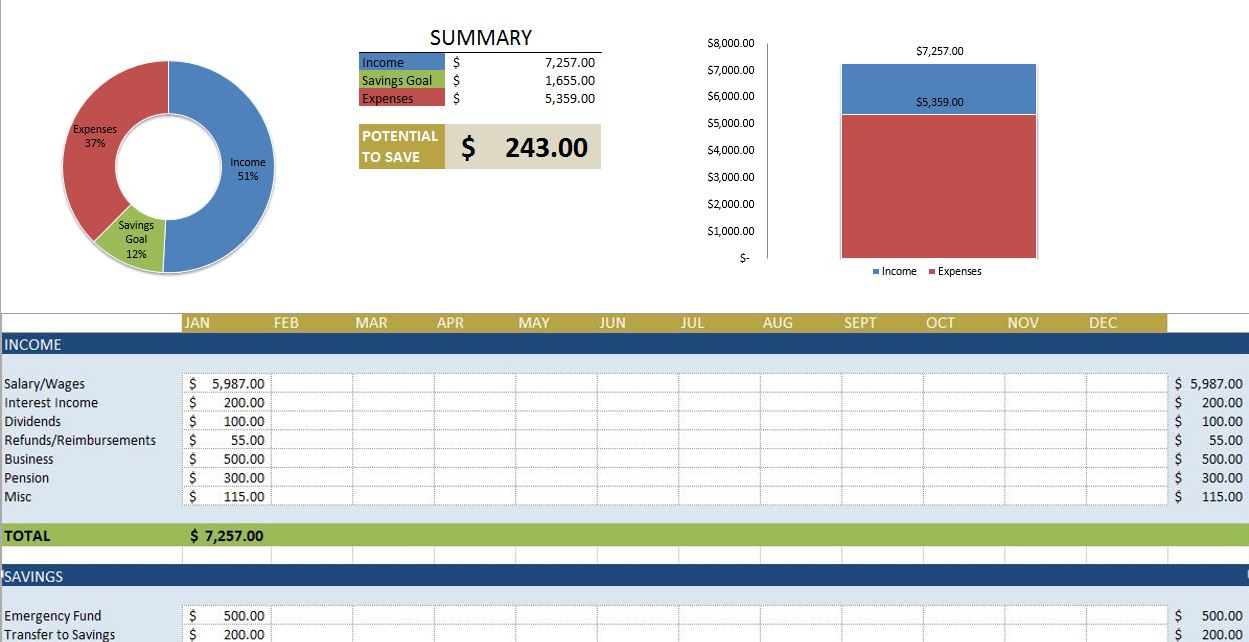

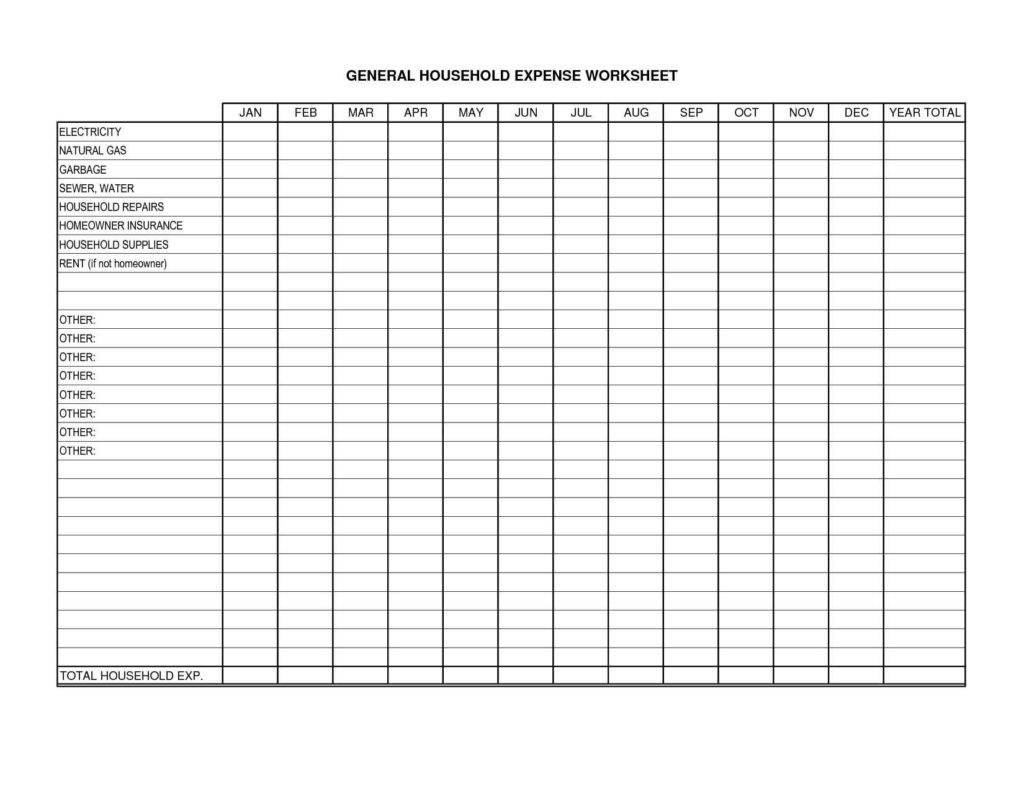

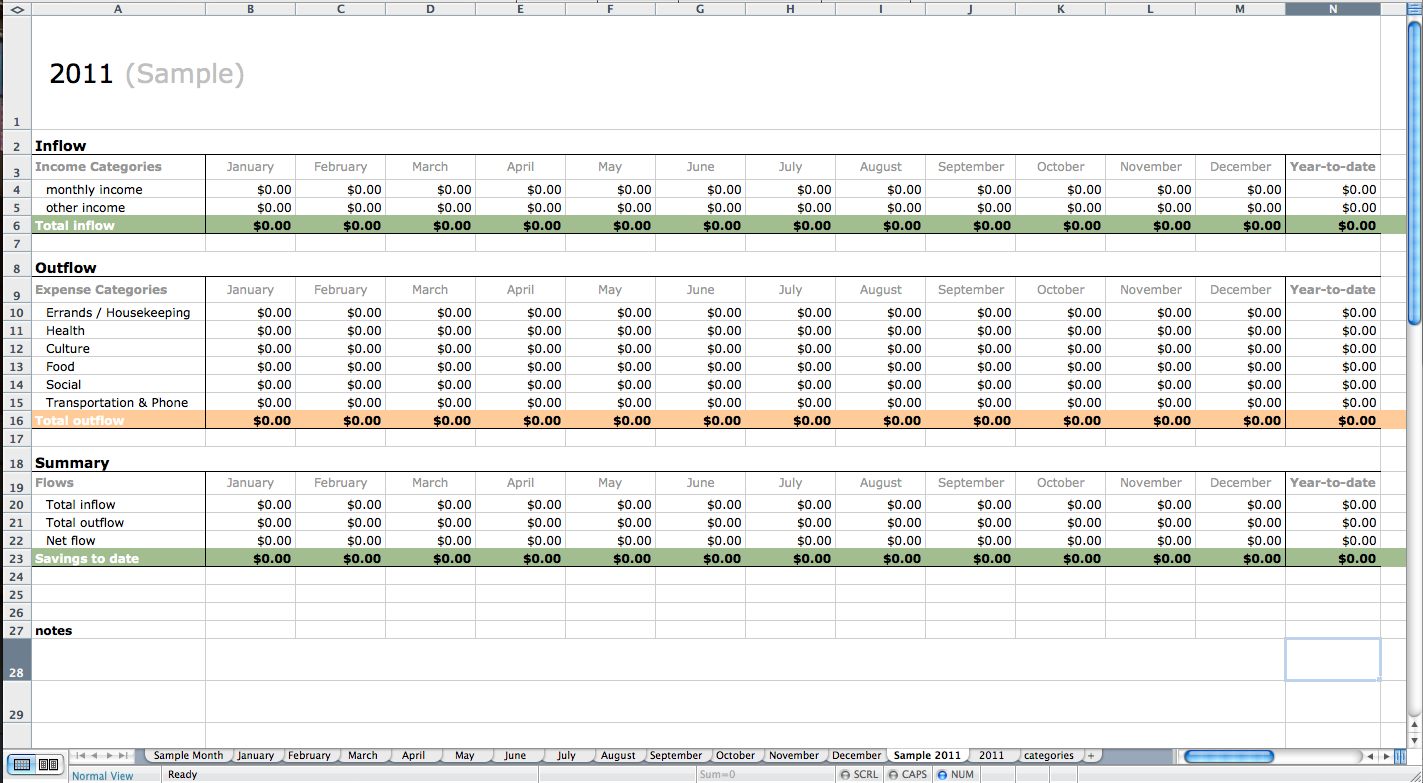

One of the best things about this system is that you have an easy to understand and follow format for creating an effective household bookkeeping template. All you need to do is decide how much money you want to save and spend each month and then use that amount to calculate your monthly budget. The rest of the instructions are simple and straightforward to follow.

You will have to calculate the interest that you must pay on any home mortgage that you have as well as any monthly credit card repayments and the amounts that you will be earning in the coming year. Your house payment should also be accounted for and you will need to think about your income from other sources such as your pension income.

You must consider whether you need to begin to pay off any debts such as your mortgage, monthly bills, or even overdrafts. All these expenses need to be taken into account. Once all the important aspects of your budget have been done, you are ready to take a look at your monthly income.

You may not always know exactly how much you are making each month, but you will need to account for this before you are able to make the final calculations. You must include everything including what you earn from jobs, your children’s education fees, and your annual holiday.

However, do not get carried away with your calculations, as the best household bookkeeping template does not actually tell you how much money you need to be making to pay your monthly expenditure. What you need to do is to add up all the income that you have received and subtract it from the amount you need to earn in order to pay your monthly expenditures. It is then possible to create a realistic monthly budget.

The most important step when you use a household bookkeeping template is to decide what to pay your bills. This way you will not find yourself constantly running late and you will always have the ability to pay the mortgage or other important bills.

When you are trying to plan how much money you need to save for a rainy day or to buy some extra insurance, the best household bookkeeping template is going to show you how to do this. That is because it will give you a clear idea of what expenses you will need to eliminate and how much money you will need to save.

It is also important to note that the best household bookkeeping template will not only tell you how much money you need to earn, but also how much you need to save. This is because you have to know where your money is going so that you can easily manage it.

The best household bookkeeping template does not just tell you how much money you need to earn, but also how much you need to save. This is because you have to know where your money is going so that you can easily manage it. PLEASE LOOK : home bookkeeping excel template

Sample for Household Bookkeeping Template